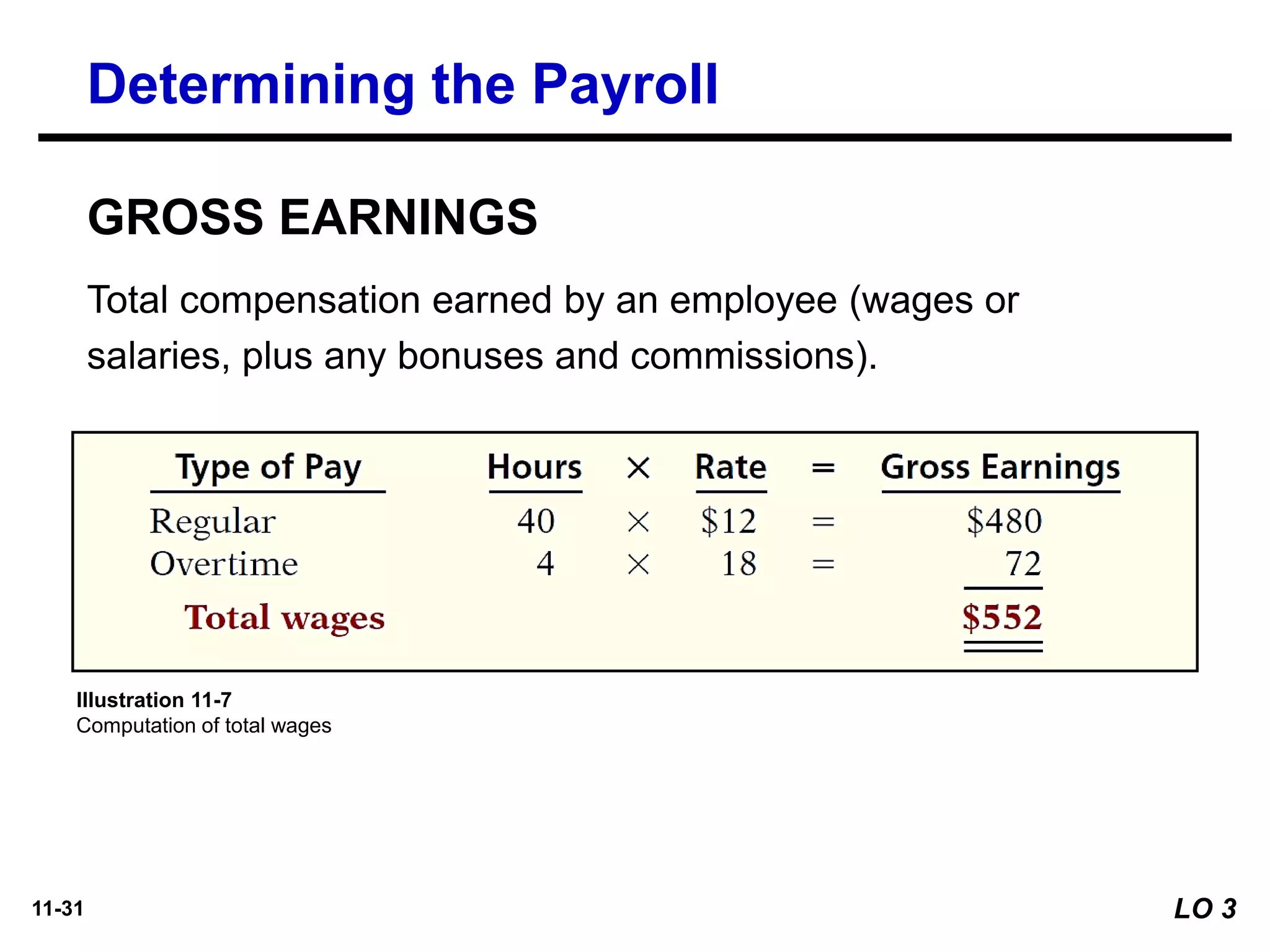

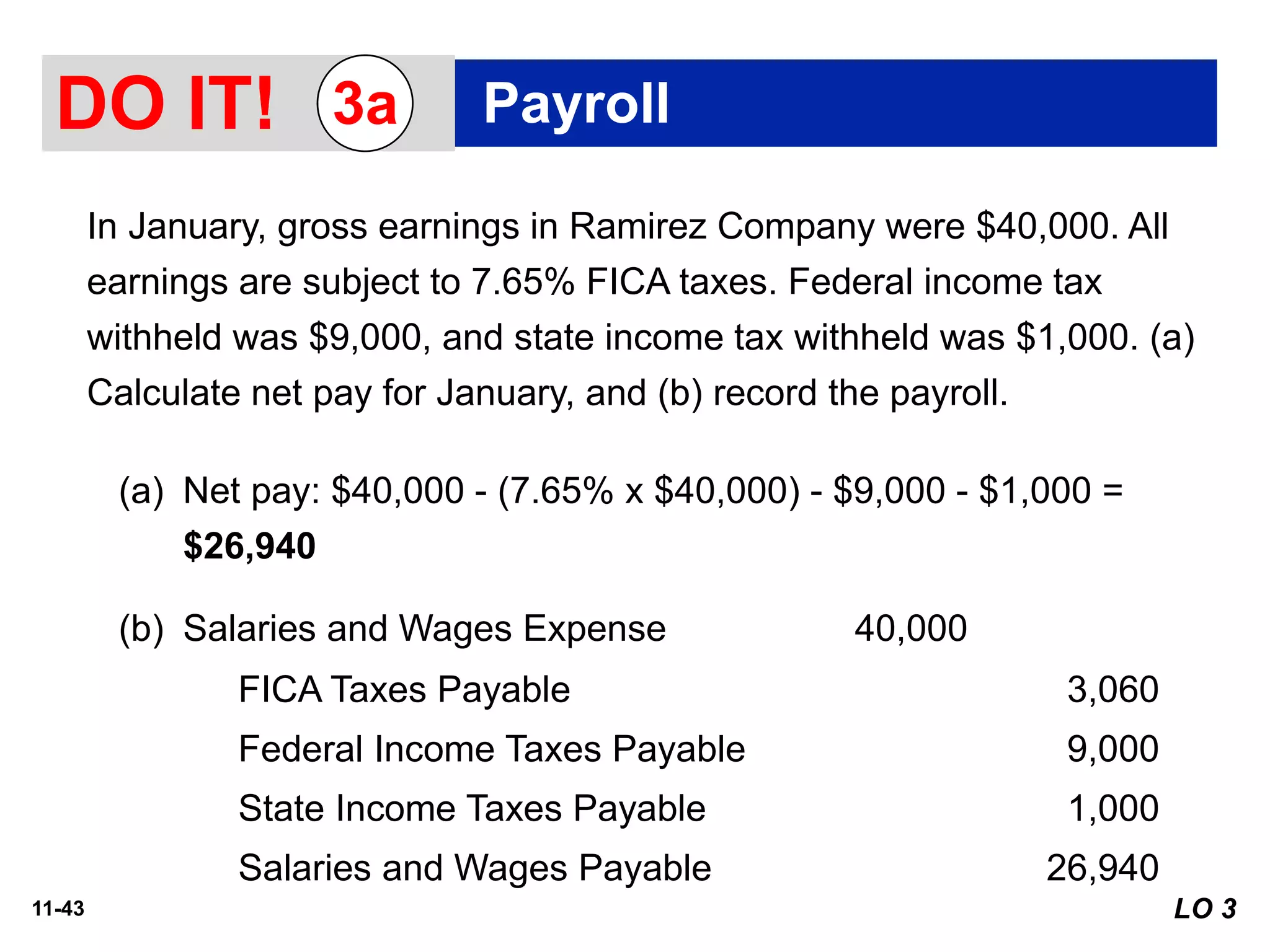

