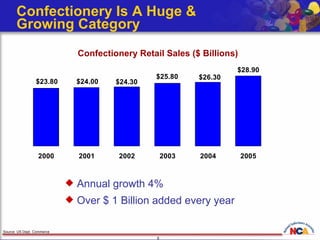

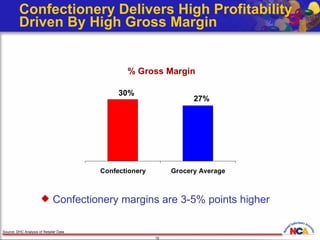

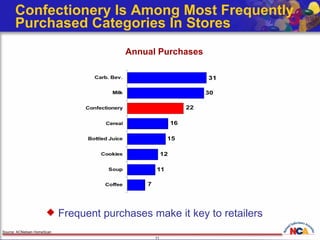

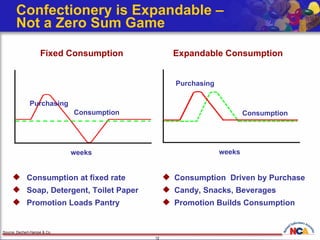

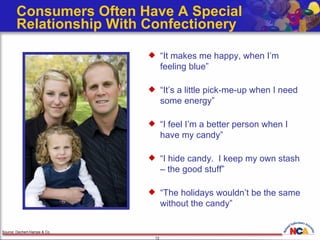

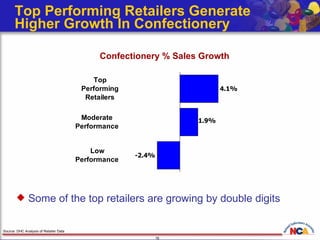

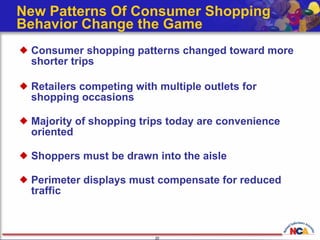

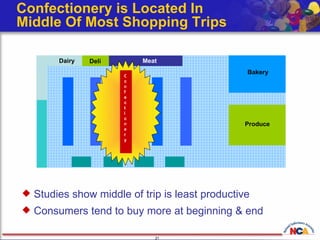

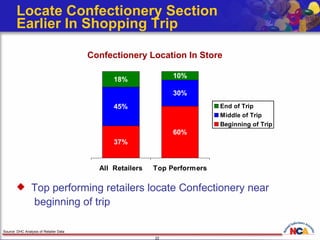

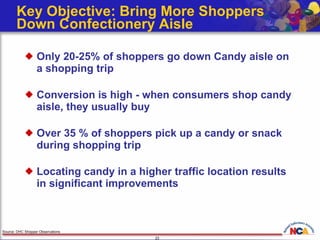

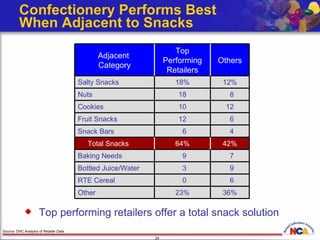

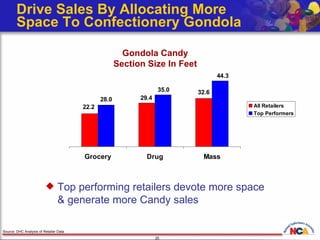

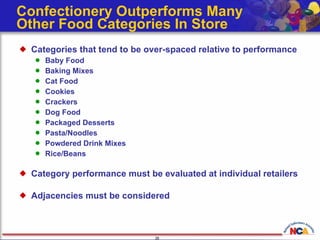

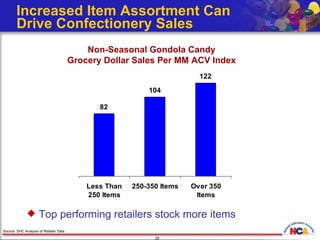

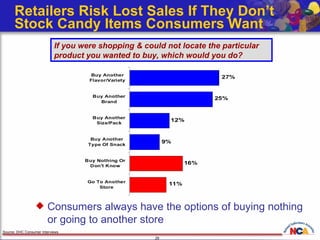

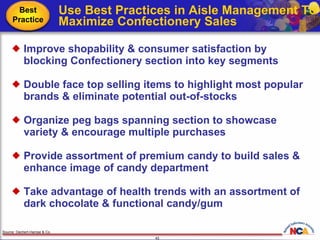

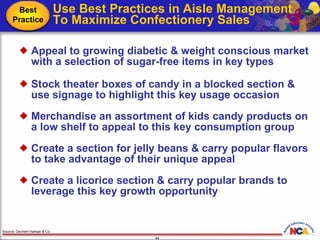

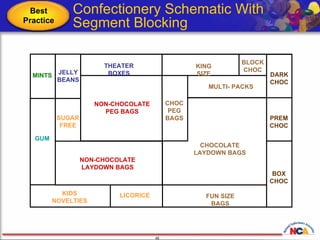

