JPM prime brokerage global hedge fund trends august 2013

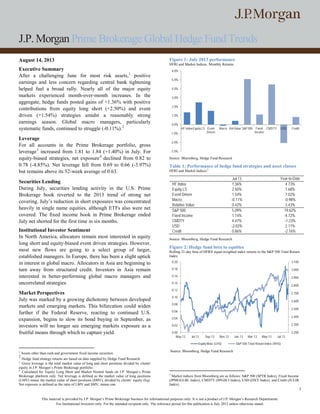

- 1. J.P. Morgan Prime Brokerage Global Hedge Fund Trends 1 This material is provided by J.P. Morgan’s Prime Brokerage business for informational purposes only. It is not a product of J.P. Morgan’s Research Departments. For Institutional Investors only. For the intended recipient only. The reference period for this publication is July 2013 unless otherwise stated. August 14, 2013 Executive Summary After a challenging June for most risk assets,1 positive earnings and less concern regarding central bank tightening helped fuel a broad rally. Nearly all of the major equity markets experienced month-over-month increases. In the aggregate, hedge funds posted gains of +1.36% with positive contributions from equity long short (+2.50%) and event driven (+1.54%) strategies amidst a reasonably strong earnings season. Global macro managers, particularly systematic funds, continued to struggle (-0.11%).2 Leverage For all accounts in the Prime Brokerage portfolio, gross leverage3 increased from 1.81 to 1.84 (+1.40%) in July. For equity-biased strategies, net exposure4 declined from 0.82 to 0.78 (-4.85%). Net leverage fell from 0.69 to 0.66 (-3.97%) but remains above its 52-week average of 0.63. Securities Lending During July, securities lending activity in the U.S. Prime Brokerage book reverted to the 2013 trend of strong net covering. July’s reduction in short exposures was concentrated heavily in single name equities, although ETFs also were net covered. The fixed income book in Prime Brokerage ended July net shorted for the first time in six months. Institutional Investor Sentiment In North America, allocators remain most interested in equity long short and equity-biased event driven strategies. However, most new flows are going to a select group of larger, established managers. In Europe, there has been a slight uptick in interest in global macro. Allocators in Asia are beginning to turn away from structured credit. Investors in Asia remain interested in better-performing global macro managers and uncorrelated strategies. Market Perspectives July was marked by a growing dichotomy between developed markets and emerging markets. This bifurcation could widen further if the Federal Reserve, reacting to continued U.S. expansion, begins to slow its bond buying in September, as investors will no longer see emerging markets exposure as a fruitful means through which to capture yield. 1 Assets other than cash and government fixed income securities. 2 Hedge fund strategy returns are based on data supplied by Hedge Fund Research. 3 Gross leverage is the total market value of long and short positions divided by clients' equity in J.P. Morgan’s Prime Brokerage portfolio. 4 Calculated for Equity Long Short and Market Neutral funds on J.P. Morgan’s Prime Brokerage platform only. Net leverage is defined as the market value of long positions (LMV) minus the market value of short positions (SMV), divided by clients’ equity (Eq). Net exposure is defined as the ratio of LMV and SMV, minus one. Figure 1: July 2013 performance HFRI and Market Indices. Monthly Returns Source: Bloomberg, Hedge Fund Research Table 1: Performance of hedge fund strategies and asset classes HFRI and Market Indices5 Jul-13 Year-to-Date HF Index 1.36% 4.73% Equity LS 2.50% 7.68% Event Driven 1.54% 7.02% Macro -0.11% -0.98% Relative Value 0.42% 3.43% S&P 500 5.09% 19.62% Fixed Income 1.14% -4.72% CMDTY 4.47% -1.23% USD -2.03% 2.11% Credit 0.86% -2.16% Source: Bloomberg, Hedge Fund Research Figure 2: Hedge fund beta to equities Rolling 21-day beta of HFRX equal-weighted index returns to the S&P 500 Total Return Index Source: Bloomberg, Hedge Fund Research 5 Market indices from Bloomberg are as follows: S&P 500 (SPTR Index), Fixed Income (JPMGGLBL Index), CMDTY (SPGSCI Index), USD (DXY Index), and Credit (JULIR Index). -3.0% -2.0% -1.0% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% HF IndexEquity LS Event Driven Macro Rel Value S&P 500 Fixed Income CMDTY USD Credit 2,200 2,300 2,400 2,500 2,600 2,700 2,800 2,900 3,000 3,100 0.00 0.02 0.04 0.06 0.08 0.10 0.12 0.14 0.16 0.18 0.20 May-12 Jul-12 Sep-12 Nov-12 Jan-13 Mar-13 May-13 Jul-13 Equity Beta (LHS) S&P 500 Total Return Index (RHS)

- 2. Prime Brokerage Global Hedge Fund Trends – Performance, Leverage, and Risk Exposures 2 This material is provided by J.P. Morgan’s Prime Brokerage business for informational purposes only. It is not a product of J.P. Morgan’s Research Departments. For Institutional Investors only. For the intended recipient only. The reference period for this publication is July 2013 unless otherwise stated. This section presents a summary of the changes that we have observed in leverage and sector exposures across the range of hedge funds that we work with. The confidentiality of our clients’ positions is important to us and as such this information has been aggregated and displayed in an anonymous manner in an effort to mitigate the risk of revealing or alluding to any one fund’s exposures. Information may be excluded due to the perceived risk of revealing sensitive information. The information discussed is specific to activities on J.P. Morgan’s books, and may not represent total client activity. These numbers should only be viewed as representative observations. Market Overview6 July was a bookend to June. Whereas risk assets were lower across the board in June, partly in reaction to hawkish guidance from the Federal Reserve, they rallied broadly in July. Almost all major equity markets experienced month- over-month increases. The S&P 500 Index7 continued its year-to-date ascent amidst a reasonably