The document summarizes the 1Q17 earnings release of Pine Bank. Key highlights include:

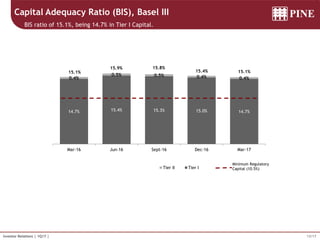

- The bank maintained a strong liquidity position with cash of R$1.1 billion and a BIS capital ratio of 15.1%.

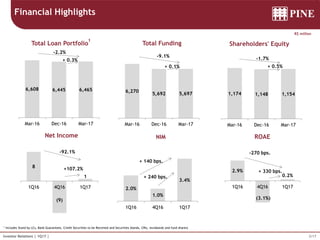

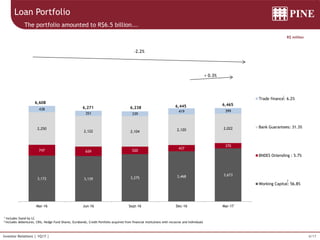

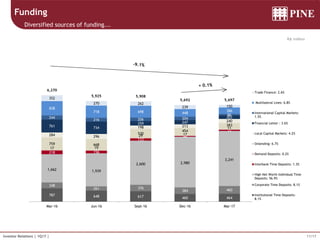

- The loan portfolio decreased slightly by 2.2% while funding decreased by a larger 9.1%.

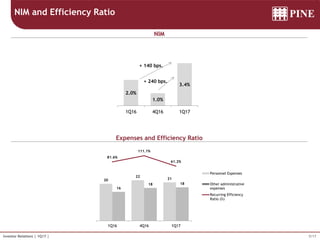

- Net interest margin improved significantly to 3.4% in 1Q17 compared to 1% in 4Q16 and 2% in 1Q16.

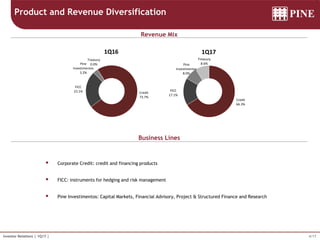

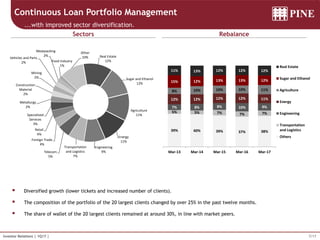

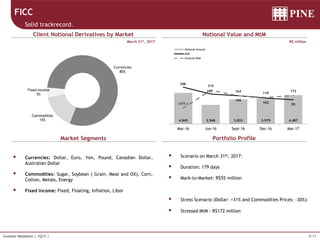

- Revenue was diversified across business lines including corporate credit, fixed income, and financial advisory services.

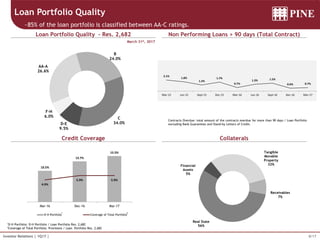

- Asset quality remained stable with non-performing loans below 1% and loan loss reserves covering over 5