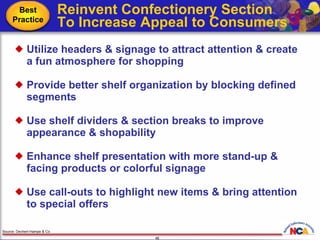

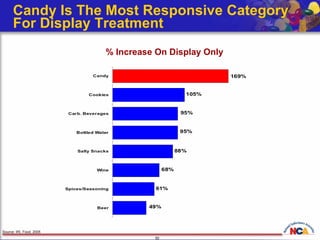

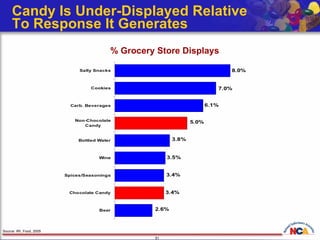

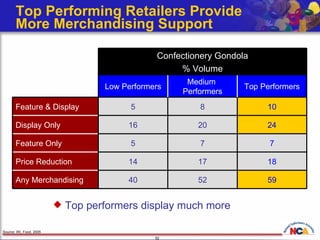

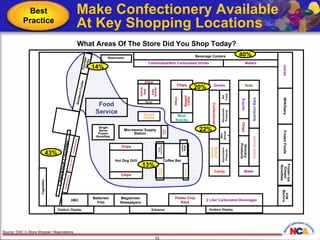

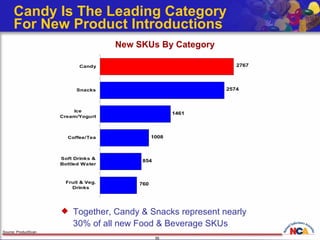

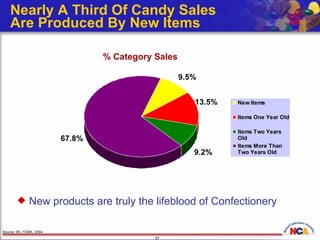

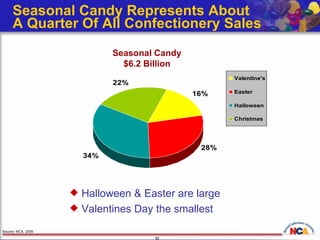

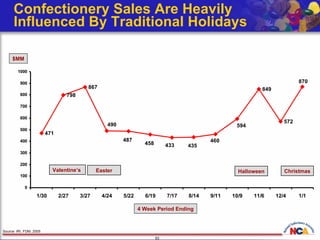

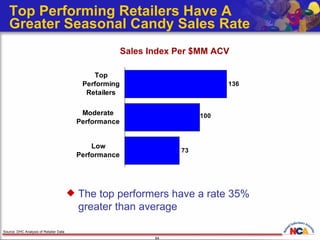

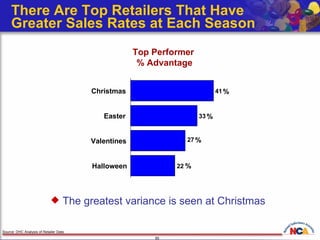

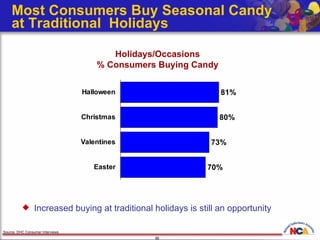

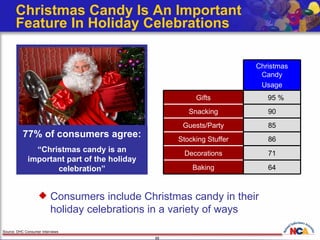

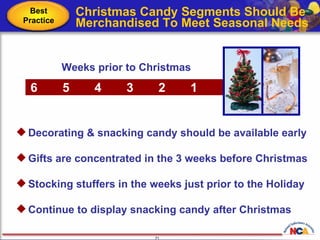

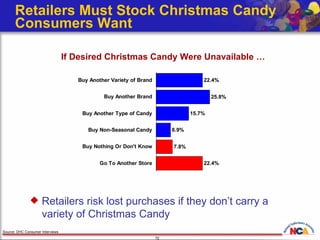

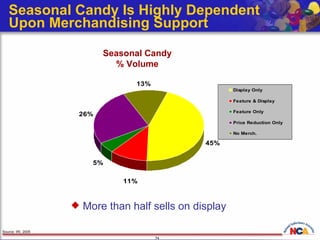

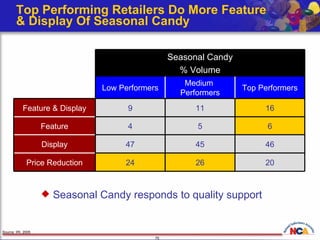

