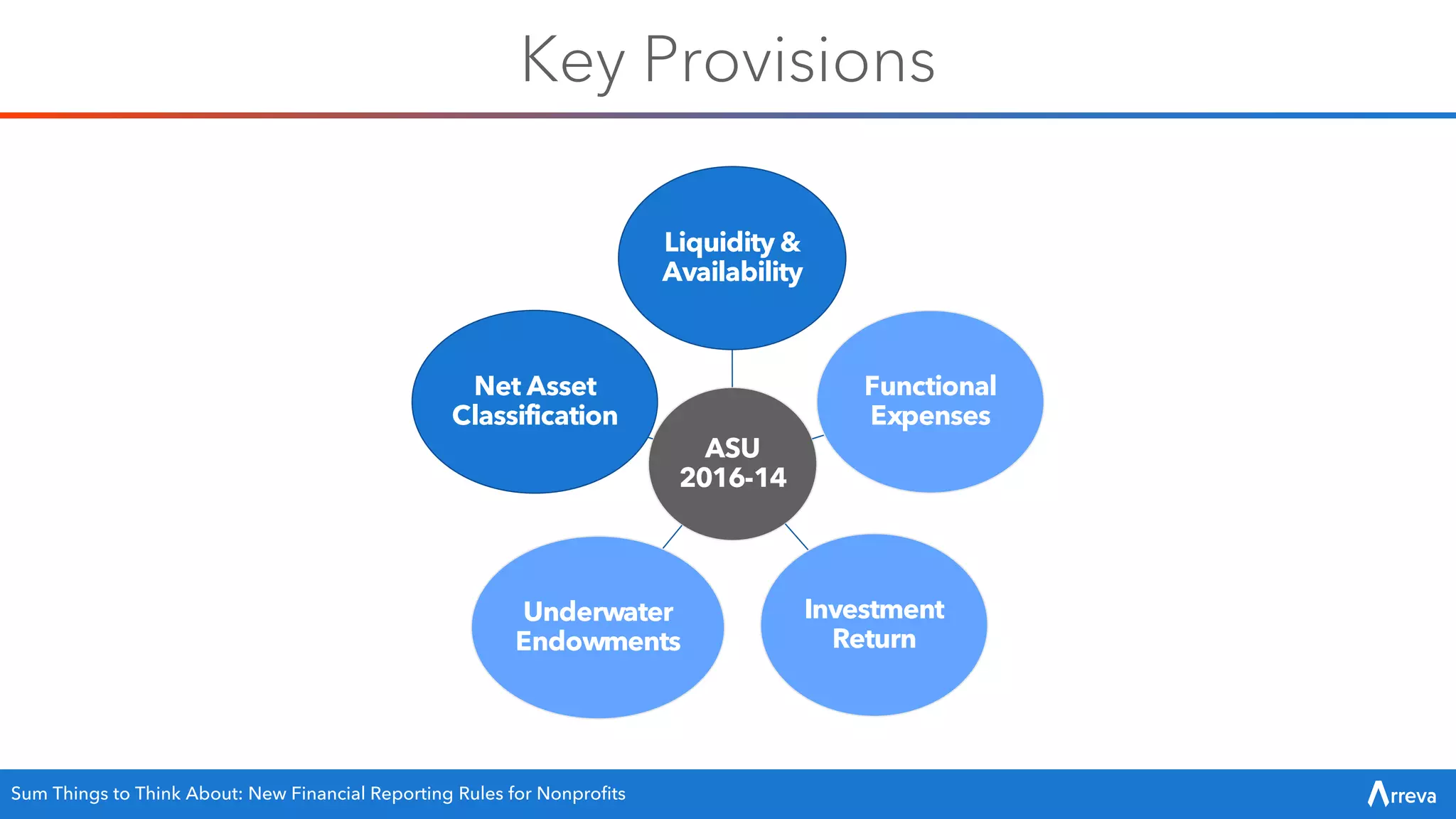

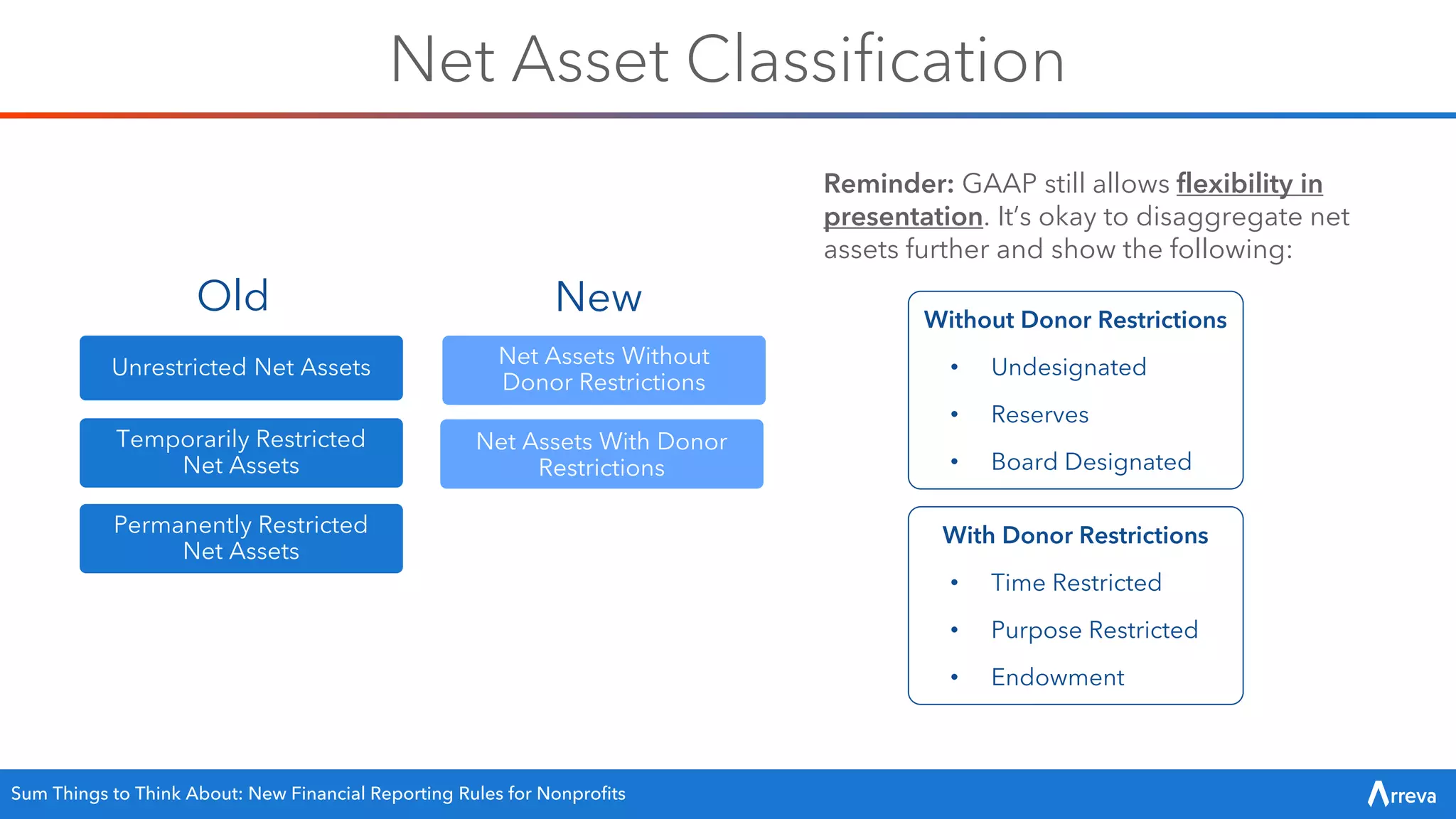

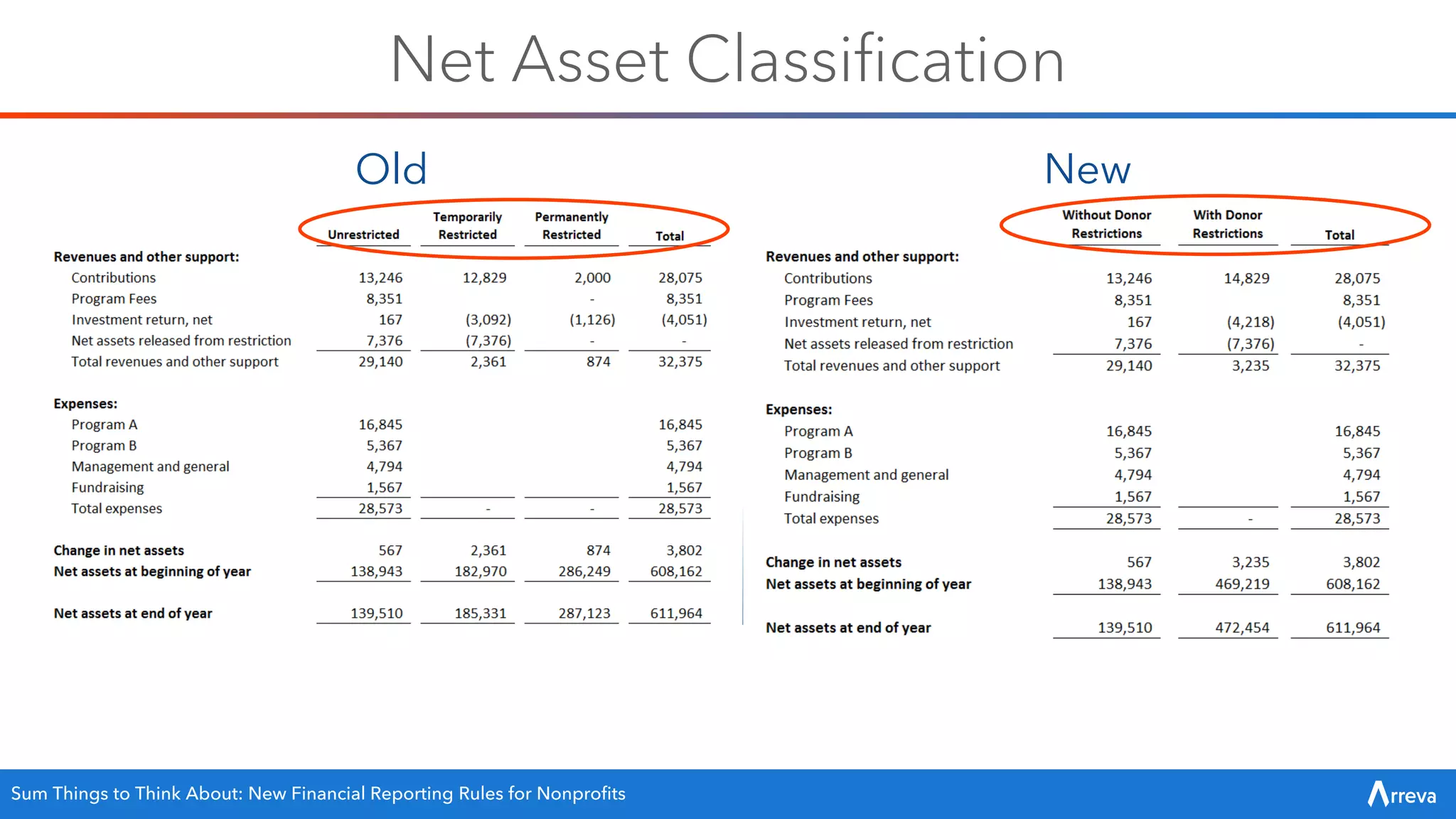

