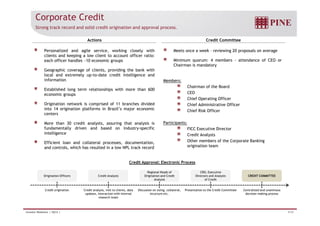

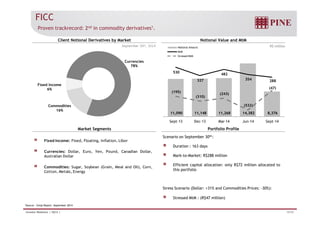

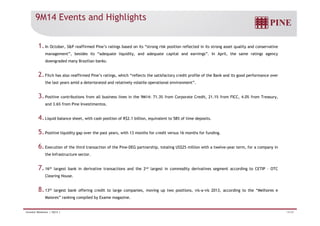

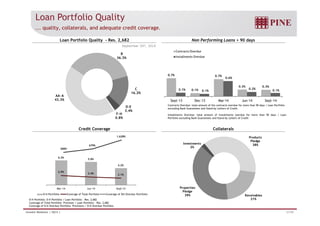

Pine is a Brazilian bank specialized in providing financial solutions to corporate clients. It has a long history dating back to 1939 and focuses on establishing long-term client relationships. It operates along three primary business lines: corporate credit, fixed income currencies and commodities trading, and capital markets and financial advisory services. Pine has maintained a solid credit portfolio and asset quality over its history and has diversified its business over time. It recently received rating reaffirmations from Fitch and S&P recognizing its stable financial metrics and strategic positioning.