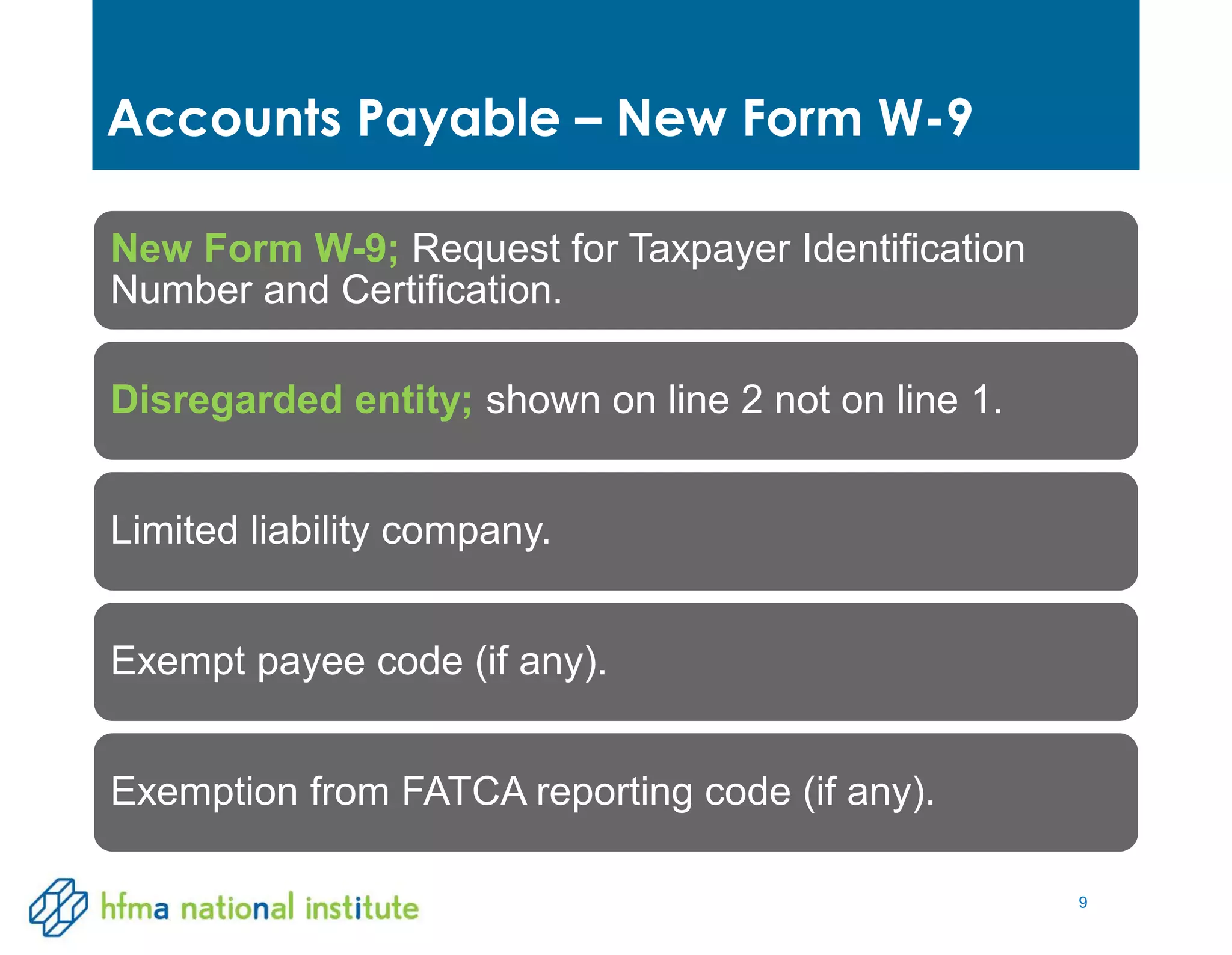

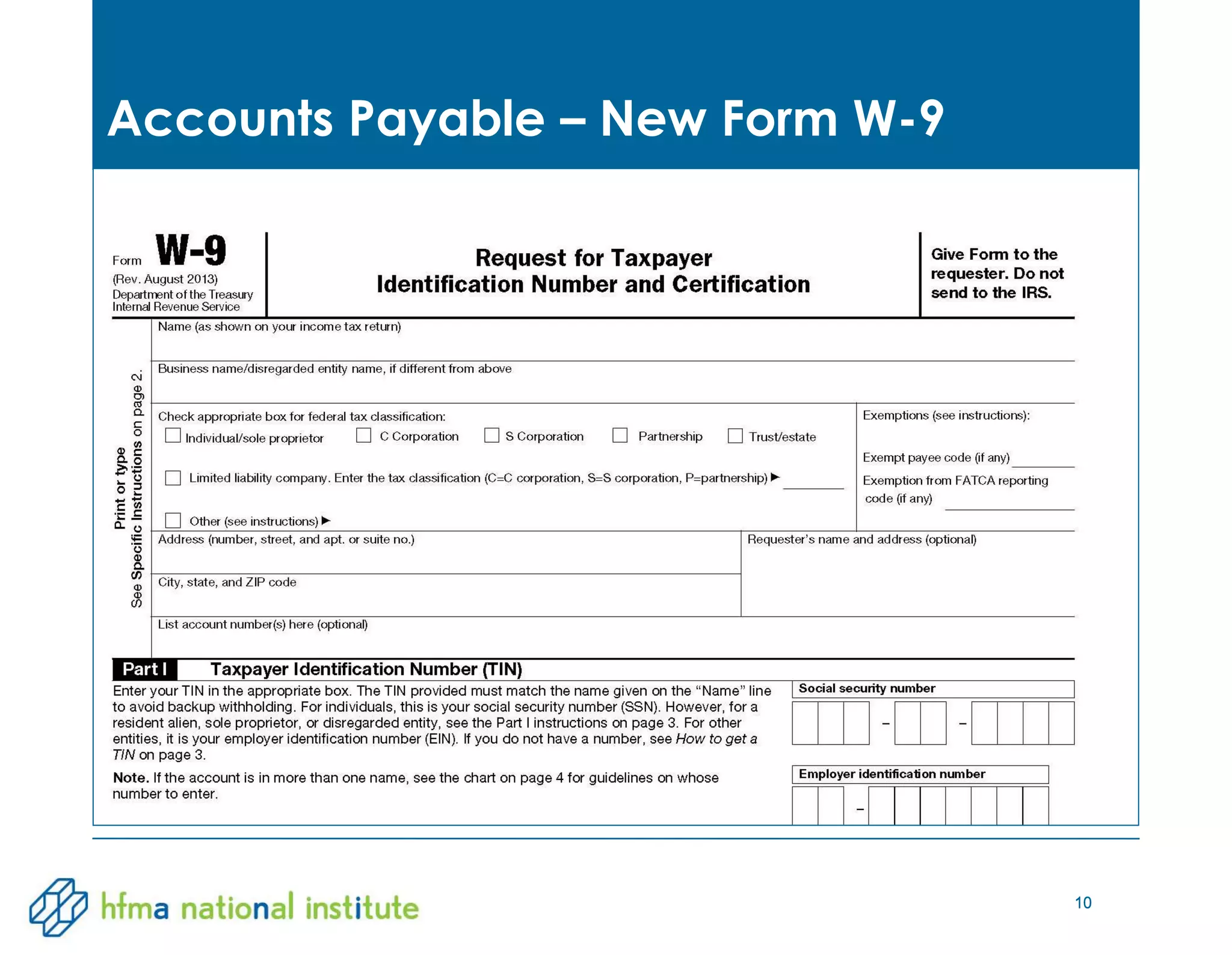

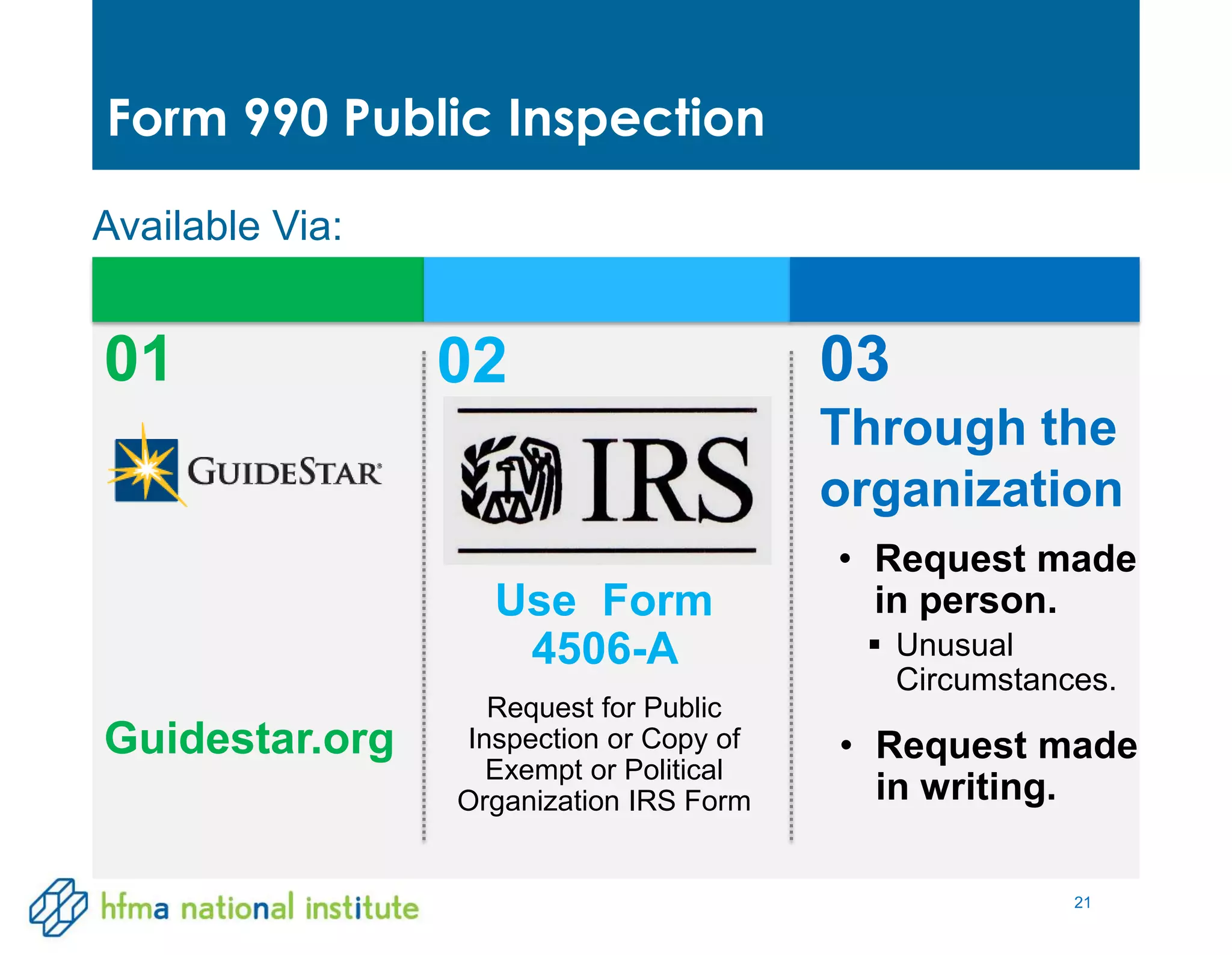

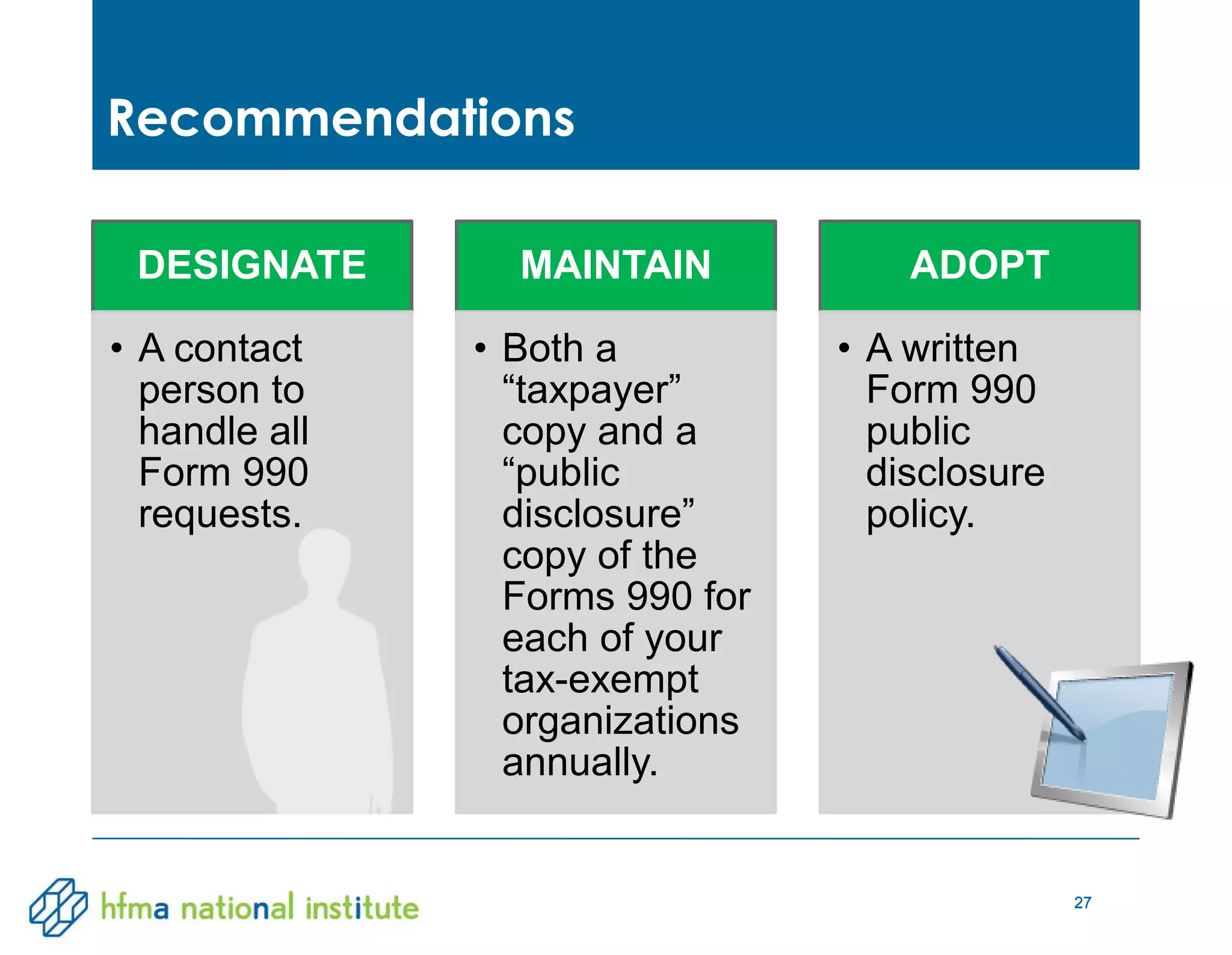

