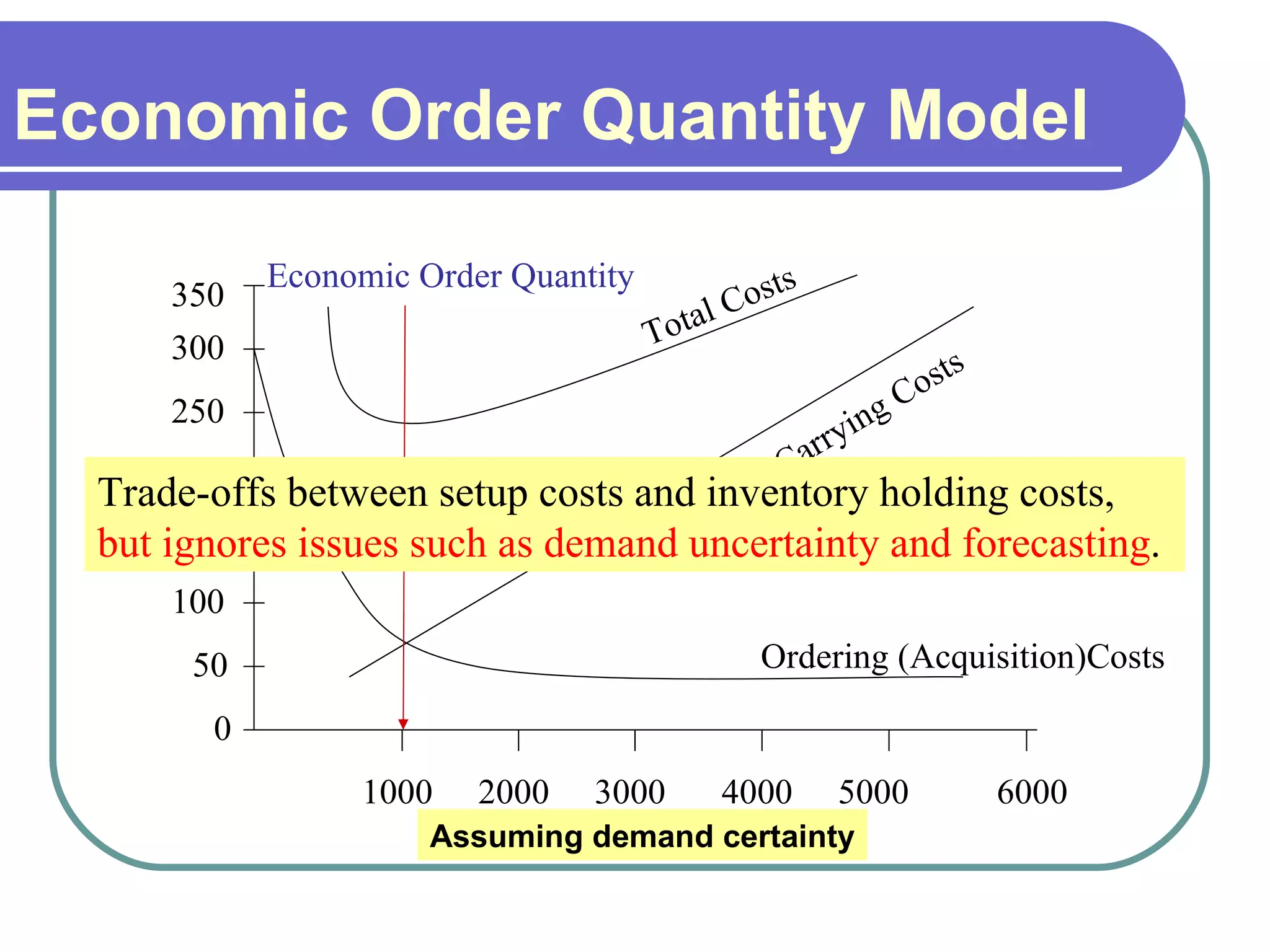

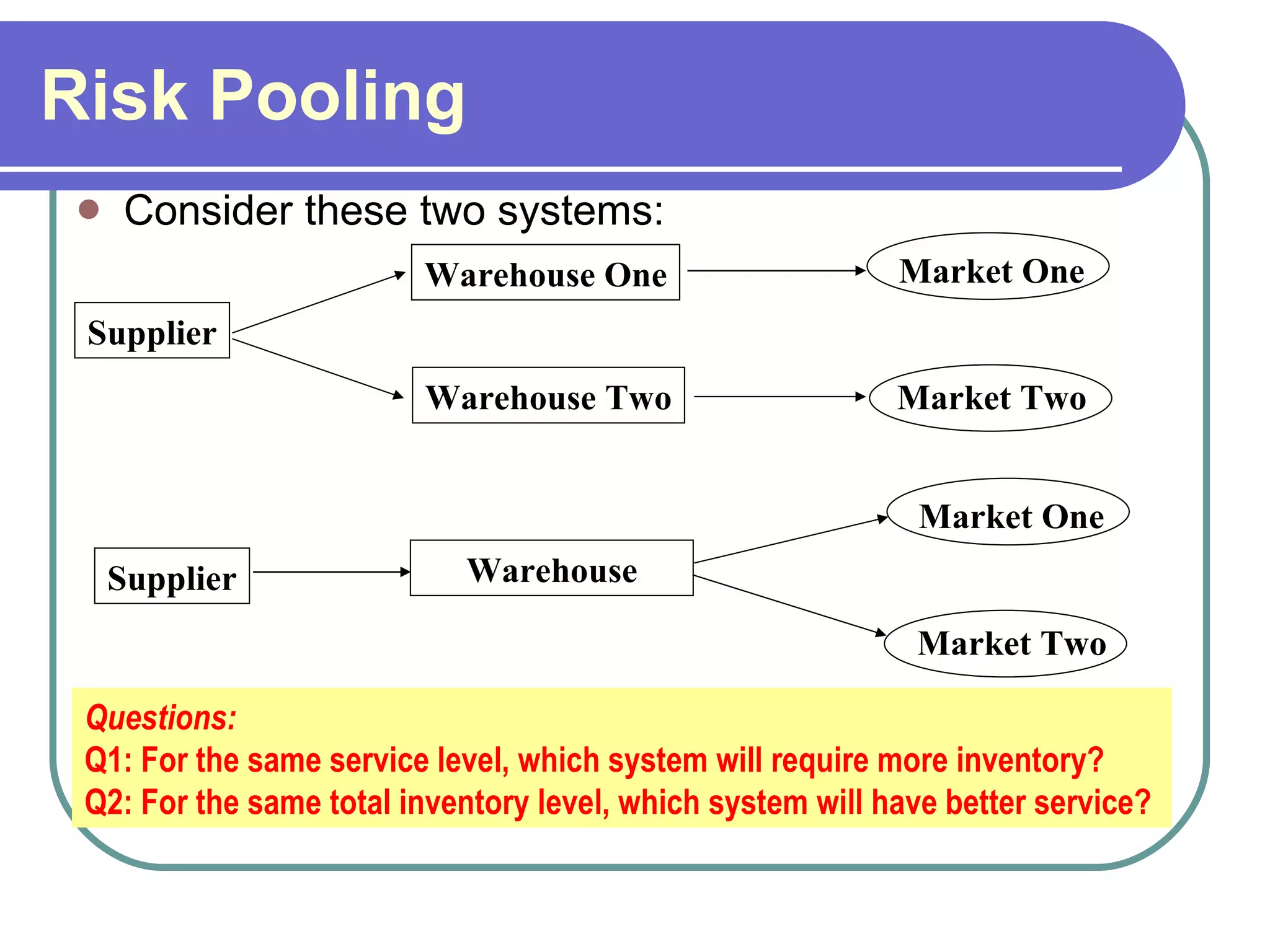

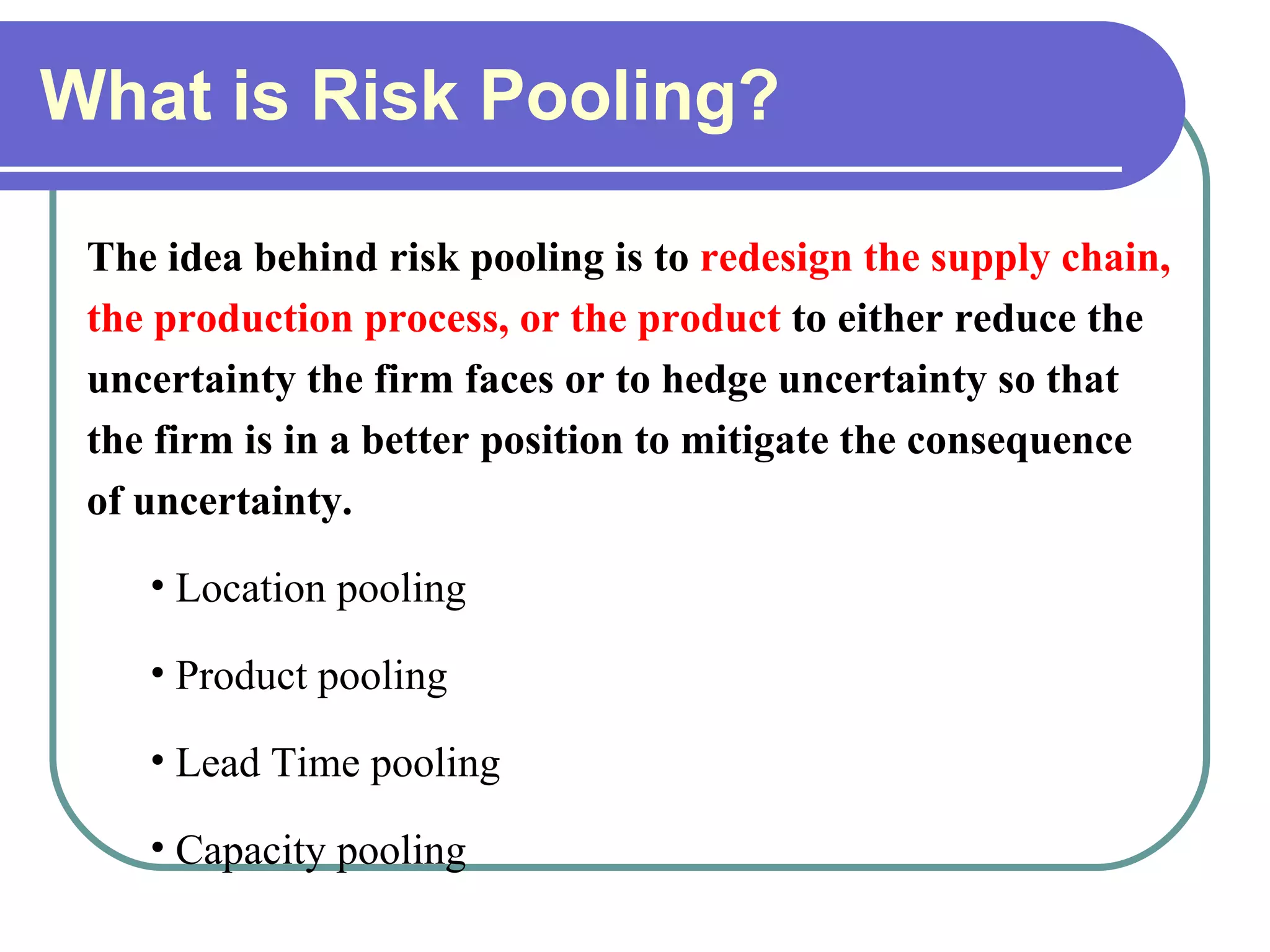

