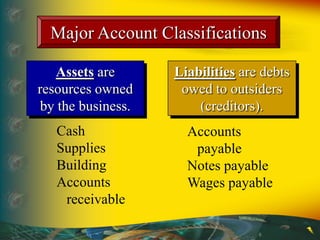

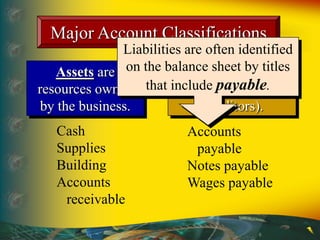

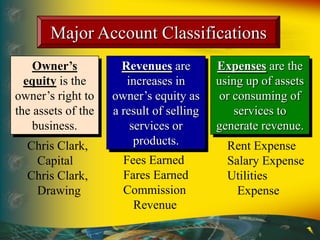

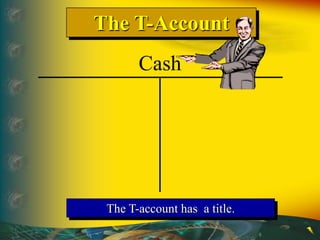

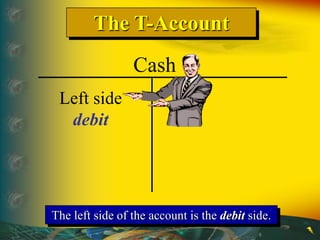

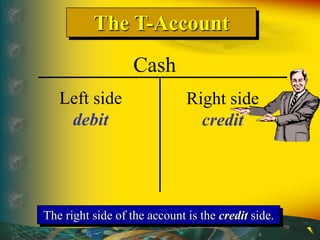

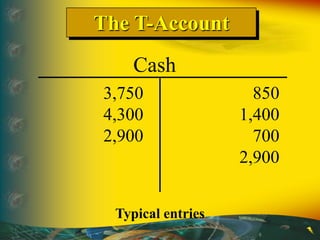

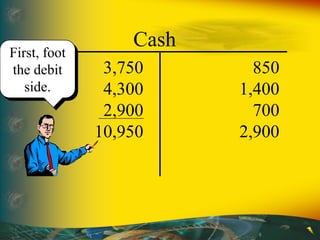

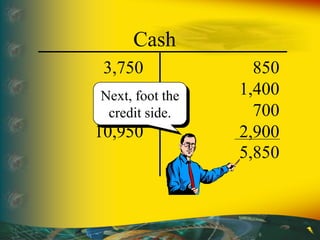

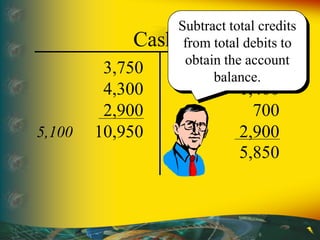

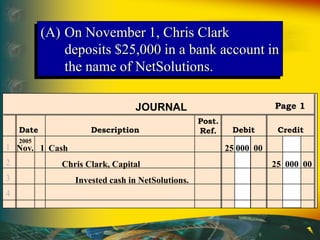

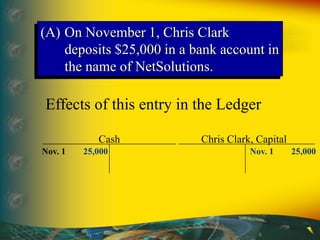

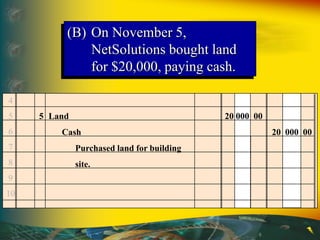

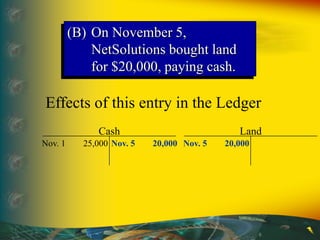

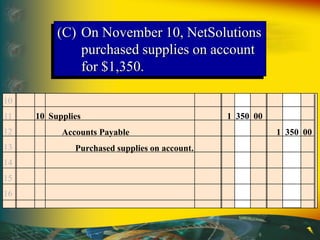

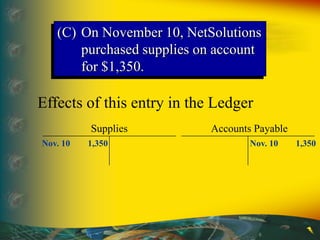

