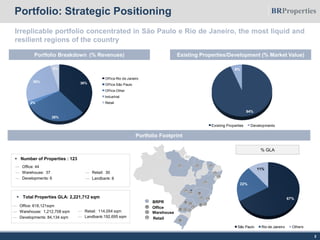

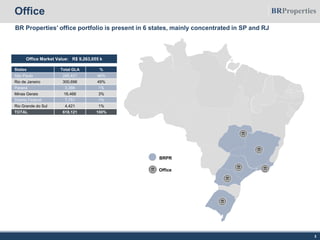

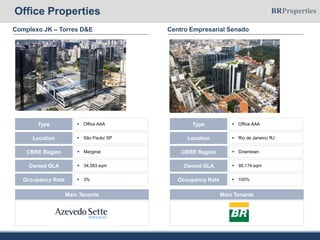

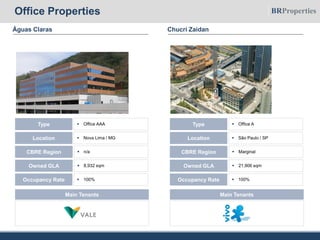

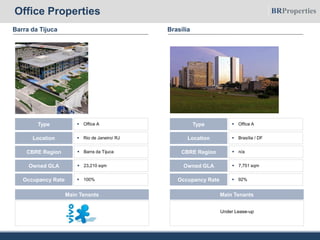

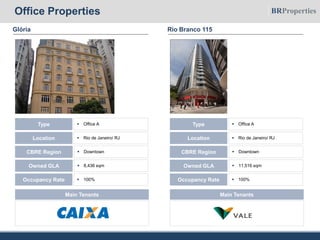

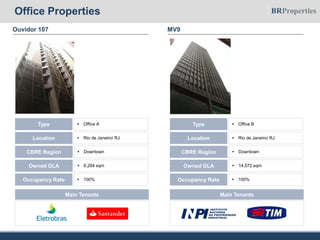

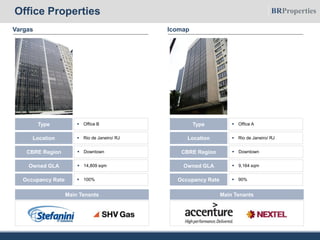

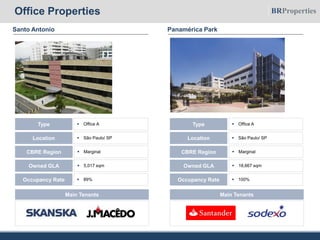

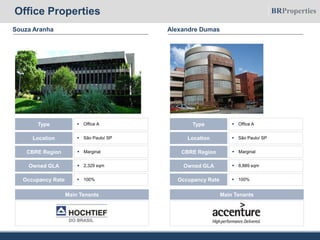

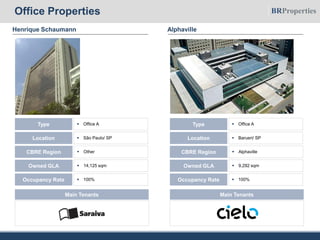

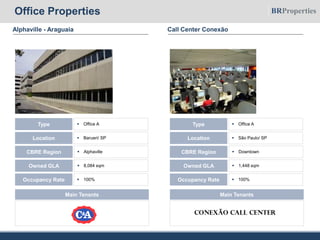

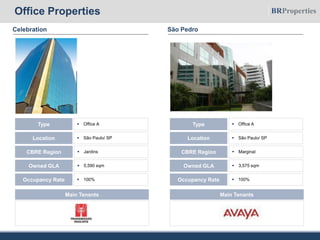

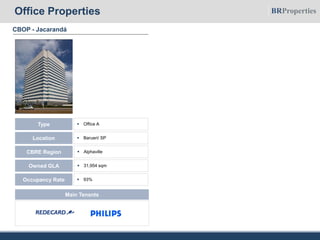

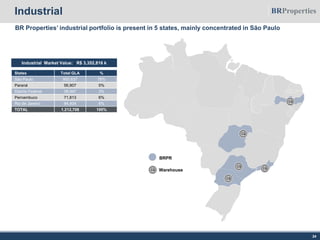

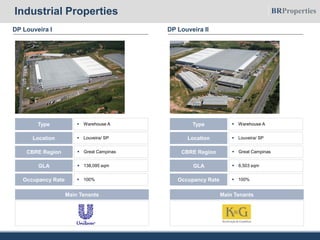

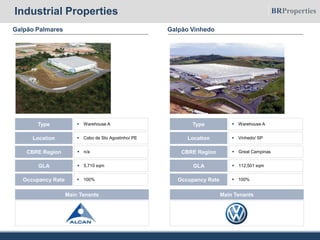

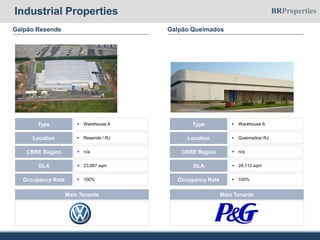

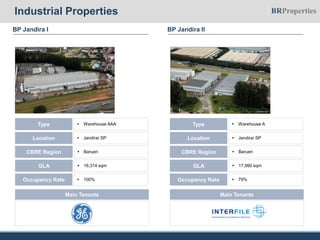

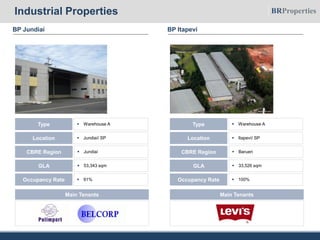