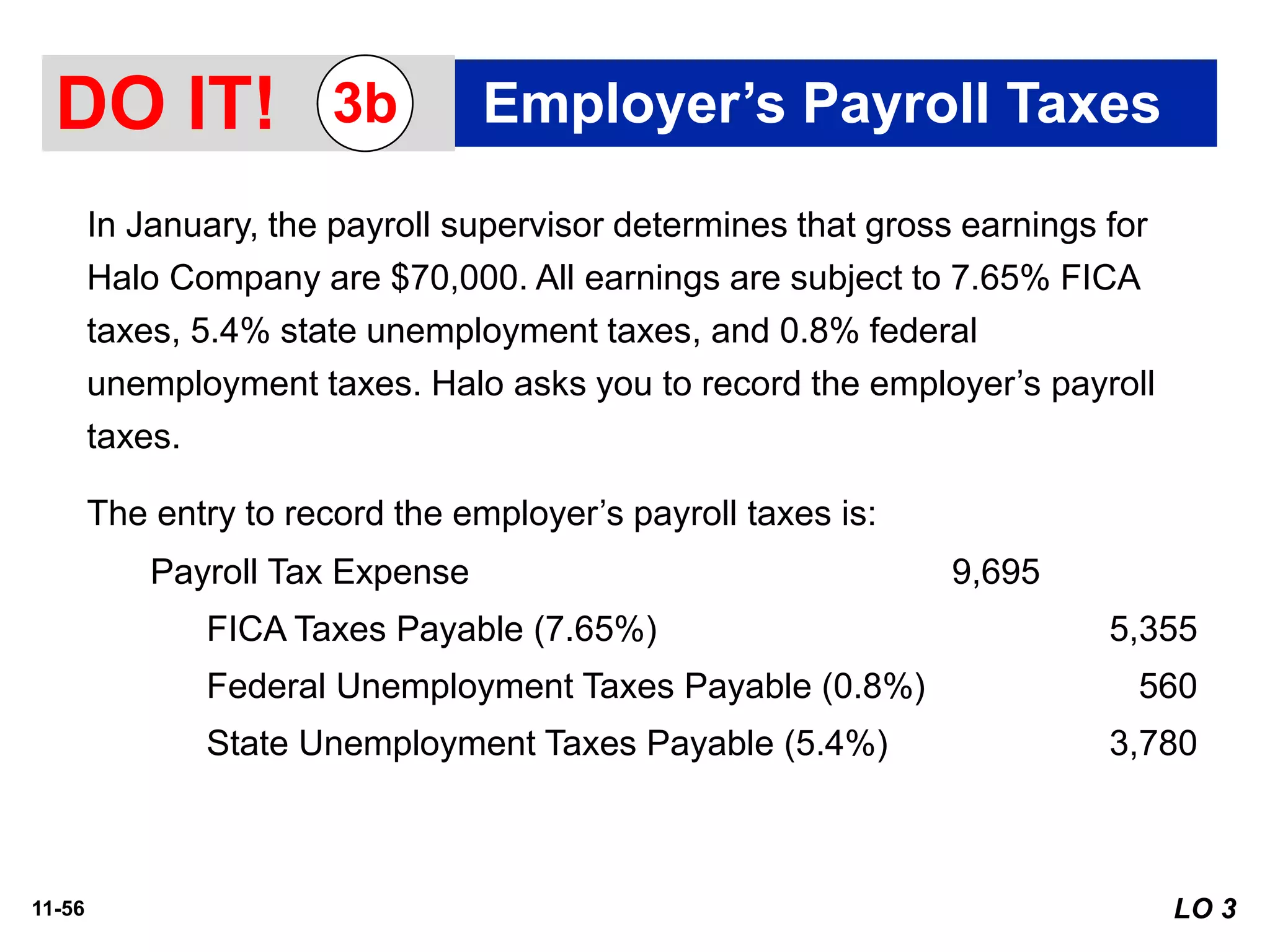

Here are the steps to solve this payroll problem:

