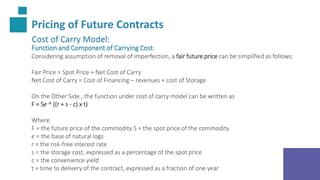

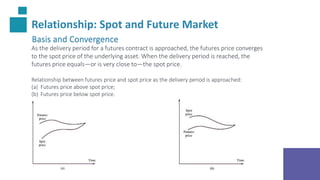

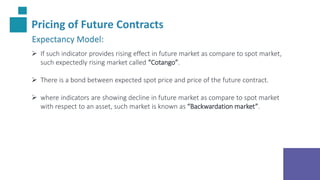

The document discusses pricing models for future contracts. It describes the expectancy model, which states that futures prices are expected future spot prices. It also describes the cost of carry model, where the price is the spot price plus the net cost of carry, which includes financing costs, storage costs, and convenience yield. The relationship between spot and futures prices depends on factors like costs of carry and interest rates. As the delivery date approaches, futures prices converge to the spot price to avoid arbitrage opportunities. However, inherent risks and uncertainties remain due to changing future variables.

![Pricing of Future Contracts

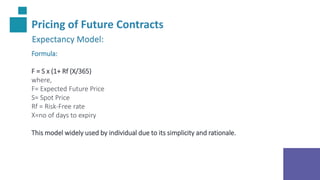

Expectancy Model:

Example:

Assume ABC Corporation spot is trading at $2,280.5 with 7 more days to expiry. Actual Future

are being traded in the market at $2284. The Risk-Free Rate is 8.3528%. what should ABC’s

current month futures contract be priced at using Expectancy Model and “Spot-Future Parity”

Function?

Calculation:

Futures Price = Spot price * [1+ Rf*(x/365) – d]

Futures Price = 2280.5 * [1+8.3528 %( 7/365)] – 0=$2283

ABC is not expected to pay any dividend over the next 7 days, hence It is assumed dividend as 0.

Solving the above equation, the future price turns out to be $2283. This is called the ‘Fair value’

of futures .However, the actual futures price is $2284. The actual price at which the futures

contract trades is called the ‘Market Price’.](https://image.slidesharecdn.com/ageneralapproachtofuturepricing1-231028071652-a49ac6a0/85/A-General-Approach-to-Future-Pricing-pptx-10-320.jpg)