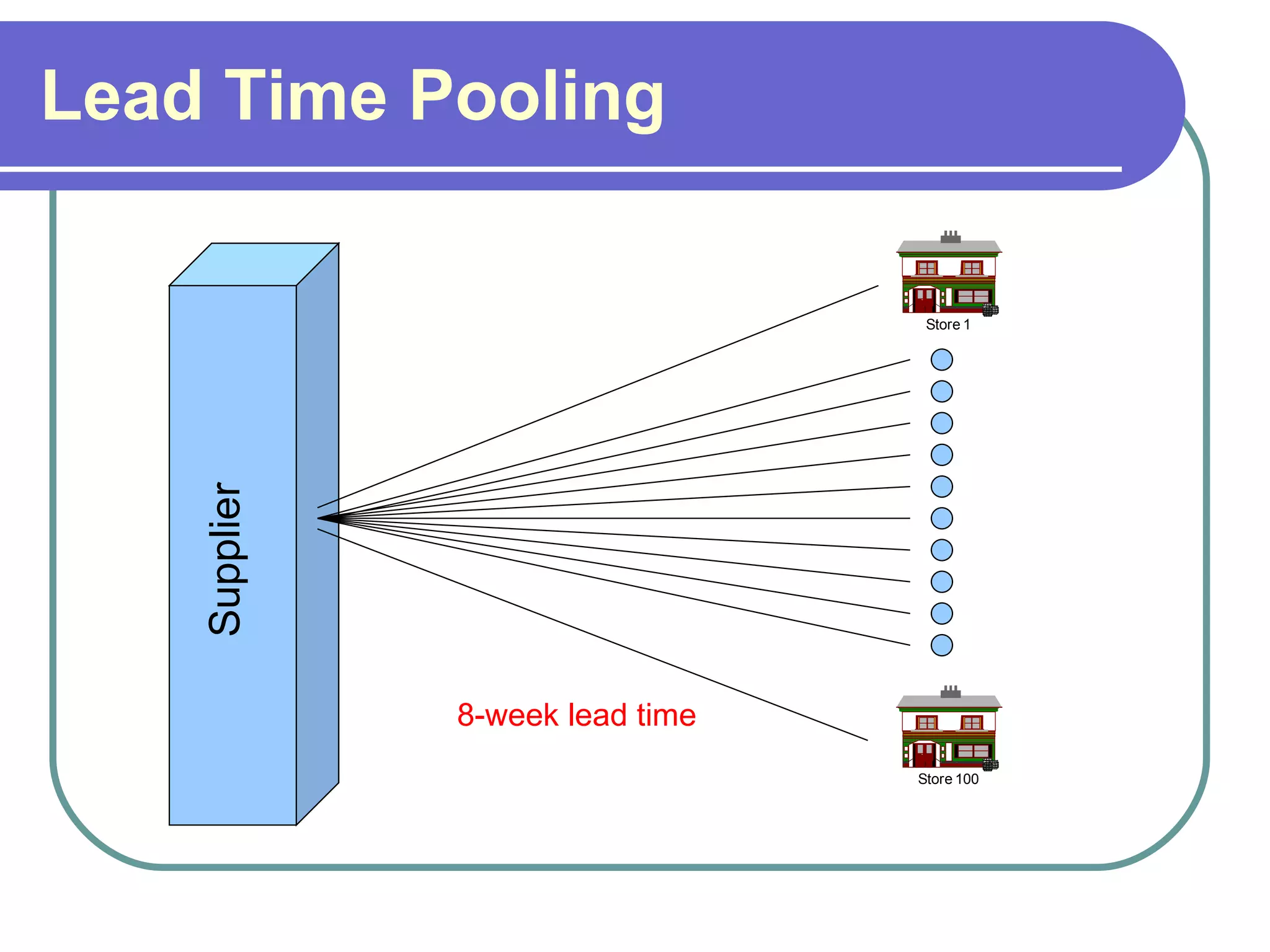

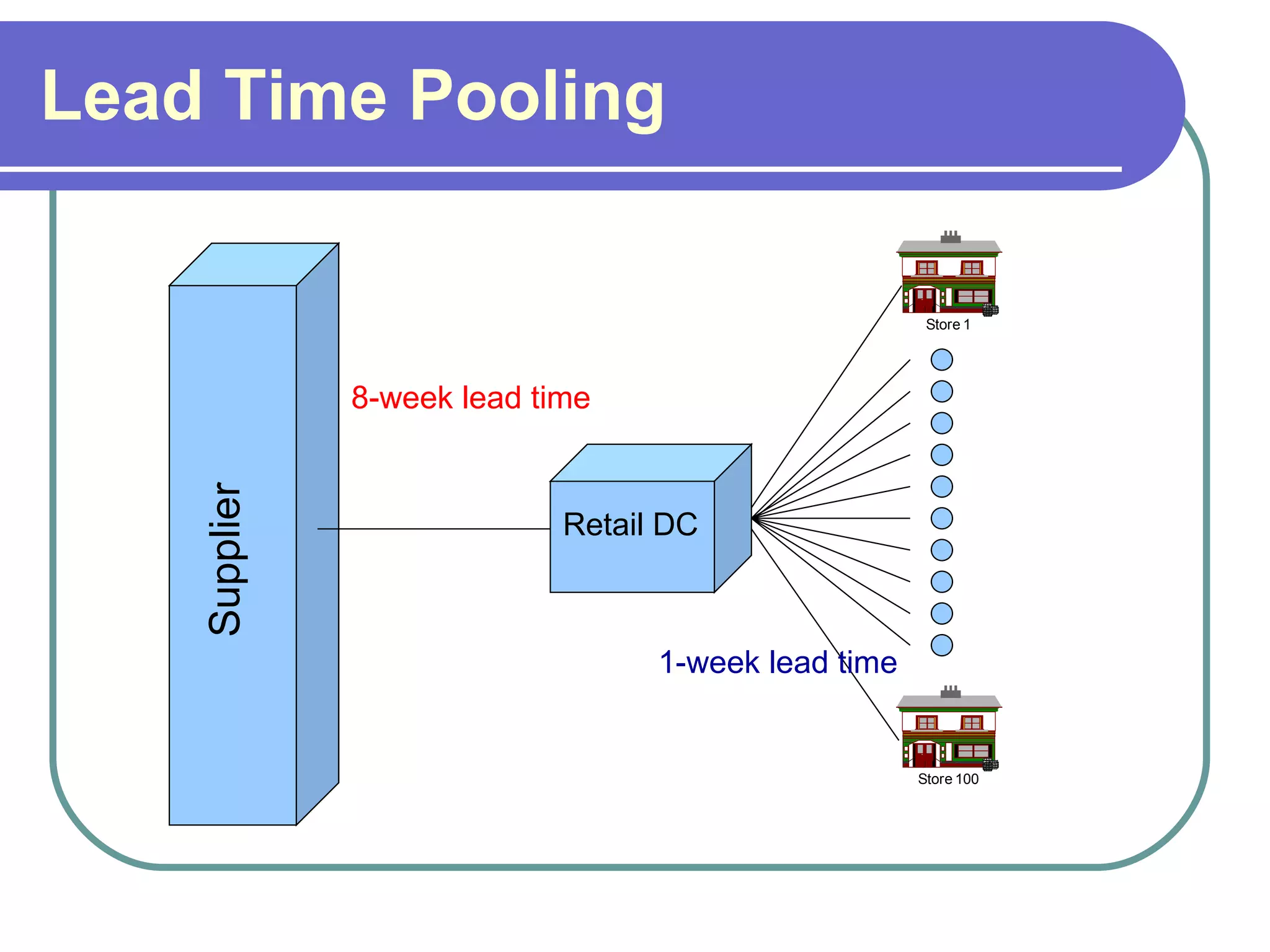