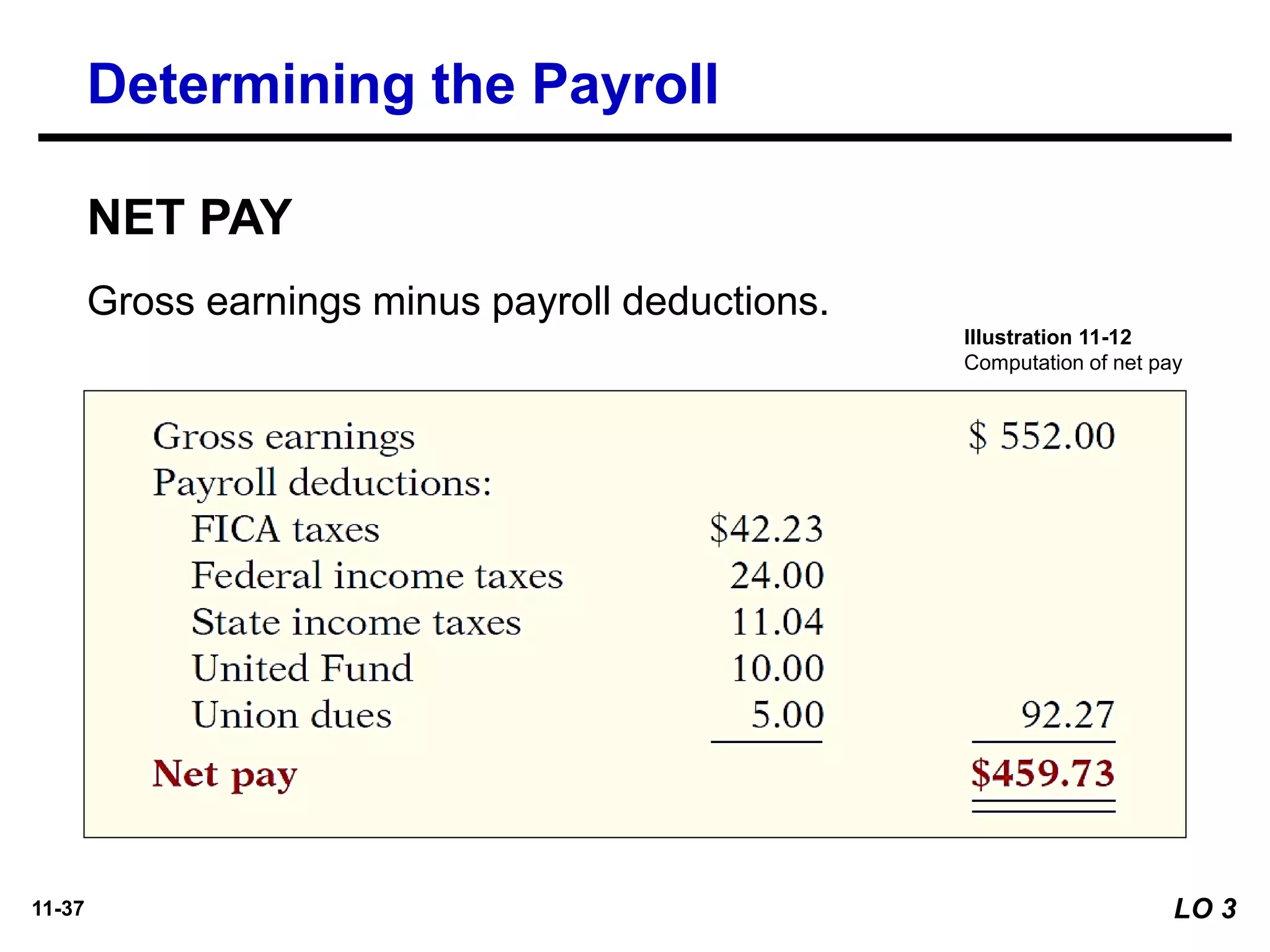

(a) Gross earnings: $40,000

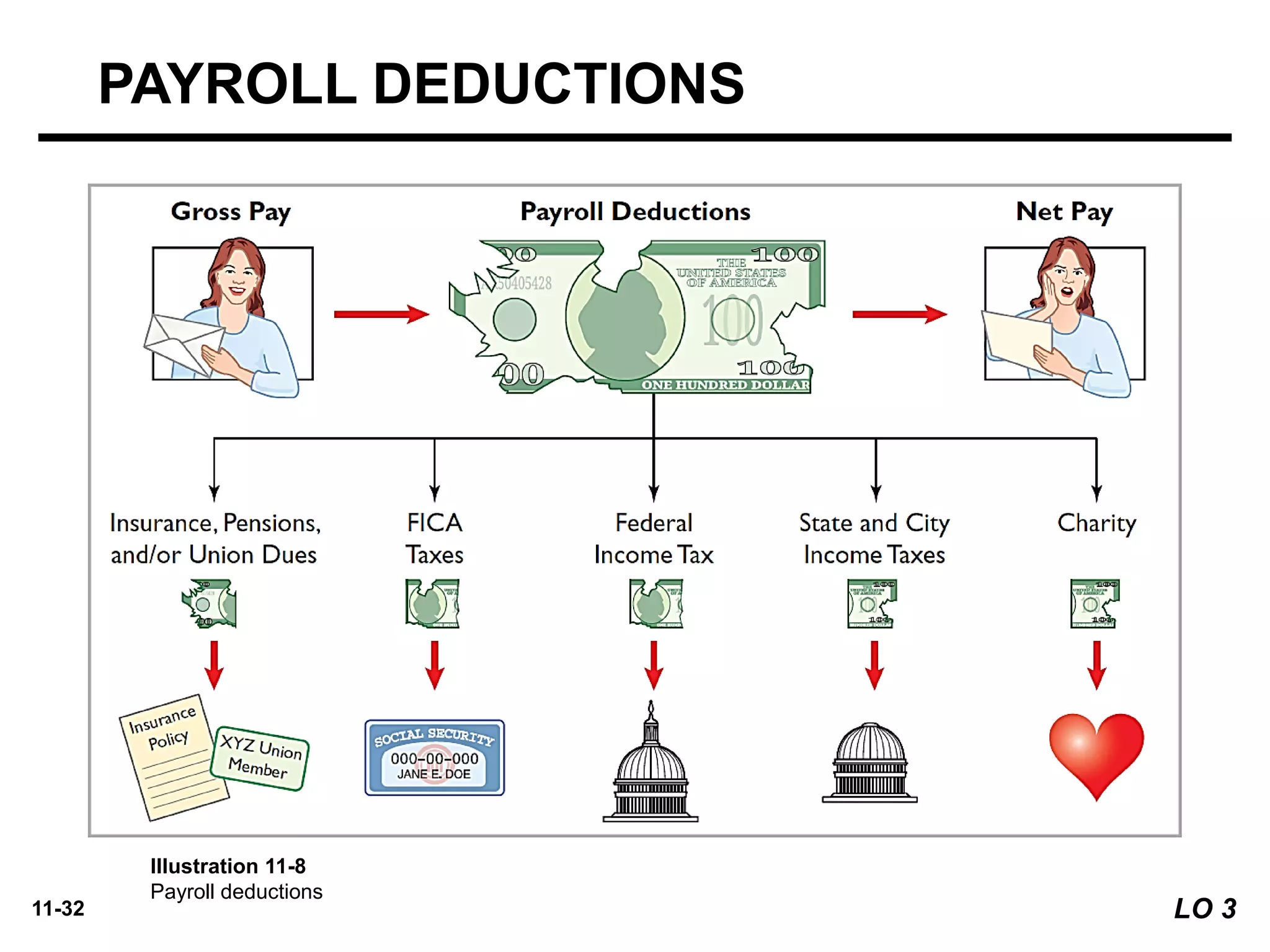