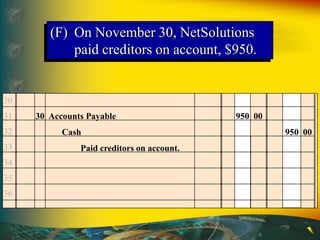

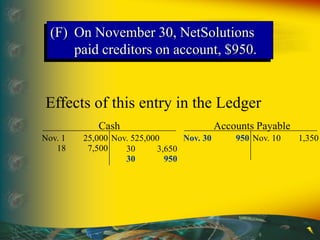

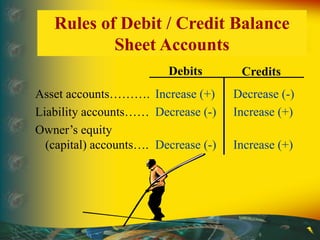

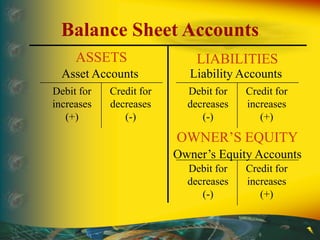

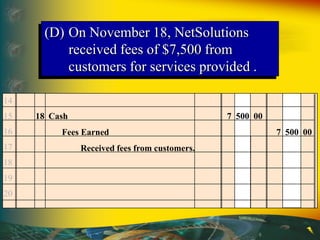

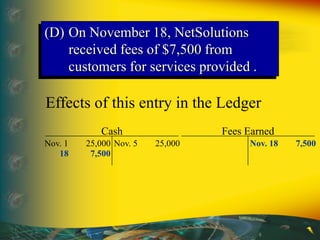

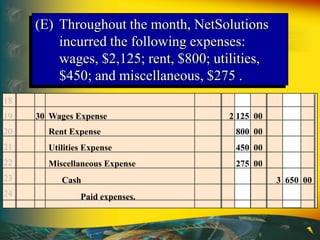

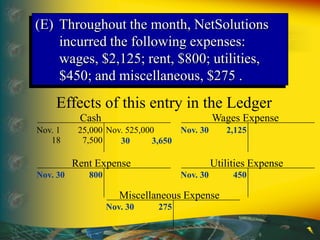

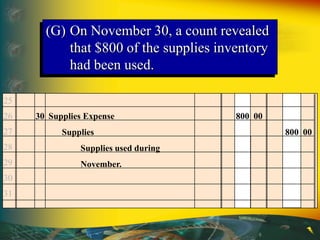

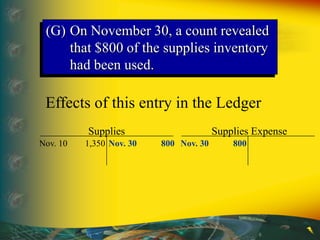

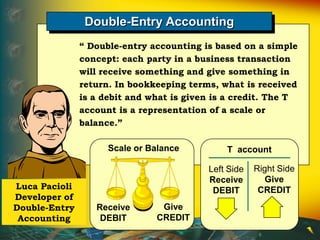

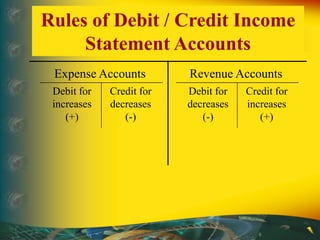

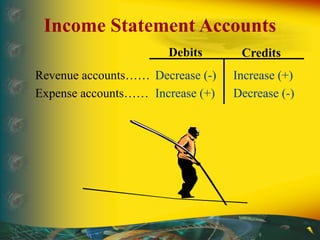

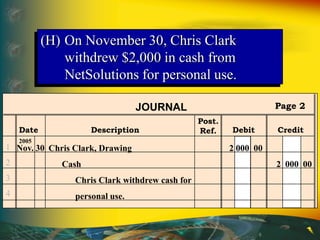

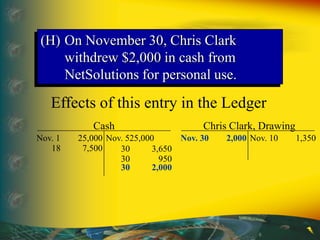

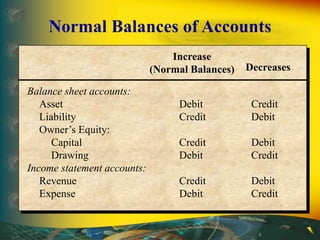

