Q3 2016 Review and Outlook

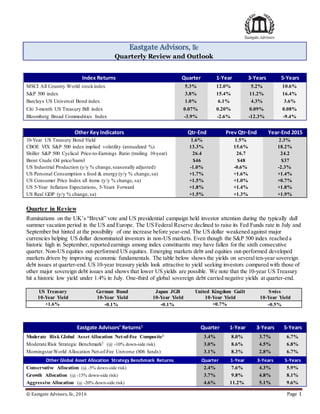

- 1. © Eastgate Advisors, llc, 2016 Page 1 Eastgate Advisors, llc Quarterly Review and Outlook Other Key Indicators Qtr-End Prev Qtr-End Year-End 2015 10-Year US Treasury Bond Yield 1.6% 1.5% 2.3% CBOE VIX S&P 500 index implied volatility (annualized %) 13.3% 15.6% 18.2% Shiller S&P 500 Cyclical Price-to-Earnings Ratio (trailing 10-year) 26.4 26.7 24.2 Brent Crude Oil price/barrel $46 $48 $37 US Industrial Production (y/y % change, seasonally adjusted) -1.0% -0.6% -2.3% US Personal Consumption x food & energy (y/y % change,sa) +1.7% +1.6% +1.4% US Consumer Price Index all items (y/y % change, sa) +1.5% +1.0% +0.7% US 5-Year Inflation Expectations, 5-Years Forward +1.8% +1.4% +1.8% US Real GDP (y/y % change, sa) +1.5% +1.3% +1.9% Quarter in Review Ruminations on the UK’s “Brexit” vote and US presidential campaign held investor attention during the typically dull summer vacation period in the US and Europe. The US Federal Reserve declined to raise its Fed Funds rate in July and September but hinted at the possibility of one increase before year-end. The US dollar weakened against major currencies helping US dollar denominated investors in non-US markets. Even though the S&P 500 index reached a historic high in September, reported earnings among index constituents may have fallen for the sixth consecutive quarter. Non-US equities out-performed US equities. Emerging markets debt and equities out-performed developed markets driven by improving economic fundamentals. The table below shows the yields on severalten-year sovereign debt issues at quarter-end. US 10-year treasury yields look attractive to yield seeking investors compared with those of other major sovereign debt issues and shows that lower US yields are possible. We note that the 10-year US Treasury hit a historic low yield under 1.4% in July. One-third of global sovereign debt carried negative yields at quarter-end. US Treasury 10-Year Yield German Bund 10-Year Yield Japan JGB 10-Year Yield United Kingdom Guilt 10-Year Yield Swiss 10-Year Yield +1.6% -0.1% -0.1% +0.7% -0.5% Index Returns Quarter 1-Year 3-Years 5-Years MSCI All Country World stockindex 5.3% 12.0% 5.2% 10.6% S&P 500 index 3.8% 15.4% 11.2% 16.4% Barclays US Universal Bond index 1.0% 6.1% 4.3% 3.6% Citi 3-month US Treasury Bill index 0.07% 0.20% 0.09% 0.08% Bloomberg Broad Commodities Index -3.9% -2.6% -12.3% -9.4% Eastgate Advisors’ Returns1 Quarter 1-Year 3-Years 5-Years Moderate Risk Global Asset Allocation Net-of-Fee Composite1 3.4% 8.0% 3.7% 6.7% Moderate Risk Strategic Benchmark2 (@ -10% down-side risk) 3.0% 8.6% 4.5% 6.8% MorningstarWorld Allocation Net-of-Fee Universe (806 funds) 3.1% 8.3% 2.8% 6.7% Other Global Asset Allocation Strategy Benchmark Returns Quarter 1-Year 3-Years 5-Years Conservative Allocation (@ -5% down-side risk) 2.4% 7.6% 4.3% 5.9% Growth Allocation (@ -15% down-side risk) 3.7% 9.8% 4.8% 8.1% Aggressive Allocation (@ -20% down-side risk) 4.6% 11.2% 5.1% 9.6%

