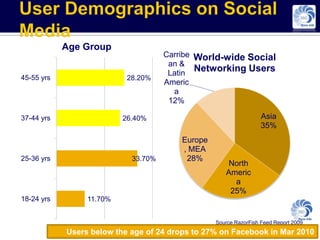

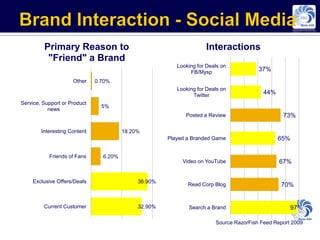

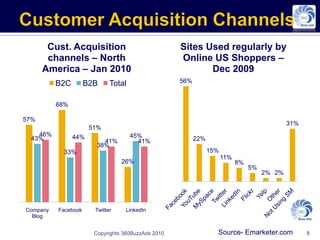

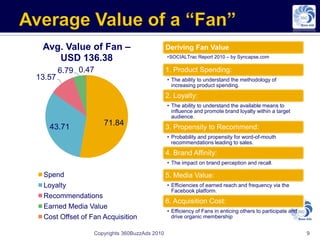

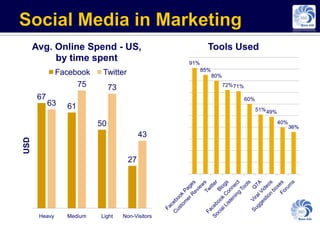

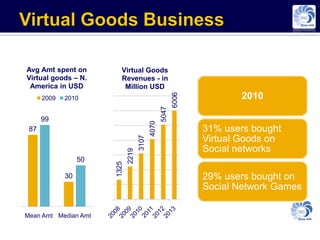

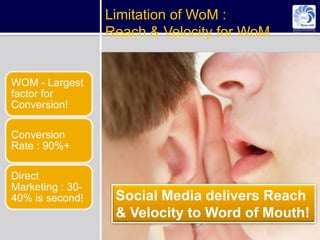

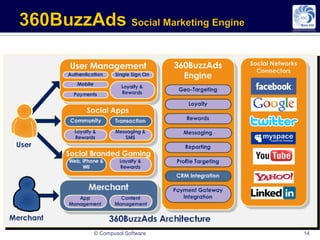

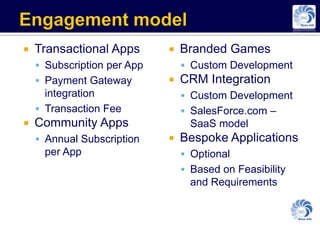

The document discusses the evolution of social media, highlighting its growth and importance in online engagement and brand community building since 2009. It emphasizes the shift from traditional marketing to a conversation-driven approach where brands can build loyalty and elicit recommendations through social platforms. The integration of social media with CRM tools and various engagement strategies is also addressed, showcasing the potential for brands to enhance customer acquisition and retention.