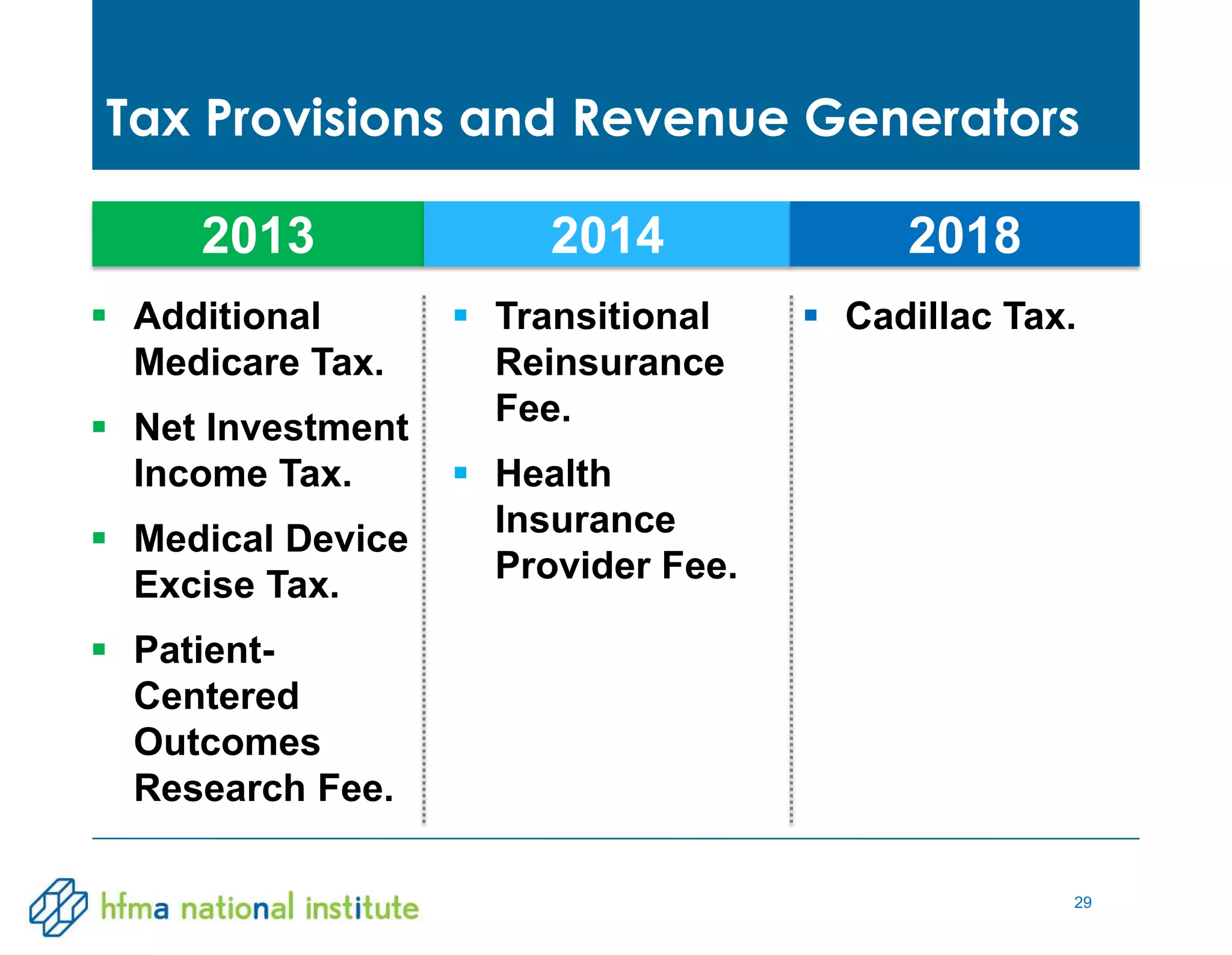

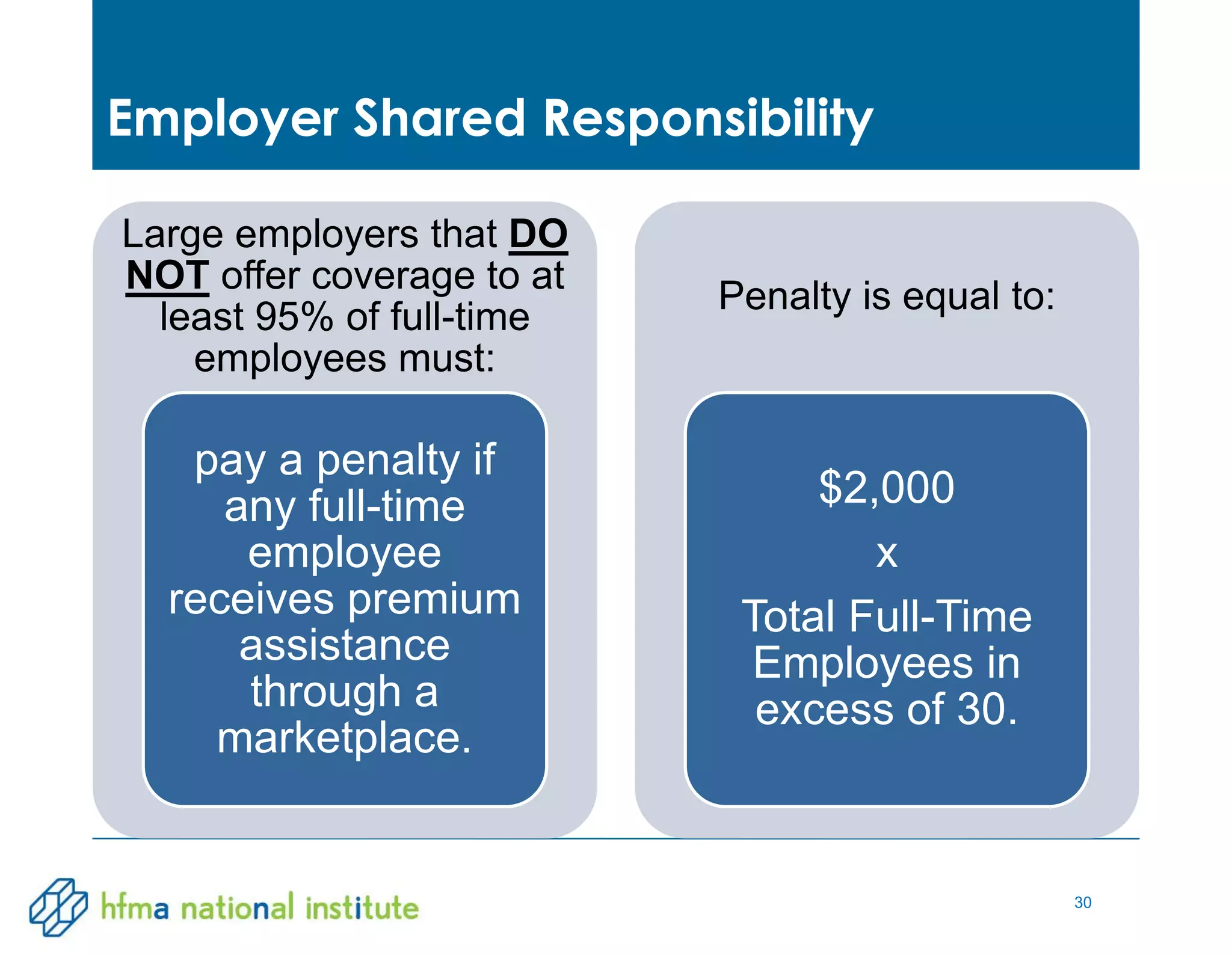

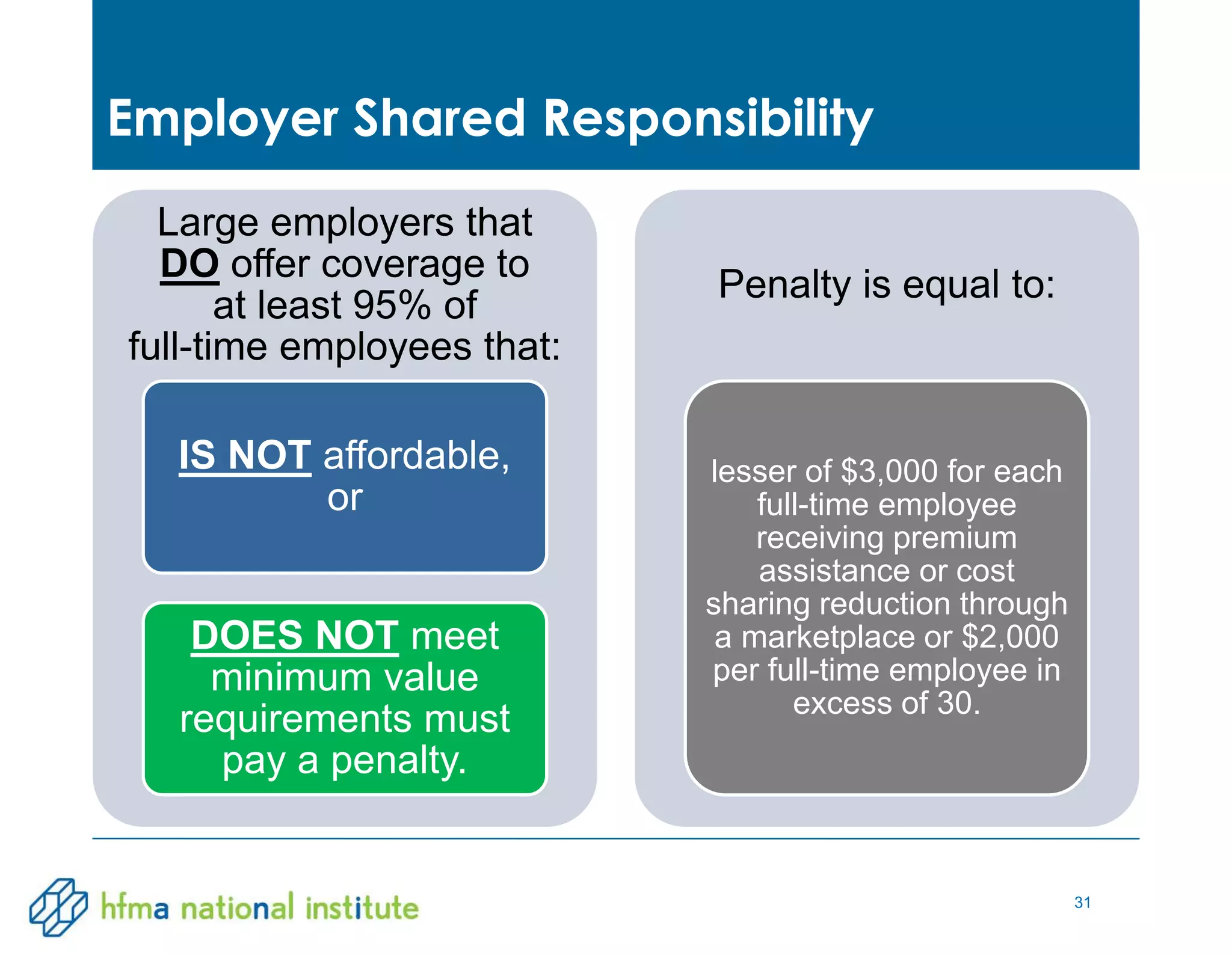

