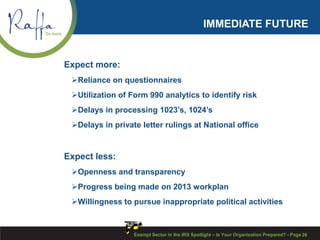

This document summarizes a presentation about the IRS's increased scrutiny of exempt organizations and how organizations should prepare. The IRS workplan includes examining over 1,500 organizations, political activity of 501(c) groups, and compensation transparency. New 990 FAQs address governance, public disclosure, and compensation reporting. The self-declarer project and auto-revocation updates were also discussed. Intermediate sanctions for excessive compensation and a higher education survey provided lessons for other non-profits. The path forward may include changes to 501(c)(4) political activity rules.