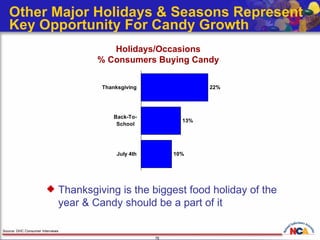

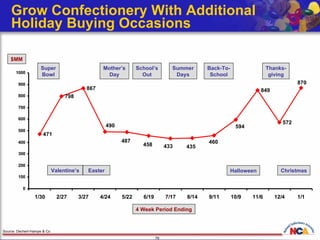

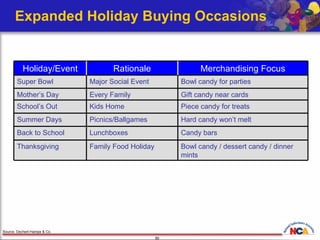

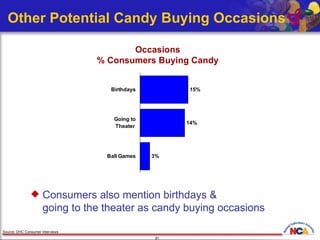

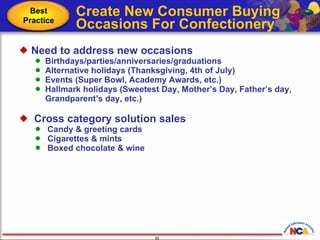

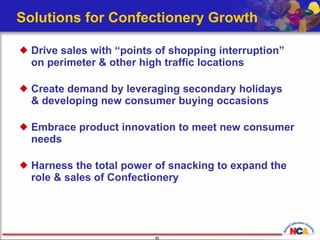

The document discusses opportunities to grow the confectionery category in retail stores. It identifies a $10 billion growth opportunity by improving merchandising practices based on research. Key findings include that top performing retailers devote more space to confectionery, use best practices like blocking items into segments, and provide more points of purchase interruptions including perimeter and checkout displays. Seasonal merchandising and new product innovation are also opportunities.