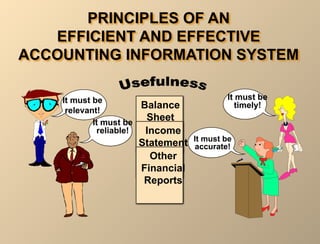

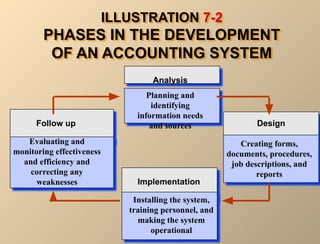

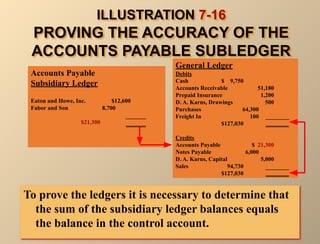

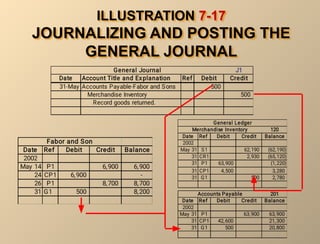

The document provides information about accounting principles and accounting information systems. It discusses the principles of an efficient and effective accounting information system, including that the system must be relevant, reliable, accurate, and timely. It also discusses the phases in developing an accounting system, including planning, design, implementation, and follow up. Finally, it provides examples of journals used in accounting information systems, including sales journals, cash receipts journals, purchases journals, and cash payments journals.