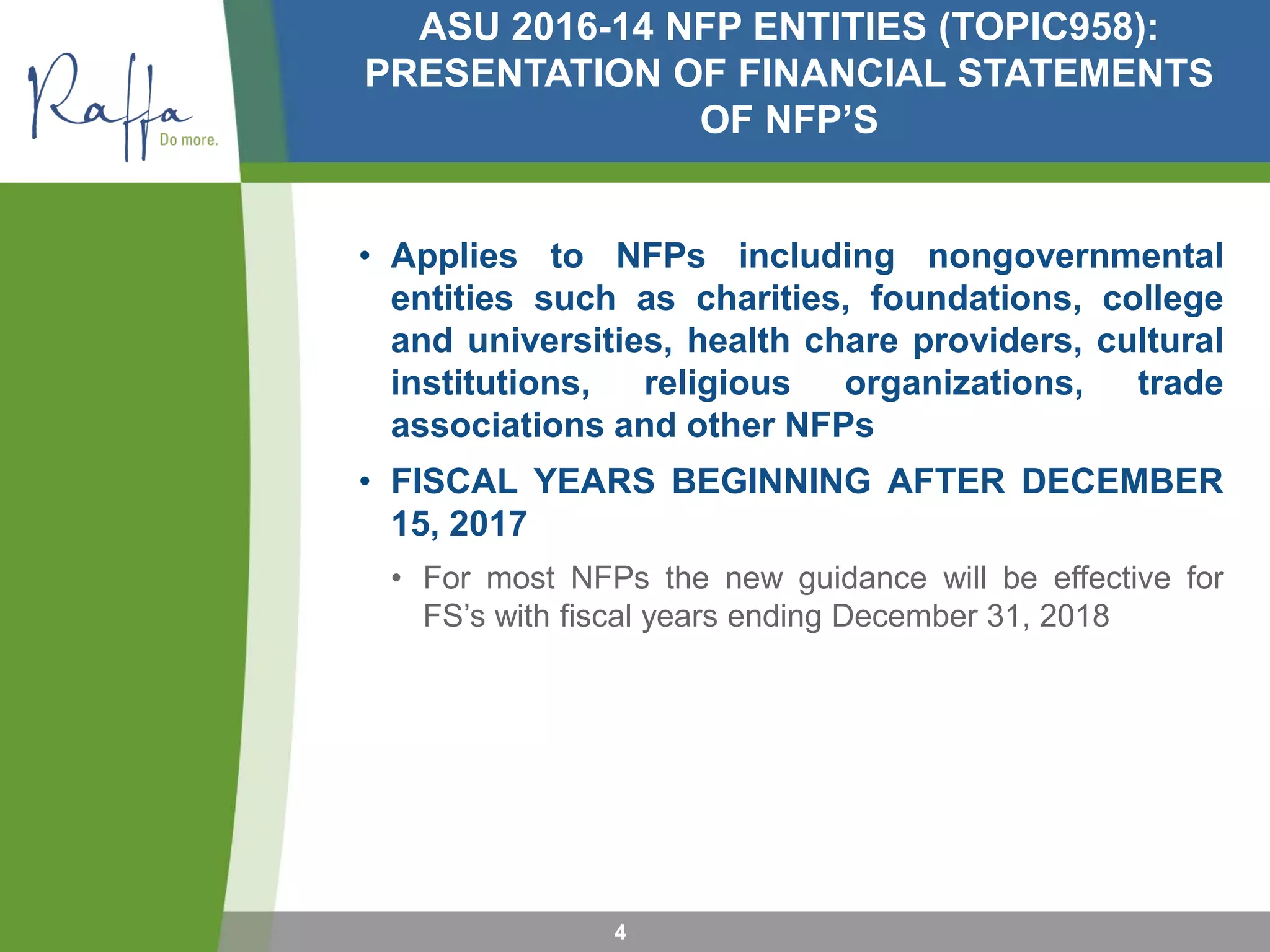

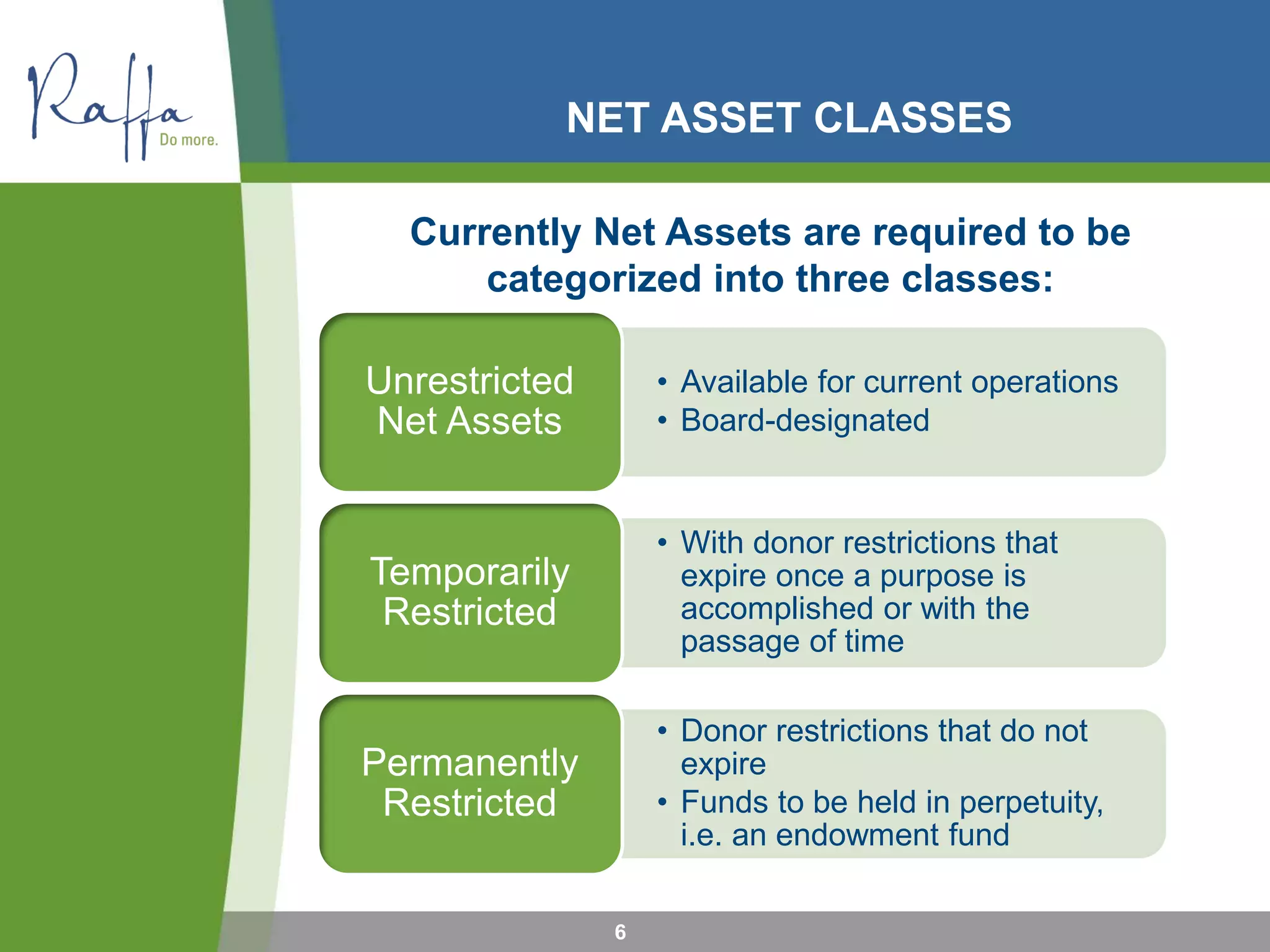

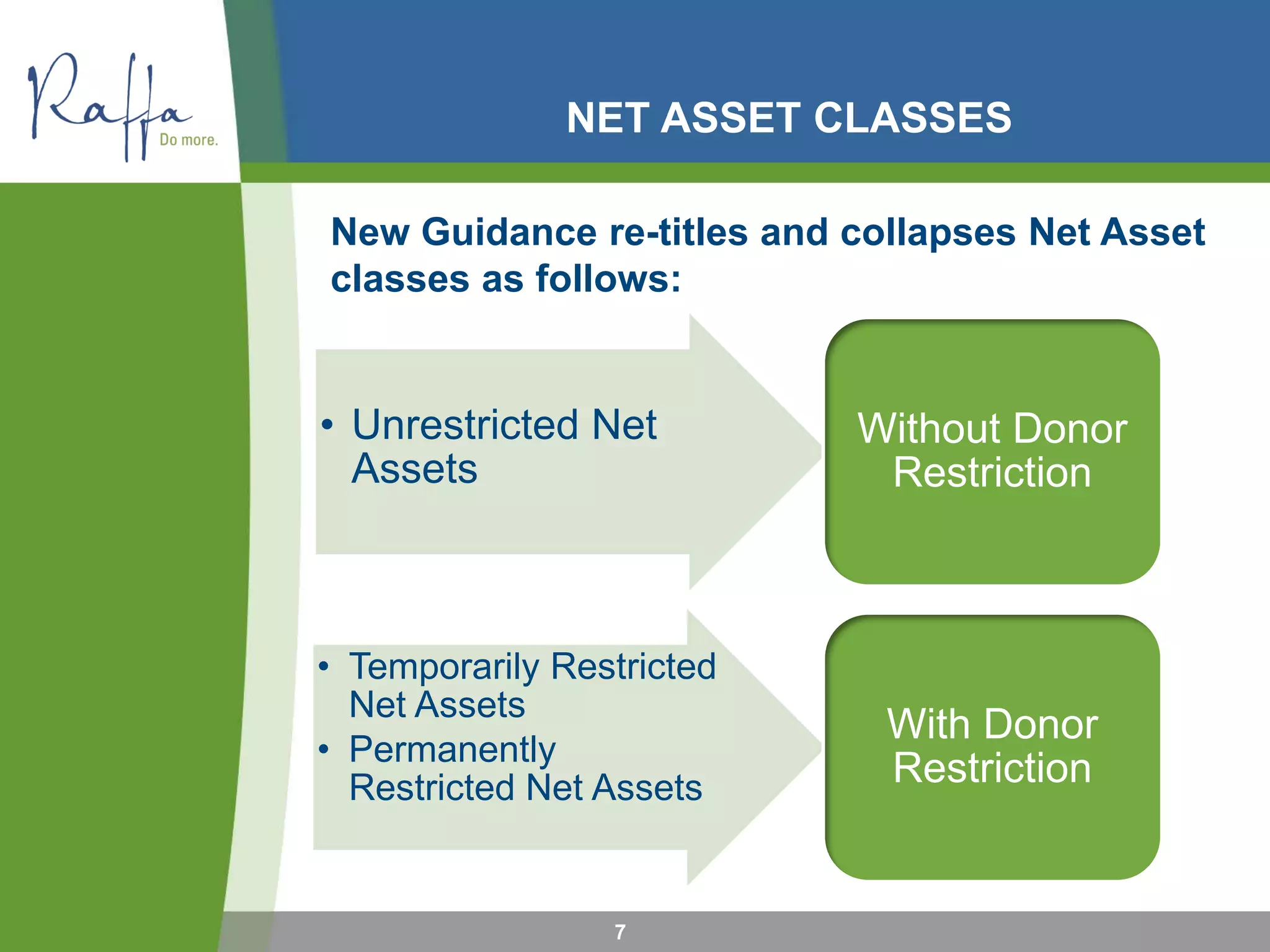

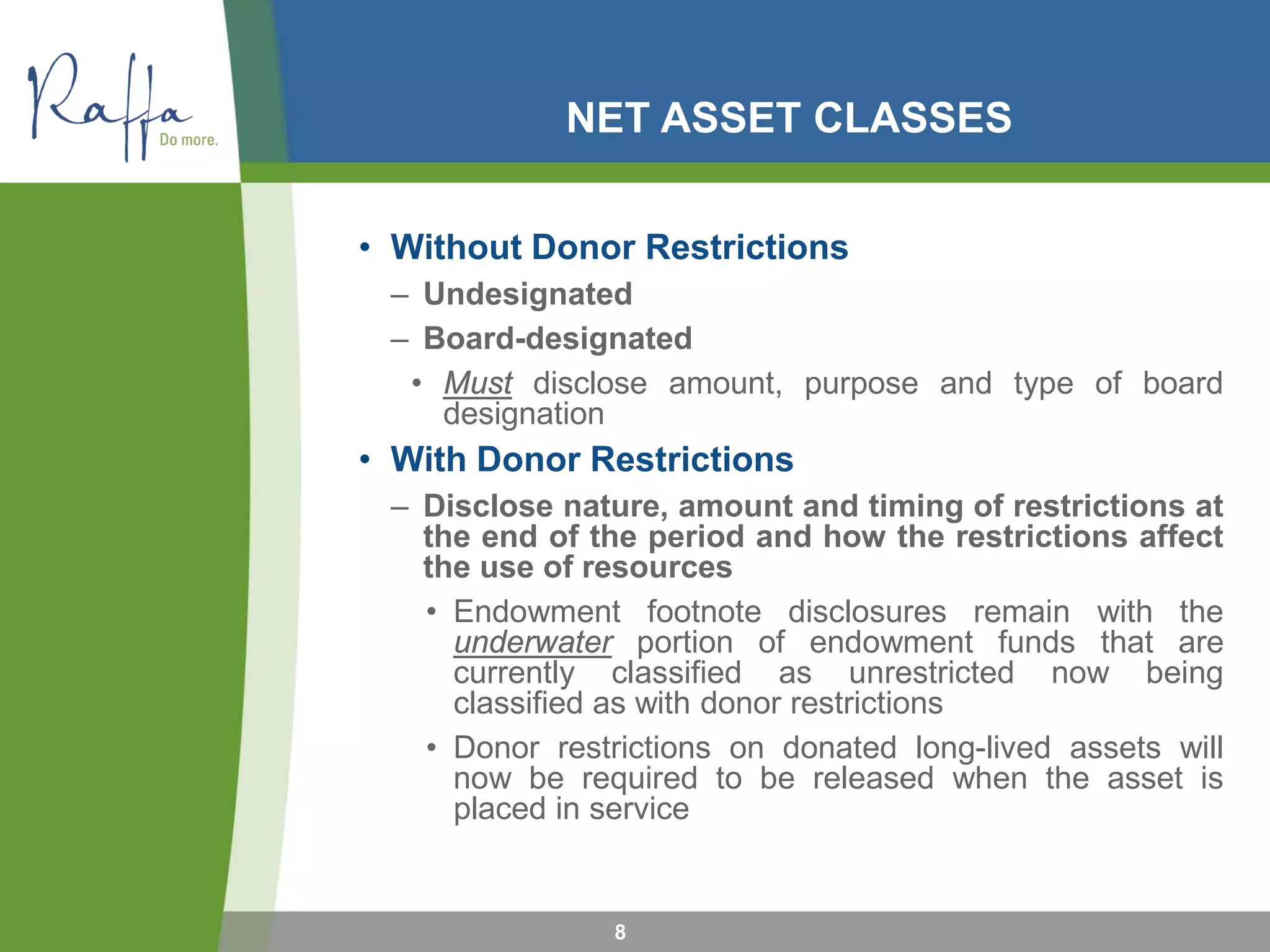