strong earnings season, rising +4.95% in July and crossing the 1700 threshold for the first time in its history. Other key equity indices also rallied in July, with Europe experiencing unexpectedly strong gains. The MSCI Europe rose +7.4% month-over-month and the MSCI AC Index increased +4.7%. In the U.S. and Europe, Small Cap stocks outperformed Large Caps. The Industrials sector was a top performer in both regions, and with the exception of Telecommunications, all key sectors were up in July. With respect to earnings season, at the time of this writing, approximately 74% of S&P 500 companies that have reported earnings exceeded estimates, slightly above the historical trend. Implied volatility was down among all asset classes, as Figure 3 shows, reversing the substantial increases that occurred in May and June. The S&P 500’s volatility fell close to its lowest levels for the year during July (8.7%) due to the bullish environment caused by the S&P’s positive performance and investors’ optimistic outlook on the U.S. economy. The decline in volatility was not limited to equities, as interest rate volatility (as measured by the MOVE Index) also declined. Consequently, cross asset correlations were down in July. Fixed income markets rose slightly on the month but, year-to- date, are down nearly -5.0% as yields continue their upward climb. Credits of lesser quality outperformed higher quality credits in July and credit spreads (in both dollars and euros) regained nearly half of the widening that began in May based on fears of Fed tapering. The U.S. high yield spread over Treasuries currently is 501 basis points and loan spreads over Treasuries stand at 470 basis points.8 6 Hedge fund strategy returns are based on data supplied by Hedge Fund Research. 7 Reference is to the SPX Index, not the SPTR Index, as in Table 1. 8 J.P. Morgan North America High Yield and Leveraged Loan Research, Credit Strategy Weekly Update, August 9, 2013, https://jpmm.com/research/content/GPS- 1188133-0. Figure 3: Average implied volatility across five asset classes Average of five asset classes (equities, FX, commodities, credit and rates) Source: CFTC, J.P. Morgan Global Asset Allocation Composite Hedge Fund Performance Along with other risk assets, hedge funds experienced broad- based gains in July, increasing +1.36% in reaction to robust corporate earnings and a benign absence of macro risks. July was therefore the strongest month for aggregate hedge fund performance since January. Hedge funds have now delivered positive performance in eight of the last nine months. All of the major hedge fund strategies delivered positive performance in July except for global macro, which declined slightly (-0.11%). Equity Hedge Equity long short and market neutral strategies led hedge fund performance, rising +2.5% in July on strong earnings reports. Technology/Healthcare-focused funds experienced robust gains (+4.04%), posting their strongest performance since September 2010. Energy/Basic Materials-specific funds (+3.67%) also rose substantially. July thus marked the best performance for energy-focused equity funds in 18 months. Fundamental value managers were up +3.3% on the month, benefitting from exposure to the U.S. consumer, financial and energy sectors. Exposure to European names also contributed to strong performance among fundamental value funds. 10 15 20 25 30 35 40 Jan-07 Oct-07 Jul-08 Apr-09 Jan-10 Oct-10 Jul-11 Apr-12 Jan-13

- 3. Prime Brokerage Global Hedge Fund Trends – Performance, Leverage, and Risk Exposures 3 This material is provided by J.P. Morgan’s Prime Brokerage business for informational purposes only. It is not a product of J.P. Morgan’s Research Departments. For Institutional Investors only. For the intended recipient only. The reference period for this publication is July 2013 unless otherwise stated. Figure 4: Sector performance, July 2013 Source: Bloomberg, Standard & Poor’s Event Driven Event driven strategies posted aggregate gains of +1.54% in July. Event driven managers have therefore delivered positive aggregate performance in thirteen of the last fourteen months. Activist and special situations managers contributed to July’s gains, posting respective increases of +3.8% and +1.8%. Popular event-focused names that have been in the news include Sony, Dell, Herbalife, Air Products and Publicis/Omnicom. Merger arbitrage managers reversed June’s losses (-0.49%), posting month-over-month gains of +1.0%. Distressed strategies also posted solid gains in July (+1.4%) benefitting from the tightening of spreads. As panic over Fed tapering and interest rate shock subsided in July, high yield credit tightened to below 5%. The historical trend9 with respect to high grade spreads over Treasuries indicates that high grade spreads should be just over 100 basis points, well below the current 160 basis point spread. Figure 5: USD high grade spreads over U.S. Treasuries Basis points. Line denotes trend through cycle troughs. Source: Bloomberg, J.P. Morgan Global Asset Allocation 9 J.P. Morgan Global Asset Allocation, Global Markets Outlook and Strategy, August 8, 2013, https://jpmm.com/research/content/GPS-1185674-0. Relative Value The environment in July was more benign for relative value strategies than in June. Consequently, relative value managers posted month-over-month aggregate gains of +0.42%. Those gains were fueled largely by structured credit and yield alternative strategies, which rose +0.84% and +0.61%, respectively. After two months of less liquidity, demand increased for structured products across residential and commercial mortgage backed securities. Convertible arbitrage managers also were up month-over-month (+0.32%); convertibles managers with high U.S. exposure were the best performers within this subset. Global Macro Global macro strategies were down slightly in July (-0.11%), the third consecutive monthly decline. Managers with commodities and currency exposure suffered losses on the month as a result of which systematic managers, including CTAs, were down -1.07%. Such losses were partially offset by gains among discretionary macro managers with exposure to energy and emerging markets, the latter of which had experienced sharp aggregate losses (-4.00%) in June. Active trading also partially offset the losses experienced among systematic managers and CTAs. 7.09% 5.60% 5.51% 5.28% 5.14% 5.00% 4.20% 4.10% 3.88% -0.74% -1.0% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% 0 100 200 300 400 500 600 Jan-73 Jan-78 Jan-83 Jan-88 Jan-93 Jan-98 Jan-03 Jan-08 Jan-13

- 4. Prime Brokerage Global Hedge Fund Trends – Performance, Leverage, and Risk Exposures 4 This material is provided by J.P. Morgan’s Prime Brokerage business for informational purposes only. It is not a product of J.P. Morgan’s Research Departments. For Institutional Investors only. For the intended recipient only. The reference period for this publication is July 2013 unless otherwise stated. Leverage and Risk Exposures Gross Leverage With equity markets edging higher in July, gross leverage for all accounts in the Prime Brokerage portfolio increased from 1.81 to 1.84 (+1.4%) (See Figure 6). Gross leverage of levered accounts in the Prime Brokerage portfolio rose from 2.41 to 2.54 (+5.7%) (See Figure 7). July was a slight reversal of the recent downward trend in leverage but does not necessarily reflect an increase in risk appetite, as it seems to have been driven by clients adding short exposures despite the market grinding higher. Figure 6: Daily gross leverage and the S&P 500 Index Source: Bloomberg, J.P. Morgan Prime Brokerage Figure 7: Gross leverage (levered accounts) 5-day moving average and the S&P 500 Index Source: Bloomberg, J.P. Morgan Prime Brokerage Figure 8: Z-score of gross leverage and the S&P 500 Index The Z-score measures how many standard deviations an observation is above or below the mean Source: Bloomberg, J.P. Morgan Prime Brokerage Gross Leverage by Strategy Convertible Arbitrage and High Yield Fixed Income saw notable increases in gross leverage month-over-month, rising +5.5% and +5.4%, respectively. The only strategy to have experienced a decrease in gross leverage in July was High Grade Fixed Income (-8.0%). Market Neutral, Equity Long Short, Convertible Arbitrage and High Yield Fixed Income are running gross leverage above their two-year averages. High Grade Fixed Income and Multi-Strategy are running leverage below those levels. Figure 9: Gross leverage by strategy Source: J.P. Morgan Prime Brokerage 1.75 1.80 1.85 1.90 1.95 1,300 1,350 1,400 1,450 1,500 1,550 1,600 1,650 1,700 Jul-12 Sep-12 Nov-12 Jan-13 Mar-13 May-13 Jul-13 S&P 500 Index (LHS) Gross Leverage (RHS) 2.3 2.4 2.5 2.6 2.7 2.8 1,300 1,350 1,400 1,450 1,500 1,550 1,600 1,650 1,700 Jul-12 Sep-12 Nov-12 Jan-13 Mar-13 May-13 Jul-13 S&P 500 Index (LHS) Gross Leverage (Levered Account s - RHS) -2.0 -1.0 0.0 1.0 Aug-11 Dec-11 Apr-12 Aug-12 Dec-12 Apr-13 Difference between gross leverage and S&P 500 Index Z-scores 0 1 2 3 4 5 Market Neutral Equity Long Short Multi-Strategy Convertible Arbitrage High Grade Fixed Income High Yield Fixed Income May-13 Jun-13 Jul-13

- 5. Prime Brokerage Global Hedge Fund Trends – Performance, Leverage, and Risk Exposures 5 This material is provided by J.P. Morgan’s Prime Brokerage business for informational purposes only. It is not a product of J.P. Morgan’s Research Departments. For Institutional Investors only. For the intended recipient only. The reference period for this publication is July 2013 unless otherwise stated. Table 2: Gross leverage by strategy Average and first quartile calculated for the period of July 2011 to July 2013 Source: J.P. Morgan Prime Brokerage Net Exposure and Net Leverage Net exposure for equity-biased funds fell in July, declining from 0.82 to 0.78 (-4.85%). Net leverage also declined, falling from 0.69 to 0.66 (-3.97%). The month-over-month decrease in net exposures may be attributable to clients repositioning themselves in the wake of earnings season or could simply be attributable to equity managers being cautious by reducing longs/taking profits and increasing macro protection. Figure 10: Net exposure and net leverage Equity Long Short and Market Neutral funds on the Prime Brokerage platform only. LMV: Market value of long positions. SMV: Market value of short positions. Eq: Equity in the clients’ accounts Source: J.P. Morgan Prime Brokerage Sector Exposures The largest month-over-month increases in the long Prime Brokerage portfolio were in the Financial (+0.7%) and Consumer, Non-cyclical (+0.4%) sectors. The largest declines were in Energy (-0.4%) and Communications (- 0.3%). The largest increase in the Prime Brokerage short portfolio was in Non sector-specific ETFs (+1.9%) due to increased macro hedging. The most substantial decrease in short exposure occurred in the Communications (-0.6%) sector due to deal-related activity. The Prime Brokerage portfolio may have become more bullish on the Consumer, Non-cyclical sectors, which experienced a month-over-month increase in long exposure and decreases in short exposure. Table 3: Long and short exposures by sector Long (Short) exposure by sector as a percentage of total client long (short) exposure in Prime Brokerage portfolio Long exposure Short exposure Jul-12 Jun-13 Jul-13 Jul-12 Jun-13 Jul-13 Basic Materials 5.2% 4.3% 4.4% 4.9% 5.1% 5.4% Communications 11.7% 