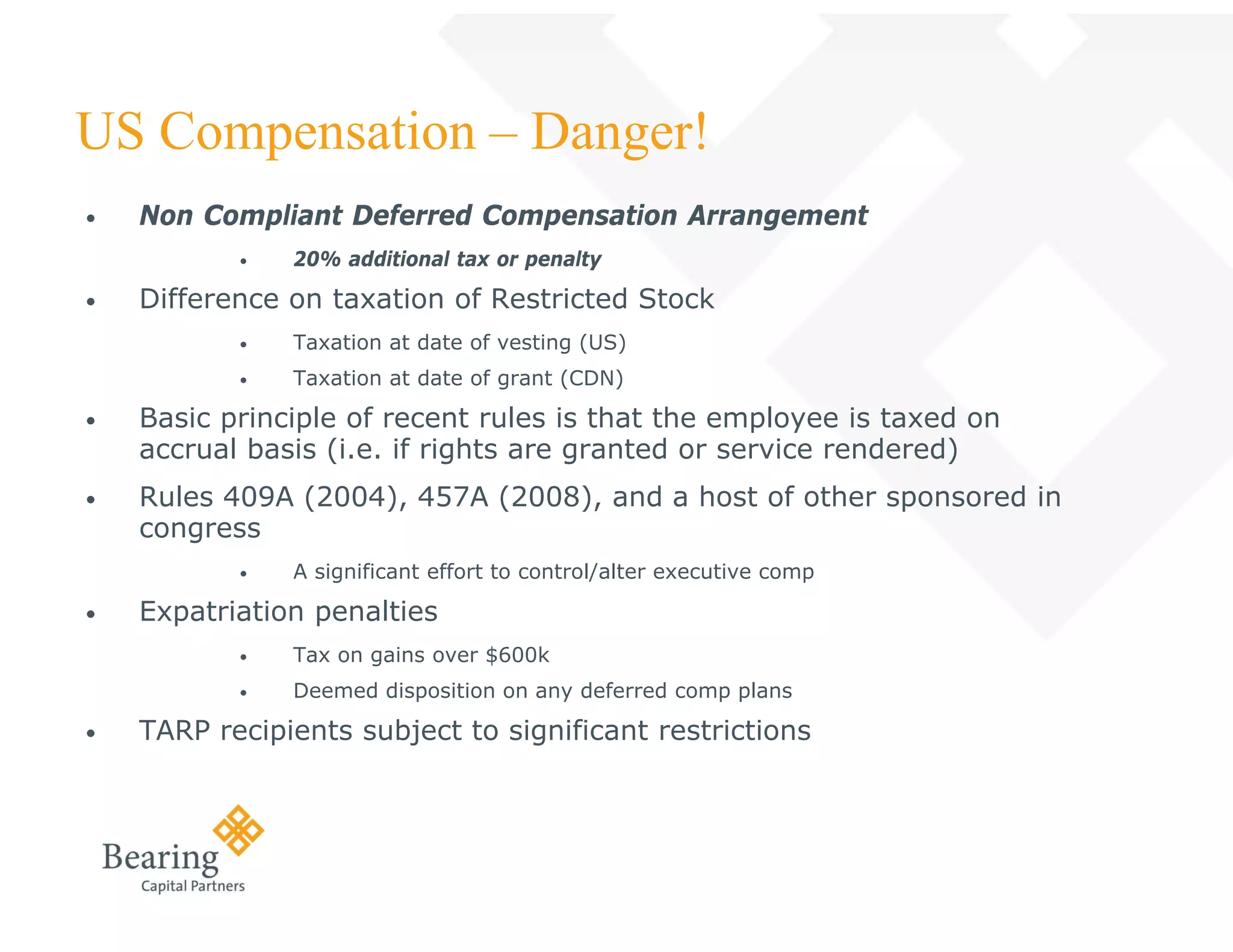

This document discusses executive compensation strategies for negotiating tax-efficient rewards. It provides an overview and assumptions, then covers topics like negotiated vs contingent compensation, quick planning solutions, entitlements, equity plans like stock options and SARs, US employment considerations, negotiating benefits, exit strategies, dealing with severance, and more. The overall message is that executives have opportunities to structure compensation to maximize wealth in a tax-efficient manner through various negotiated arrangements.