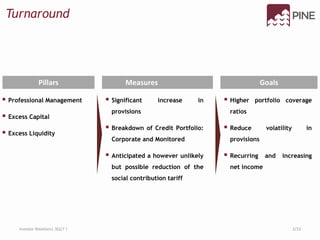

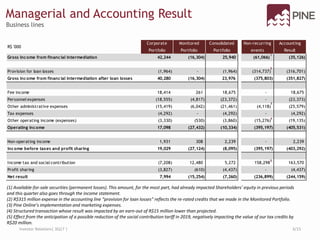

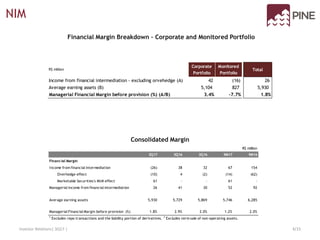

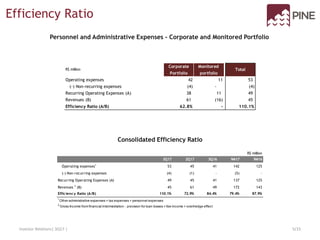

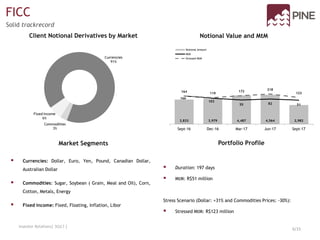

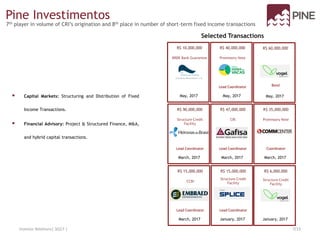

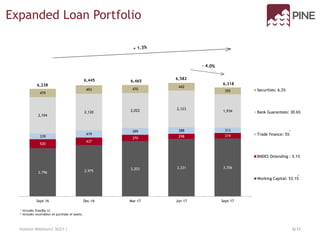

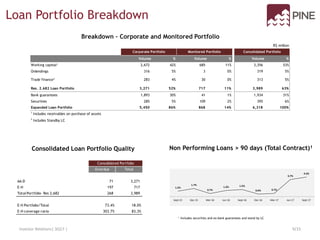

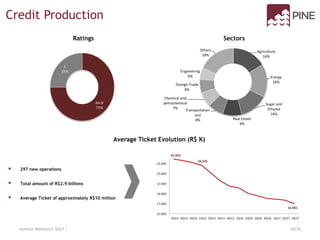

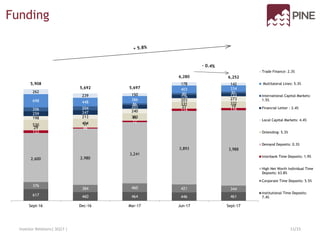

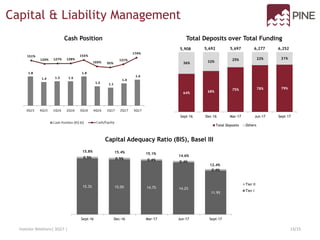

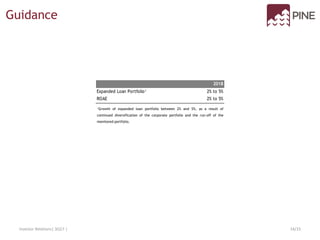

This document summarizes Pine Bank's 3Q17 earnings release conference call. It discusses the bank's turnaround efforts focusing on professional management, excess capital, and excess liquidity. Key measures taken include increasing loan loss provisions, breaking down credit portfolios, and increasing portfolio coverage ratios to reduce provision volatility and allow for recurring net income growth. The document provides financial results, highlights from various business lines, and guidance for 2018 with a focus on loan portfolio growth and return on equity.