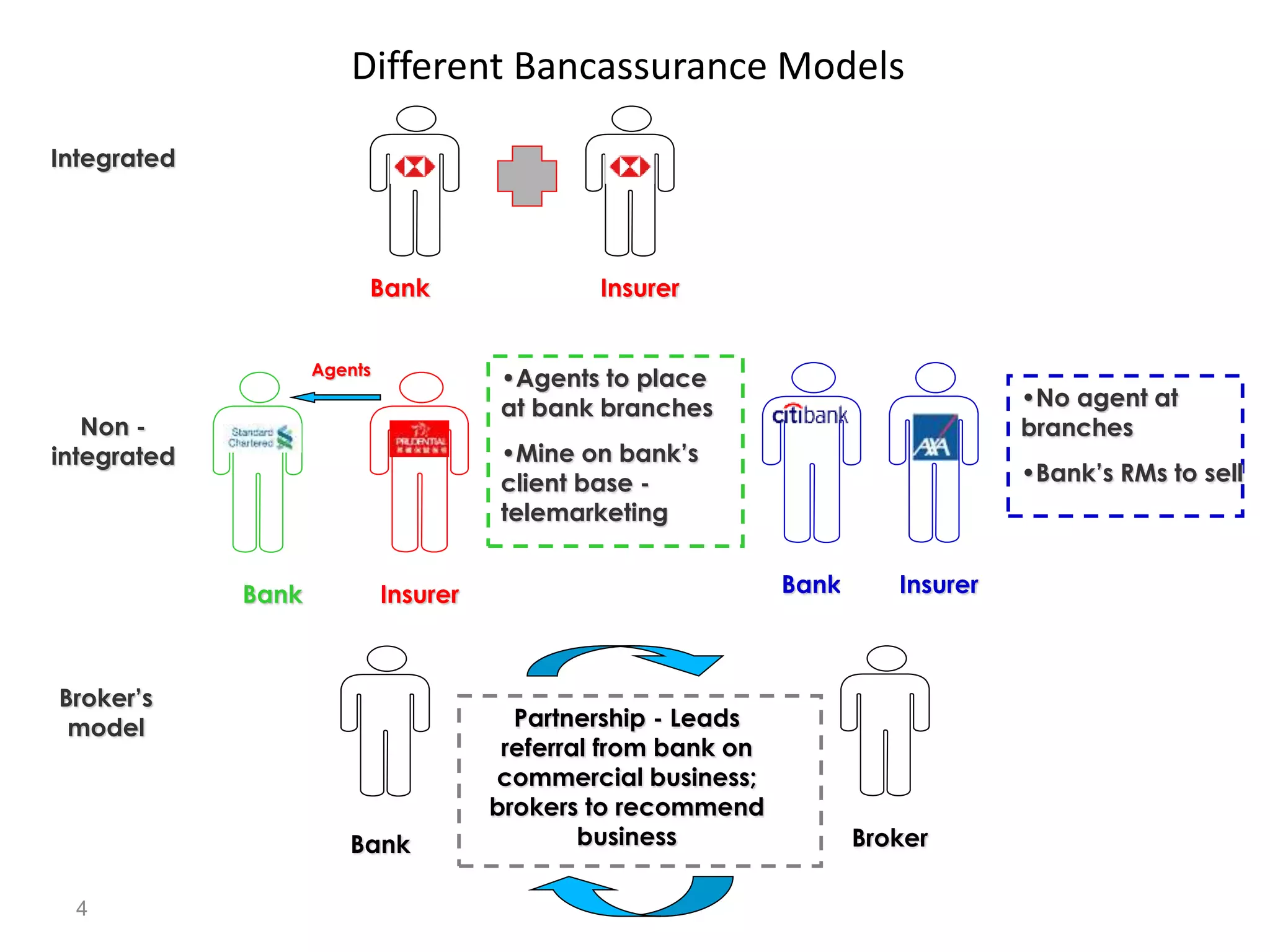

Bancassurance allows banks to sell insurance products through their distribution channels, forming partnerships between banks and insurers. This provides immediate access to new markets and increased penetration for insurers. Banks benefit through additional income from commissions and enhanced customer satisfaction from offering diverse services. Customers benefit from lower prices, better quality products, and convenient purchasing through their banks. Regulations in India require separate governance of banking and insurance, but allow banks to partner with insurers as agents.