- Banco PINE is a Brazilian bank focused on providing corporate financial services to companies with annual revenues over R$150 million. It offers credit, treasury, and investment products.

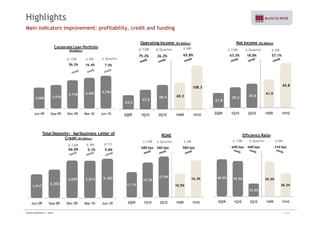

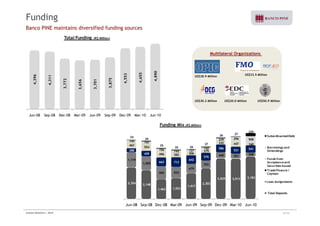

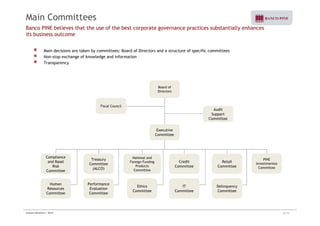

- The presentation discusses Banco PINE's history, business strategy of cross-selling multiple products, organizational structure, current performance, and future prospects. Key metrics like loans, deposits, and profitability increased in the most recent quarter and year.

- Banco PINE aims to sustain earnings growth by leveraging cross-selling opportunities within its existing corporate client base and maintaining its solid credit quality and adequate capital levels.