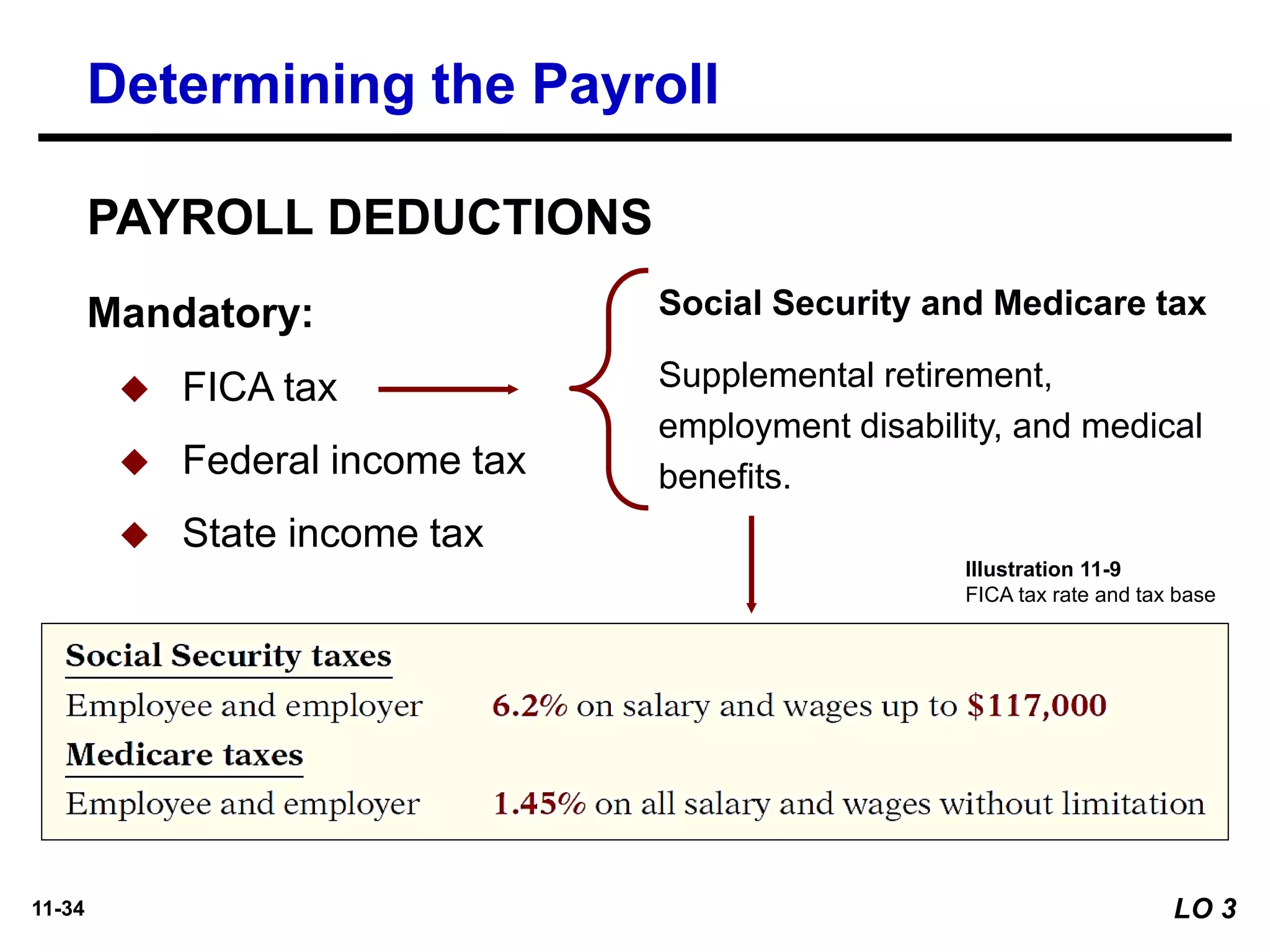

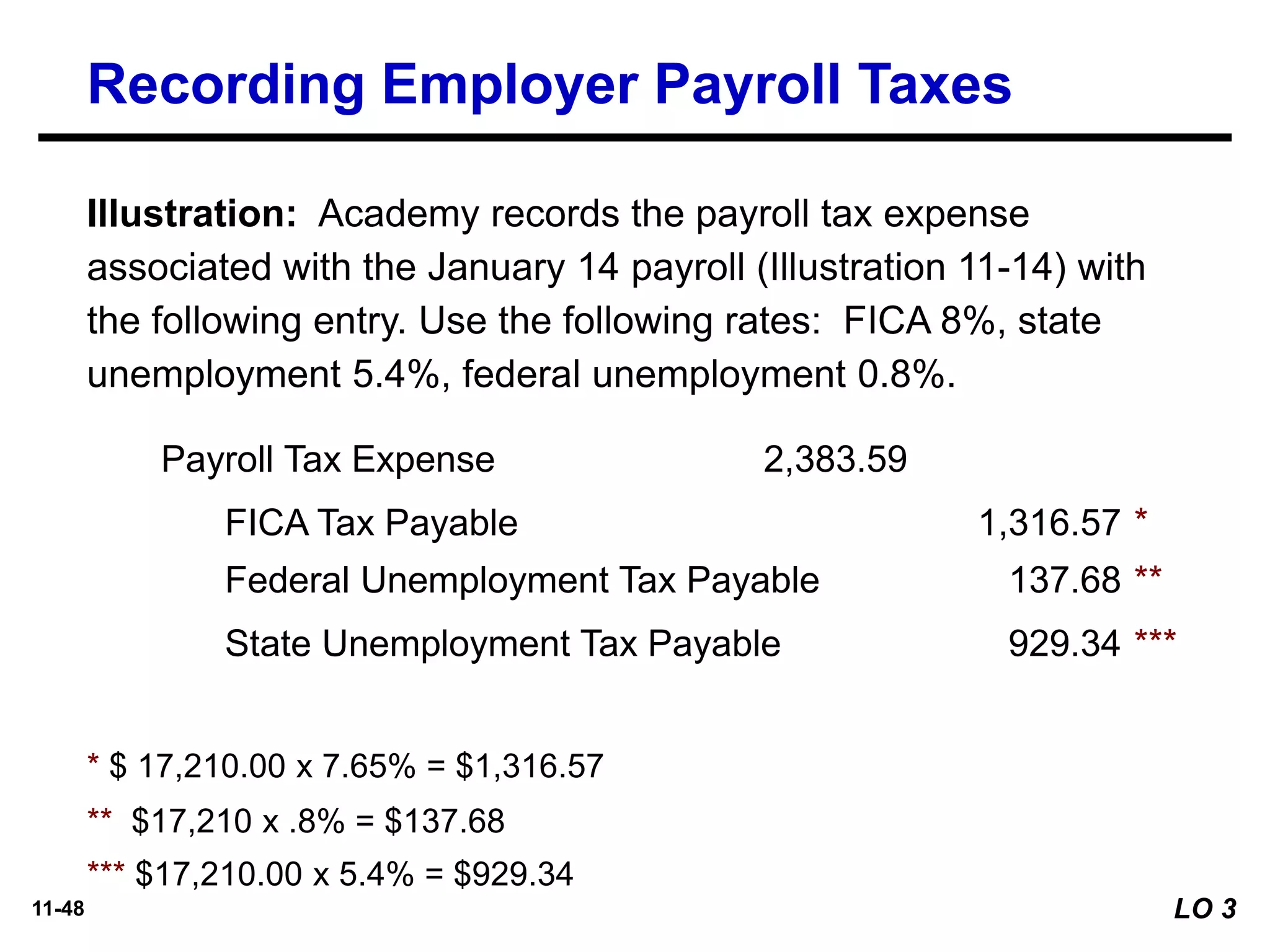

FICA taxes (7.65% of $40,000): 0.0765 * $40,000 = $3,060

Federal income tax withheld: $9,000

State income tax withheld: $1,000

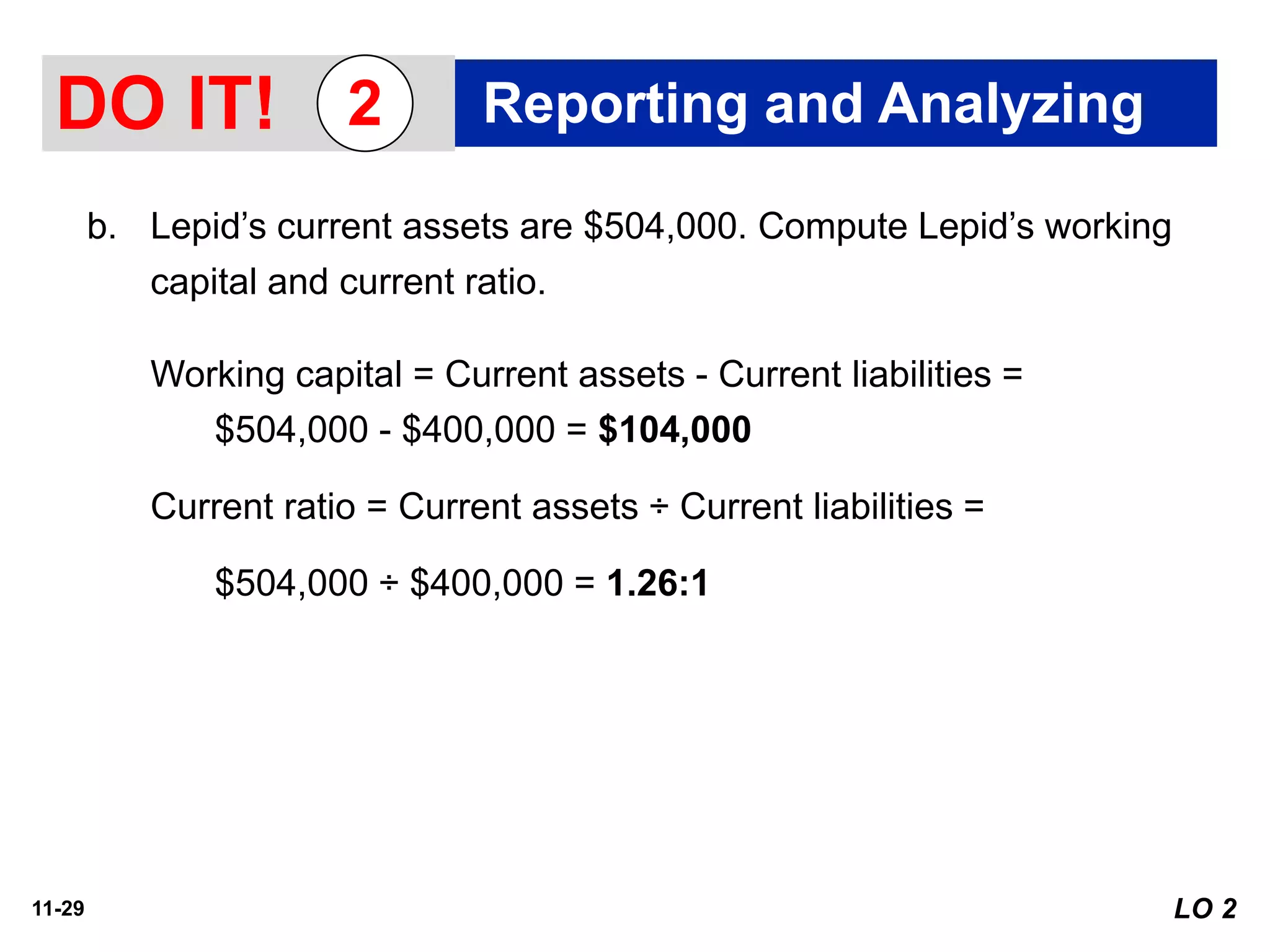