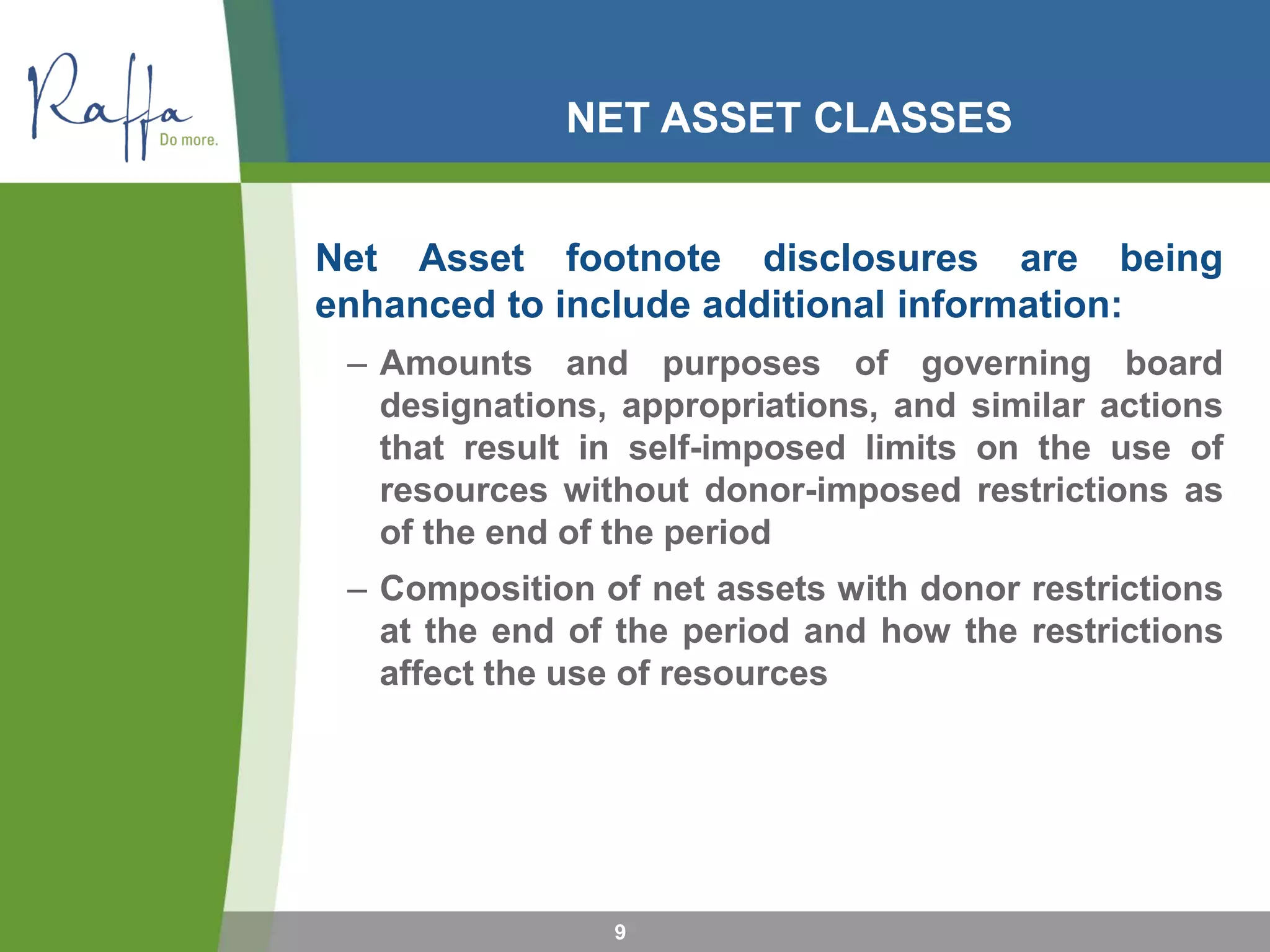

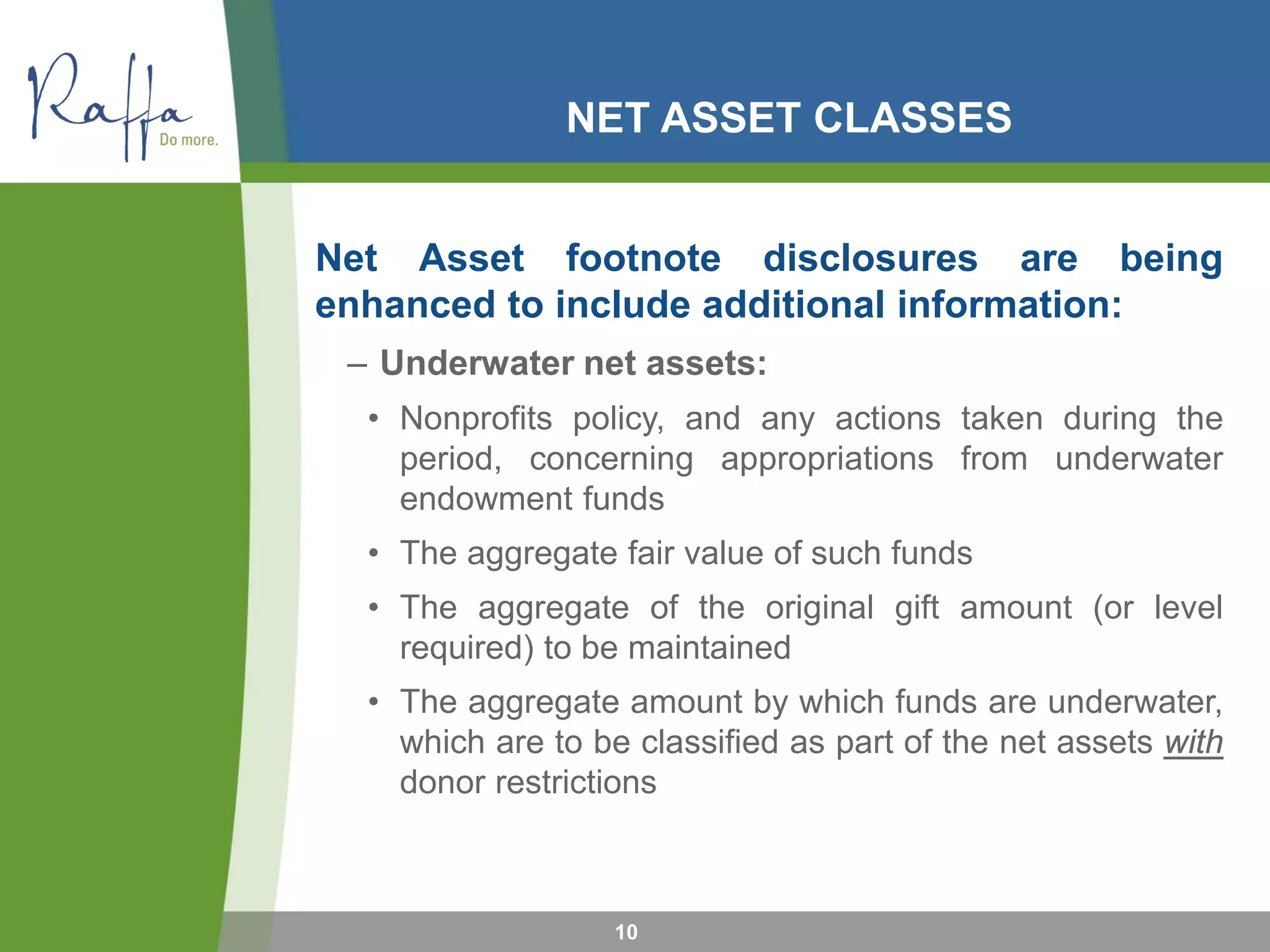

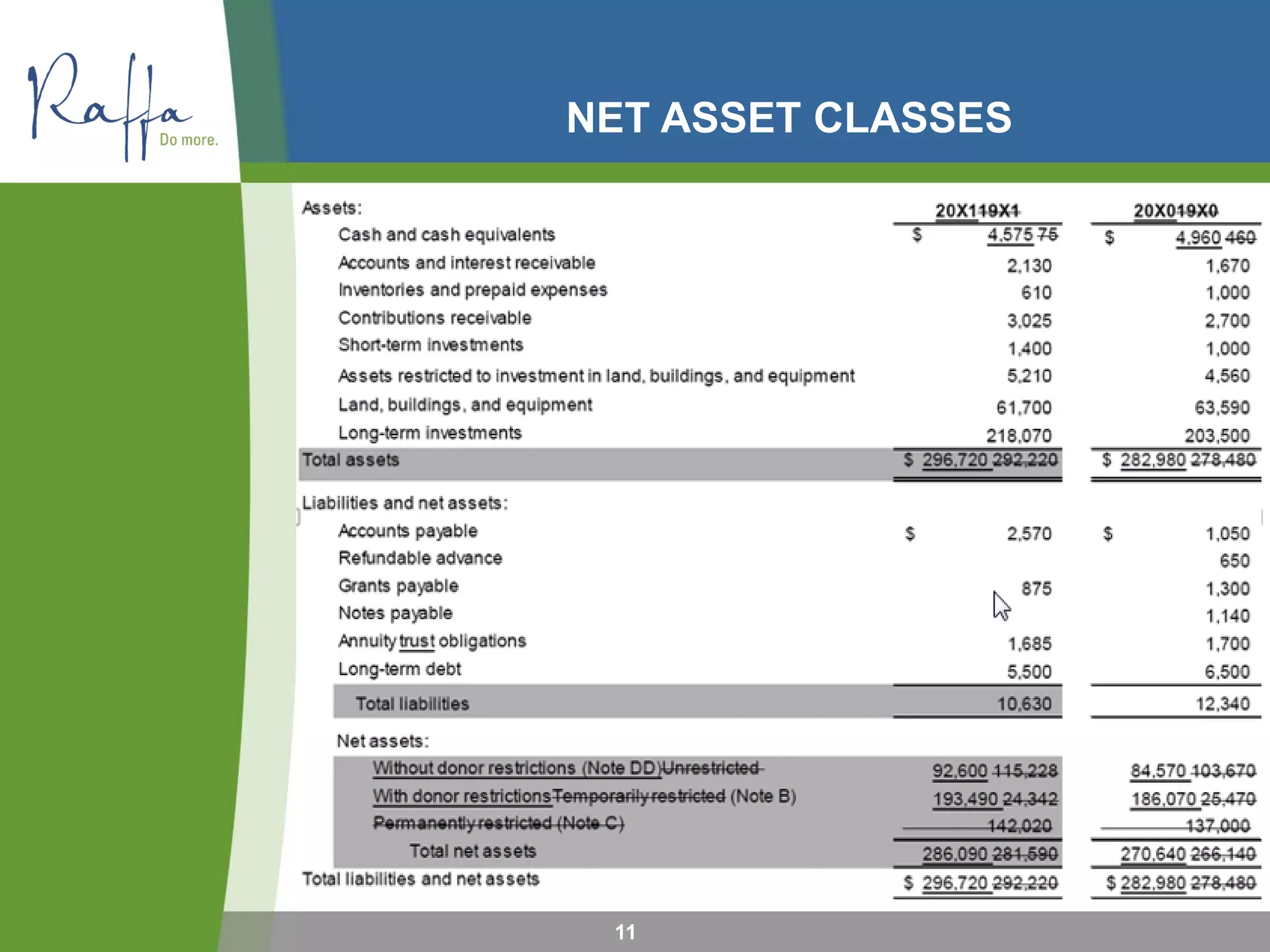

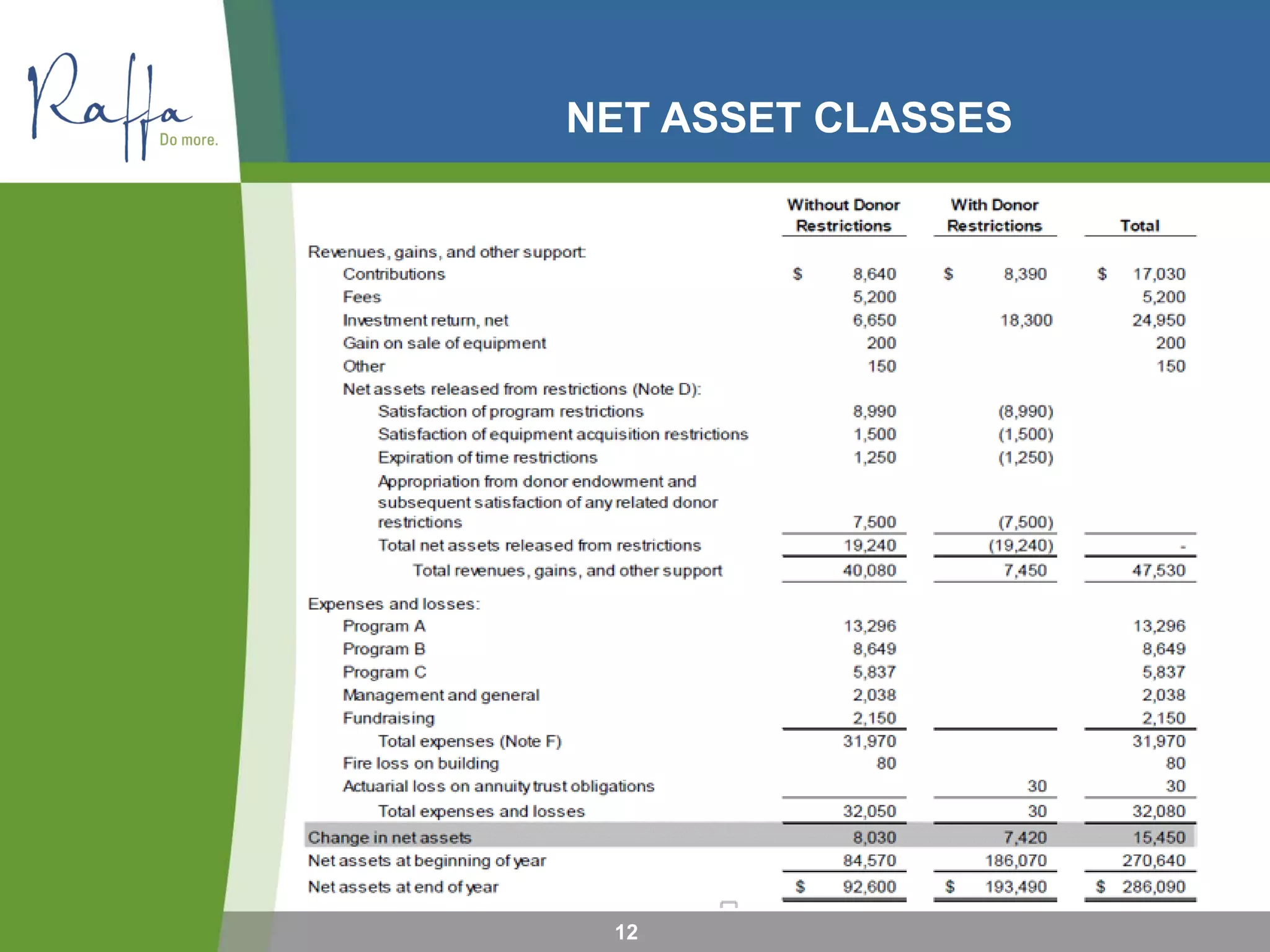