14.0% 13.7% 7.3% 6.4% 5.8% Consumer, Cyclical 10.8% 11.6% 11.7% 9.3% 7.7% 8.1% Consumer, Non- cyclical 15.9% 16.1% 16.5% 10.3% 11.1% 11.0% Diversified 0.2% 0.3% 0.4% 0.1% 0.0% 0.0% Energy 7.8% 8.6% 8.2% 6.6% 7.2% 6.9% Non sector-specific ETF 3.5% 1.7% 1.9% 16.8% 17.5% 19.4% Financial 19.1% 17.4% 18.1% 11.7% 9.0% 9.0% Industrial 6.0% 6.8% 6.6% 5.8% 7.3% 7.3% Technology 5.4% 5.1% 4.9% 5.2% 7.0% 6.7% Utilities 1.7% 1.3% 1.3% 1.5% 1.7% 1.6% Government 5.4% 7.4% 7.2% 10.9% 7.5% 6.8% Other 7.2% 5.4% 5.1% 9.7% 12.4% 12.1% Source: J.P. Morgan Prime Brokerage May-13 Jun-13 Jul-13 Average First Quartile % Change Market Neutral 3.94 4.08 4.15 3.80 3.54 1.7% Equity Long Short 1.96 1.97 1.99 1.82 1.72 1.1% Multi-Strategy 1.74 1.72 1.73 1.76 1.73 0.9% Convertible Arbitrage 3.57 3.62 3.81 3.68 3.49 5.5% High Grade Fixed Income 1.82 2.08 1.92 2.48 2.24 -8.0% High Yield Fixed Income 1.29 1.41 1.48 1.24 1.16 5.4% PB Portfolio (Levered Accounts) 2.44 2.41 2.54 2.51 2.47 5.7% 0.4 0.7 1.0 Jul-11 Nov-11 Mar-12 Jul-12 Nov-12 Mar-13 Jul-13 Net Exposure (LMV/SMV)-1 Net Leverage (LMV-SMV)/Eq

- 6. Prime Brokerage Global Hedge Fund Trends – Securities Lending 6 This material is provided by J.P. Morgan’s Prime Brokerage business for informational purposes only. It is not a product of J.P. Morgan’s Research Departments. For Institutional Investors only. For the intended recipient only. The reference period for this publication is July 2013 unless otherwise stated. North America Securities Lending Equities During July, securities lending activity in the U.S. Prime Brokerage book reverted to the 2013 trend of strong net covering. July’s reduction in short volume was concentrated heavily in single name equities. Cumulative net activity (shorts vs. covers) hit a 2013 low on July 18th. Although there was increased shorting towards month end, the long term trend of covering remained intact. Gross short volume declined slightly on the month, though short volumes remain above the 2013 average for the Prime Brokerage book. From a sector perspective, covering was concentrated in Communications, Financials and Energy, while the Consumer, Cyclical and Technology sectors were net shorted for the month. ETFs Along with single name equities, ETFs were net covered in July. The largest covering occurred with respect to XLE (Energy Select Sector SPDR ETF) and XOP (SPDR S&P Oil & GaS Exploration & Production ETF). Country ETFs were again active with improved liquidity and new shorting in EEM (iShares MSCI Emerging Markets Index ETF), EWZ (iShares MSCI Brazil Index ETF) and FXI (iShares FTSE/ Xinhua China 25 Index ETF). Fixed income ETF demand subsided alongside covering in HYG (iShares iBoxx High Yield Corp Bond ETF), JNK (SPDR Barclays Capital High Yield Bond ETF) and LQD (iShares IBoxx Investment Grade Corp Bond ETF). In contrast to the overall trend, there was notable shorting in IWM (iShares Russell 2000 Value Index ETF), SPY (SPDR S&P 500 ETF Trust) and XLF (Select Sector Financial Select Sector SPDR ETF). Event Driven • AT&T Inc. (T) entered into an agreement to acquire Leap Wireless International, Inc. (LEAP) for $1.2 billion in cash. Leap shareholders will receive $15.00 in cash and a contingent right to receive the net proceeds of the sale of a portion of Leap’s spectrum in the Chicago area. AT&T identified the added spectrum from the acquisition as complementary to their existing coverage. The transaction is subject to review by the FCC as well as other customary closing conditions. Shares of both AT&T and LEAP are currently general collateral (GC). • Hecla Mining Co. (HL) completed its acquisition of Aurizon Mines Ltd. (USA) (AZK) for $774 million in a mix of stock and cash. Aurizon had rejected an unsolicited offer from Alamos Gold in January and subsequently commenced a search for an alternative buyer. • Loblaw Companies Ltd. (L CN) and Shoppers Drug Mart Corp. (SC CN) announced an agreement whereby Loblaw will acquire all Shoppers shares for a mix of stock and cash. Shoppers shareholders will receive consideration of 53.9% cash and 46.1% stock. Loblaw’s controlling shareholder has entered into a voting agreement in support of the transaction, which is expected to close early next year. Borrow for Loblaw spiked as high as -6% before settling at -2.5%. • Halliburton Co. (HAL) announced a modified Dutch auction to repurchase up to $3.3 billion worth of shares. Halliburton shareholders may tender shares at a price between $42.50 and $48.50. Halliburton ultimately will determine the purchase price. The offer is set to expire on August 22. • After several bumps in the road, SoftBank Corp (9984 JP) completed its acquisition of Sprint Nextel Corp. (S). The deal, valued at over $21 billion, is being touted by management as creating a “stronger, more competitive” Sprint. Fixed Income The Prime Brokerage fixed income book ended July net shorted for the first time in six months. While overall volumes increased, shorting was driven by corporate bond activity. Although U.S. Treasury activity decreased for the first time in three months, the on-the-run 10-Year remained active, as did the short end of the Treasury curve, most notably the Two- and Three-Year. Increases in corporate activity were led by the Basic Materials, Consumer, Non-cyclical, and Energy sectors. Issues remain concentrated with continued interest in the following names: Fortescue Metals Group Limited (FMG), Cliffs Natural Resources Inc. (CLF), Alpha Natural Resources Inc. (ANR), Arch Coal Inc. (ACI), Walter Energy, Inc. (WLT), Dell Inc. (DELL) and BMC Software, Inc. (BMC). Lam Research Corp. (LRCX), Priceline.com Inc. (PCLN) and RadioShack Corp. (RSH) led increases in convertible bond activity.

