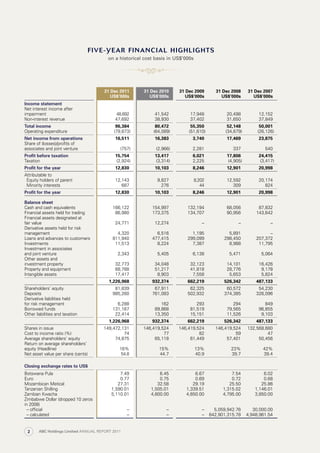

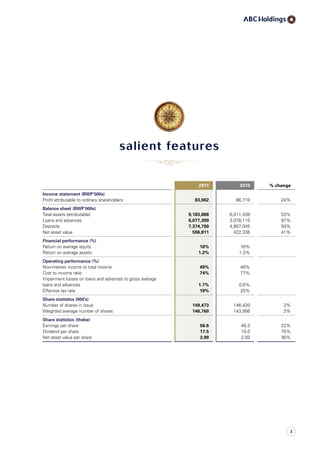

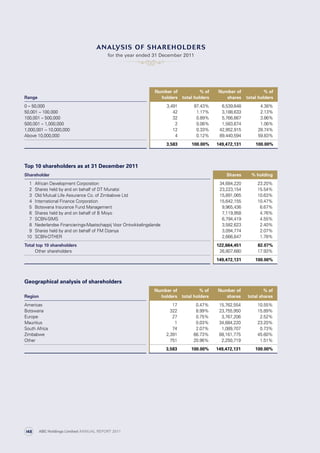

The document is ABC Holdings Limited's 2011 annual report. It provides an overview of ABC Holdings, which is the parent company of a number of banks operating in sub-Saharan Africa. Key highlights from 2011 include total income increasing 21% to BWP659 million, attributable profit to shareholders increasing 24% to BWP83 million, and total assets increasing 53% to BWP9.2 billion. The report also summarizes economic conditions in ABC Holdings' markets in 2011, which generally saw continued growth despite challenges from the global economic slowdown.