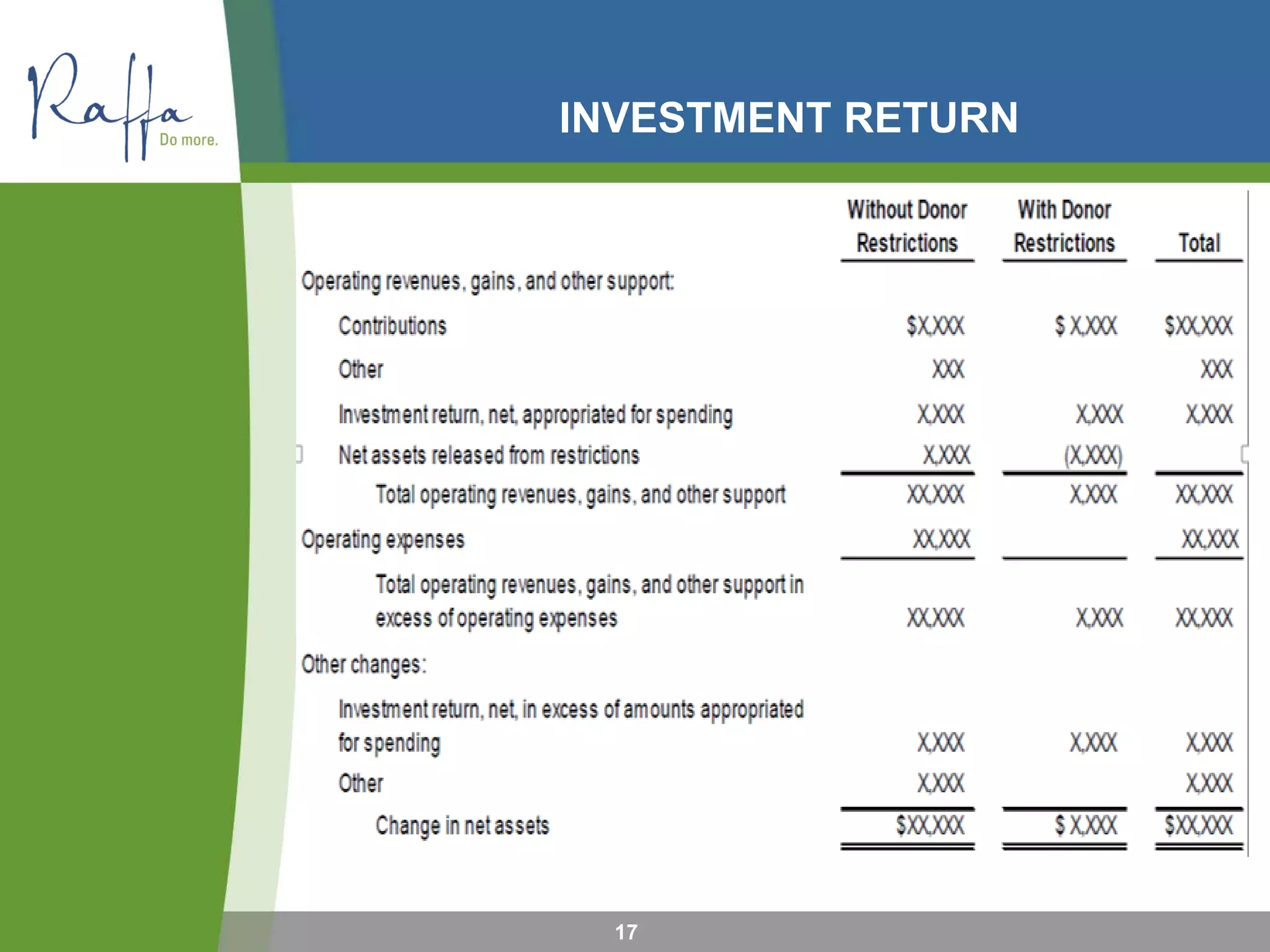

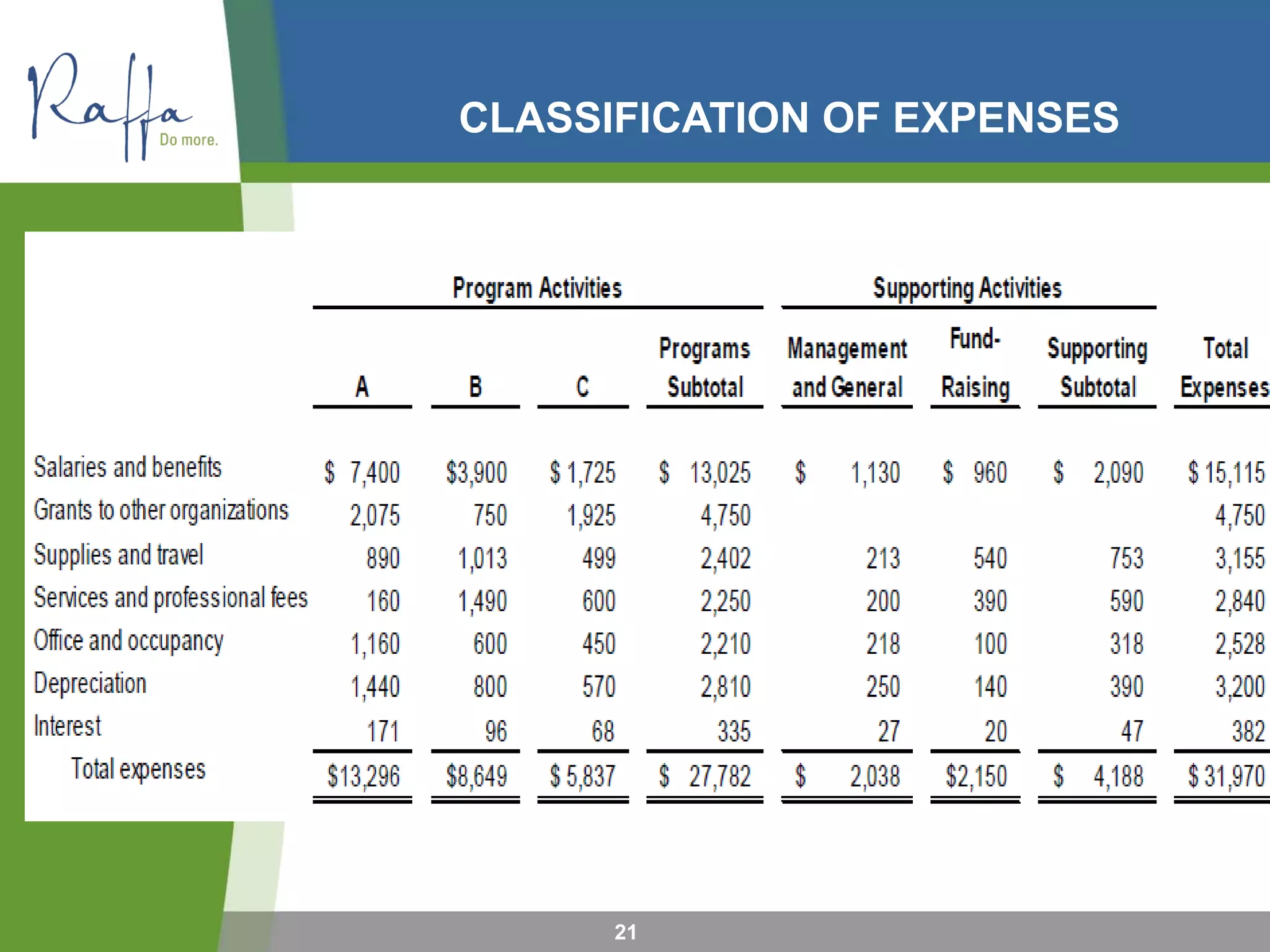

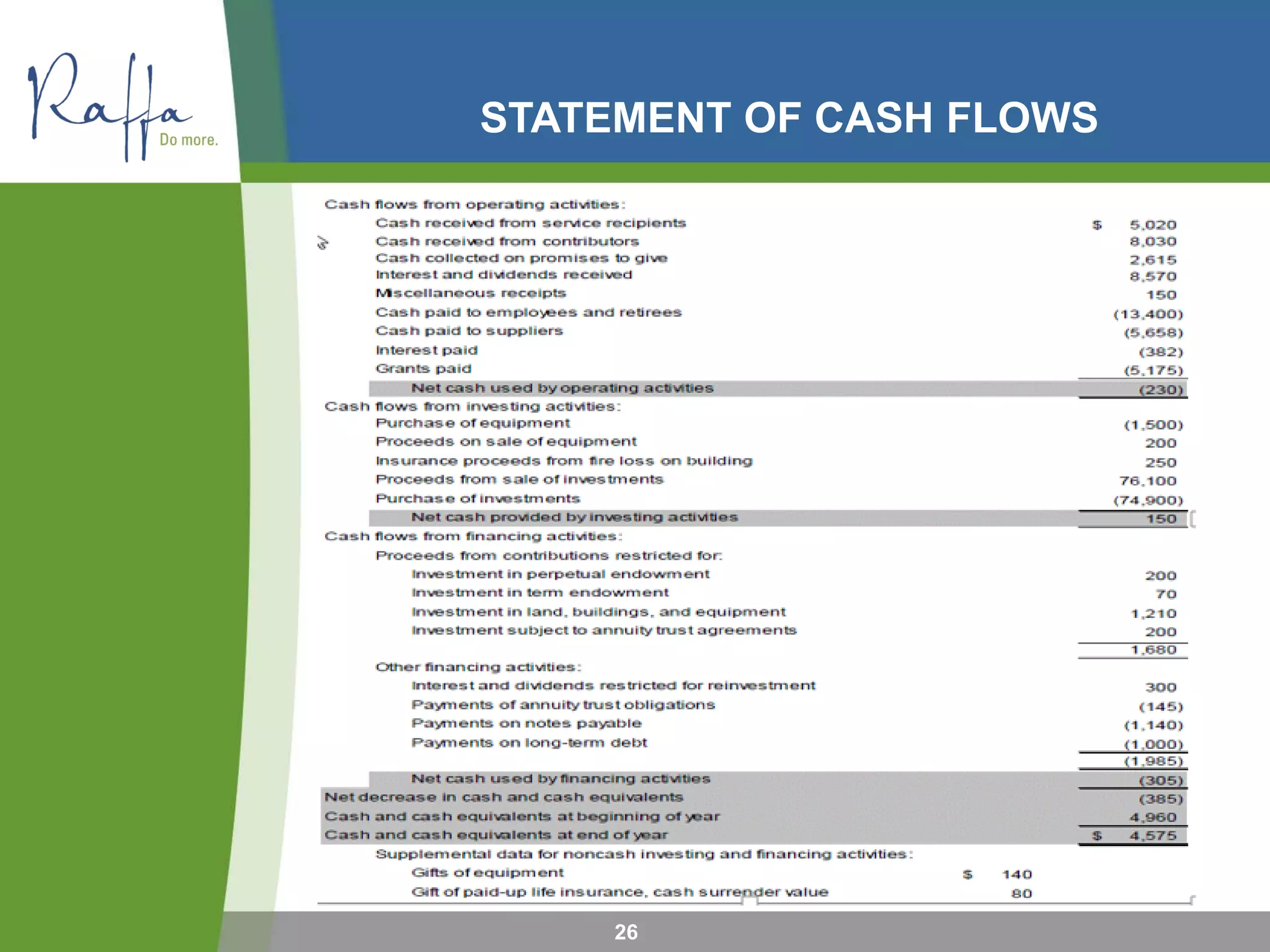

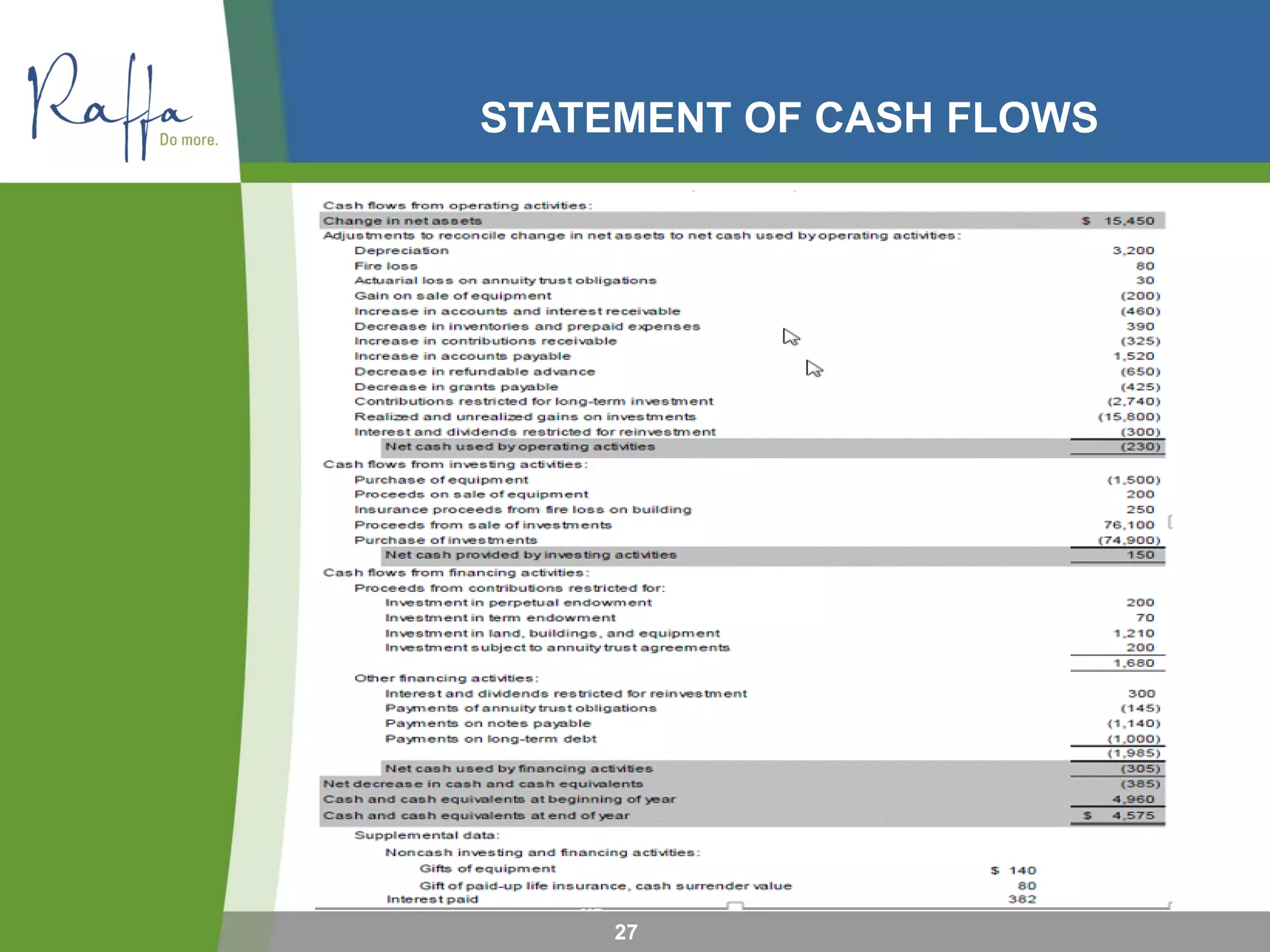

