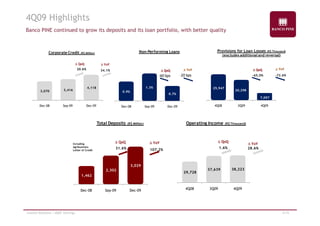

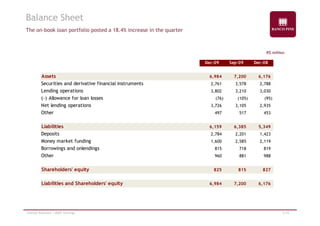

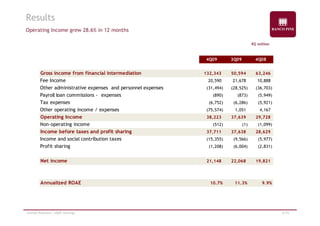

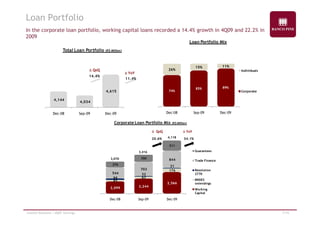

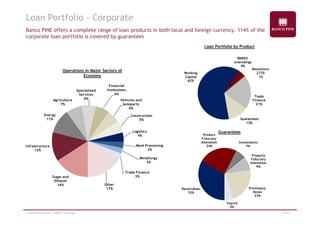

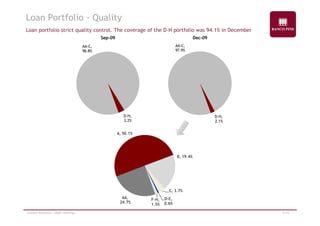

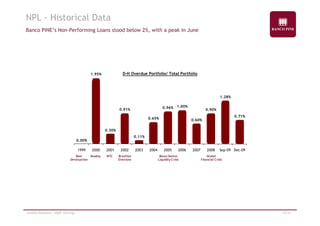

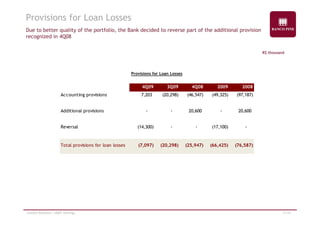

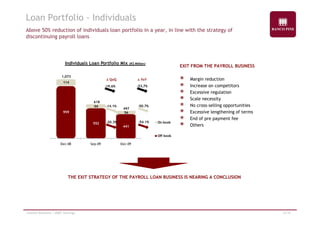

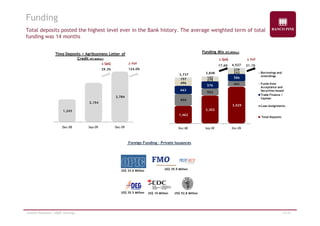

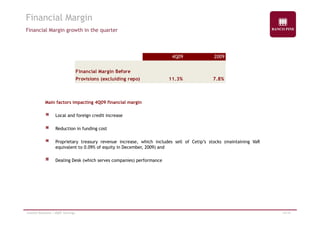

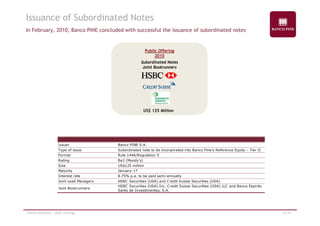

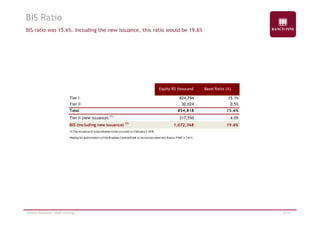

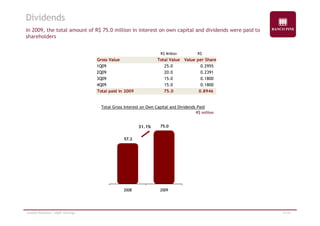

Banco PINE reported its financial results for the fourth quarter and full year of 2009. In 2009, the bank showed strong fundamentals through efficient cash management and cost structure adjustments. For 4Q09, total deposits grew 31.6% compared to the previous quarter and the corporate loan portfolio increased 20.6%. Non-performing loans declined to 0.7% of total loans. The bank reported net income growth of 10.7% for 4Q09 and reversed loan loss provisions due to improved credit quality. In February 2010, the bank issued $125 million in subordinated notes to boost its BIS ratio to a projected 19.6%.