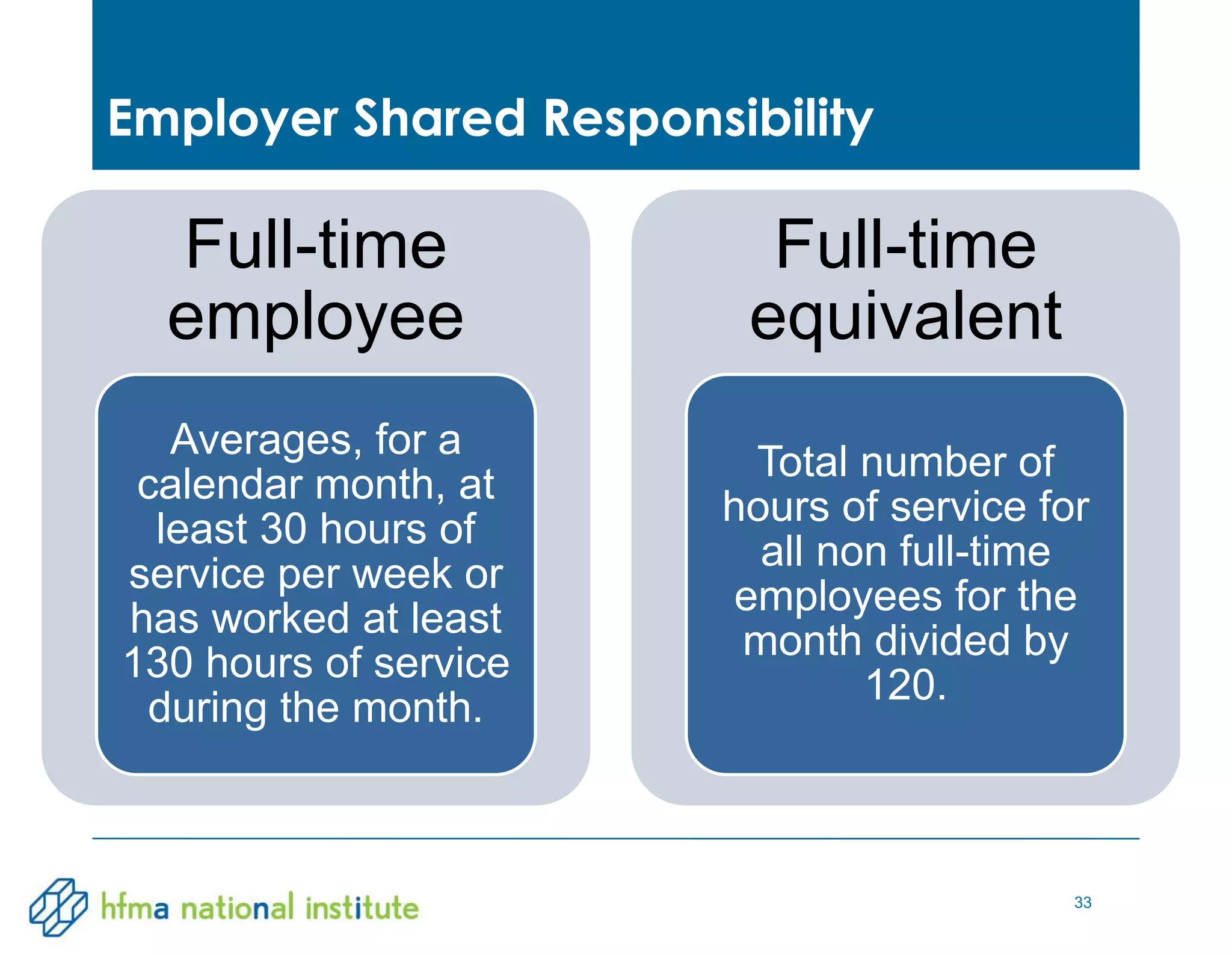

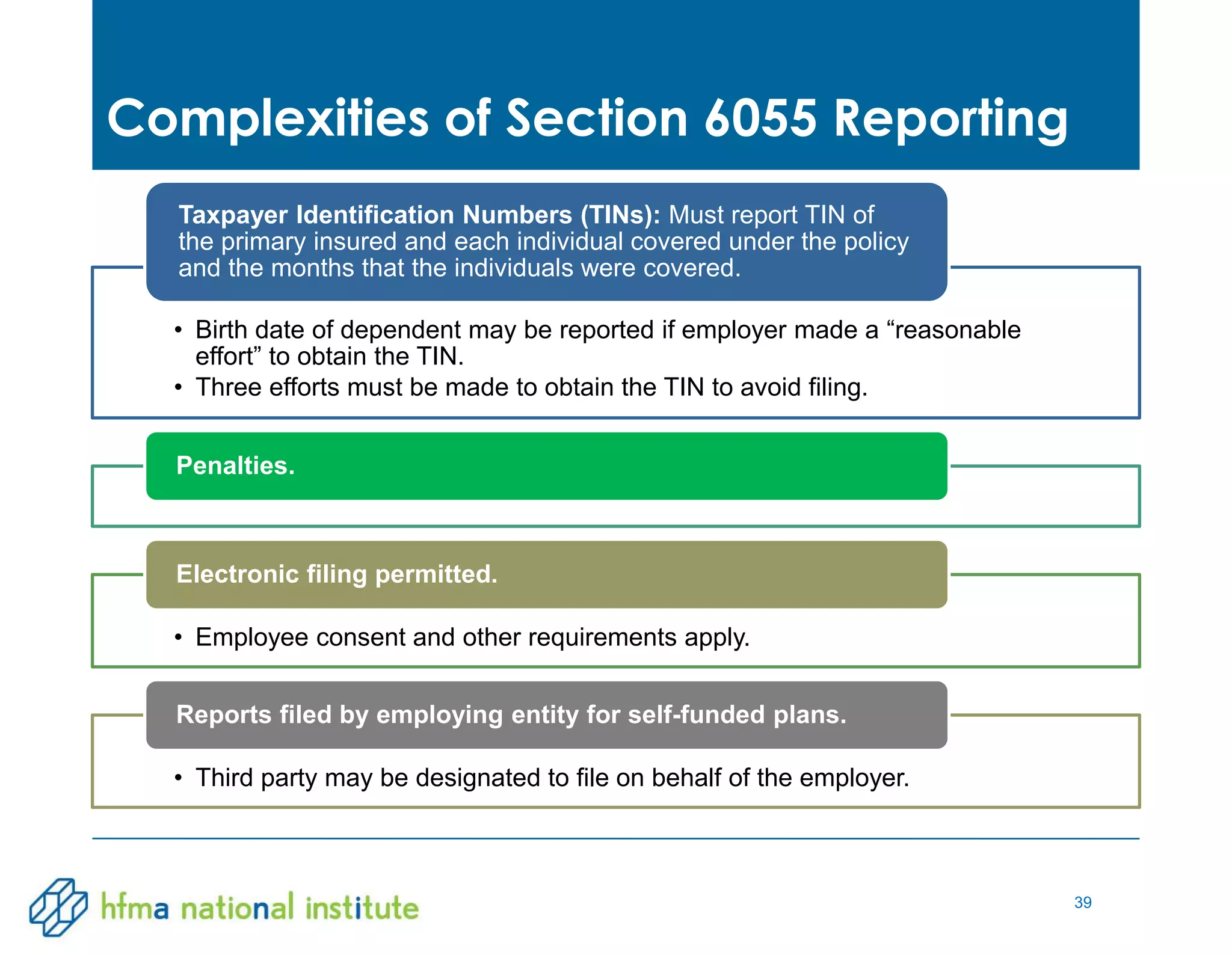

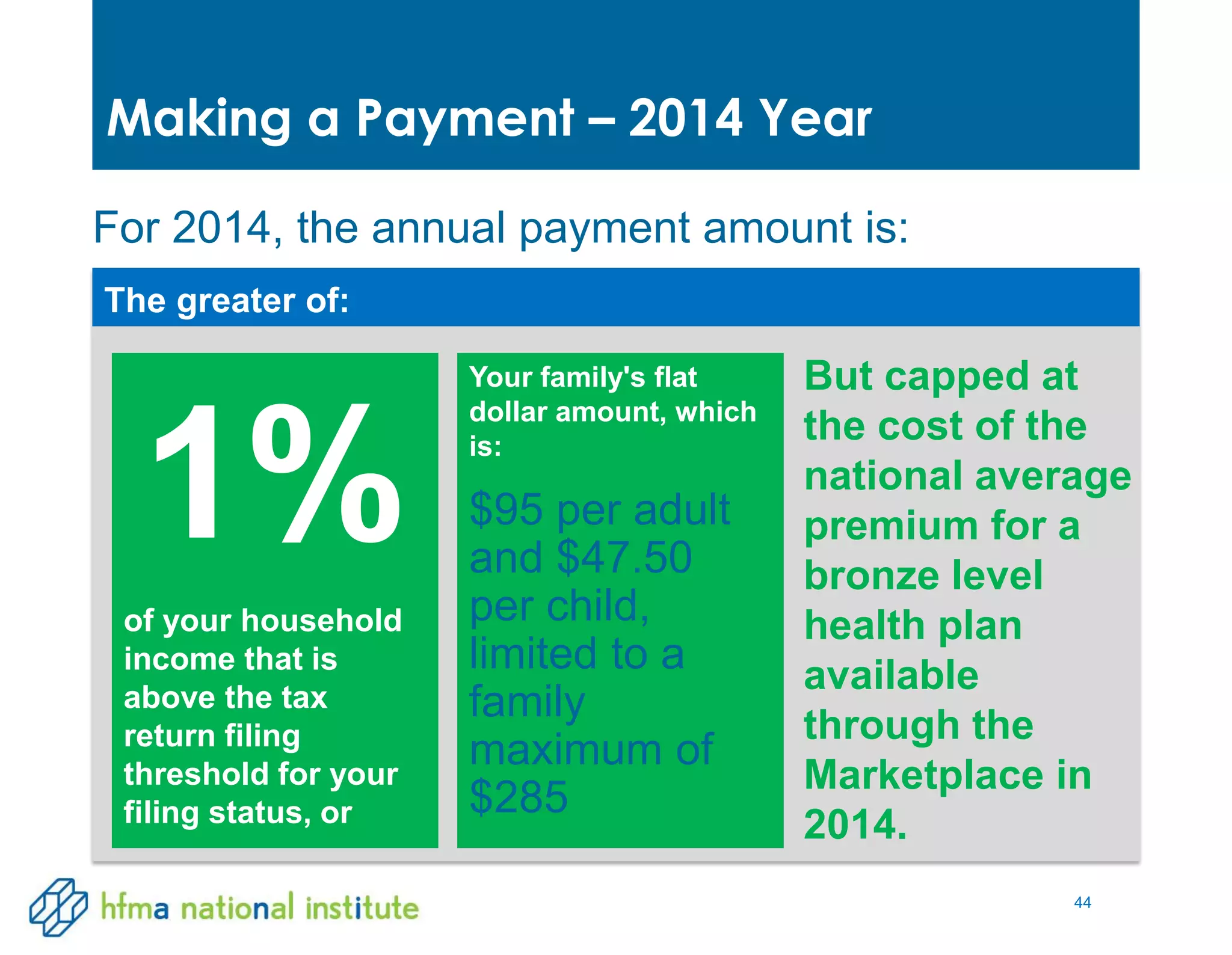

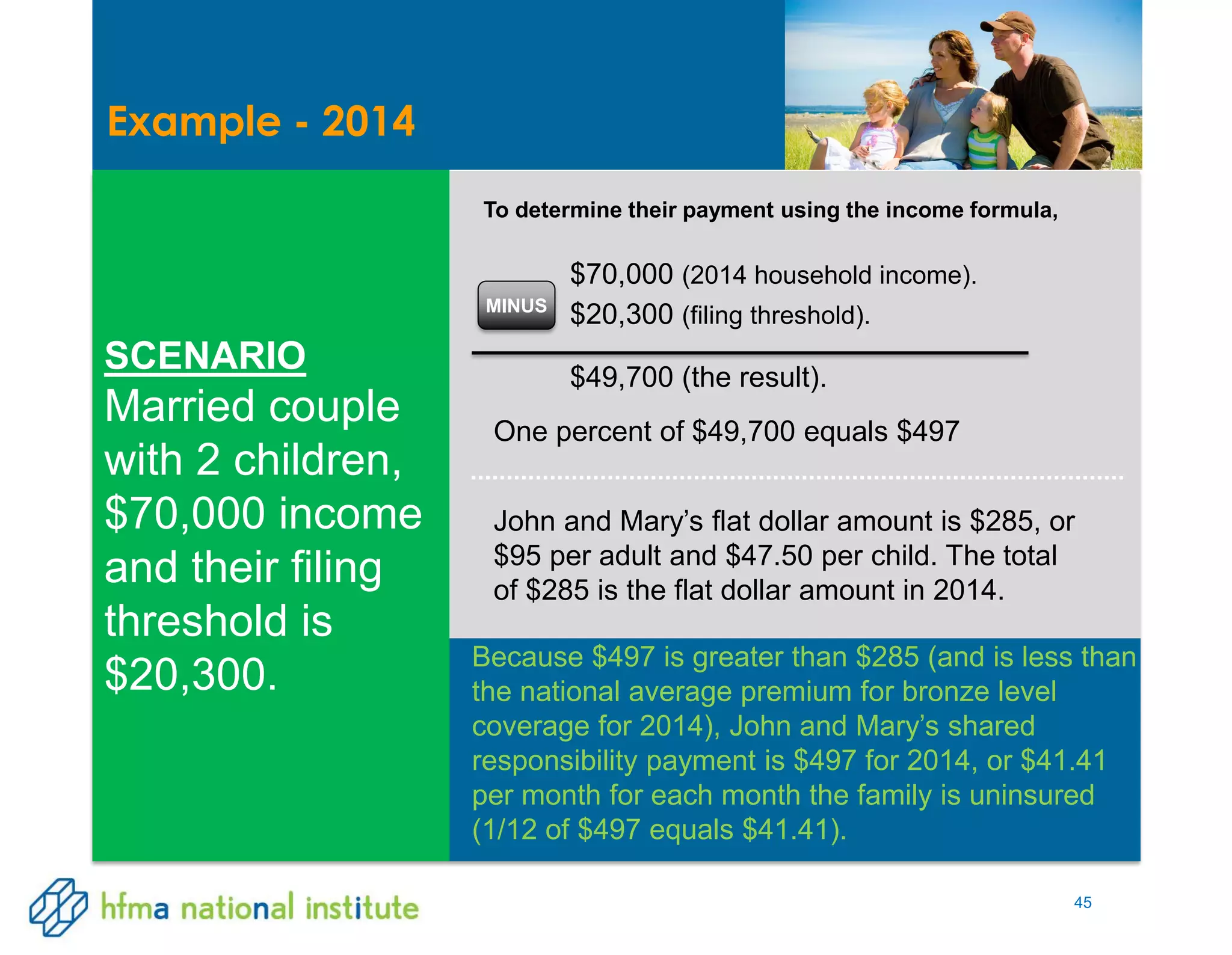