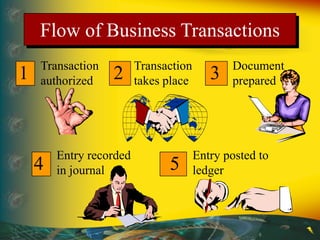

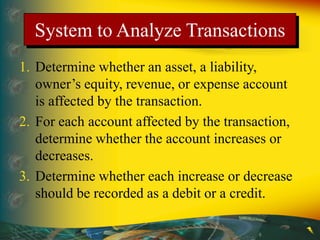

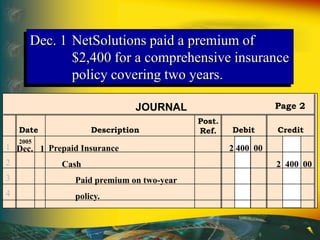

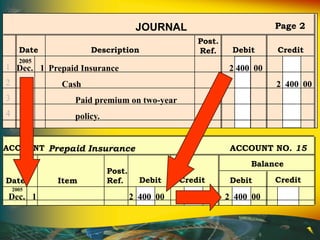

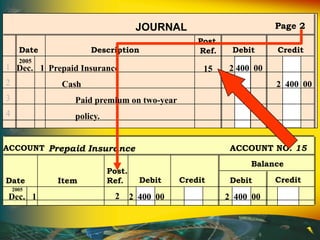

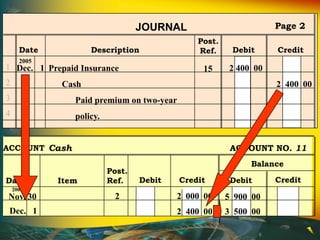

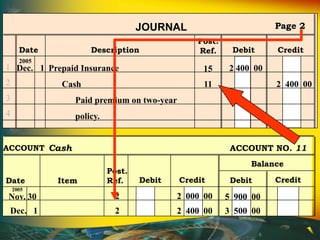

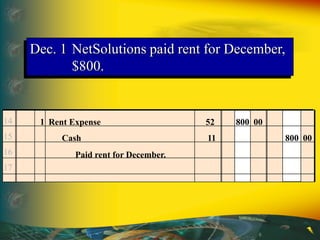

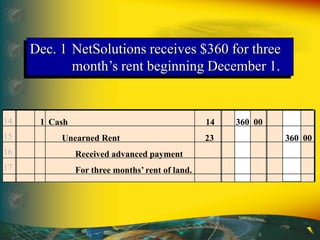

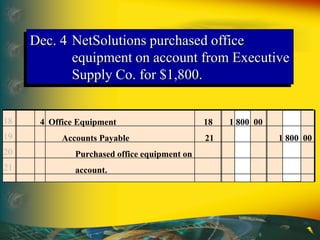

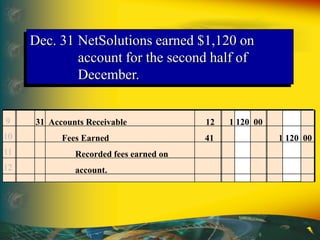

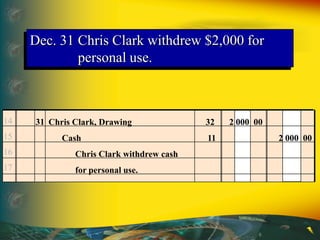

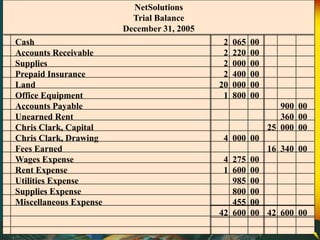

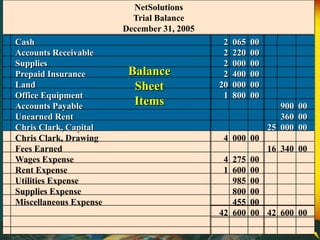

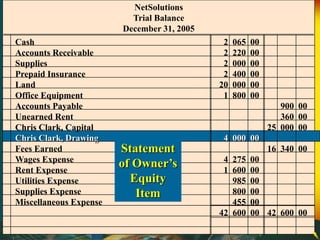

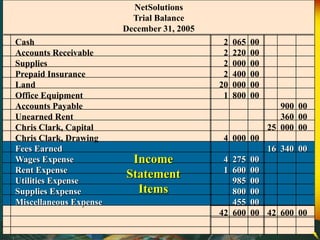

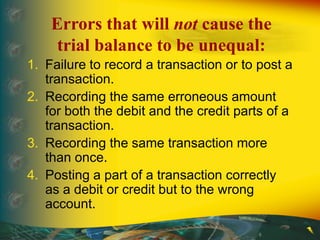