Net pay = Gross earnings - FICA taxes - Federal taxes - State taxes

= $40,000 - $3,060 - $9,000 - $1,000 = $26,940

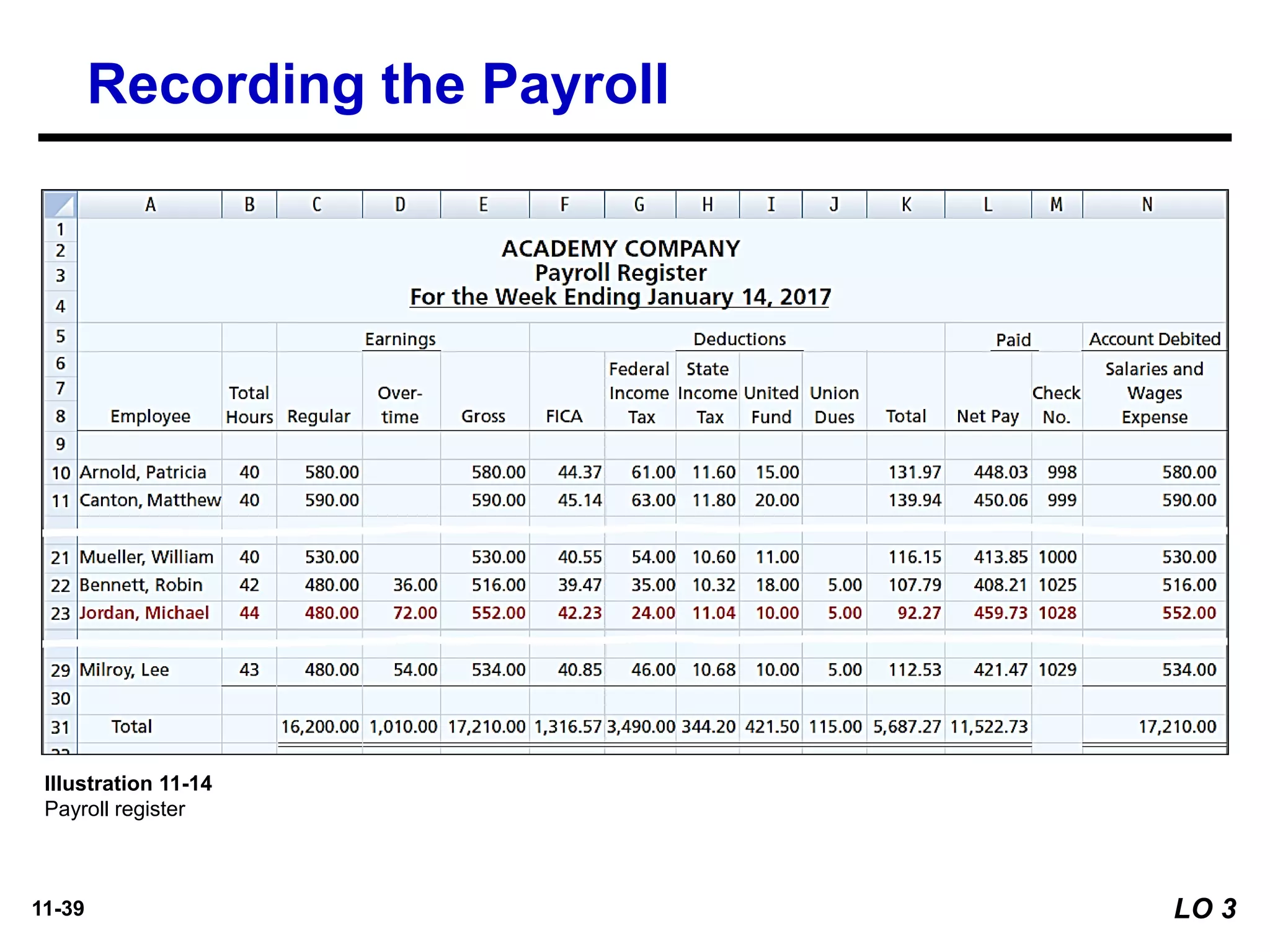

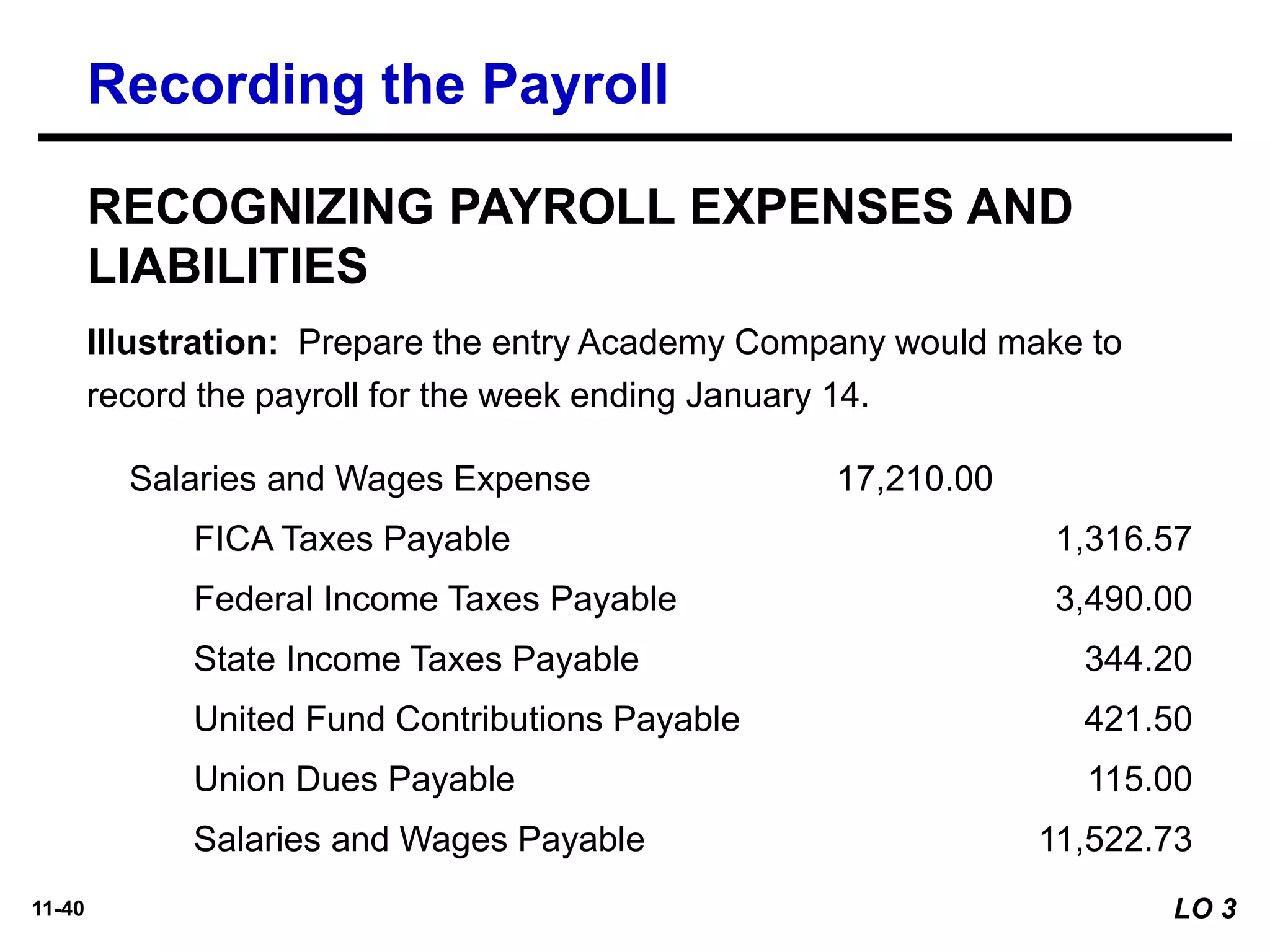

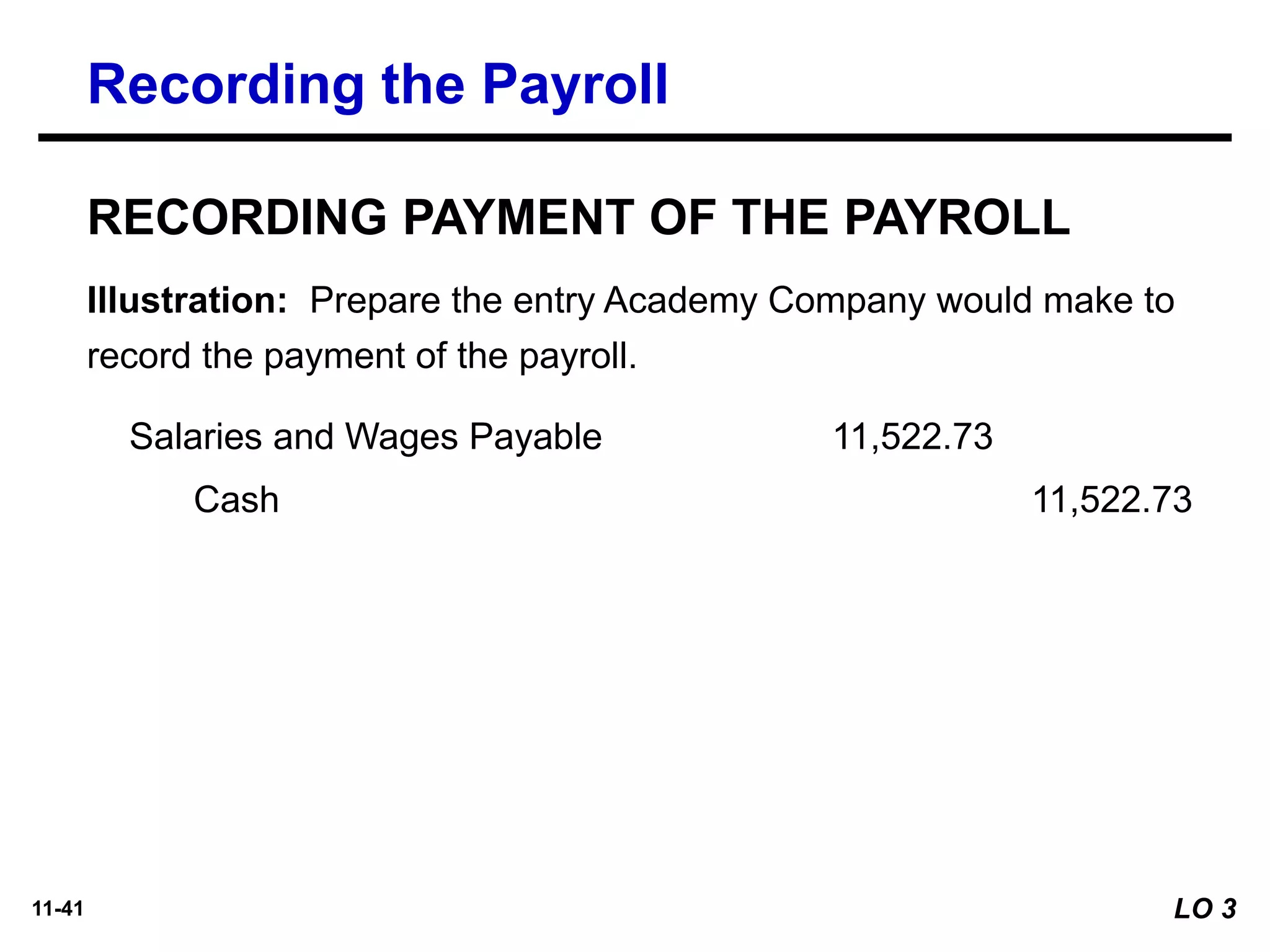

(b) Salaries and Wages Expense 40,000

FICA Taxes Payable 3,060

Federal Income Taxes Payable 9,000