- 2. © Eastgate Advisors, llc, 2016 Page 2 *Based on quarter-end manager holdings. Gross exposures may not sum to 100%. Return Analysis Our return objective is to out-perform the strategic benchmark after fees, over a three-to-five-year investment horizon. We seek to add value through asset allocation decisions, external manager selection, manager allocation decisions, by managing investment risk, maintaining adequate liquidity and controlling investment costs. Active Decision Quarterly Value Added Versus The Strategic Benchmark Asset Allocation +0.41% Manager Selection +0.01% Manager Allocation -0.01% Total Quarterly Net-of-Fee Value Added: +0.41% What affected returns during the quarter? Underlying holdings analysis at quarter-end showed that we had higher small and mid-cap global equity exposures, more non-US fixed income and more non-dollar bonds than the strategic benchmark. Other key factors that affected returns: An over-weight to global equities helped but an under-weight to emerging markets hurt performance. An over-weight to emerging market bonds and non-investment grade debt helped. An under-weight to money markets helped as global equities and bonds performed well. The alpha portfolio (active managers) under-performed the passive global markets portfolio. Risk Management In managing investment risks, we seek to eliminate idiosyncratic risks, to manage market and active risks and control leverage in order to keep annual down-side risk at no more than -10% in nine-of-ten years while maintaining adequate liquidity and earning a return which we believe fairly compensates investors for risk. We have explicit allocation limits in place for each active manager. We also have a 3% maximum annual active risk budget. This means that we should expect to earn the return of the strategic benchmark plus or minus 3% in seven-of-ten years. That is why the strategic benchmark is a key part of our investment process. Key Risk Metrics Metric Value Q/Q Change Estimated 12-month down-side risk potential (@ 90% confidence): -9% (+) Risk relative to the strategic benchmark (leverage): 1.0 x (-) % of return explained by the strategic benchmark allocation (R2): 97% (-) Estimated annual active risk (tracking error): 1.1% (+) Active allocations % of total fund (active managers + tactical allocations): 31% (+) Weighted average annual expense ratio: 0.33% (+) Number of global stocks (idiosyncraticrisk indicator): 5,377 (-) Number of global bonds: 6,760 (+) Estimated interest rate sensitivity relative to the strategic benchmark index: 100% (-) Asset Class Allocations* US Equities Non-US Equities Global Bonds Commodities Money Markets Eastgate Moderate Risk Weight 30.1% 23.1% 38.7% 1.0% 7.7% Strategic Benchmark Weight 26.1% 23.9% 40.0% 0.0% 10.0% Eastgate Advisors Over/Under Weight +4.0% -0.8% -1.3% 1.0% -2.3%

- 3. © Eastgate Advisors, llc, 2016 Page 3 Looking Ahead We are not focused on a quarter-to-quarter or a year-to-year investment horizon. Strategically, we maintain exposure to global markets with historic risk premia in excess of the return of a risk-free asset,like a treasury bill. We seek to control costs, manage risks and maintain adequate liquidity. Over a one-to-three year investment horizon, we determine tactical allocations to global equities, global bonds, commodities, and money markets based on valuations and our expectations for inflation and economic growth. In attempting to add additional value, we may use active external investment managers with whom we have had years of favorable experiences. Our three-to-five year strategic outlook is for slow global economic growth and modest inflation. The global economy remains mired in an excess debt induced, low growth environment. Sovereign bond yields in severaleconomies reflect deflationary pressures. Market expectations for US inflation over the next five years are under 2% with modest inflation in most developed global economies. The US Treasury yield curve has flattened since December 31, 2015 driven by high demand for yield from pension funds, insurance companies and global investors whose local sovereign bonds carry negative yields. This dynamic may continue as long as US treasuries hold a yield advantage over other sovereign issues and it puts upward pressure on the US dollar in what is likely a rising short-rate environment in the US. Our one-to-three year tactical outlook suggests a near benchmark weight to global public equities relative to the strategic benchmark and a higher volatility investing regime. Based on our bottom-up fundamental input models, we expect public global equity market returns in the mid-single digits over our three-to-five year strategic investment horizon. The yield-to-maturity of the Barclays US Universal index (our preferred bond index) implies expected annual returns to US bonds under 2.4% over our strategic investment horizon. Rising rates would reduce realized bond market returns further. Market estimates of the Fed Funds rate imply money market returns near one percent over our one-to-three year tactical investment horizon. Barring an unexpected rise in global inflation or consumption driven growth, commodities as an asset class remain unattractive given weak global demand and an over-supply for many of them although we added an allocation to gold via an exchange traded fund (ETF) as a volatility hedge during the quarter. Risks to allocations over our investment horizon include excessive debt in major global economies which increase deflationary pressures that harm growth prospects. Risks also include unanticipated inflation; a significant geopolitical shock, an emerging markets crisis or a contagion effect of the British exit from the EU. The impact of the UK’s exit from the European Union on both the UK and EU is a big unknown and is likely to only be realized over severalyears. Reduced trading liquidity in corporate bonds, to which we are over-weight relative to the strategic allocation benchmark, continues to be a concern. High equity valuations increase the risks of investing in the asset class if corporate earnings continue to decline. Price-to-earnings ratio (multiple) expansion and not earnings growth has sustained US equity market returns over the past couple of years. We don’t expect this to continue. Thank you for taking time to read our thoughts. Contact Greg Johnsen, CFA with questions or comments at: gjohnsen@eastgateadv.com. Connect with Greg on Linked In. His Linked In profile: gregjohnsencfa. Important Disclosures 1The Eastgate Advisors’ Moderate Risk global allocation composite return is the realized net-of-fees, assetweighted,geometric average total return of several public markets accounts of a private familyinvestmentoffice. Returns in excess of one-year are annualized.Returns are through 9-30-2016. 2 The Moderate Risk Allocation strategic benchmark is an unmanaged combination ofbroad marketindices.It consists of50% of the return of the MSCI All Country World ™ stock index (net), 40% of the Barclays US Universal Bond ™ index and 10% US treasury bills. Holdings analytics:Morningstar Advisor Workstation. Performance analysis and attribution:Eastgate Advisors,llc. Economic data sources:US Federal Reserve,US Departmentofthe Treasury, US Bureau of Economic Analysis,RobertShiller,the Economist,World Bank,International Monetary Fund, Factset Research Systems. Visit our website: www.eastgateadvisors.com or Linked In companypage: https://www.linkedin.com/company/eastgate-advisors?