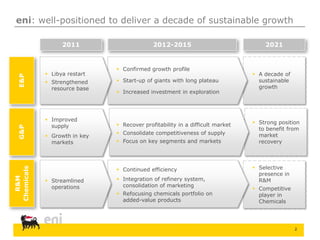

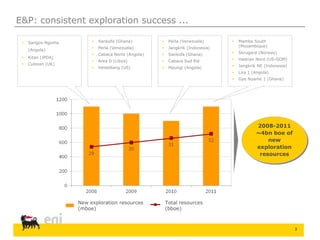

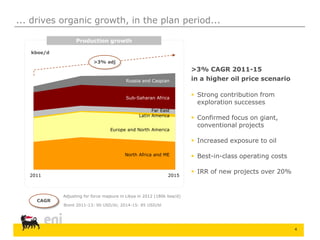

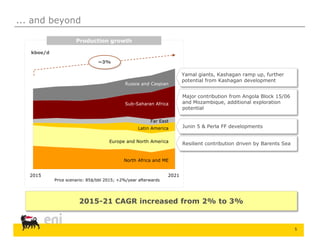

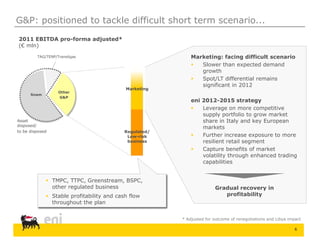

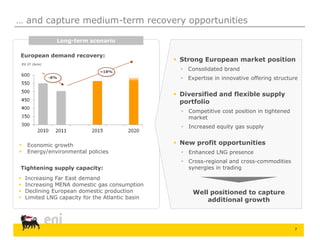

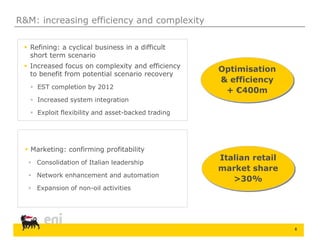

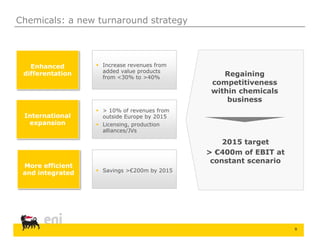

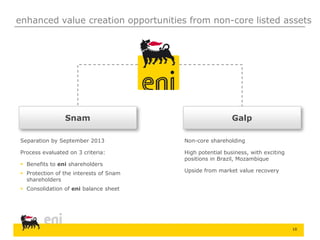

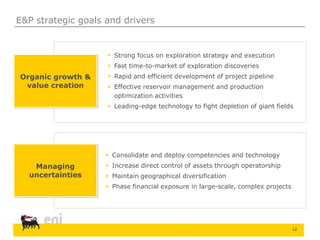

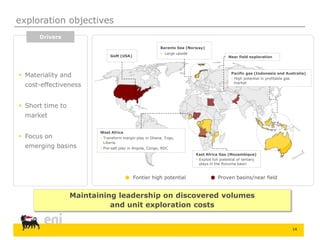

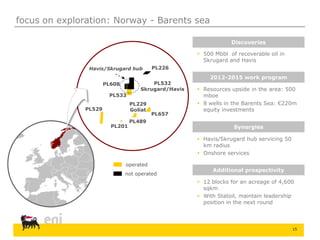

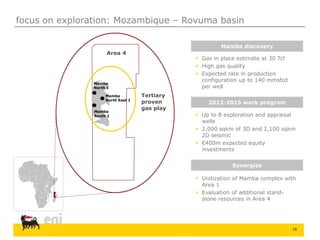

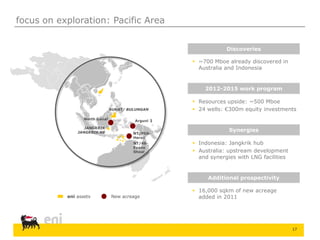

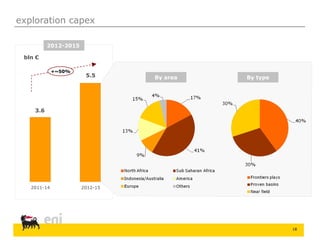

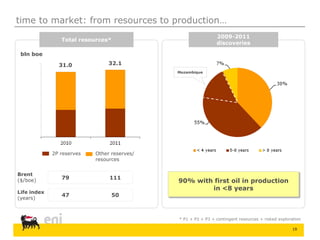

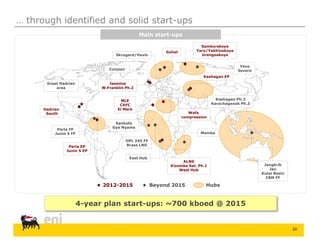

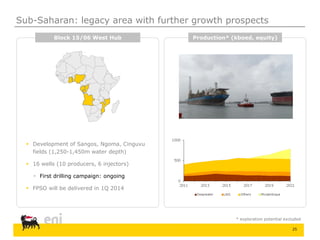

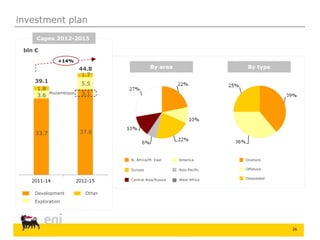

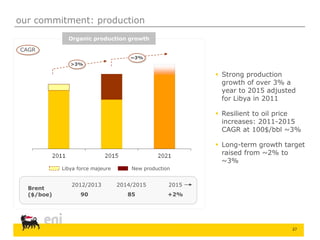

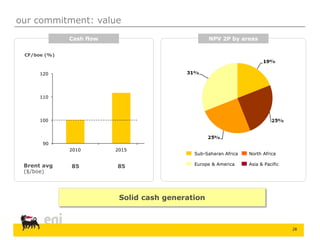

