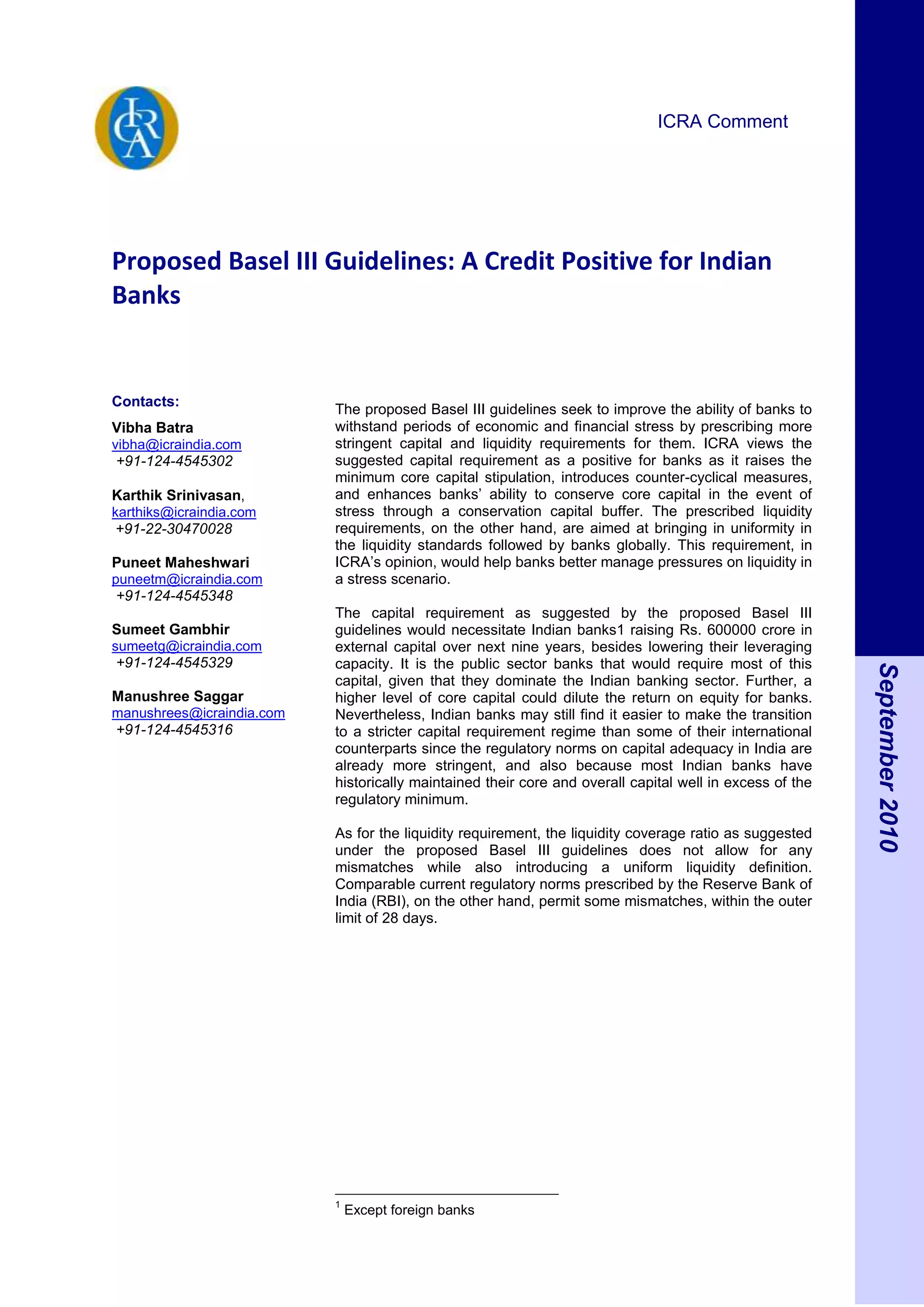

The proposed Basel III guidelines seek to improve banks' ability to withstand financial stress by prescribing more stringent capital and liquidity requirements. ICRA views the capital requirements as positive as it raises minimum capital levels and enhances banks' ability to conserve capital in stressful periods. The liquidity requirements aim to bring uniformity to global standards and help banks better manage liquidity pressures. Indian banks will need to raise approximately Rs. 600000 crore in external capital over nine years to meet the new capital norms, with most of this requirement for public sector banks. While return on equity may decline with higher capital levels, Indian banks should find it easier than international peers to transition due to existing strong capital levels in India.