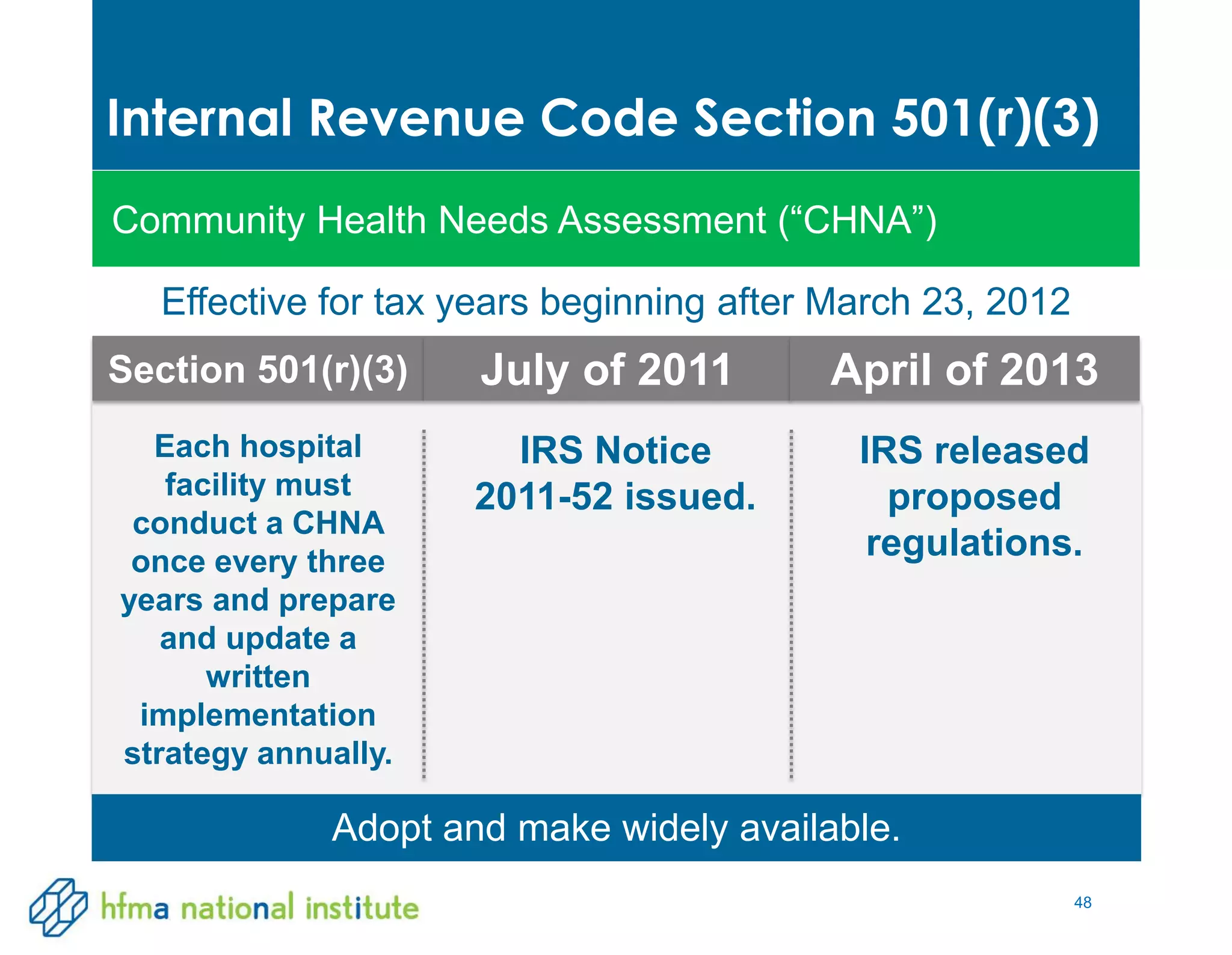

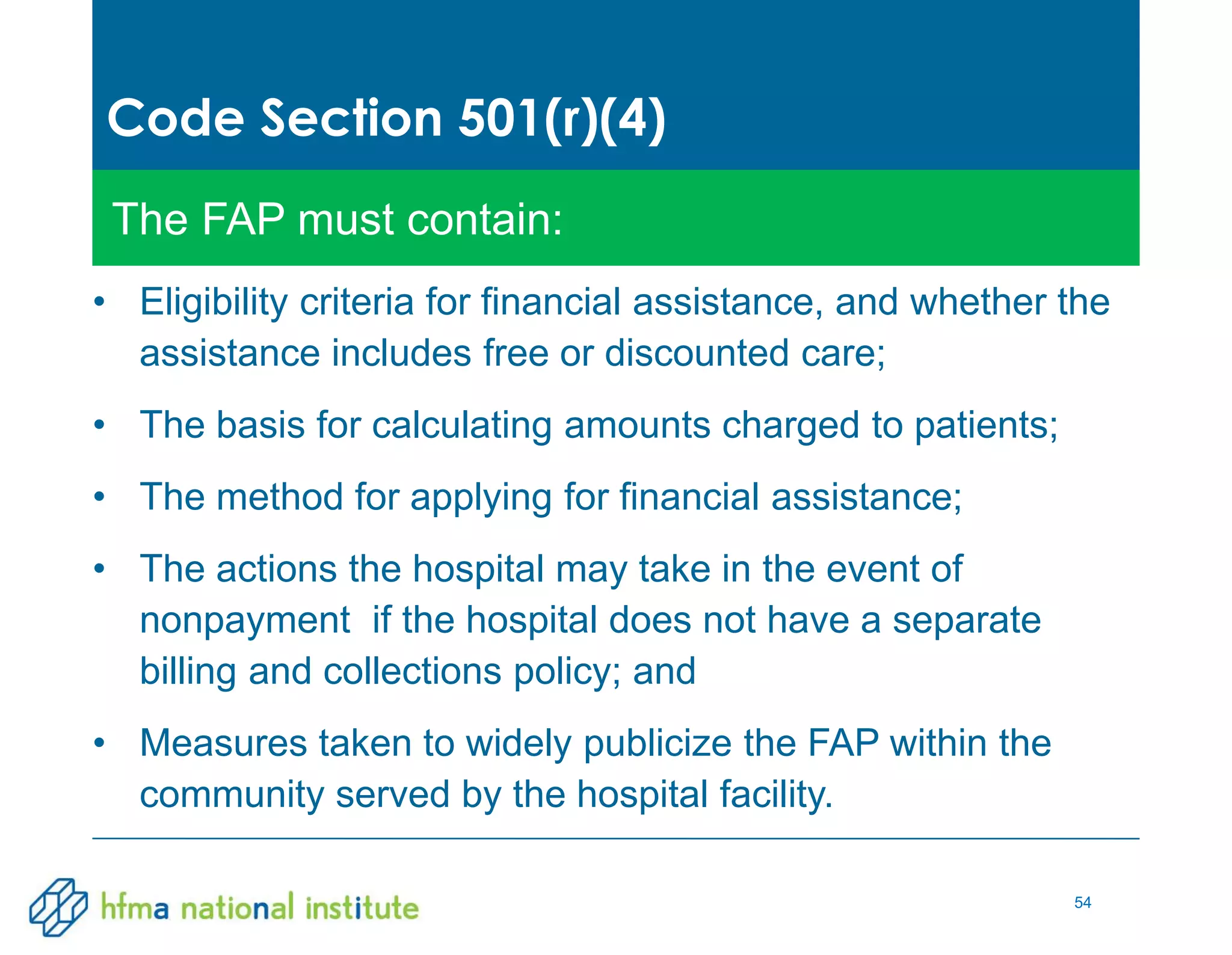

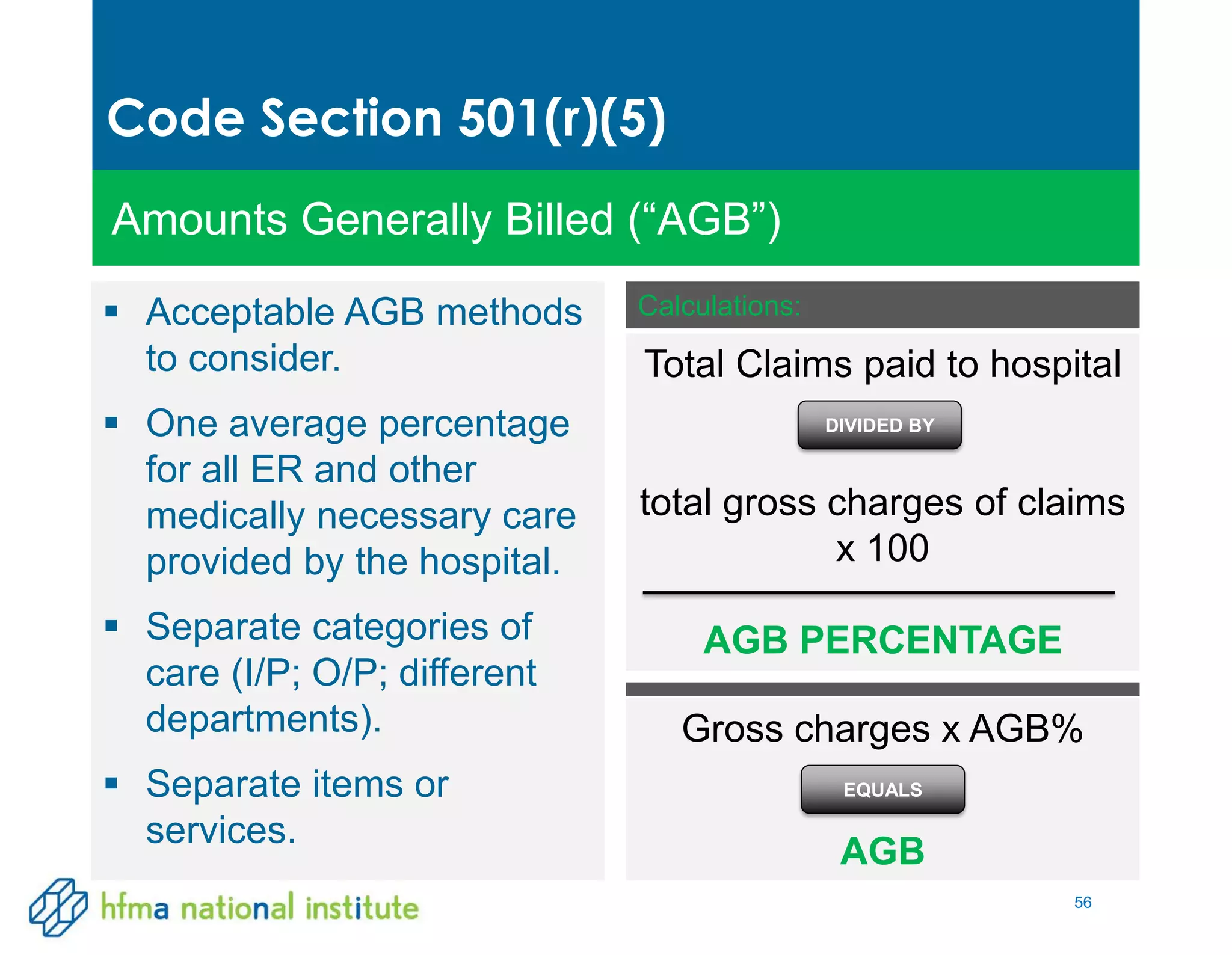

