The document discusses the cash cycle, which is a measure of the number of days it takes a firm to purchase inventory, sell that inventory, and collect payment from customers. Specifically:

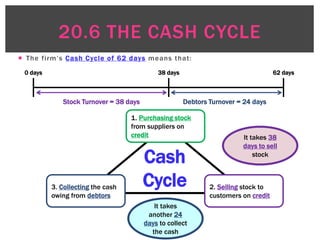

1) The cash cycle is calculated by adding the stock turnover ratio in days and the debtors turnover ratio in days.

2) It represents the continuous process of purchasing inventory on credit from suppliers, selling that inventory on credit to customers, and collecting payment from debtors.

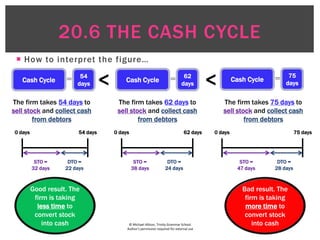

3) A cash cycle of 62 days for a firm means it takes 38 days to sell inventory and another 24 days to collect payment from customers, for a total of 62 days to convert inventory into cash. A lower cash cycle is preferable.