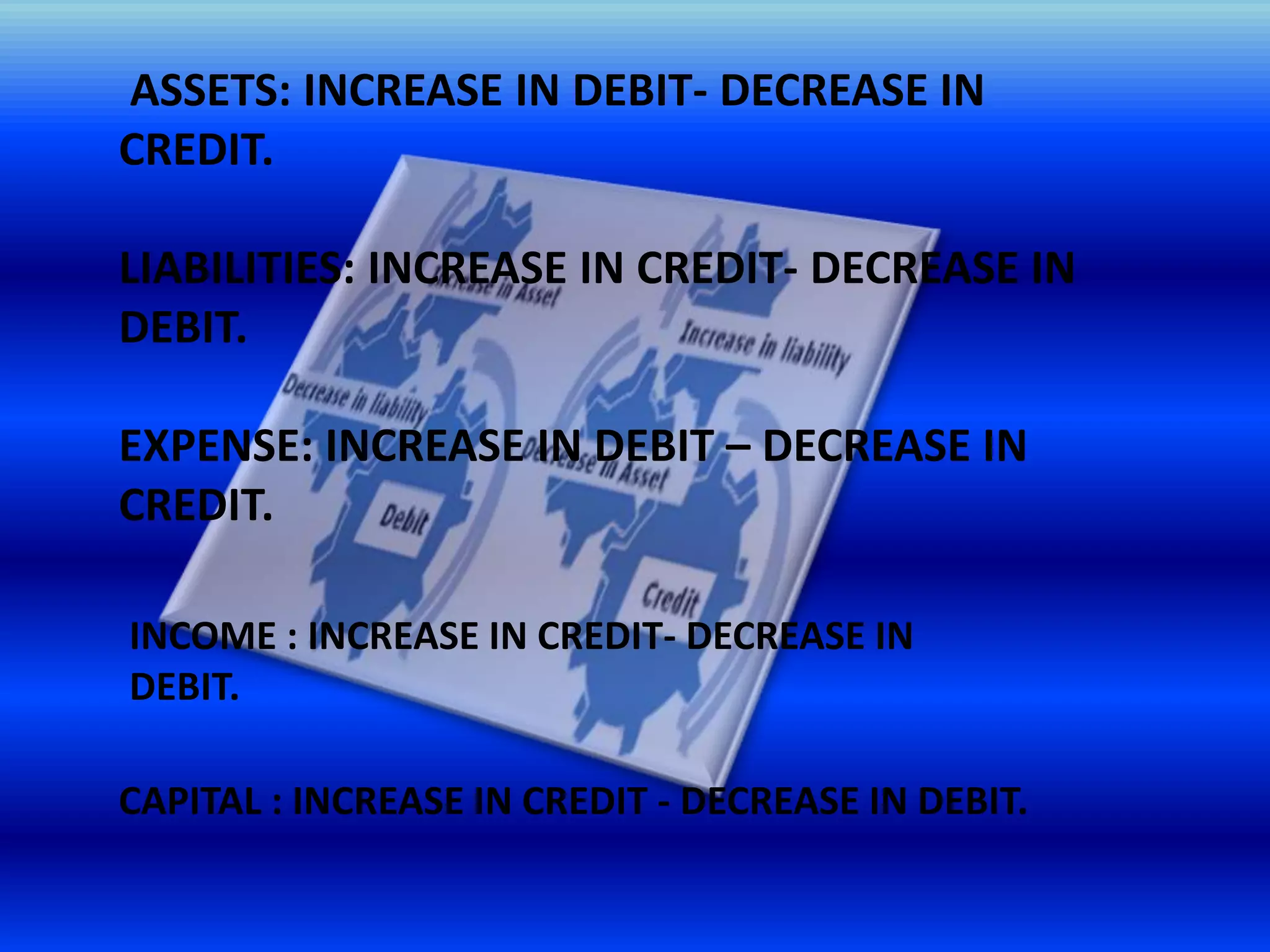

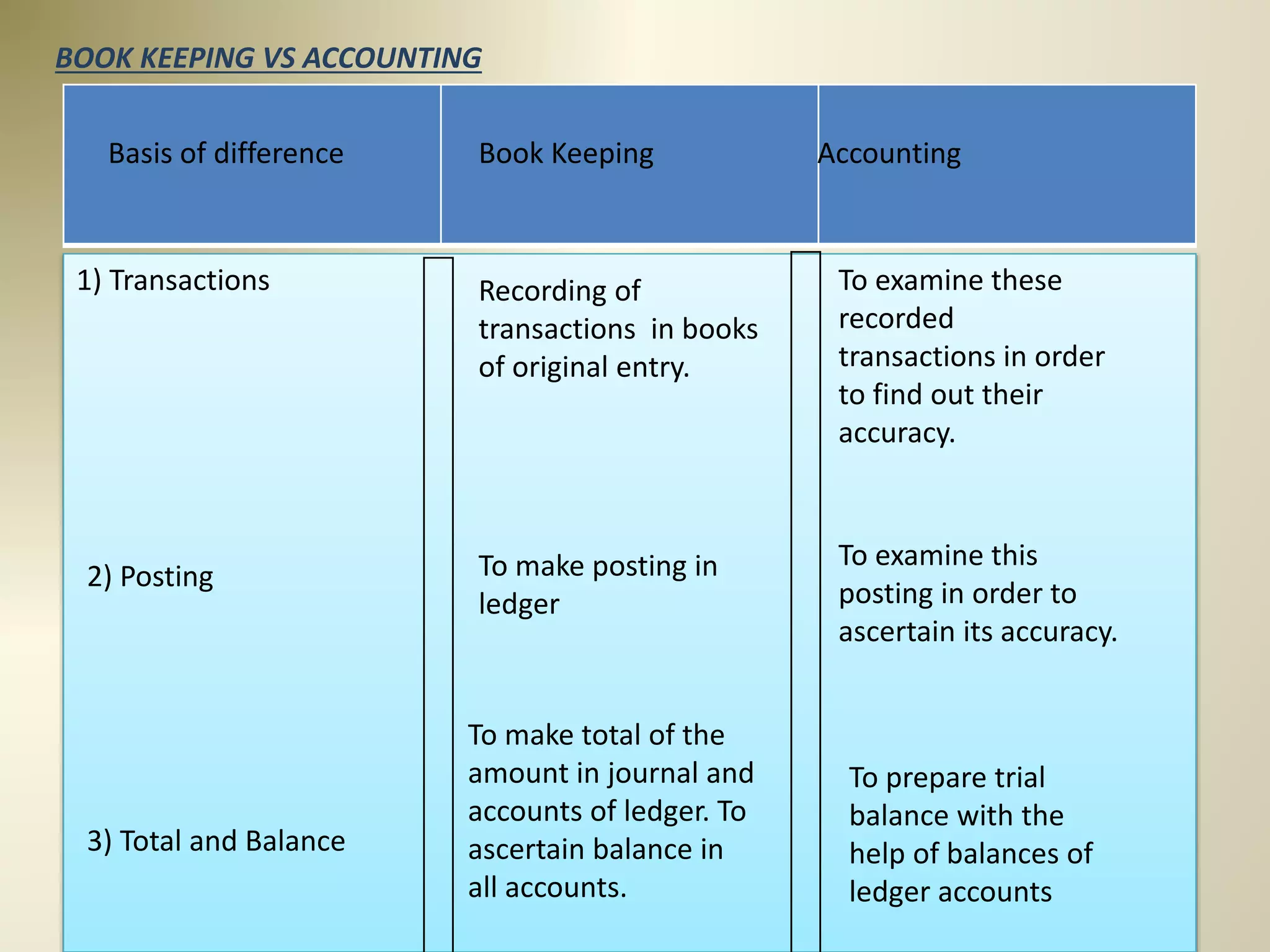

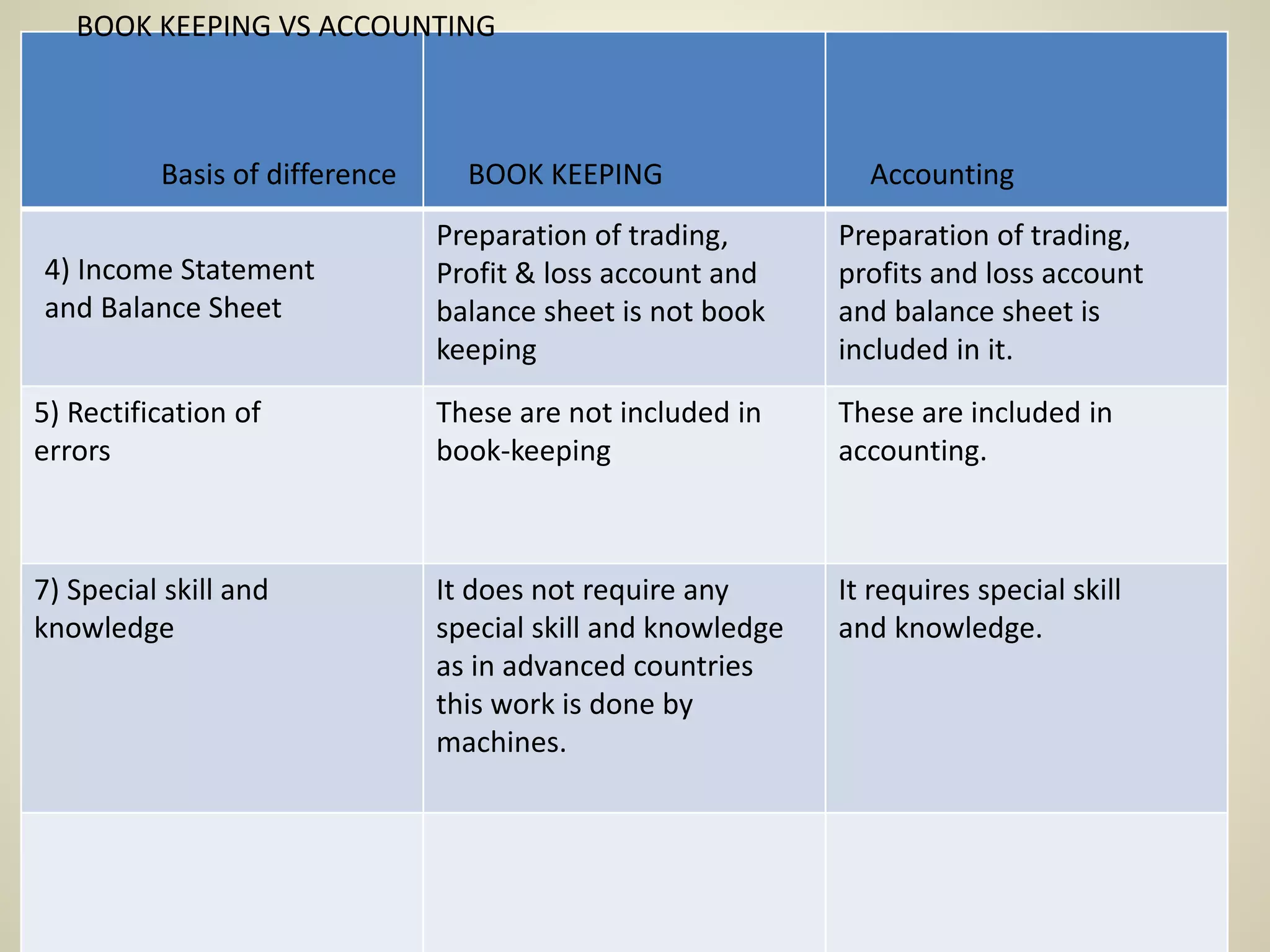

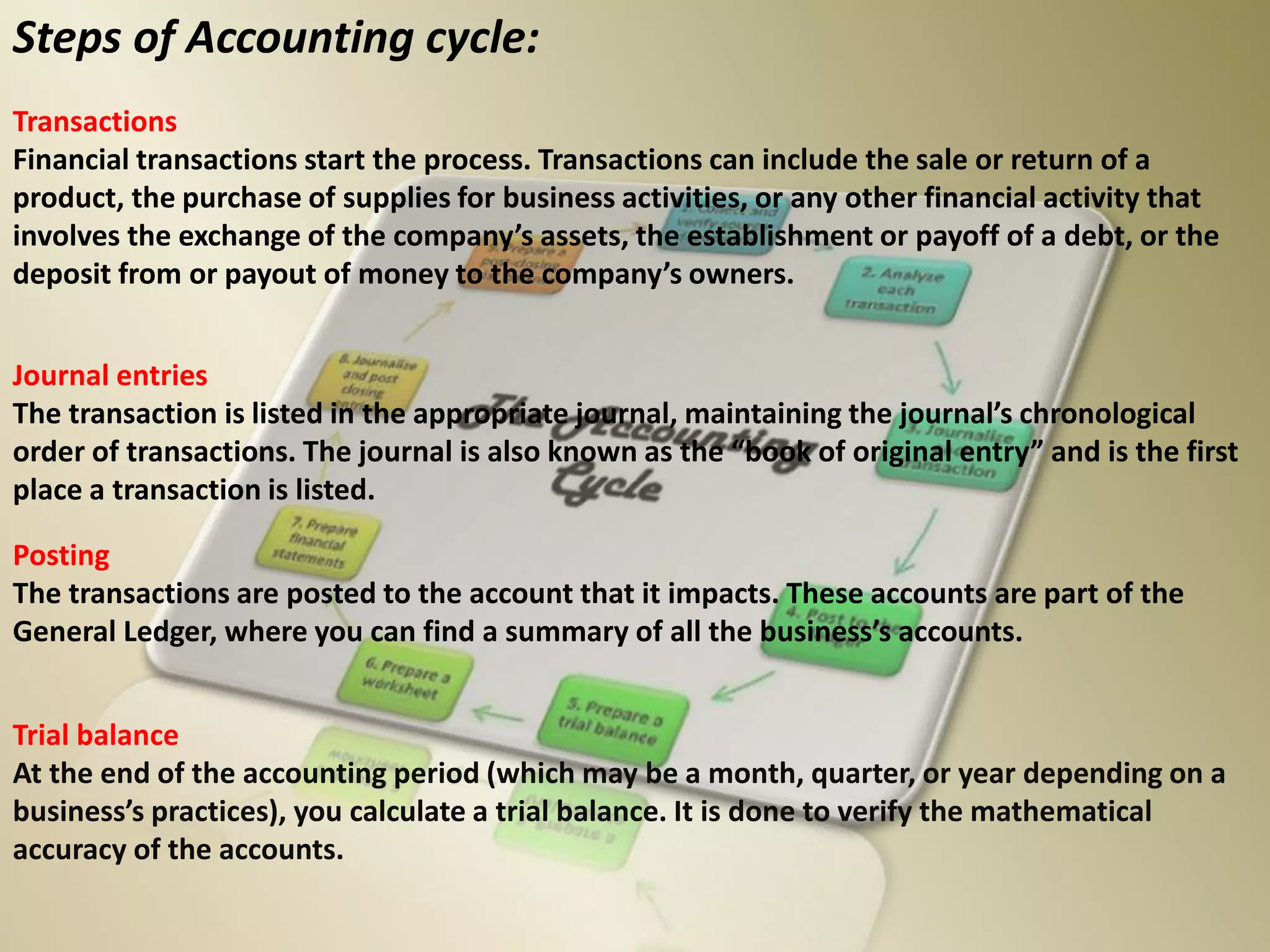

The document discusses two accounting systems: the double entry system, which records each business transaction in at least two accounts and maintains the accounting equation of assets, liabilities, and owner's equity in balance, and the single entry system, which records only personal transactions and is less reliable. It highlights the advantages of the double entry system, including accuracy, comprehensive records, and fraud prevention, while contrasting it with bookkeeping and systematic accounting processes. The document also outlines the accounting cycle, which consists of nine steps to ensure accurate financial reporting.

![This presentation is owned by

ABUL KALAM AZAD PATWARY

“for class 9-10[accounting]”](https://image.slidesharecdn.com/accounting-chapter-3-150209045001-conversion-gate02/75/Accounting-chapter-3-2-2048.jpg)