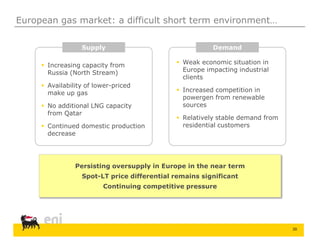

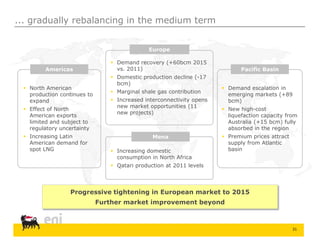

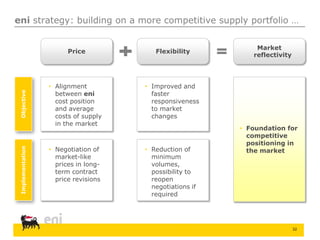

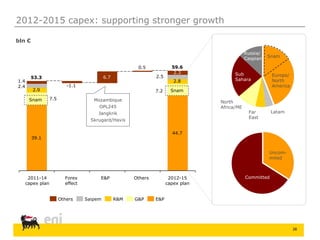

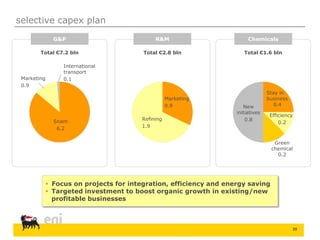

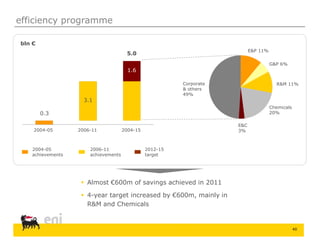

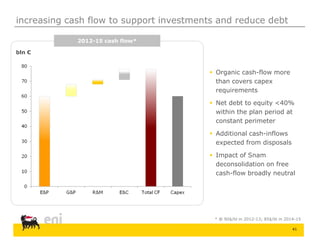

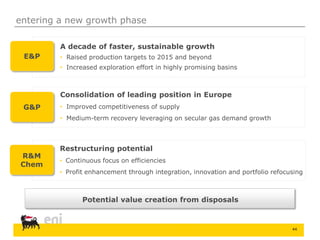

The document outlines eni's strategy and plans for 2012-2015. It aims to deliver sustainable growth through increased investment in exploration, focusing on giant fields and new discoveries. Key aspects include ramping up production from recent exploration successes in Norway, Mozambique, Indonesia and Australia; starting up major projects in Russia and the Caspian region; and continuing development in Libya and West Africa. The strategy also focuses on strengthening eni's positions in downstream gas and power and improving efficiency in refining and chemicals.