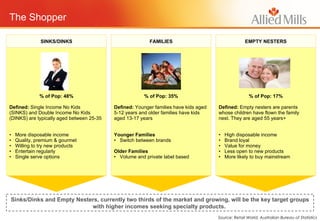

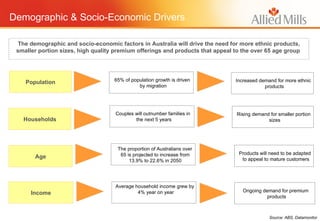

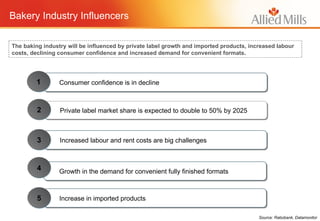

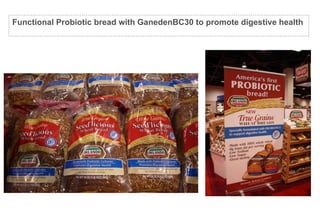

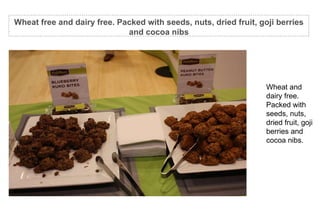

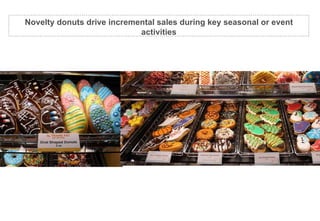

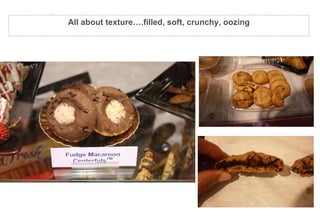

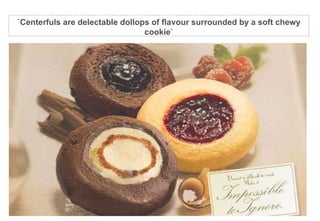

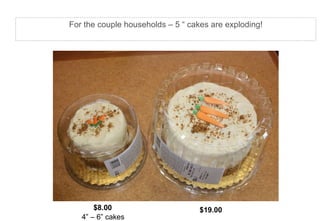

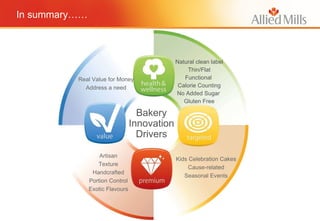

The document summarizes key points from a meeting of the Australian Society of Baking. It discusses current market trends in the bakery industry including demographic shifts, consumer preferences, and retail environment dynamics. It also summarizes insights from the 2011 International Dairy Deli and Bakery Association trade show, noting a focus on natural, clean label, functional, and portion-controlled products. Future growth opportunities identified include expanding specialty offerings and implementing shopper marketing strategies.