- 7. Prime Brokerage Global Hedge Fund Trends – Securities Lending 7 This material is provided by J.P. Morgan’s Prime Brokerage business for informational purposes only. It is not a product of J.P. Morgan’s Research Departments. For Institutional Investors only. For the intended recipient only. The reference period for this publication is July 2013 unless otherwise stated. Figure 11: Cumulative net activity Market value change of activity across equities, ETFs, and fixed income Source: J.P. Morgan Securities Lending Figure 12: Rolling 1-month daily short flow Daily Activity Relative to 30-Day Average (LHS) and S&P 500 Index (RHS) Source: Bloomberg, J.P. Morgan Securities Lending Table 4: U.S. securities lending trends by sector For the month of July 2013 5 Day 30 Day 90 Day Price Change Position Change (shares) Price Change Position Change (shares) Price Change Position Change (shares) Consumer, Non-cyclical 1.6% 0.3% 8.2% 1.9% 12.5% -5.2% Financial -0.8% -0.5% 4.9% -7.4% 6.2% -9.7% Technology 1.1% 1.4% 5.8% 2.3% 9.5% -8.2% Energy 0.6% 0.1% 5.9% -1.2% 5.0% 8.1% Communications 0.7% -2.3% 5.7% -4.2% 7.3% -5.2% Industrial 0.3% -0.7% 5.7% -0.2% 7.3% 7.5% Consumer, Cyclical 1.8% -0.5% 6.9% 1.0% 10.7% -2.4% Basic Materials -1.7% 0.5% 4.3% 1.3% -2.9% -1.0% Utilities 0.1% 5.7% 3.0% -0.6% -5.6% 22.5% Source: J.P. Morgan Securities Lending Table 5: U.S. securities lending trends by ETFs For the month of July 2013 5 Day 30 Day 90 Day Price Change Position Change (shares) Price Change Position Change (shares) Price Change Position Change (shares) SPDR S&P 500 ETF TRUST 0.1% 0.6% 5.2% 0.6% 6.7% 13.2% ISHARES RUSSELL 2000 0.1% 5.0% 6.8% 4.5% 11.4% 9.8% ENERGY SELECT SECTOR SPDR -0.3% 2.9% 5.3% -26.1% 7.1% -5.2% SPDR S&P MIDCAP 400 ETF 0.2% -4.2% 6.7% -6.9% 7.8% -30.3% ISHARES MSCI EMERGING MARKETS ETF -1.8% -34.4% 0.6% 24.4% -8.5% 150.9% ISHARES MSCI BRAZIL CAPPED (EWZ) -1.8% 6.3% -1.2% 49.6% -19.9% 178.9% SPDR S&P OIL & GAS EXPLORE & PROD. (ETF) 1.2% -4.6% 7.3% -16.8% 10.4% 3.7% SPDR S&P RETAIL ETF 1.8% 38.7% 6.5% 98.4% 12.0% -5.1% FINANCIAL SELECT SECTOR SPDR -0.7% 26.3% 5.6% 20.4% 10.8% 20.9% POWERSHARES QQQ TRUST, SERIES 1 (ETF) 1.8% -8.1% 6.6% -0.5% 8.7% 42.5% Source: J.P. Morgan Securities Lending -$16.0 -$14.0 -$12.0 -$10.0 -$8.0 -$6.0 -$4.0 -$2.0 $0.0 $2.0 $4.0 1-Aug 31-Aug 30-Sep 30-Oct 29-Nov 29-Dec 28-Jan 27-Feb 29-Mar 28-Apr 28-May 27-Jun 27-Jul Equity ETF Fixed Income Net Activity 1,550 1,575 1,600 1,625 1,650 1,675 1,700 -200% -150% -100% -50% 0% 50% 100% 150% 200% 250% 300% 350% 01-Jul 08-Jul 15-Jul 22-Jul 29-Jul Net Cover Activity (LHS) Net Short Activity (LHS) S&P 500 Index (RHS)

- 8. Prime Brokerage Global Hedge Fund Trends – Securities Lending 8 This material is provided by J.P. Morgan’s Prime Brokerage business for informational purposes only. It is not a product of J.P. Morgan’s Research Departments. For Institutional Investors only. For the intended recipient only. The reference period for this publication is July 2013 unless otherwise stated. International Securities Lending EMEA Fundamental equity long short funds were busy with Q2 reporting season in full swing in July. The Prime Brokerage portfolio saw significant increases in short interest in the following names, giving rise to some of the most crowded shorts in Europe: Banco de Sabadell (SAB: SM), Banca Monte Dei Paschi Siena (BMPS: MI), New World Resources (NWR: LN), K&S (KSC: ASE), Gemalto (GTO: EN), Petropavlovsk (POG: LN) and Frontline Ltd. (FRO). The Prime Brokerage book also saw significant interest across the capital structure in K&S, Banca Monte Dei Paschi, Outotec (OTE1V) and Caixabank (CABK), where hedge funds are looking to short equities, bonds or convertible instruments to express their directional views. Securities lending interest continued for companies seeking to raise capital or re-structure debt. There was increased demand in Royal Imtech (IM: EN) as the rights traded and borrow became highly illiquid. There are several more companies deemed to have capital deficiencies which should translate into an ongoing trend of capital raisings into the second half of 2013. Among convertible arbitrage clients, Alcatel Lucent (ALU FP) continued to be a name of interest, although borrow eased throughout July. There was strong interest in International Consolidated Airlines (IAG LN) borrow as the share price rallied and funds have re-hedged their delta. Nokia (NOK) and Peugeot (UG) have also seen easing in their borrow. Borrow for Emaar Properties (EMAAR) has tightened, as clients have been building positions. Asia Pacific Ex-Japan Taiwan July saw ongoing recalls from onshore brokers around dividend dates. However, the impact on outstanding shorts was limited, as increased offshore non-recallable supply helped offset the recalls. Rates came off in HTC Corp. (2498 TT) as supply previously recalled for the dividend date returned to the market, thereby adding liquidity. July also saw increased shorting in the Technology sector. Hong Kong Demand for financial stocks continued. Minsheng Bank (1988 HK) was the most heavily shorted name in the sector. July saw continued two way flow in ETE (iShares FTSE/Xinhua A50 China Tracker). There was also new demand in the real estate sector for Evergande Real Estate Group Limited (3333 HK). Japan The market in Japan was flat to down slightly (-0.7%) month- over-month, which resulted in an overall decrease in borrow demand. There was strong demand for SNS online-related names, which generally are lacking in availability. The Prime Brokerage book saw daily locates on Gree, Inc. (3632 JP), DeNA Co. (2432 JP), GunHo Online Entertainment (3765 JP), Colopl (3668 JP), Altplus, Inc. (3672 JP), Klab, Inc. (3656 JP), CROOZ (2138 JP), and Dwango (3715 JP). Clients also sought locates in Yakult Honsha Co. (2267 JP), Kenedix Residential Investment Corp. (3278 JP), and U- SHIN Ltd. (6985 JP). Australia There was considerable activity among metals and mining companies in Australia. Fortescue Metals Group (FMG AU) experienced short covering as the iron ore price recovered during July. There was also covering in Iluka Resources Limited (ILU AU) as the Zircon spot price recovered. Rare earth prices strengthened throughout July, but Lynas Corporation Limited (LYC AU) shorts remained resolute with borrow utilization increasing slightly to 97%. Demand for Oz Minerals (OZL AU) increased after the company cut its guidance on production for 2013 from 130-150 thousand ounces of gold to 120-130 thousand ounces. Treasury Wine Estates Limited (TWE AU) took a $160 million write-down as it attempted to address a glut of stock in the United States, attracting moderate interest from short sellers. APA Group (APA AU) bid for shares in Envestra Ltd. (ENV AU), attracting limited demand from risk arbitrageurs. However, the spread remains too expensive to attract strong demand. Borrow utilization in McMillan Shakespeare (MMS AU) doubled after tax changes affecting auto leasing businesses were proposed by the Federal Government. Demand for Macquarie Bank (MQG AU) fell on company guidance for stronger profits this year.

