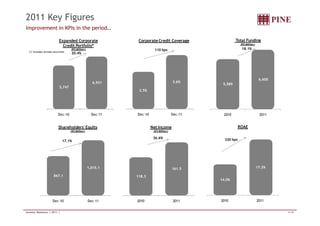

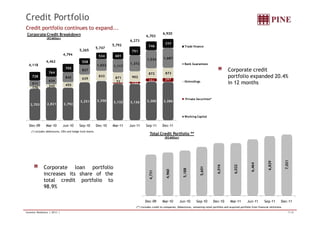

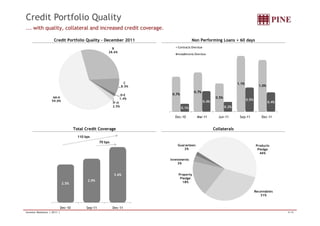

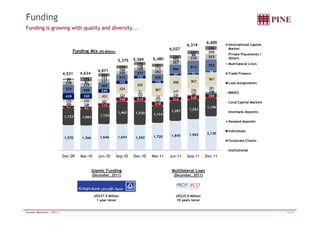

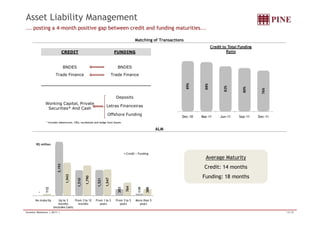

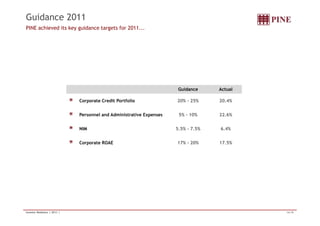

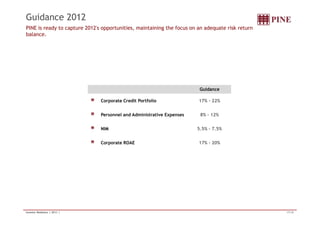

This document summarizes PINE Bank's 2011 earnings conference call. In 2011, PINE saw credit portfolio expansion of 20.4%, funding growth of 18.1%, and ROAE of 17.5%. The bank strengthened its balance sheet through extraordinary revenues from a successful lawsuit. For 2012, PINE provides guidance of 17-22% credit portfolio growth, 8-12% expense growth, maintaining a NIM of 5.5-7.5% and ROAE of 17-20%.