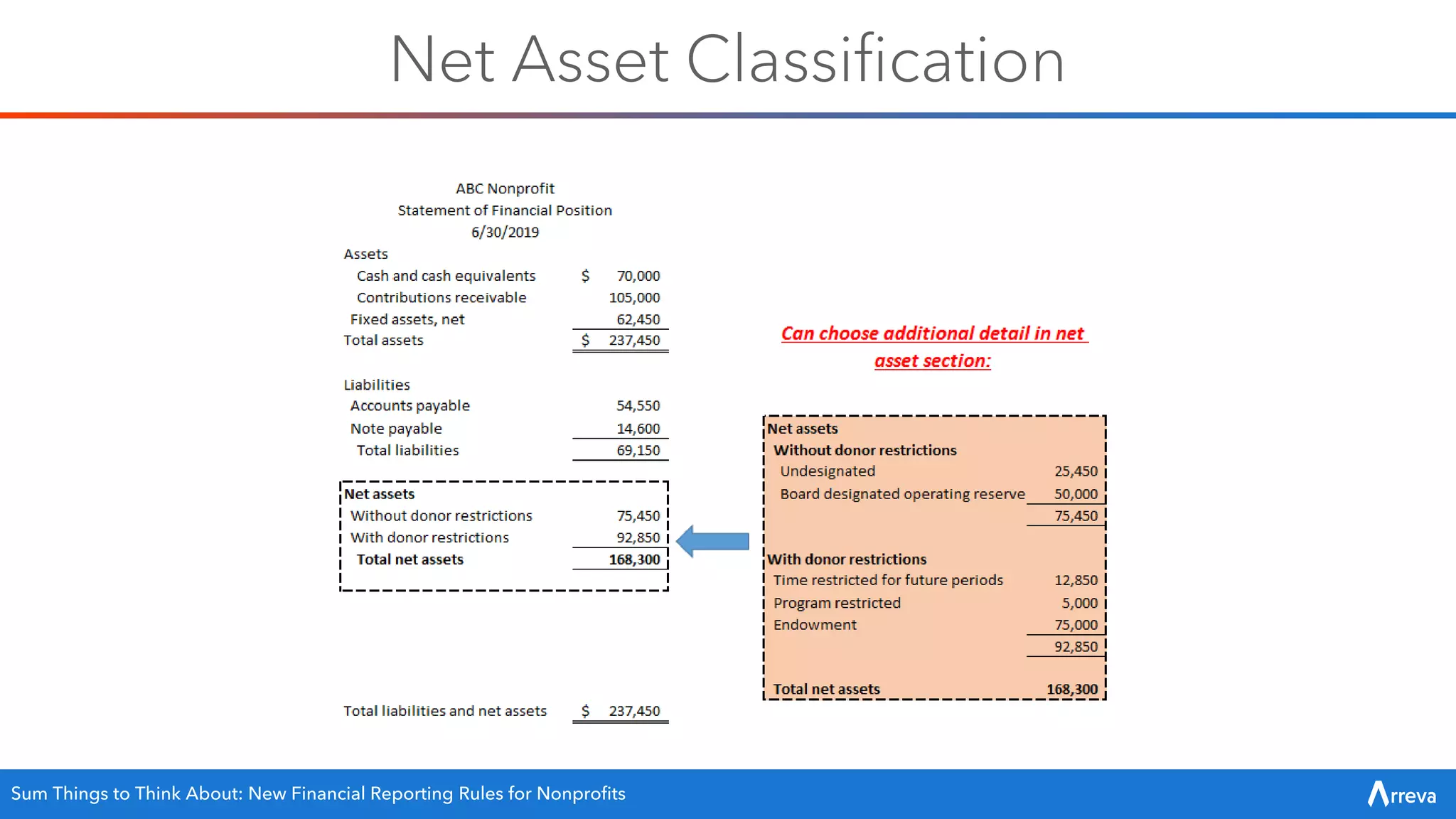

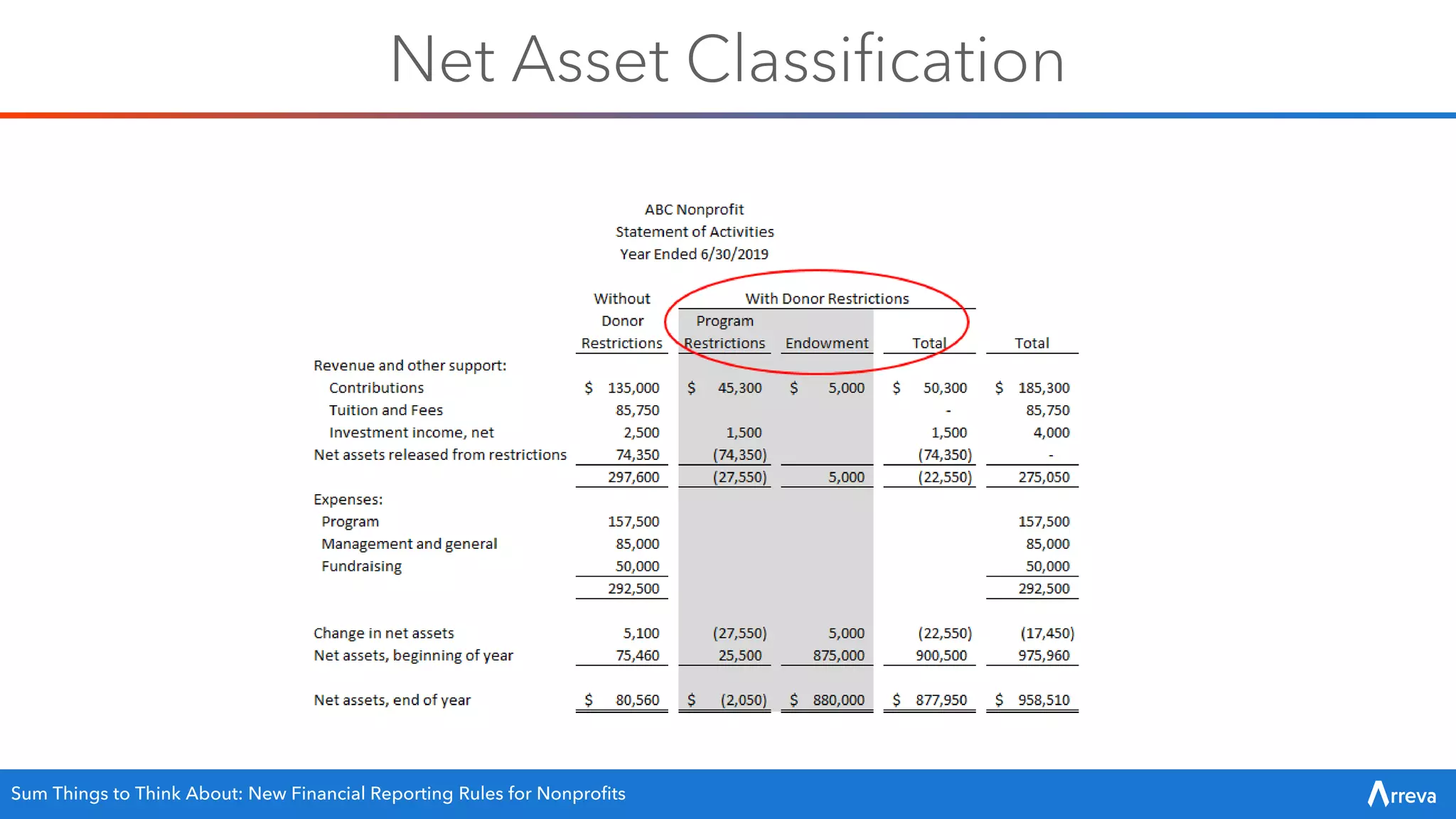

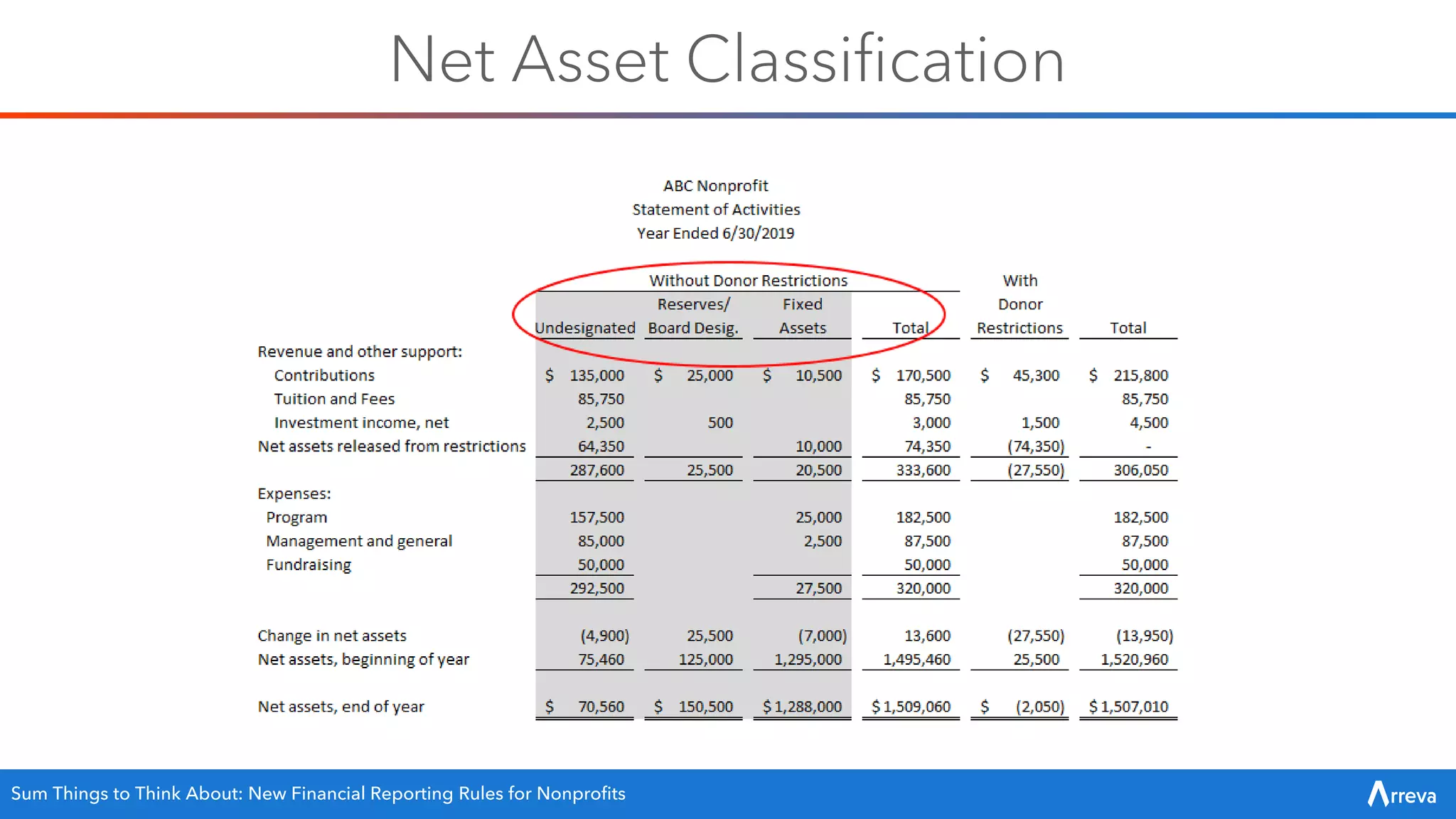

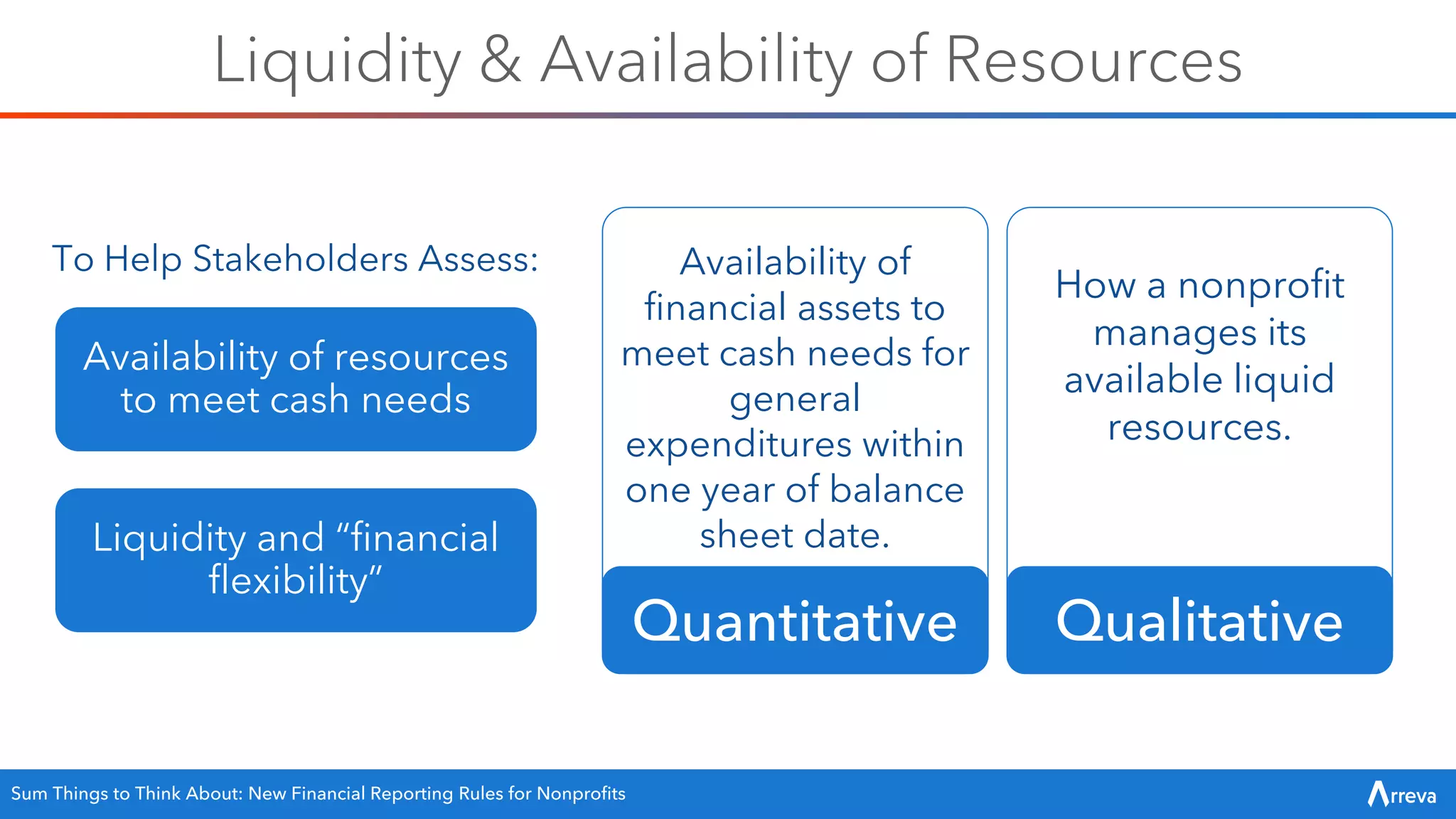

