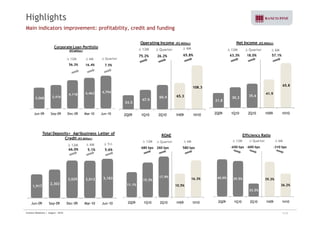

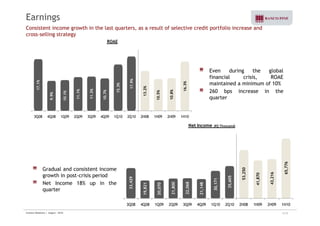

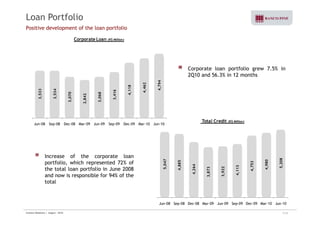

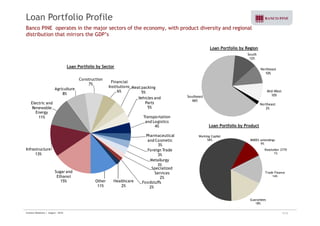

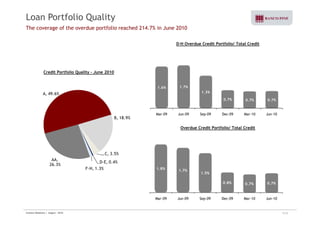

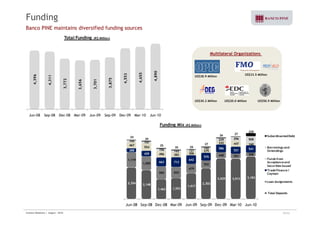

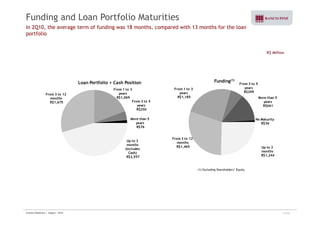

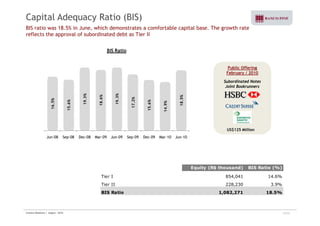

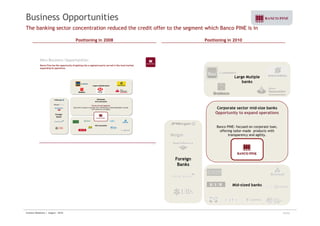

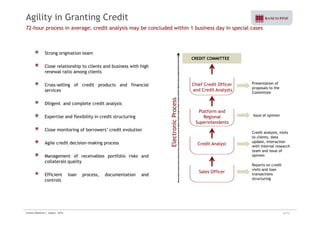

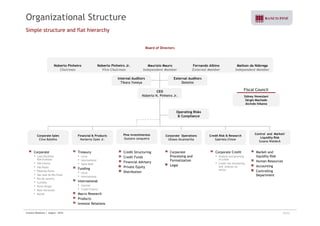

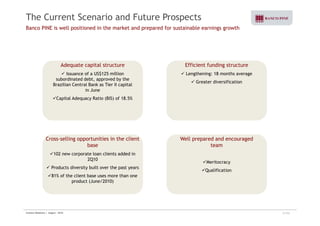

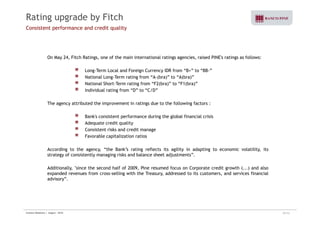

Banco PINE held a presentation covering its 2Q10 results and business strategy. The summary highlights strong income growth in recent quarters driven by selective credit expansion and cross-selling. Banco PINE maintains a diversified funding base and comfortable capital ratios. Its consistent strategy is to provide a full range of financial products and services to mid-sized corporations with an emphasis on customized solutions and rapid credit decisions.