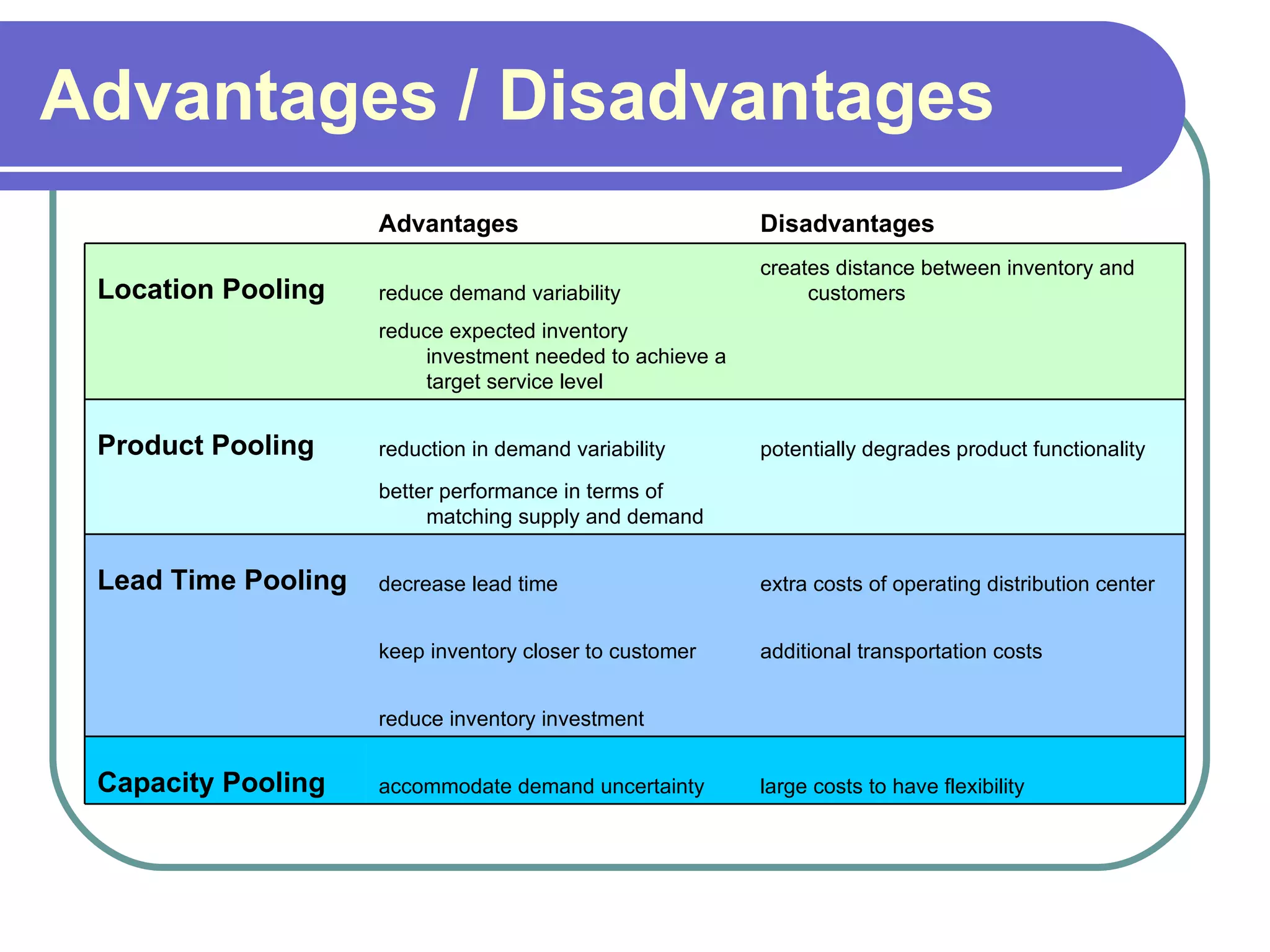

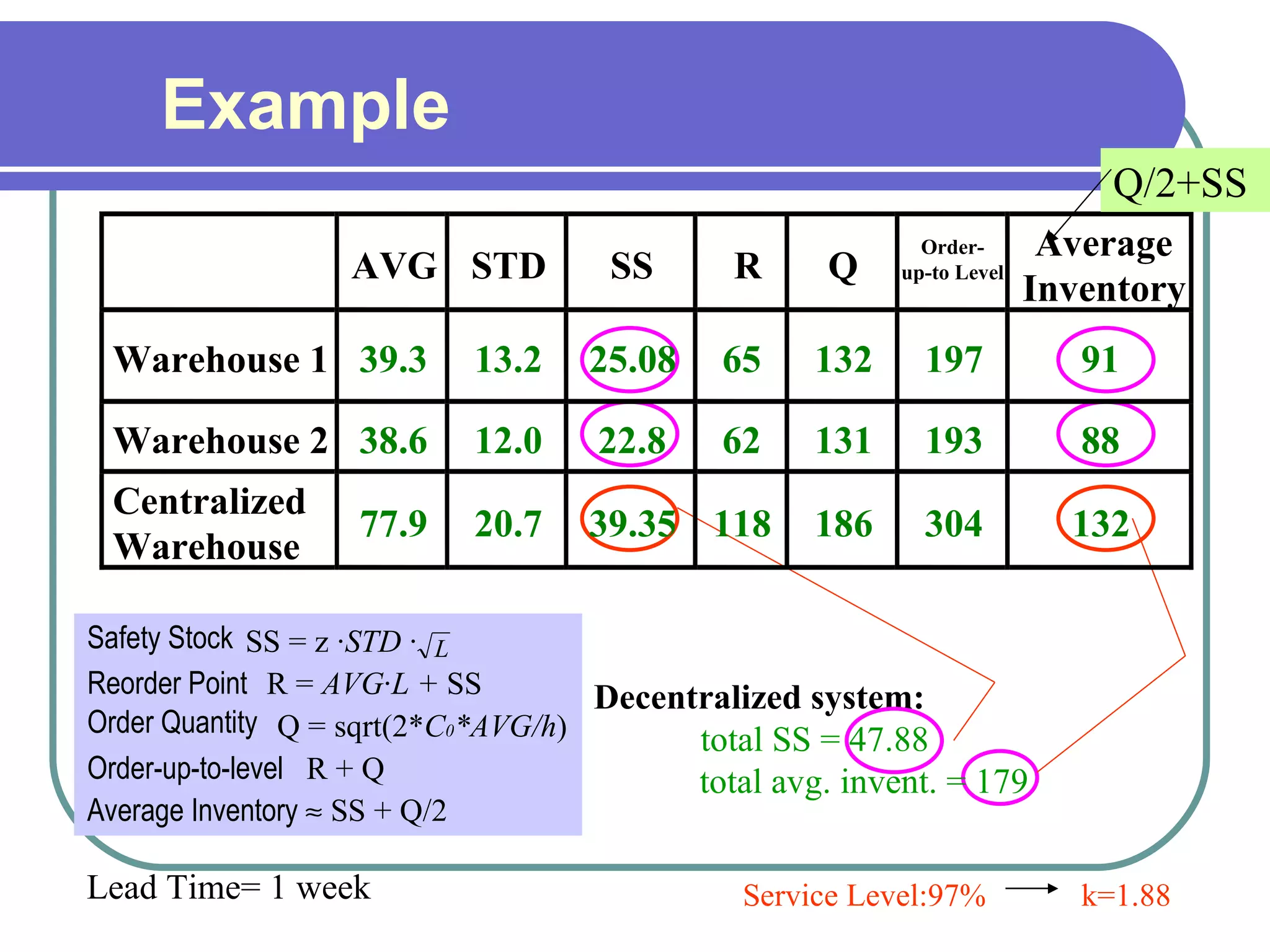

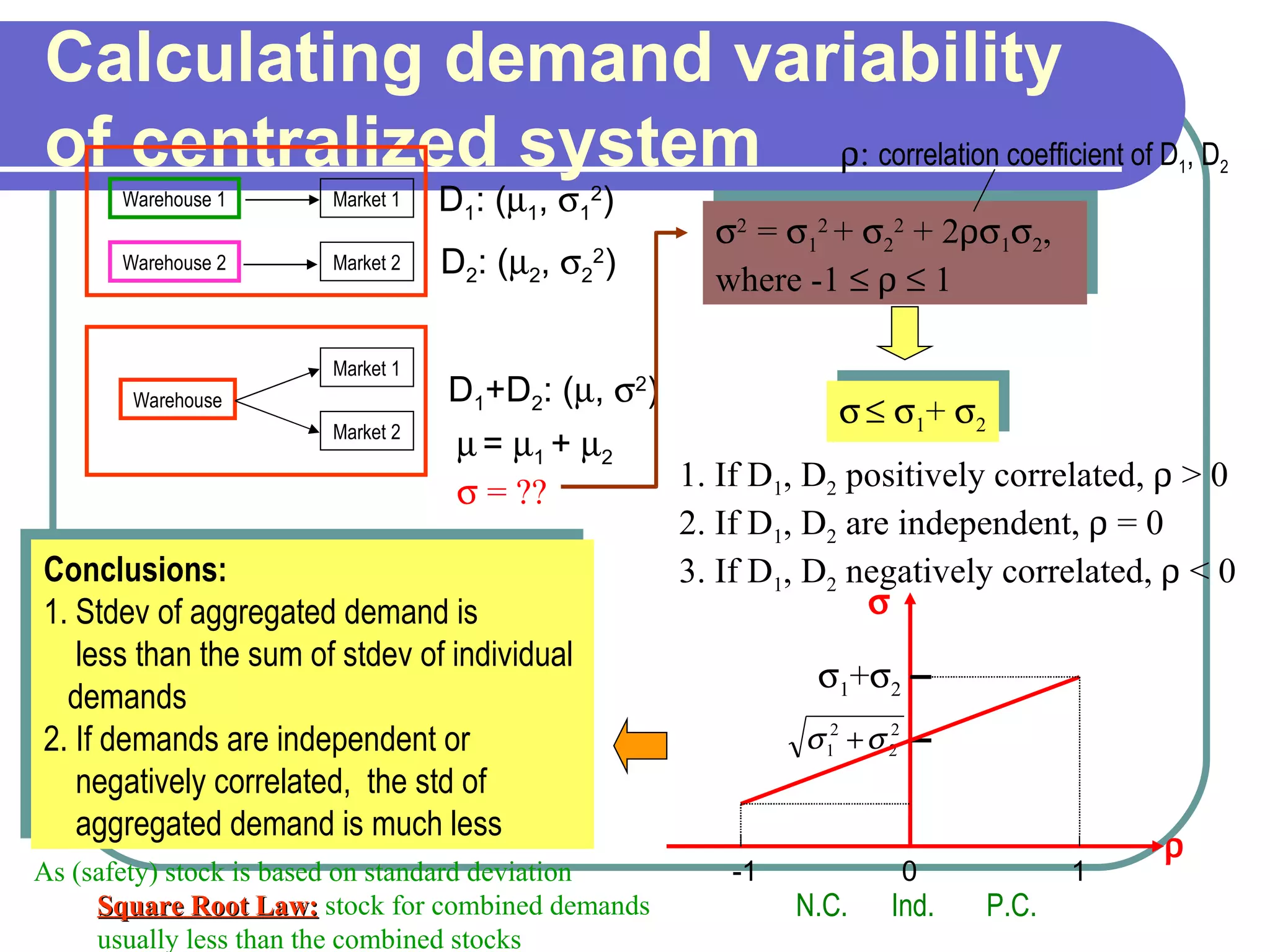

Inventory management and risk pooling are important concepts in supply chain management. General Motors in 1984 had a large logistic network with high inventory levels and transportation costs. Effective inventory management and risk pooling strategies can help companies reduce costs and improve customer service by reducing inventory levels while maintaining the same level of service or improving service with the same inventory. These strategies work best when demands across different locations are negatively correlated as it reduces overall demand variability.