- 9. Prime Brokerage Global Hedge Fund Trends – Institutional Investor Sentiment 9 This material is provided by J.P. Morgan’s Prime Brokerage business for informational purposes only. It is not a product of J.P. Morgan’s Research Departments. For Institutional Investors only. For the intended recipient only. The reference period for this publication is July 2013 unless otherwise stated. Institutional Investor Sentiment North America During the month of July, the Capital Introduction Group (CIG) held meetings with allocators in Michigan, Atlanta and Montreal. The investor base in Michigan is concentrated among a small number of large-scale pension plans, endowments and foundations. The pension plans in Michigan, which are related mainly to the automotive sector, prefer to invest via funds of hedge funds (FoFs). To the extent that the Michigan-based pensions invest with hedge fund managers directly, they do so primarily with multi- strategy funds with several billion dollars in assets under management (AUM) for purposes of diversification. In contrast to those pension plans, the Michigan-based endowments and foundations tend to invest in hedge funds directly. However, their portfolios have minimal turnover. Accordingly, the amount of capital available for new hedge fund allocations among such investors is limited. Few of these groups use consultants for their allocations to alternatives. The institutional investor base in Atlanta is more diversified and consists of public and private pension plans, consultants as well as single- and multi-family offices. As in other regions, most of those allocators are moving away from FoFs in lieu of direct investments. While the bar remains high for garnering new allocations, a number of family offices in and around Atlanta are putting capital to work. Strategies of interest include equity long short, European credit and emerging managers. Montreal’s investor base is comprised of several large pensions and a handful of FoFs and endowments. Equity long short with low net exposure is the strategy most in demand. While some groups are willing to consider sector-specific managers, most prefer generalist funds. Allocators also expressed some interest in global macro. Overall, it bears noting that, although numerous allocators have in recent months expressed interest in directional strategies such as equity long short, most of the new flows have been limited to a select number of larger, established managers. Industry flows were $14.5 billion in the second quarter, the lowest level of the past five quarters.10 EMEA CIG met with investors in Germany during July. Most German allocators are in “wait and see” mode owing to 10 Hedge Fund Research Global Hedge Fund Industry Report, Second Quarter 2013. pending regulations and upcoming elections. As is the case with most European allocators, investors in Germany are interested primarily in equity long short, though global macro also is garnering increased interest. While there has been speculation that corporate plans in Germany will migrate increasingly to direct investments, most such investors still use intermediaries, i.e., consultants and FoFs, for their hedge fund allocations. Asia Pacific Equity long short remains the strategy of most interest among Asia Pacific-based allocators. There has also been an uptick in interest in Japanese equities. To date, most institutional investors have sought exposure to Japan via global or pan- Asian managers. Allocators in Asia are beginning to turn away from structured credit. Several groups are harvesting gains in the sector and making redemptions. As usual, investors in Asia remain interested in better-performing global macro managers and uncorrelated strategies. Although CTAs are not experiencing significant redemptions, investors are generally dissatisfied with their underperformance and, therefore, not allocating new capital. Table 6: Investor strategies of interest by region11 North America EMEA Asia Pacific Direction of Interest Level of Interest Direction of Interest Level of Interest Direction of Interest Level of Interest Convertible Arbitrage Neutral Neutral Neutral Distressed Neutral Neutral Neutral Equity Long Short Neutral Neutral Increasing Event Driven Neutral Increasing Increasing Macro Neutral Increasing Decreasing CTA Decreasing Neutral Neutral Market Neutral Neutral Neutral Increasing Structured Credit Decreasing Neutral Decreasing Legend Low Interest Medium Interest High Interest Source: J.P. Morgan Capital Introduction Group 11 This information comes from CIG conference calls and meetings with global hedge fund managers and institutional investors. This table represents views of the CIG team and may not be completely exhaustive.

