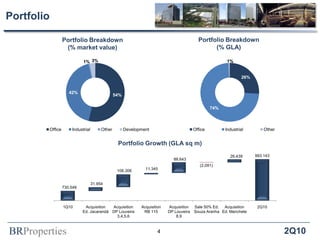

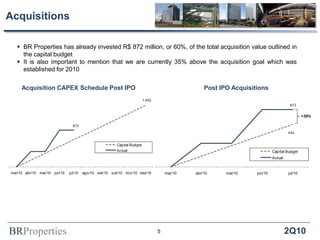

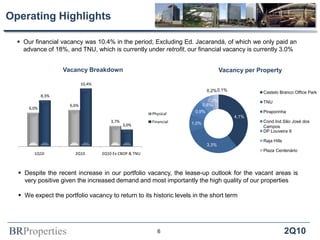

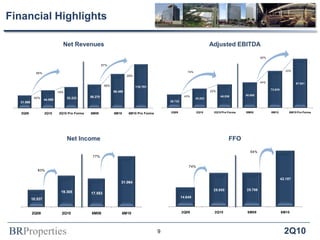

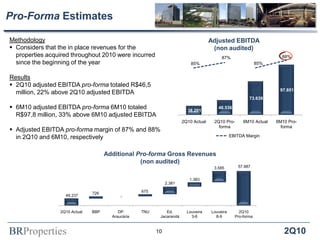

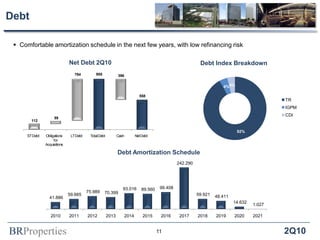

BRProperties reported strong financial and operating results for 2Q10. It acquired over 872 million reais in properties, exceeding its acquisition target for the year and increasing its portfolio by 36% to 993,143 square meters. Revenues increased 39% to 110.7 million reais while adjusted EBITDA rose 43% to 35.5 million reais. The company also saw an 83% rise in net income to 19.3 million reais and managed properties increased from 24 to 28 over the period.