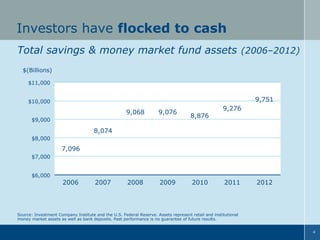

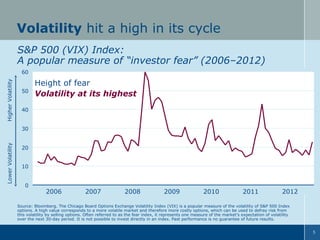

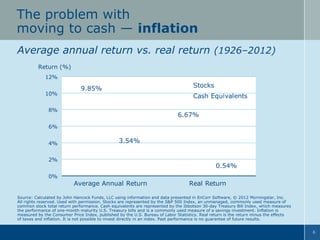

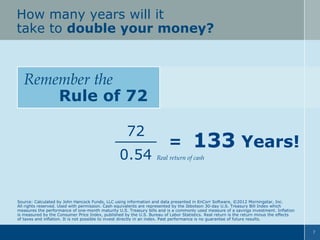

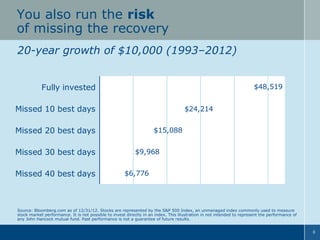

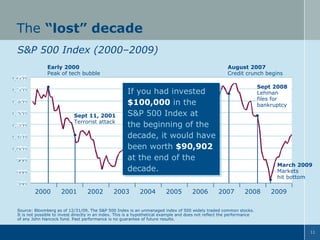

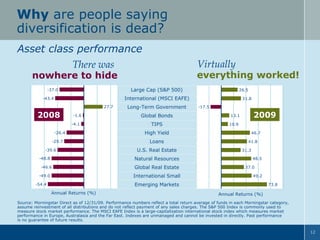

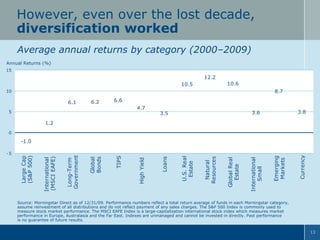

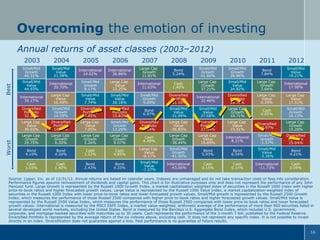

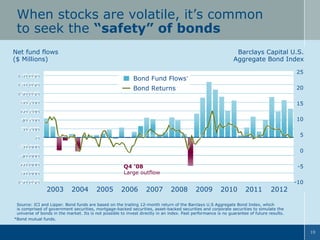

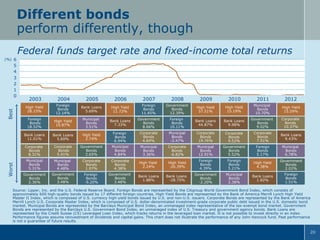

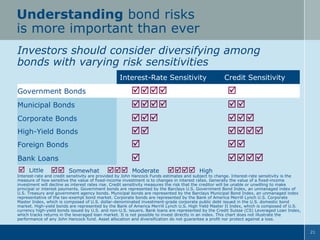

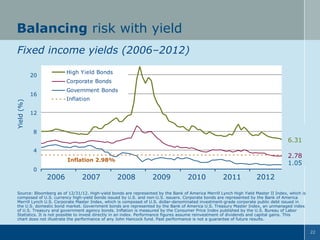

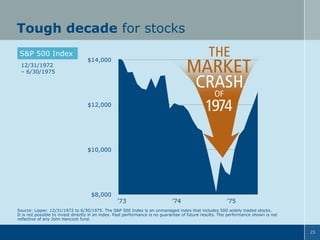

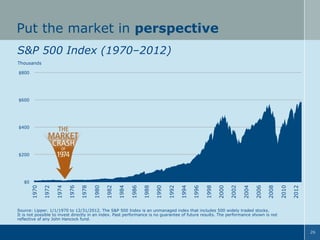

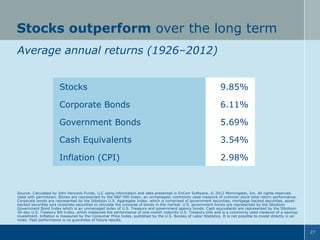

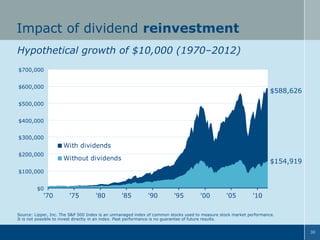

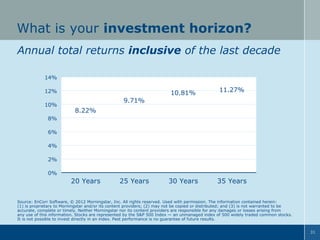

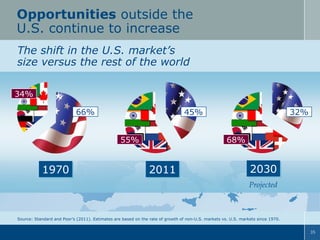

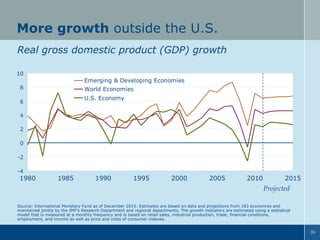

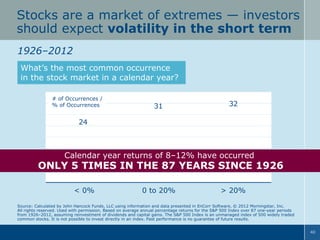

The document provides 5 investing principles based on a presentation about lessons learned. Principle 1 discusses that every investment has risks, even cash, as investors flocked to cash during volatile periods but it provided little return over the long run after accounting for inflation. Principle 2 notes that while most asset classes declined in 2008, a diversified portfolio still worked over the full market cycle from 2000-2009. Principle 3 explains that not all bonds or bond funds perform the same way. Principle 4 asserts that stocks have generally outperformed over the long run. Principle 5 advocates for including international stocks rather than avoiding foreign markets.