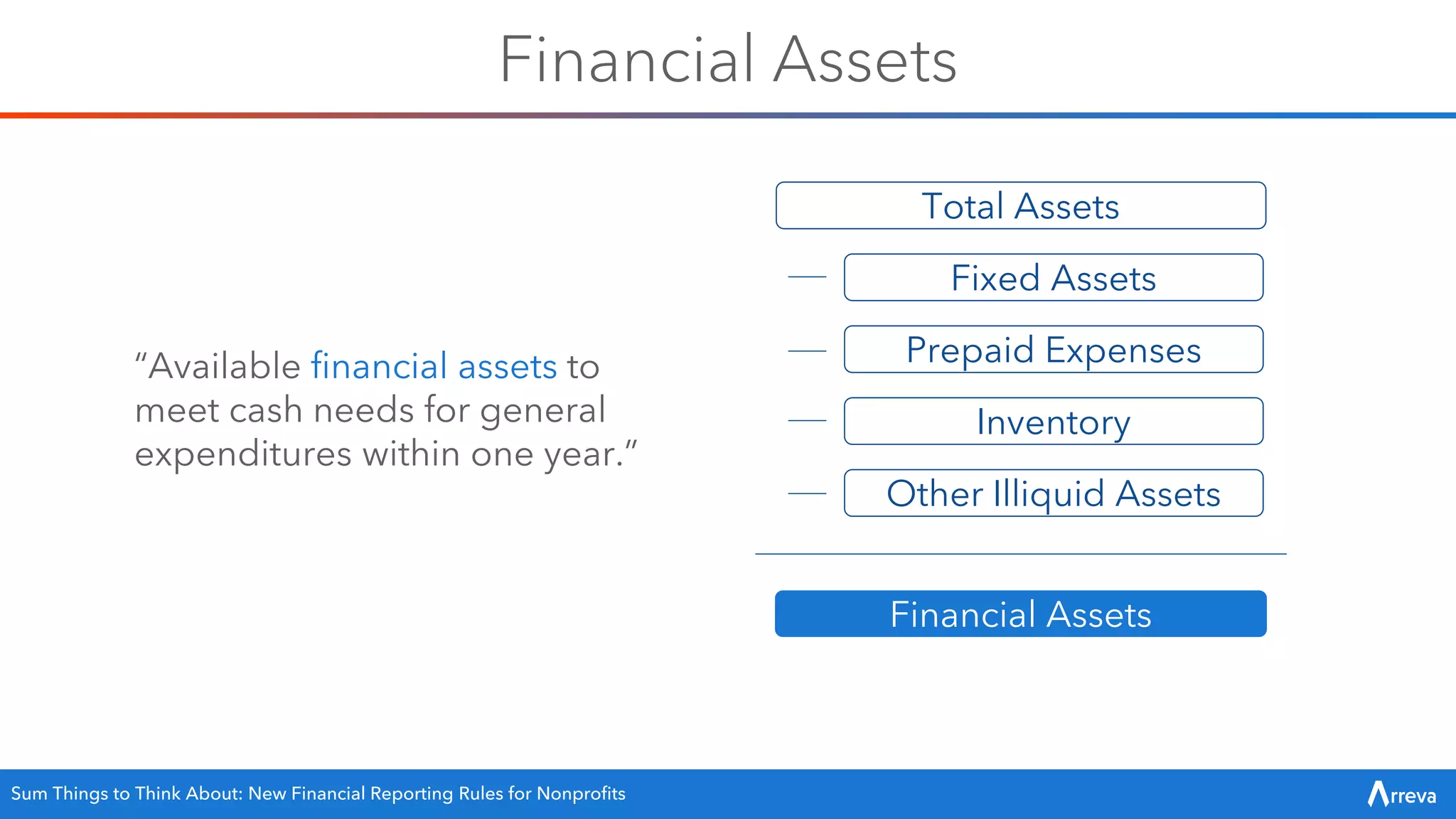

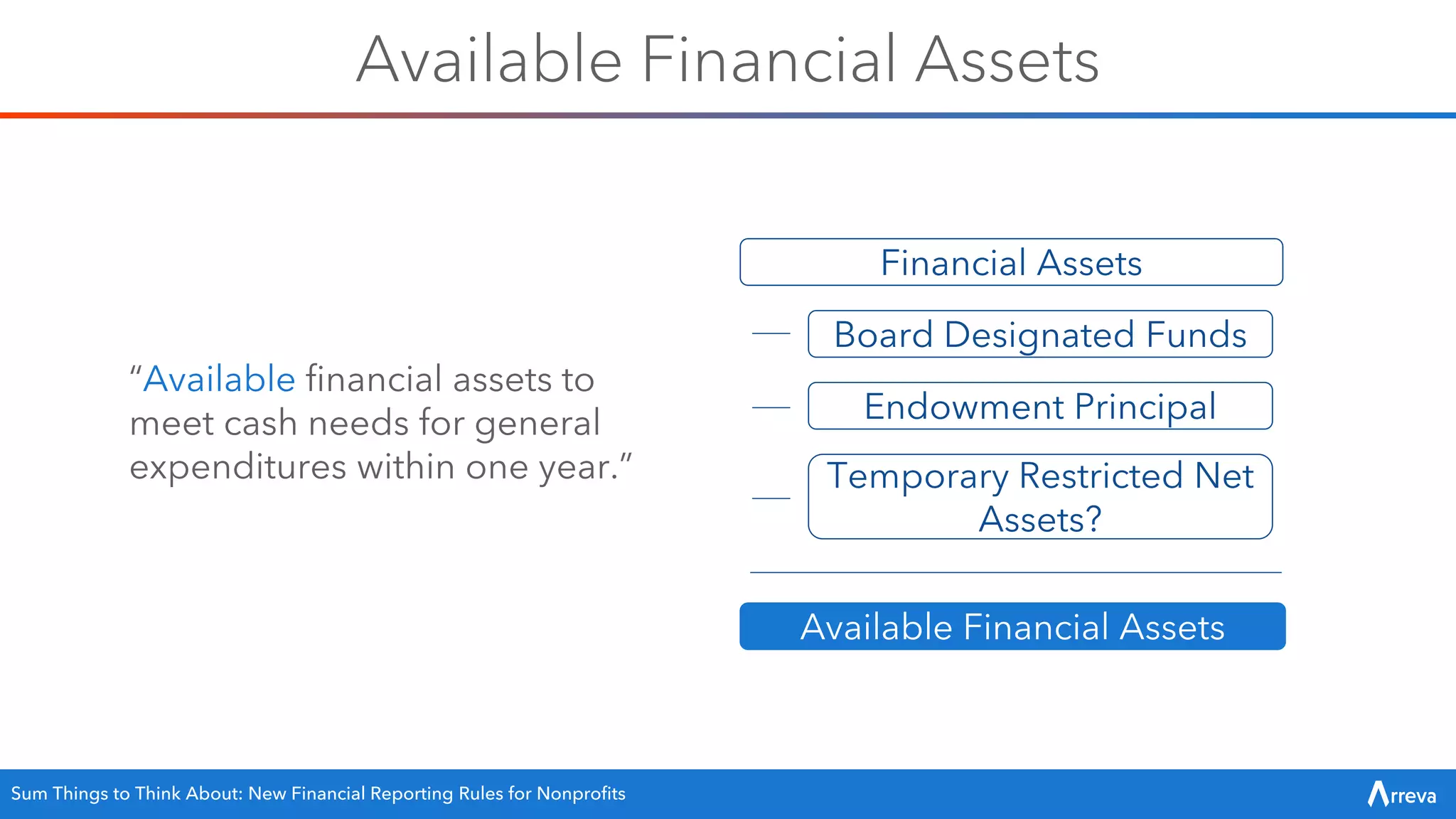

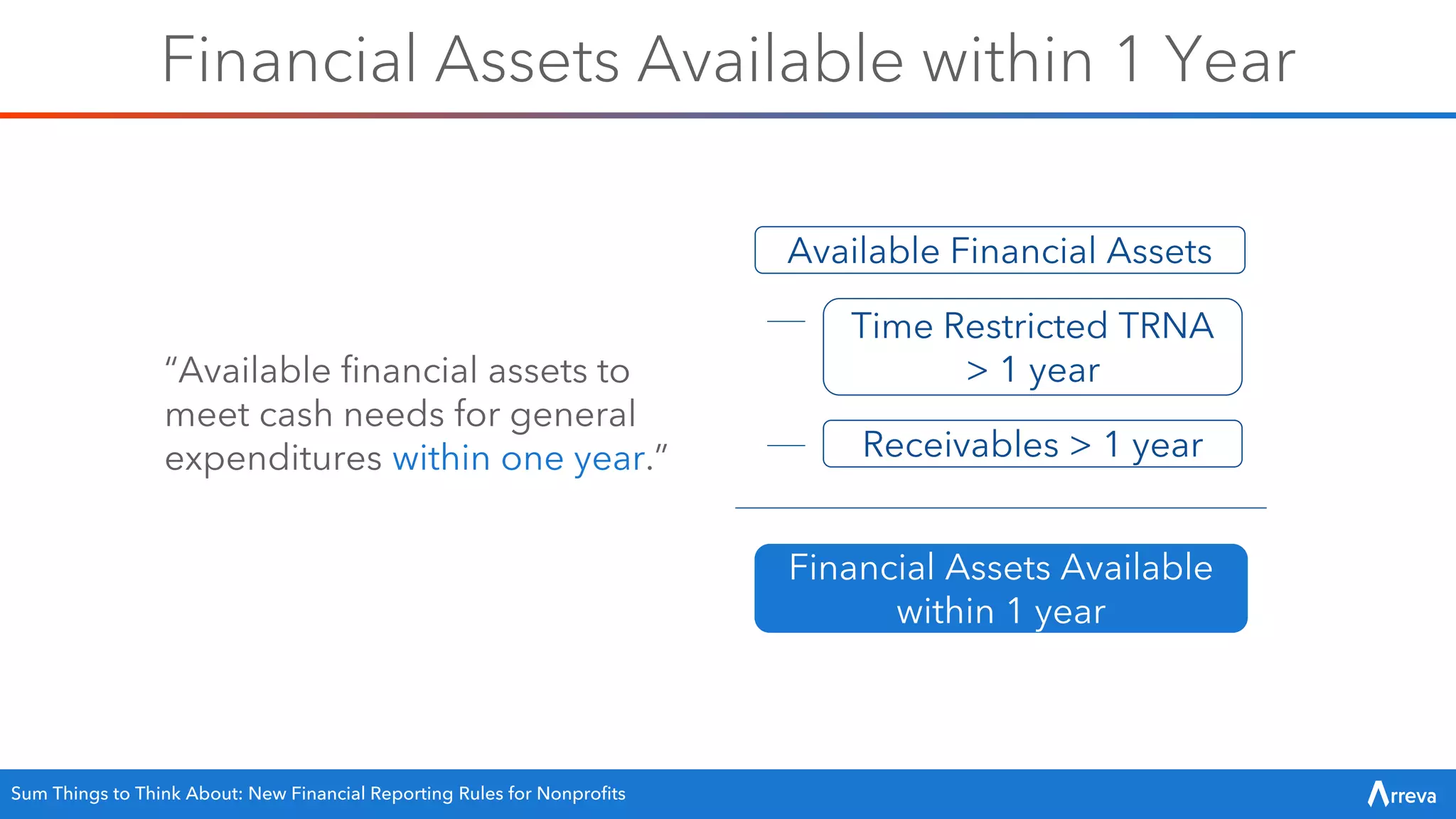