- 10. Prime Brokerage Global Hedge Fund Trends – Market Perspectives 10 This material is provided by J.P. Morgan’s Prime Brokerage business for informational purposes only. It is not a product of J.P. Morgan’s Research Departments. For Institutional Investors only. For the intended recipient only. The reference period for this publication is July 2013 unless otherwise stated. July Commentary July was marked by a growing dichotomy between developed markets (DMs), which overall delivered positive economic news, and emerging markets (EMs) in which the outlook is becoming increasingly dour. Economic news in the U.S. was especially strong. The manufacturing PMI rose from 50.9 in June to 55.4 in July, handily beating economists’ estimates for a more incremental increase to 52.0. (A reading above 50 indicates that the manufacturing sector is expanding; a reading below 50 indicates contraction.) Notably, all of the major PMI sub-components increased as well. The New Orders Index – an important leading indicator – surged from 51.9 to 58.3, which likely signifies that growth is accelerating. Although U.S. consumer confidence edged down slightly, the U.S. housing recovery continued apace in July, with no sign of an end to house price appreciation. Currently, home prices in the U.S. are increasing by double digits and the inventory-to-sales ratio remains tight. The landscape brightened in Europe where PMIs rose for a third consecutive month. The Euro zone composite manufacturing PMI advanced from 48.8 to 50.3, reflecting a transition to growth. (Spain was the only country to see a drop in manufacturing PMI in July.) This trend should help corporate profits in the Euro zone expand in subsequent quarters. By contrast, the China PMI (compiled by HSBC) contracted in July and EM growth – in both Asia and Latin America – is slowing. The DM-EM dichotomy could widen further if the Federal Reserve, reacting to continued U.S. expansion, begins to slow its bond buying in September, as investors will no longer see EMs as fruitful markets in which to capture yield. The following sections are excerpts from J.P. Morgan Research publications. The full publications can be accessed via the sources provided in the footnotes below. Job gains to lag global growth lift 12 Through a prolonged period of sub-par growth, global employment gains have continued at a solid pace. The stability of employment growth over 2011-12 was an important positive for a global economy absorbing negative shocks. As the Euro area crisis weakened global demand and weighed on confidence, labor market developments served as 12 J.P. Morgan Economic Research, Job gains to lag global growth lift, July 24, 2013, https://jpmm.com/research/content/GPS-1171067-0. a cushion. In addition, this resilience has limited the damage done by periodic bouts of commodity price inflation that dented household purchasing power. The importance of sustained job growth is most evident in the resilience of retail sales volume gains relative to other components of final demand. Consumers have, however, been standing on the back of a corporate sector whose performance has been deteriorating. Profit growth slowed alongside weaker GDP gains. This slowdown has been magnified by a margin squeeze reflecting a global productivity growth stall, a fall in finished goods price inflation, and stable wage inflation. With persistent sub- par growth and finished goods price inflation moving sharply lower during 1H13, the pressure on corporates is building. Capital spending gains have slowed in recent quarters, and we believe that a corresponding adjustment in hiring is looming. Our forecast of a grind to higher global GDP growth is built on the tension between corporate weakness, a building policy impulse, and an improvement in credit conditions. The case for this balance to deliver stronger overall global growth is good. The implications for job growth are less clear. Indeed, our forecast has all of the improvement in global GDP over the coming quarters arising from a rebound in productivity from the current stall. We expect global employment to rise at a 1% pace between now and the end of 2014, in line with its average over 2011-12. The challenge of very low inflation in the Euro area13 For an extended period, Euro area core inflation (excluding food, energy, alcohol, and tobacco) was surprisingly sticky. If indirect taxes are also excluded, this measure of core inflation averaged 1.5%oya for almost 18 months from the spring of 2011 to the late summer of 2012, not much below the 2% peak seen in the spring of 2008, just before the first recession began. A lot of economic weakness seemed to be delivering very little disinflation. But, the situation has changed significantly in the past nine months, in two respects, in our view. First, the downward momentum in area-wide core inflation has resumed. Euro area core inflation ex. taxes fell from 1.5%oya last August to 1.1%oya in May this year. The stickiness of core inflation ex. taxes appears to have been due to imported inflation and 13 J.P. Morgan Europe Economic Research & Fixed Income Strategy, The challenge of very low inflation in the Euro area, July 9, 2013, https://jpmm.com/research/content/GPS-1158342-0.

- 11. Prime Brokerage Global Hedge Fund Trends – Market Perspectives 11 This material is provided by J.P. Morgan’s Prime Brokerage business for informational purposes only. It is not a product of J.P. Morgan’s Research Departments. For Institutional Investors only. For the intended recipient only. The reference period for this publication is July 2013 unless otherwise stated. second round effects of higher commodity prices. And second, the impact of the diverging levels of slack across the region can be increasingly seen in national inflation rates, with core inflation ex. taxes reaching very low levels across the periphery, with the exception of Italy. Deflation is already well established in Greece, with the May reading of core inflation ex. taxes at -1.5%oya. In Spain and Portugal, core inflation ex. taxes in May was 0.9%oya and 0.7%oya, respectively. Across the periphery, Italy stands out, with a May reading of 1.6%oya. In our view, core inflation ex. taxes in the region as a whole will continue to decline; we expect it to fall below 1%. Moreover, the dispersion of core inflation is likely to increase. Core inflation ex. taxes is likely to rise in Germany, and to continue falling sharply across the periphery. Indeed, there is a good chance of deflation becoming entrenched in a number of peripheral countries. Daily Economic Briefing14 While some of the regional and sectoral details showed at least some improvement, the latest quarterly IIF EM bank survey was modestly negative on balance. The most notable shifts in the survey, released yesterday, revealed worsening funding conditions for EM banks, from sources both abroad and domestically based. Additionally, EM banks reported rising net non-performing loan expectations. Despite these headwinds, however, the pace of credit tightening did not pick up appreciably over the past three months. The moderate rate of increase in EM bank credit standards has been fairly constant since early 2012, weighing on GDP growth, which fell to a non-recession decade low in 1H. Our research has highlighted the direct linkages between the Euro area crisis/recession and EM bank funding conditions. Over the past few years, one way EMU banks responded to increased stress was by reducing their exposure in the EM. These periods of heightened stress were accompanied by a widespread turn toward market risk aversion. EM banks responded to these more restrictive conditions by raising terms and standards on loans. In the most recent quarter, the pace of Euro area credit tightening slowed considerably while EM international funding conditions deteriorated. Market jitters about the Fed, which prompted a pullback in capital inflows to the EM, were responsible. The same forces drove the adverse swing in 14 J.P. Morgan Economic Research, Daily Economic Briefing: EM funding conditions deteriorate, July 25, 2013, https://jpmm.com/research/content/GPS-1172604-0. EM domestic funding conditions. (In addition, there were idiosyncratic developments such as the crunch in the interbank market in China.)