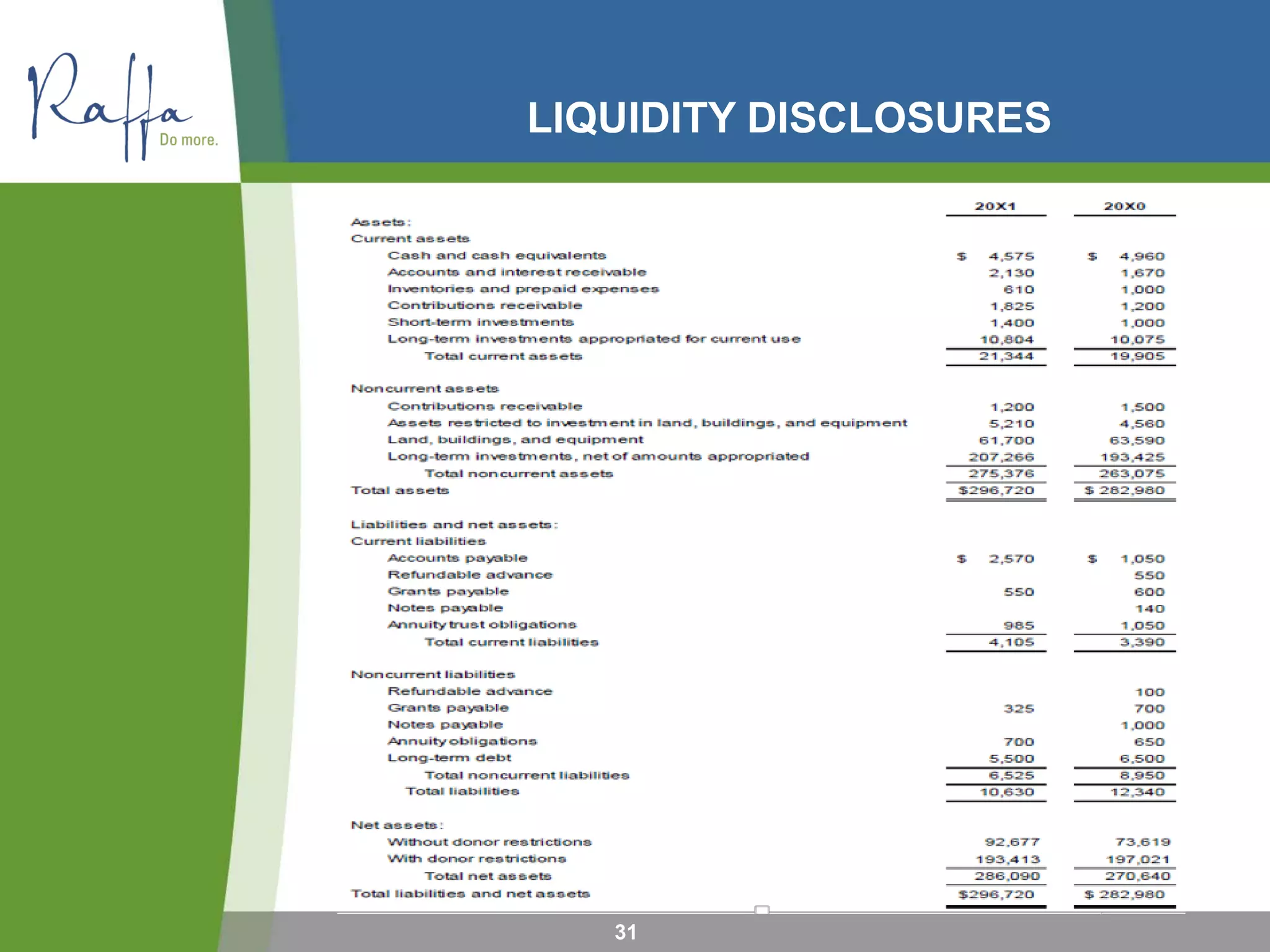

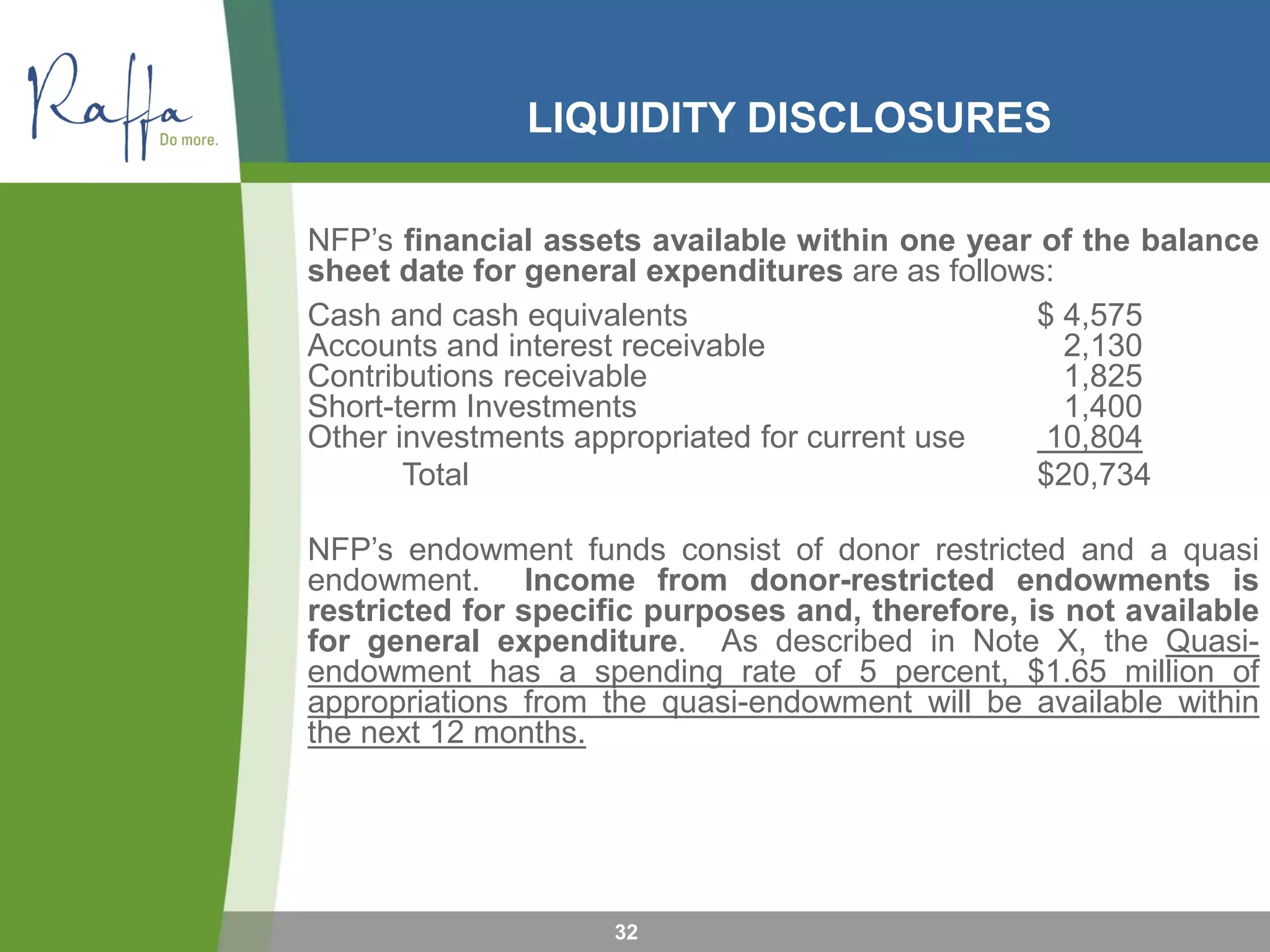

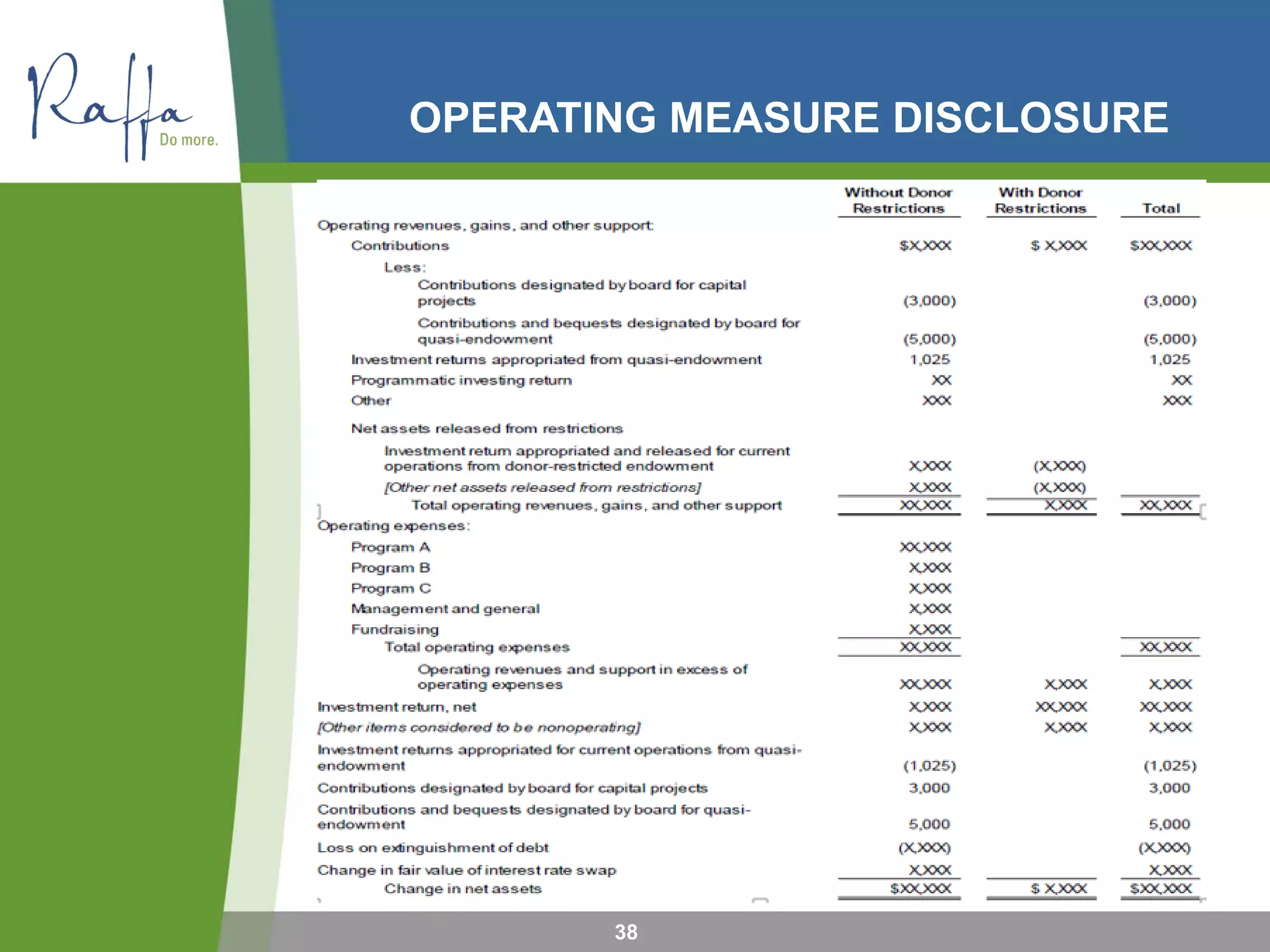

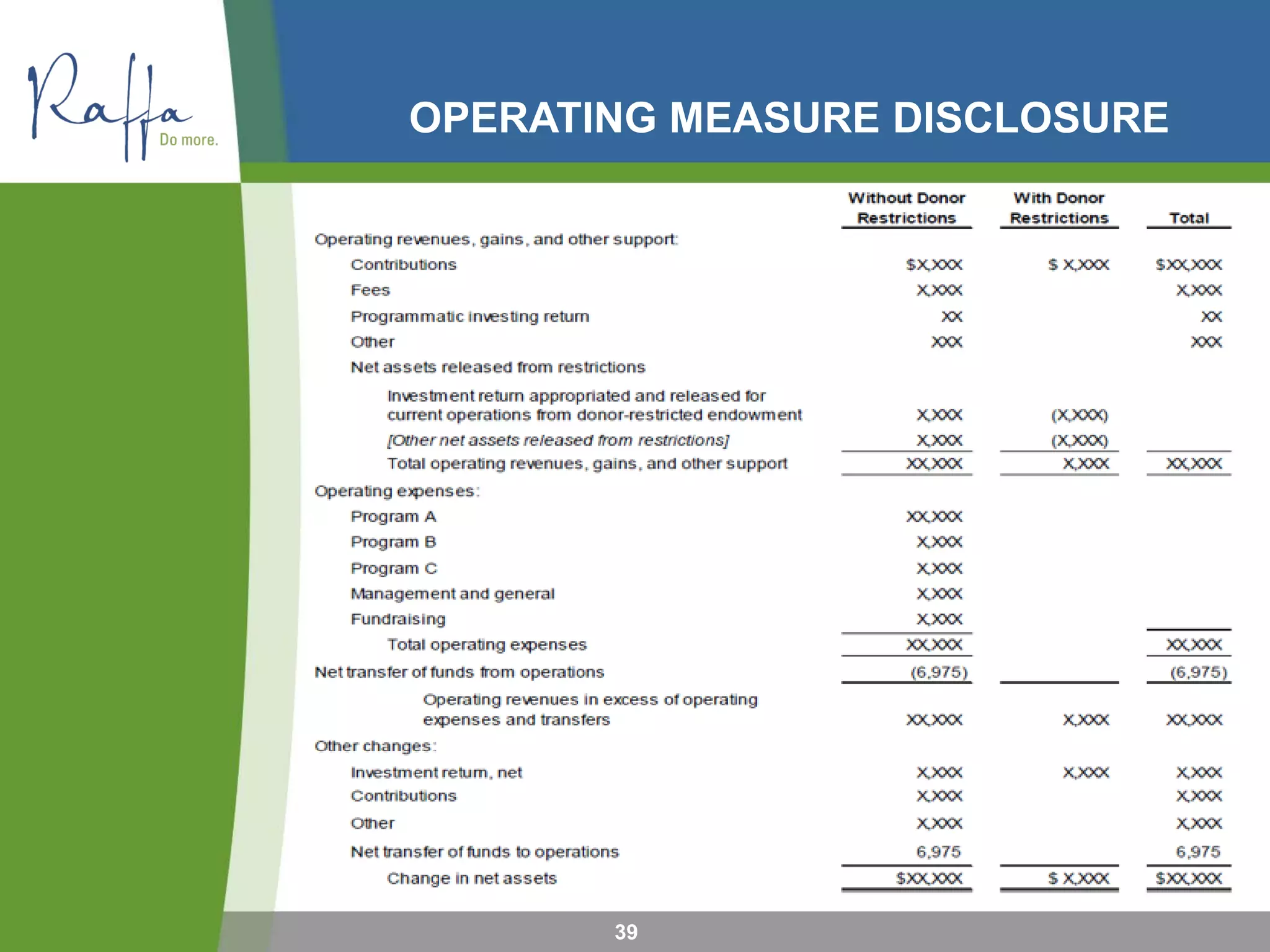

