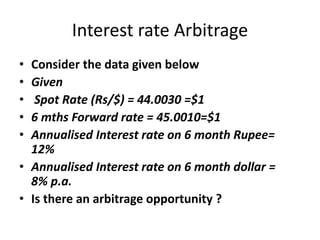

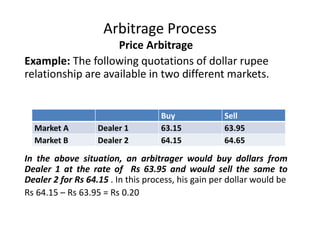

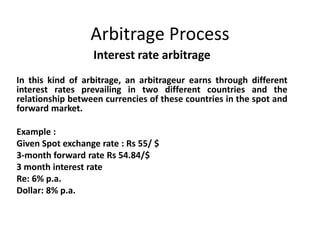

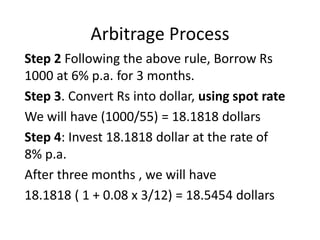

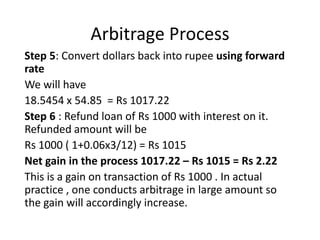

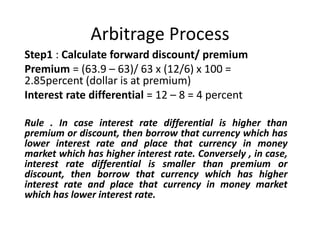

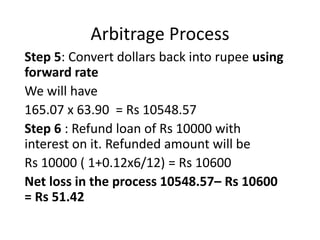

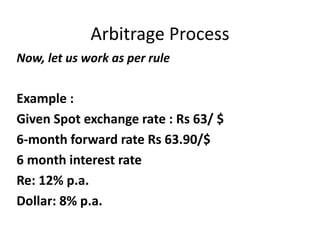

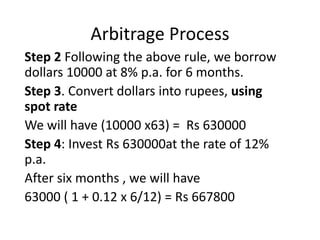

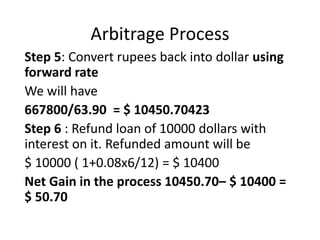

The document discusses arbitrage processes involving foreign exchange markets. It provides examples of price arbitrage and interest rate arbitrage. Price arbitrage involves buying a currency from one dealer and immediately selling it to another dealer at a higher price to profit from temporary price differences. Interest rate arbitrage exploits temporary interest rate differences between currencies - borrowing the currency with a lower interest rate and investing in the currency with a higher interest rate. The document outlines the step-by-step process for conducting interest rate arbitrage and demonstrates how following or violating the rules of which currency to borrow and invest in can lead to profit or loss.

![• Step 1: Calculate forward premium/discount using the formula

• (F-S)/S X 12/N x 100

• Forward premium/discount = [(63 – 62)/62 ] x (12/6) x 100 =

3.225806

• Dollar is at premium

• Step 2: Given interest rate differential ( RIndia – R u.s.) = 2%

• Step3: Since interest rate differential is smaller than forward

premium, borrow from the country where interest is higher and

invest in the country where interest rate is lower.](https://image.slidesharecdn.com/4arbritrage-240330142229-2425c00c/85/4_Arbritrage-process-presentation-uf-pptx-16-320.jpg)