- 12. Important Information and Disclaimers 12 This material is provided by J.P. Morgan’s Prime Brokerage business for informational purposes only. It is not a product of J.P. Morgan’s Research Departments. For Institutional Investors only. For the intended recipient only. The reference period for this publication is July 2013 unless otherwise stated. This material (“Material”) is provided by J.P. Morgan’s Prime Brokerage business for informational purposes only. It is not a product of J.P. Morgan’s Research Departments. This Material includes data and viewpoints from various departments and businesses within JPMorgan Chase & Co., as well as from third parties unaffiliated with JPMorgan Chase & Co. and its subsidiaries. The generalized hedge fund and institutional investor information presented in this Material, including trends referred to herein, are not intended to be representative of the hedge fund and institutional investor communities at large. This Material is provided directly to professional and institutional investors and is not intended for nor may it be provided to retail clients. This Material has not been verified for accuracy or completeness by JPMorgan Chase & Co. or by any of its subsidiaries, affiliates, successors, assigns, agents, or by any of their respective officers, directors, employees, agents or advisers (collectively, “JPMorgan”), and JPMorgan does not guarantee this Material in any respect, including but not limited to, its accuracy, completeness or timeliness. Information for this Material was collected and compiled during the stated timeframe, if applicable. Past performance is not a guarantee of future results. JPMorgan has no obligation to update any portion of this Material. This Material may not be relied upon as definitive, and shall not form the basis of any decisions. It is the user’s responsibility to independently confirm the information presented in this Material, and to obtain any other information deemed relevant to any decision made in connection with the subject matter contained in this Material. Users of this Material are encouraged to seek their own professional experts as they deem appropriate including, but not limited to, tax, financial, legal, investment or equivalent advisers, in relation to the subject matter covered by this Material. JPMorgan makes no representations (and to the extent permitted by law, all implied warranties and representations are hereby excluded), and JPMorgan takes no responsibility for the information presented in this Material. This Material is provided for informational purposes only and for the intended users’ use only, and no portion of this Material may be reproduced or distributed for any purpose without the express written permission of JPMorgan. The provision of this Material does not constitute, and shall not be construed as constituting or be deemed to constitute, a solicitation of, or offer or inducement to provide or carry on, any type of investment service or activity by JPMorgan. Under all applicable laws, including, but not limited to, the US Employee Retirement Income Security Act of 1974, as amended, or the US Internal Revenue Code of 1986 or the Financial Services and Markets Act 2000 (Regulated Activities) Order 2001, as amended, no portion of this Material shall constitute, or be construed as constituting or be deemed to constitute “investment advice” for any purpose, and JPMorgan shall not be considered as a fiduciary of any person or institution for any purpose in relation to Material. This Material shall not be construed as constituting or be deemed to constitute an invitation to treat in respect of, an offer or a solicitation of an offer to buy or sell any securities or constitute advice to buy or sell any security. This Material is not intended as tax, legal, financial or equivalent advice and should not be regarded or used as such. The Material should not be relied upon for compliance. An investment in a hedge fund is speculative and involves a high degree of risk, which each investor must carefully consider. Returns generated from an investment in a hedge fund may not adequately compensate investors for the business and financial risks assumed. An investor in hedge funds could lose all or a substantial amount of its investment. While hedge funds are subject to market risks common to other types of investments, including market volatility, hedge funds employ certain trading techniques, such as the use of leveraging and other speculative investment practices that may increase the risk of investment loss. Other risks associated with hedge fund investments include, but are not limited to, the fact that hedge funds: can be highly illiquid; are not required to provide periodic pricing or valuation information to investors; may involve complex tax structures and delays in distributing important tax information; are not subject to the same regulatory requirements as mutual funds; often charge higher fees and the high fees may offset the fund’s trading profits; may have a limited operating history; can have performance that is volatile; may have a fund manager who has total trading authority over the fund and the use of a single adviser applying generally similar trading programs could mean a lack of diversification, and consequentially, higher risk; may not have a secondary market for an investor’s interest in the fund and none may be expected to develop; may have restrictions on transferring interests in the fund; and may affect a substantial portion of its trades on foreign exchanges. JPMorgan may (as agent or principal) have positions (long or short), effect transactions or make markets in securities or financial instruments mentioned herein (or derivatives with respect thereto), or provide advice or loans to, or participate in the underwriting or restructuring of the obligations of, issuers mentioned herein. JPMorgan may engage in transactions in a manner inconsistent with the views discussed herein. © 2013 JPMorgan Chase & Co. All rights reserved. All product names, company names and logos mentioned herein are trademarks or registered trademarks of their respective owners. Access to financial products and execution services is offered through J.P. Morgan Securities LLC (“JPMS”) and J.P. Morgan Securities plc (“JPMS plc”). Clearing, prime brokerage and custody services are provided by J.P. Morgan Clearing Corp. (“JPMCC”) in the US and JPMS plc in the UK. JPMS and JPMCC are separately registered US broker dealer affiliates of JPMorgan Chase & Co., and are each members of FINRA, NYSE and SIPC. JPMS plc is authorized by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority in the UK. J.P. Morgan Securities (Asia Pacific) Limited is regulated by the Hong Kong Monetary Authority and the Securities and Futures Commission of Hong Kong. Contact Us: Alessandra Tocco Alessandra.Tocco@jpmorgan.com 212-272-9132 Kenny King, CFA Kenny.King@jpmorgan.com 212-622-5043 Christopher M. Evans c.m.evans@jpmorgan.com 212-622-5693 Stacy Bartolomeo Stacy.Bartolomeo@jpmorgan.com 212-272-3471