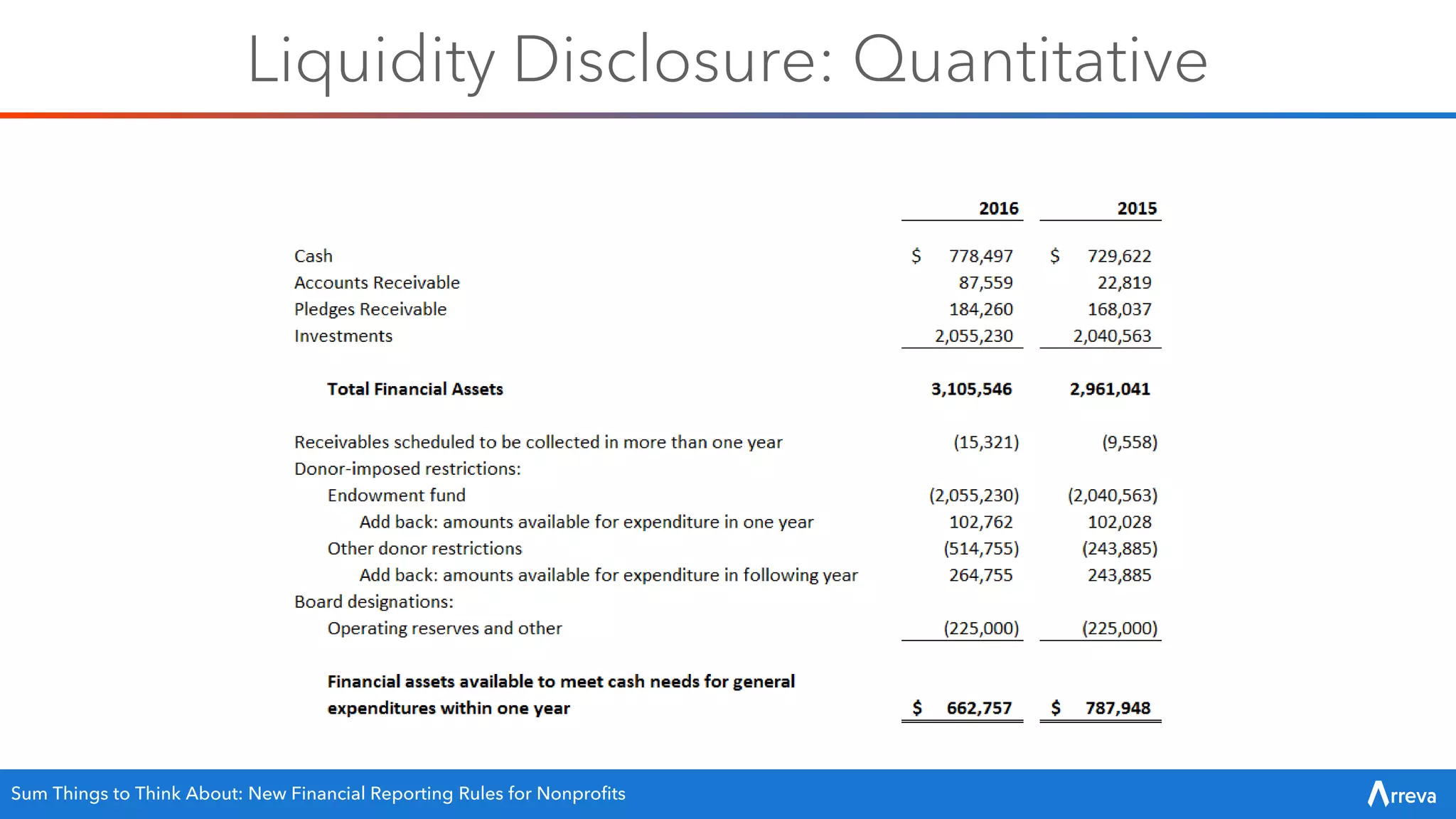

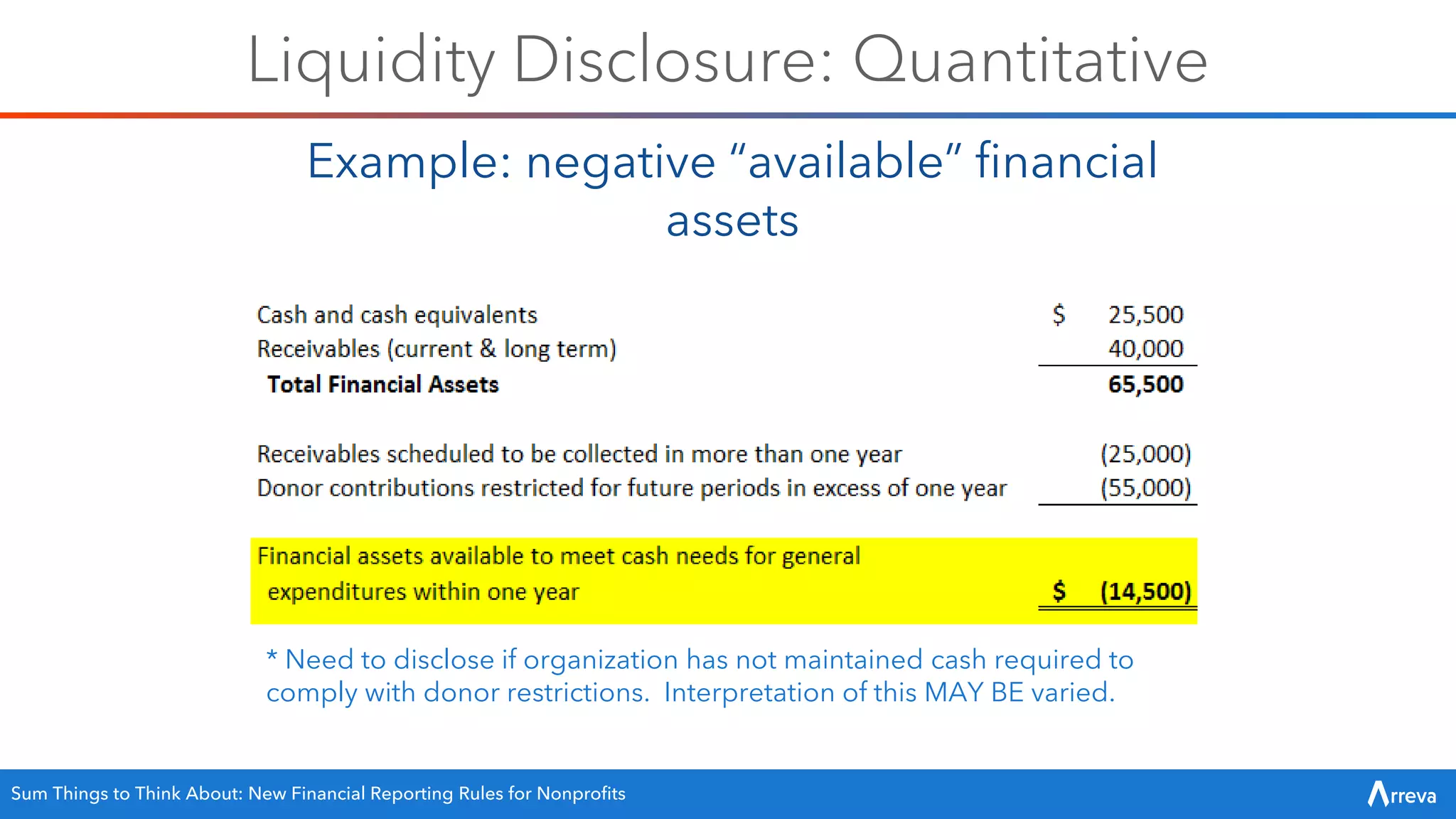

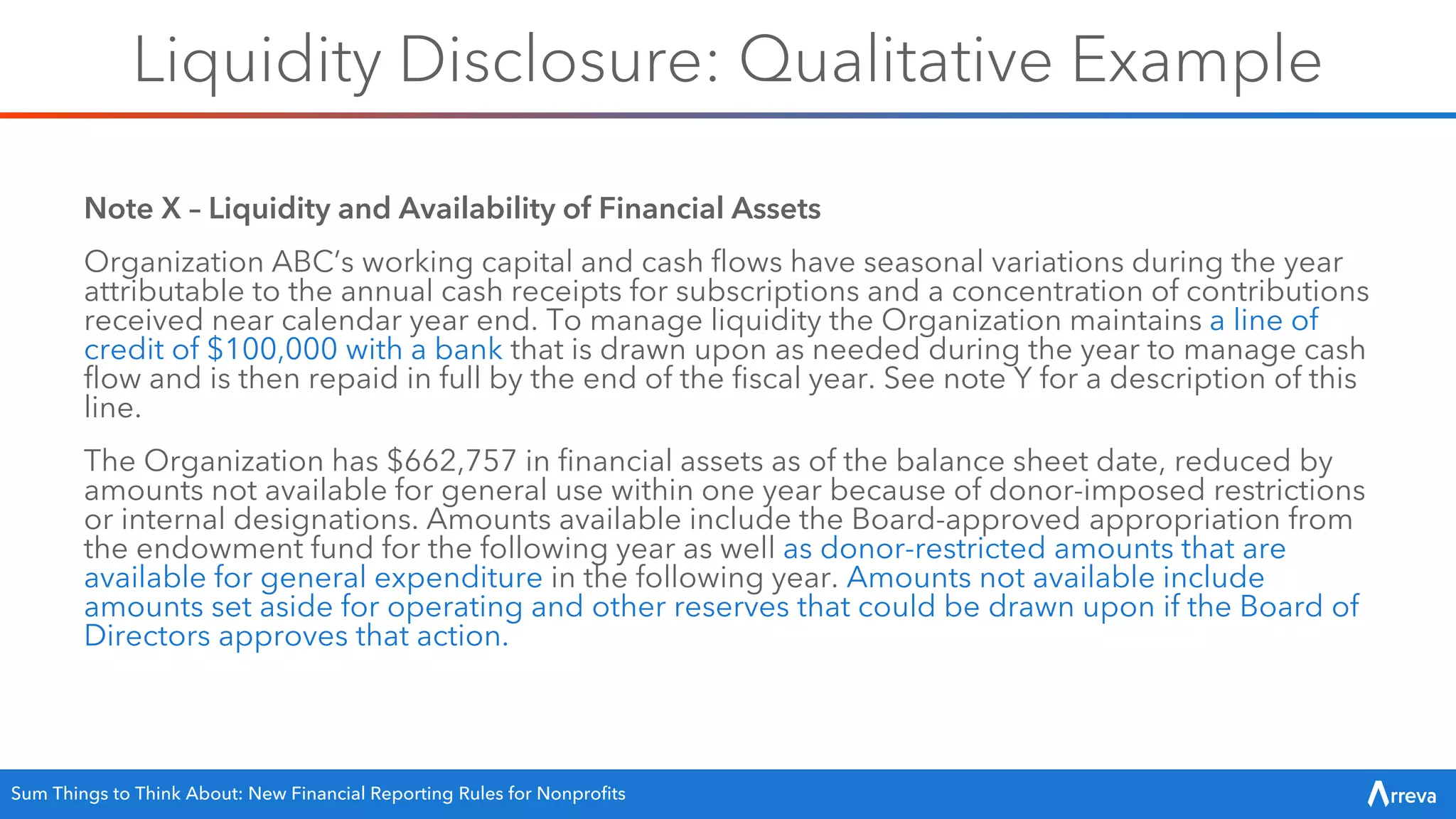

