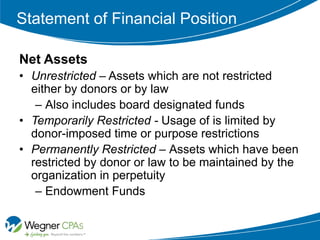

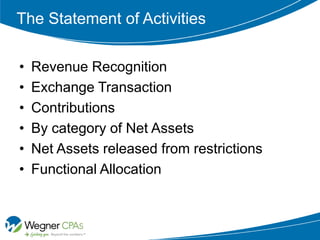

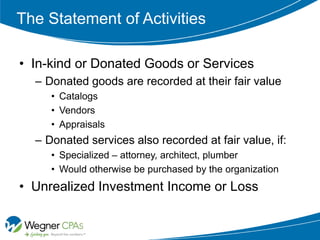

This document provides an overview of nonprofit financial statements and accounting principles. It discusses the key financial statements including the statement of financial position, statement of activities, statement of cash flows, and notes. It describes the different types of assets, liabilities, and net assets that appear on the statement of financial position. The statement of activities shows revenue, expenses, and changes in net assets. The auditor's role and internal financial statements are also summarized. Basic accounting concepts for nonprofits like pledge recognition and functional expense allocation are explained.