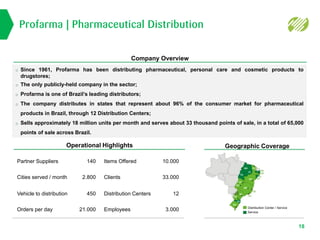

Profarma's wholesale, specialties, and retail divisions are positioned for continued growth in the Brazilian pharmaceutical market. Global pharmaceutical spending is projected to reach $1.3 trillion by 2018, with emerging markets like Brazil experiencing above-average growth rates. Profarma has a proven track record of organic and acquisition-based expansion in Brazil, and its strategic partnership with AmerisourceBergen provides access to new capabilities and markets.