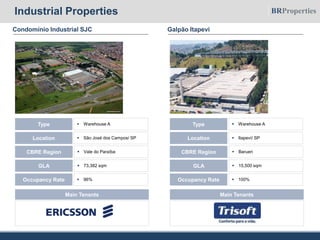

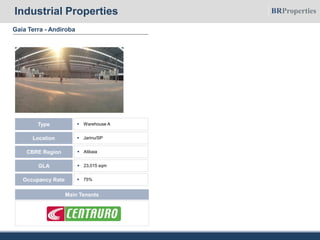

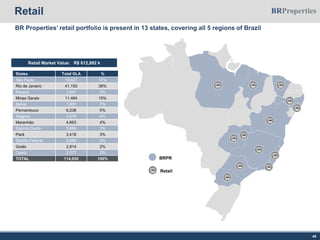

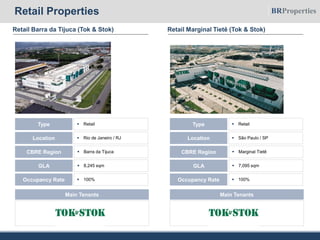

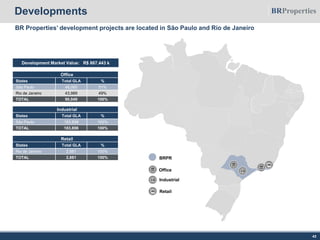

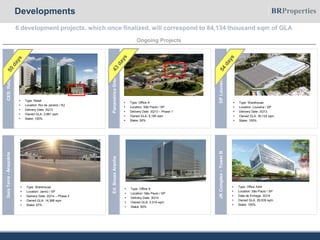

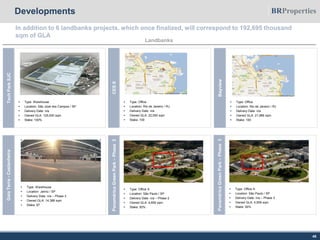

This document provides an overview of BR Properties' commercial real estate portfolio, which includes 123 properties concentrated in São Paulo and Rio de Janeiro. The portfolio consists of office, warehouse, retail, and development properties totaling over 2.2 million square meters. The office portfolio has a market value of R$9.3 billion and is located across 6 states, mainly in São Paulo and Rio de Janeiro. The industrial portfolio has a market value of R$3.35 billion and consists of warehouses across 5 states, concentrated in São Paulo.