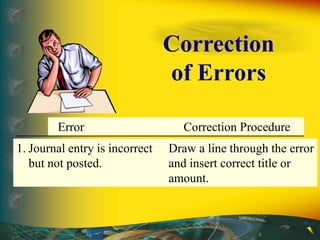

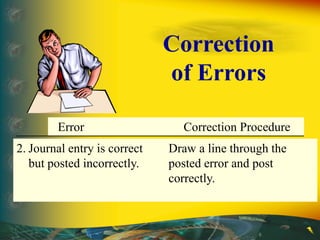

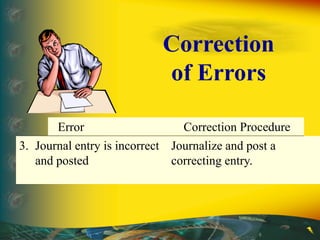

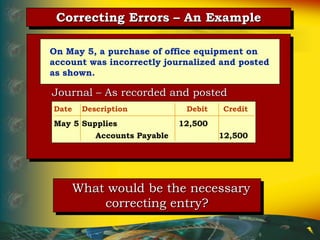

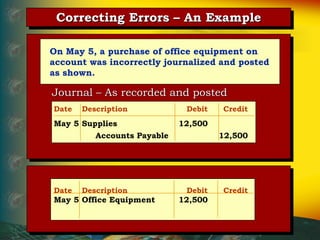

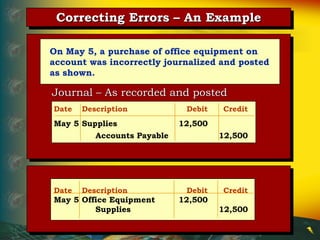

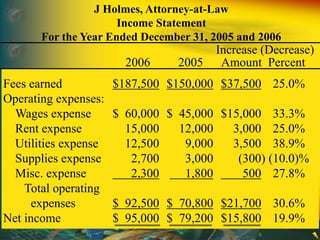

The document provides objectives and content for analyzing transactions in accounting. It discusses accounts and their characteristics, debit and credit rules, analyzing transaction effects on financial statements, preparing trial balances, and discovering and correcting errors. It also covers horizontal analysis to compare financial statements over different periods.