This document provides an earnings release and financial highlights for Profarma Group for the 4th quarter and full year of 2015. Key points include:

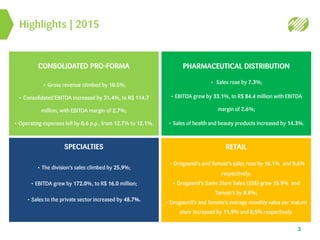

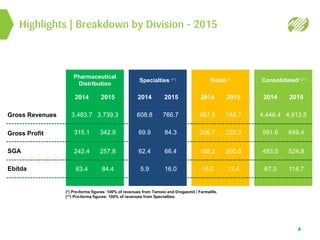

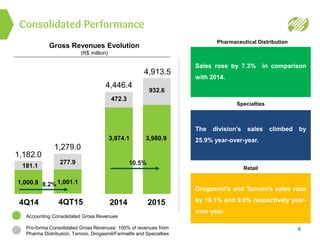

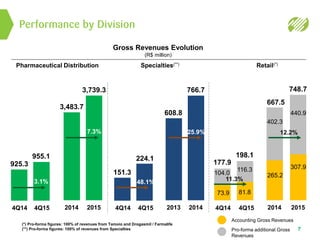

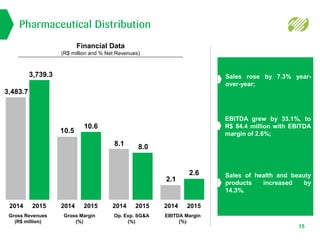

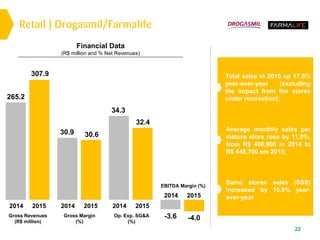

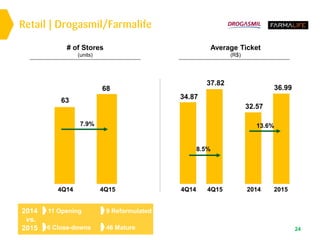

- Gross revenues increased 10.5% in 2015 driven by growth across all business divisions.

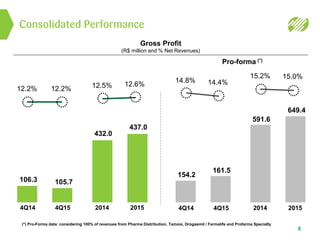

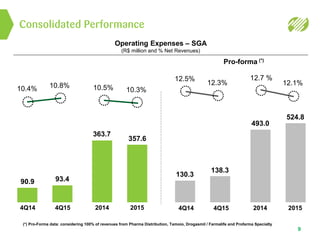

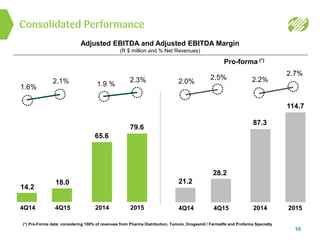

- Consolidated EBITDA grew 31.4% in 2015 with an EBITDA margin of 2.7%.

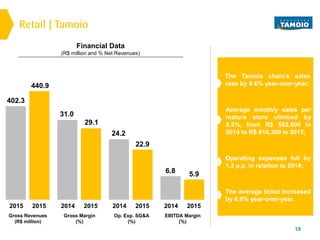

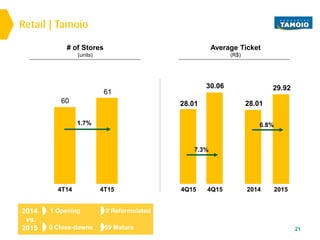

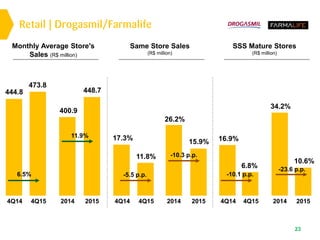

- The retail division saw same-store sales growth of 15.9% for Drogasmil and 8.8% for Tamoio.

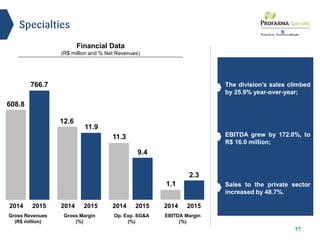

- The specialties division achieved sales growth of 25.9% and an EBITDA increase of 172%.

- Pharmaceutical distribution sales rose 7.3% while EBITDA grew 33