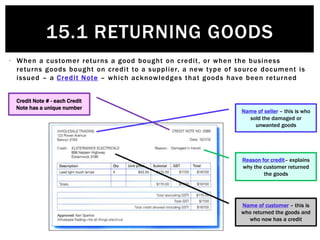

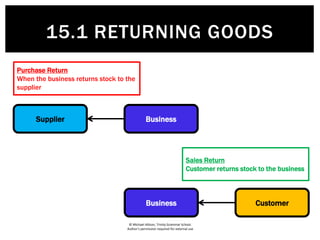

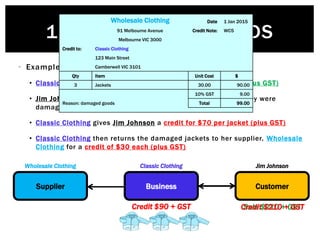

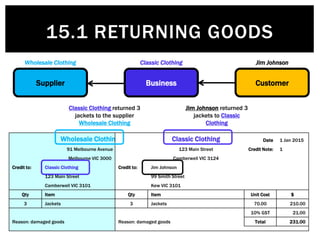

The document discusses returning goods that were purchased on credit. It explains that sometimes goods need to be returned if they are unsatisfactory, and a credit note is issued to acknowledge the return. It provides an example where a customer returns damaged jackets to a business, who then returns the jackets to their supplier. Both the customer and business receive credit notes for the returned goods.