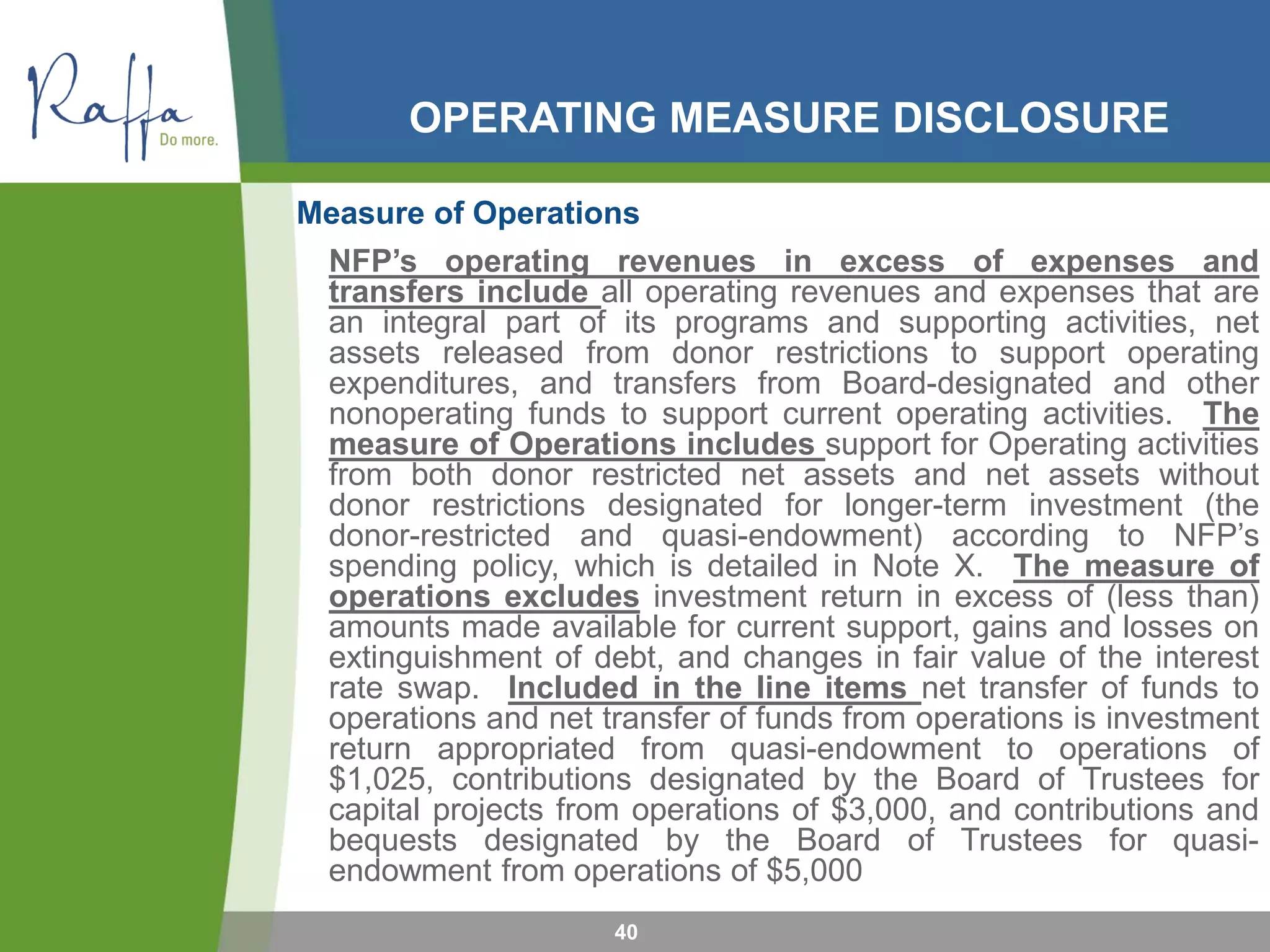

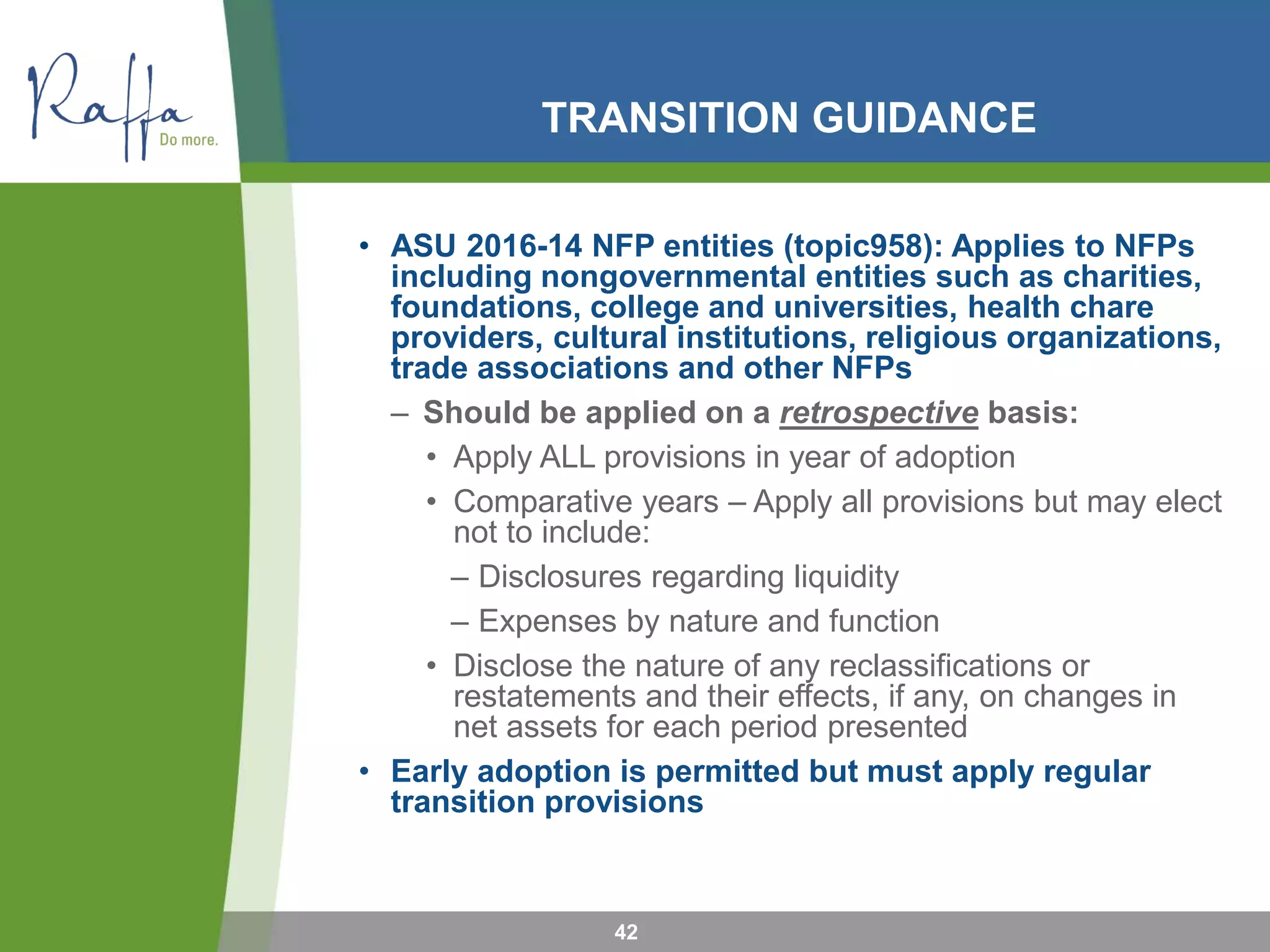

This document provides an overview and agenda for an upcoming course on the new accounting standards under FASB ASU 2016-14 for nonprofit financial statement presentation. The course will cover key changes such as consolidating net asset classes, requiring analysis of expenses by both nature and function, enhanced liquidity and investment return disclosures, and transition guidance. It outlines the objectives of the new standards to improve usefulness of nonprofit financial statements and compares current requirements to the new guidance. The document concludes with contact information for the course presenters.