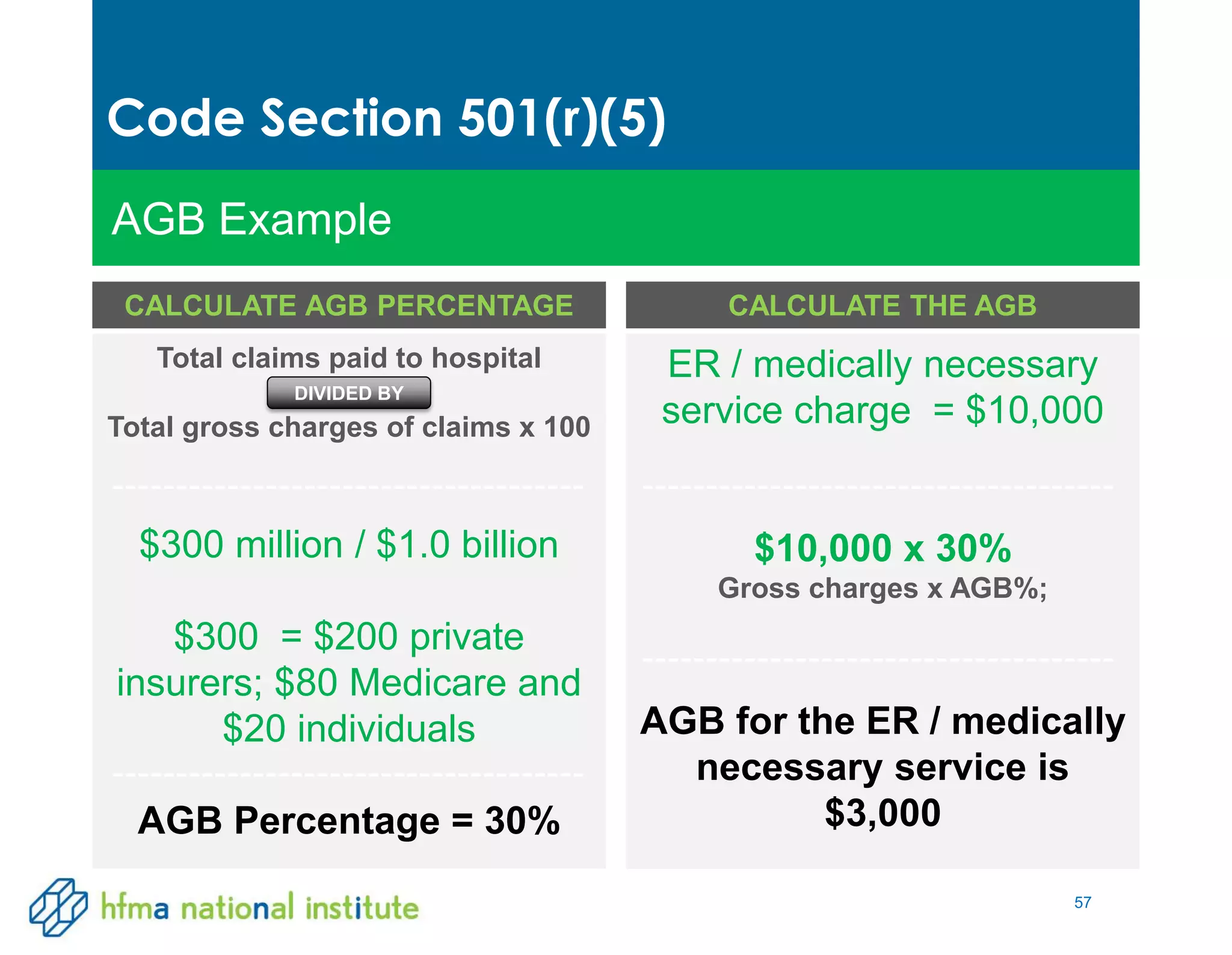

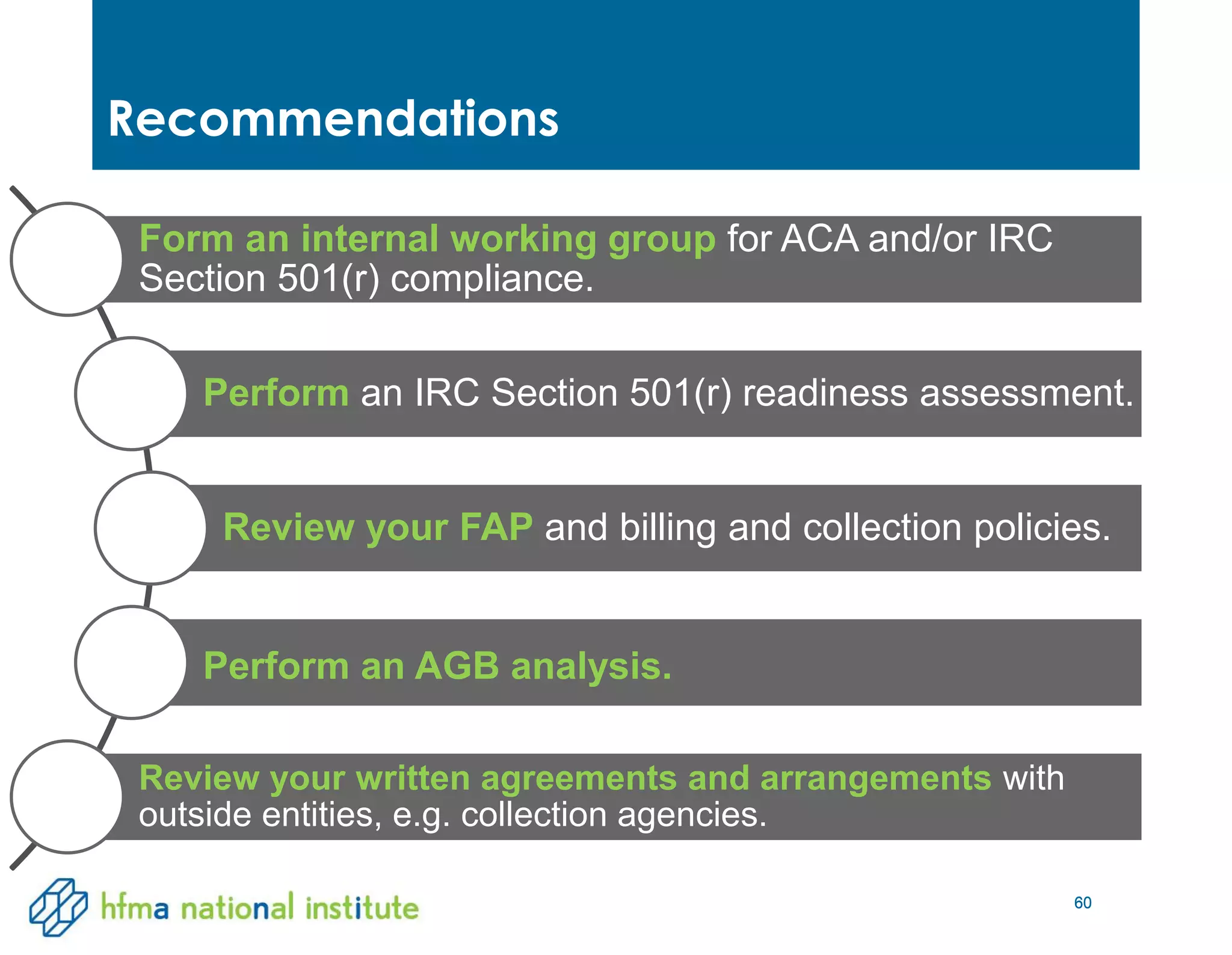

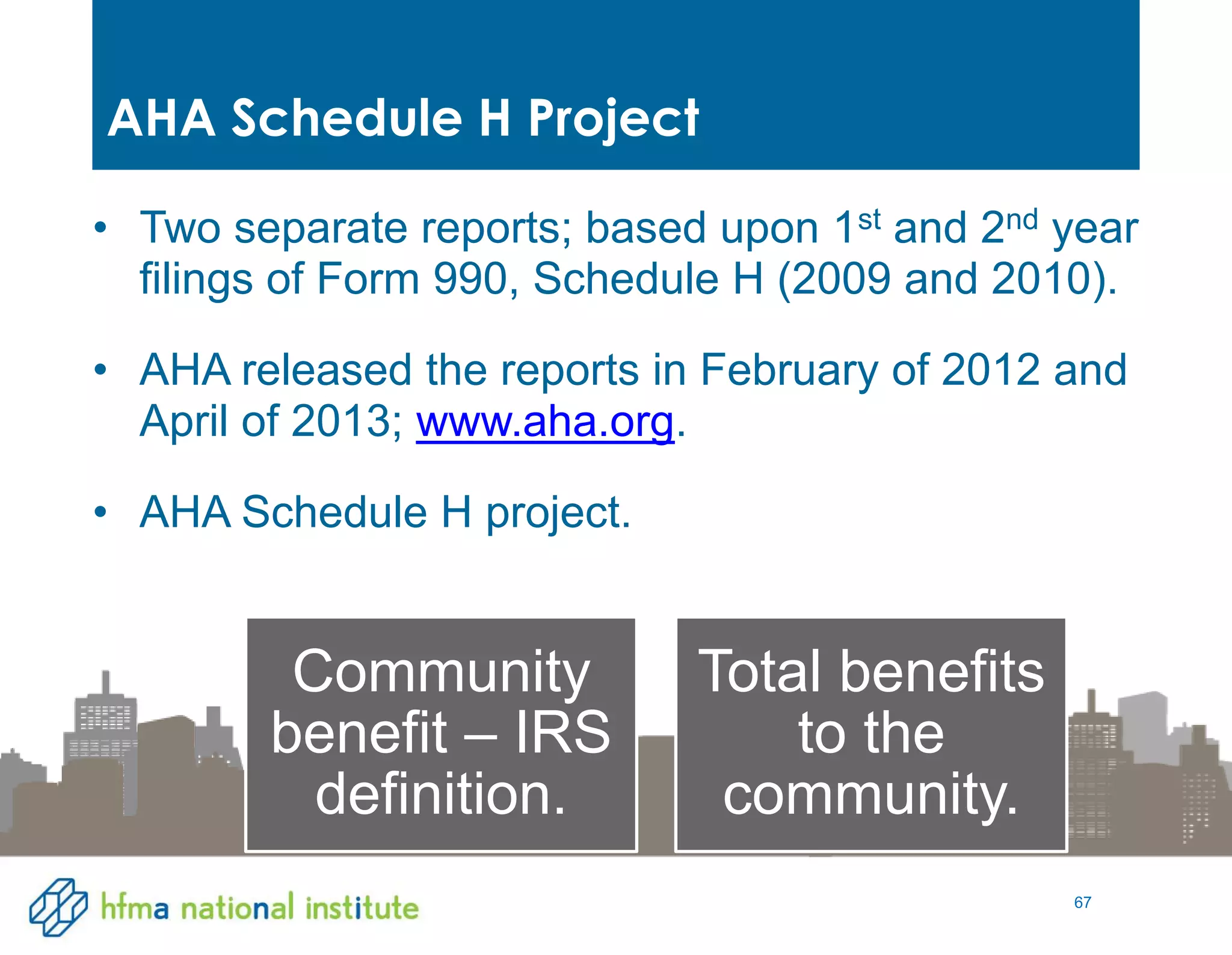

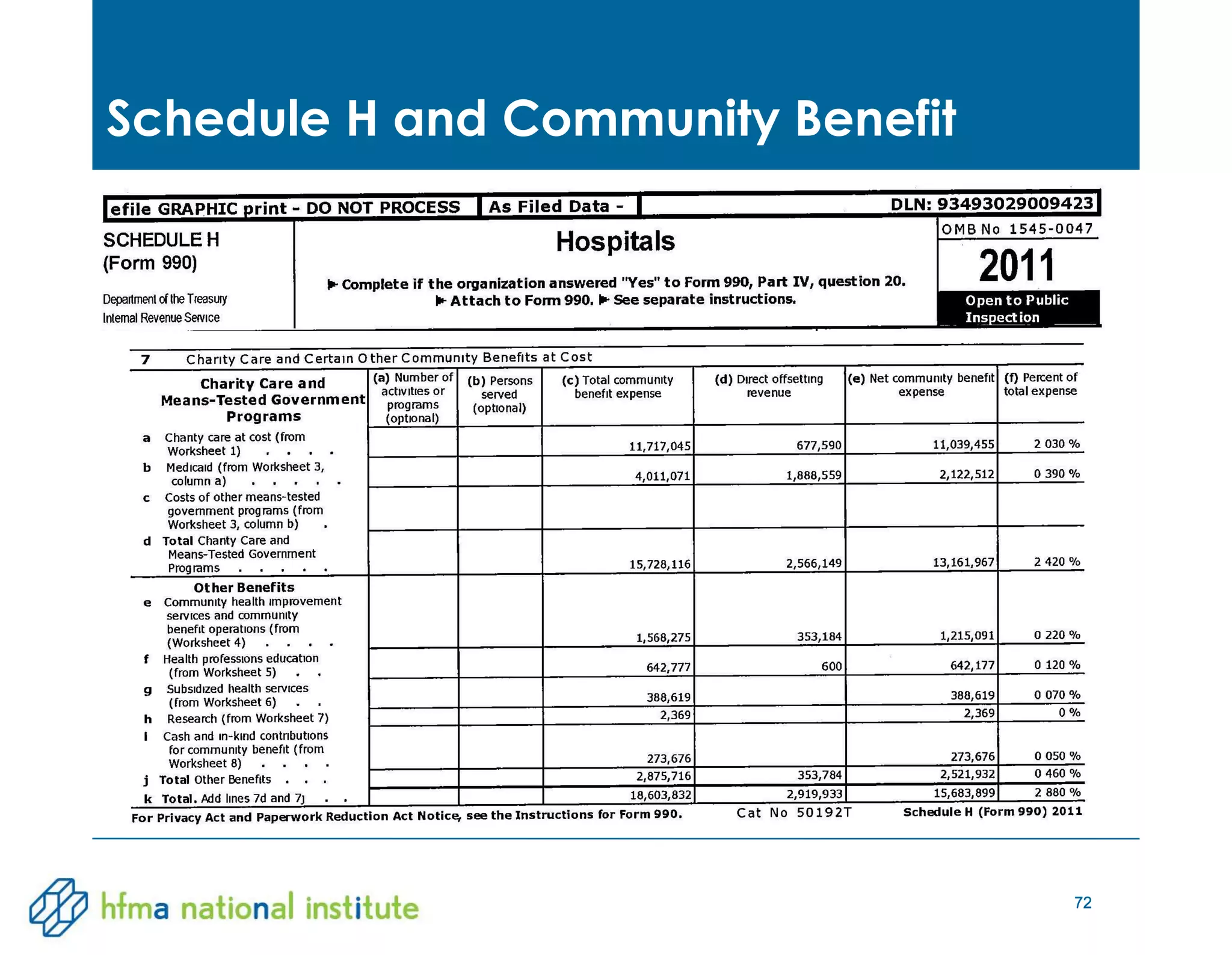

The document provides an update on healthcare industry tax regulations and practices as of 2014, including IRS updates and implications of the Affordable Care Act. It covers key changes in tax compliance, tax-exempt status for organizations, and employer responsibilities regarding health insurance coverage. Recommendations for healthcare organizations include reviewing current tax-exempt plans and vendor forms to ensure compliance with new regulations.