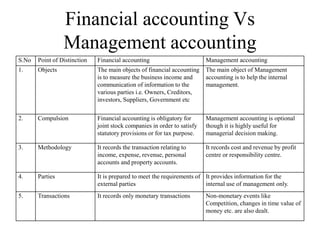

This document provides an introduction to financial accounting and management accounting. It defines accounting as recording financial transactions to help users analyze a business. Financial accounting prepares financial statements for outsiders, while management accounting helps internal management maximize profits and make decisions. Cost accounting prepares information for management decision making. The document also outlines the objectives, features, advantages, and users of financial accounting as well as the differences between financial accounting, cost accounting, and management accounting.