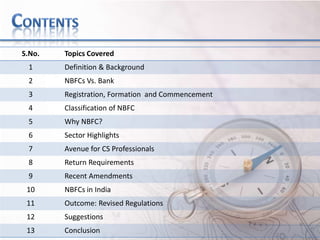

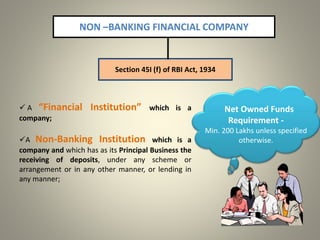

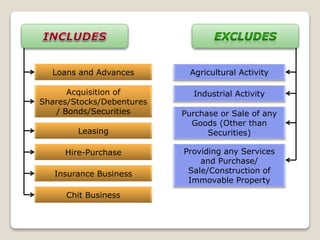

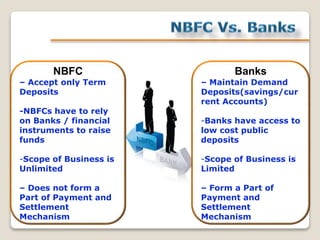

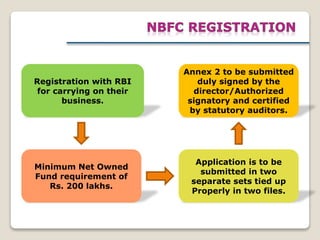

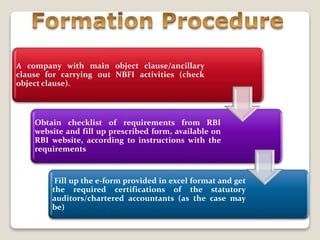

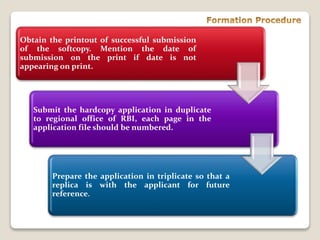

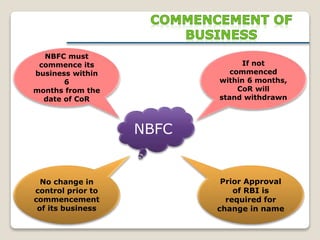

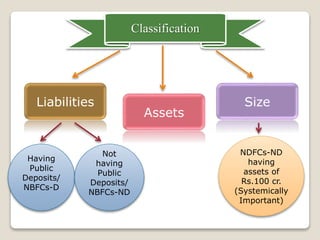

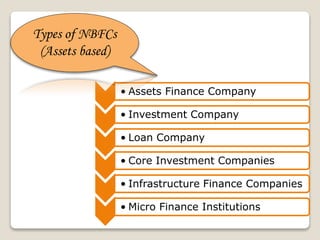

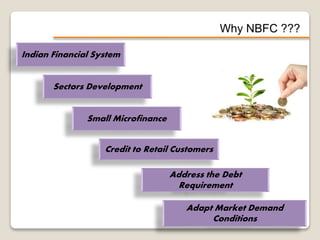

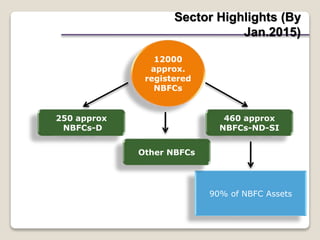

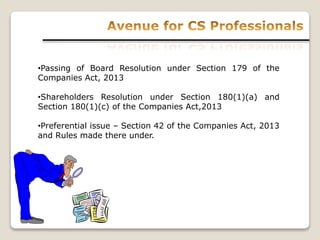

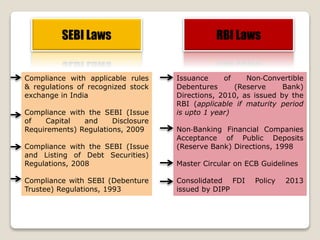

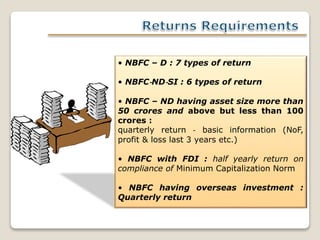

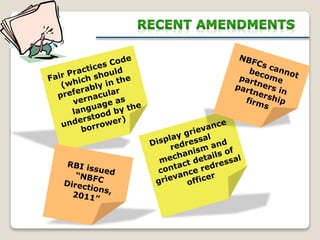

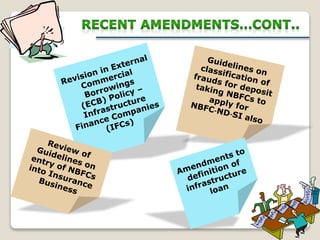

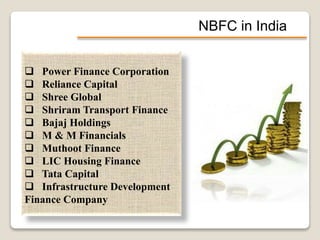

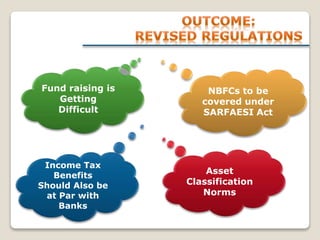

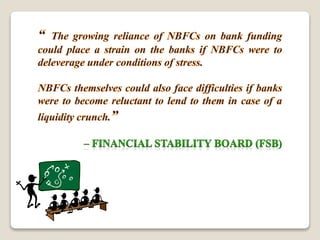

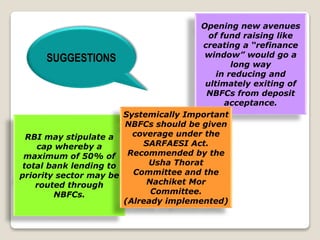

This document provides an overview of non-banking financial companies (NBFCs) in India. It defines NBFCs and distinguishes them from banks. It outlines the registration process for NBFCs and classifications of NBFCs. The document also discusses why NBFCs are important for the Indian financial system, highlights of the NBFC sector, compliance requirements, and recent regulatory changes aimed to bring parity between NBFCs and banks. Suggestions are provided such as opening new avenues of fund raising to reduce NBFCs' reliance on deposits and giving systemically important NBFCs coverage under the SARFAESI Act. In conclusion, the document states that the challenge is for NBFCs to grow pr