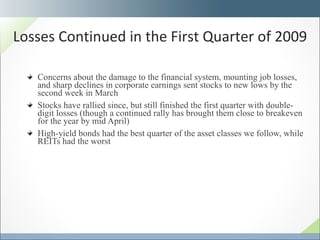

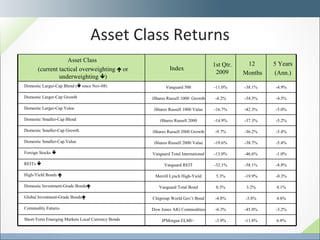

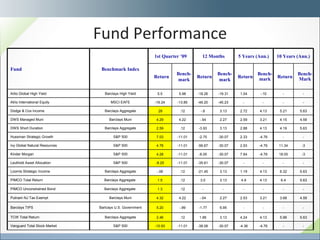

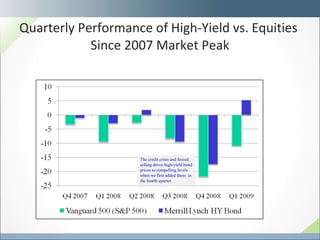

- Stocks fell sharply in the first quarter of 2009, with double-digit losses across most asset classes, though high-yield bonds gained slightly. The fund portfolios outperformed their benchmarks due to strong performance from fixed income managers and tactical equity allocations.

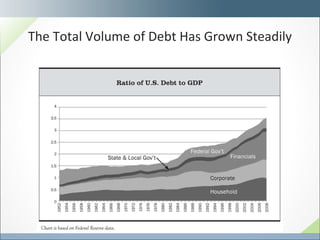

- The economic downturn was caused by a self-reinforcing cycle of debt, falling asset prices, and lower spending/profits, which has reversed the long trend of rising debt fueling growth. Breaking this debt-deflation spiral will be difficult.

- The outlook incorporates scenarios ranging from a quick recovery to a severe prolonged recession, and positions portfolios accordingly with a focus on compelling long-term opportunities from active managers, high-yield bonds