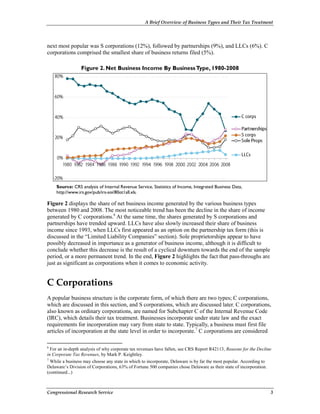

This document provides a summary of the tax treatment of different types of businesses in the United States. C corporations are taxed twice, at the corporate level and then again when profits are distributed to shareholders. Other business types like sole proprietorships, partnerships, S corporations and LLCs have their income "pass through" to owners and taxed under individual income tax rates to avoid double taxation. The document discusses the defining features and tax implications of each major business type.