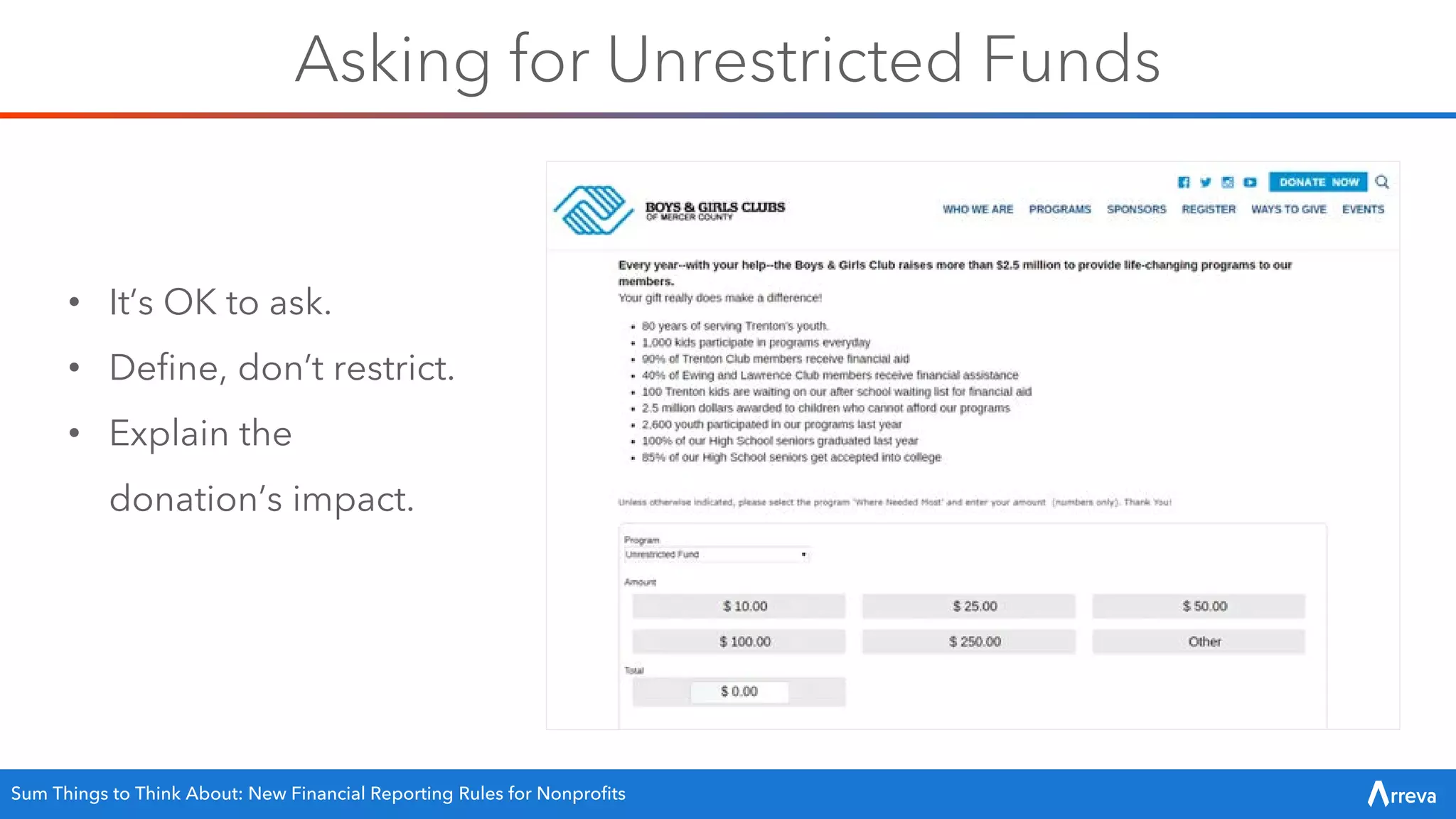

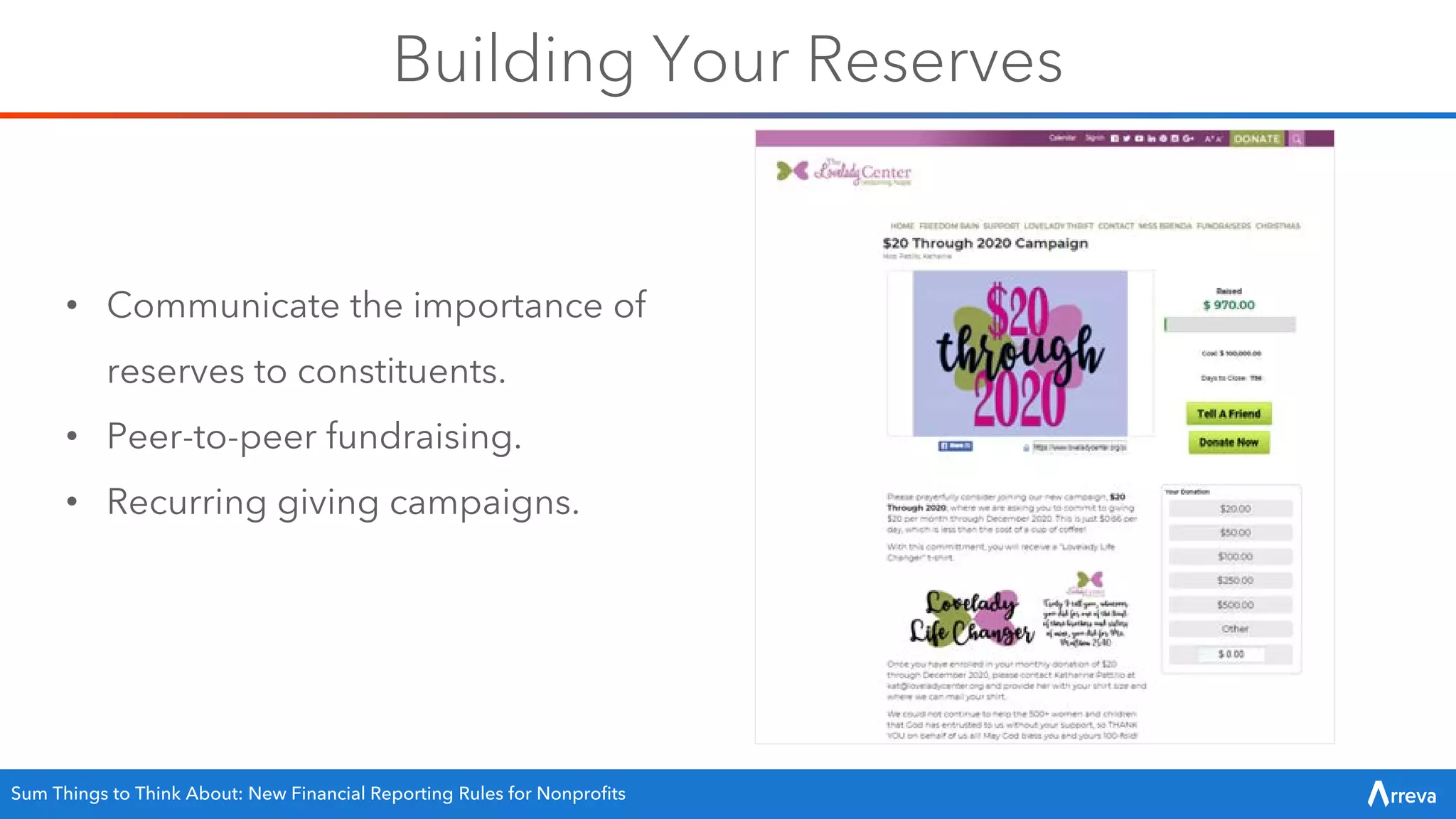

The document outlines a webinar on new financial reporting rules for nonprofits, detailing key topics such as accounting standards updates, net asset classification, and liquidity availability. It emphasizes the importance of transparency in financial reporting to better inform donors and stakeholders while providing strategies for effective communication. Additionally, it encourages nonprofits to adapt their financial practices to improve operational efficiency and fundraising effectiveness.