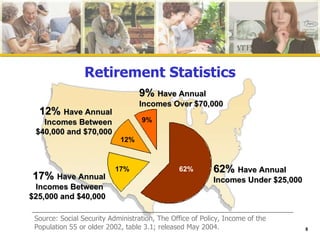

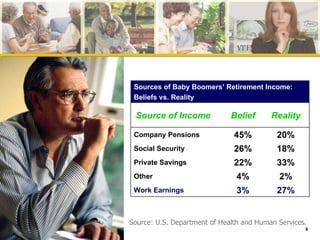

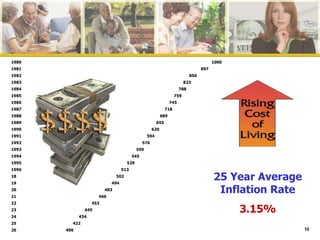

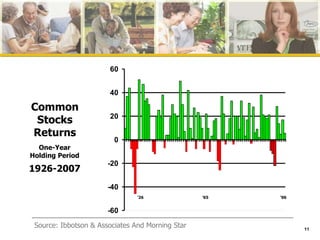

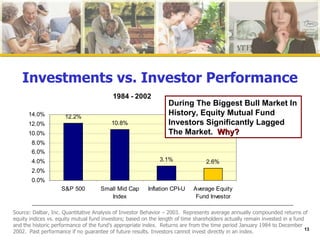

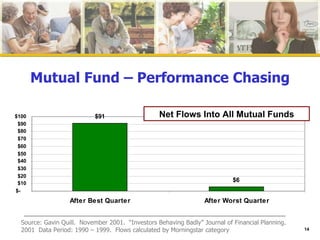

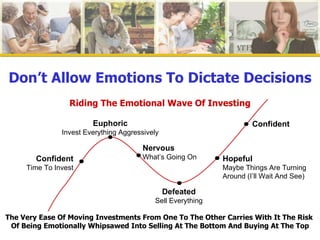

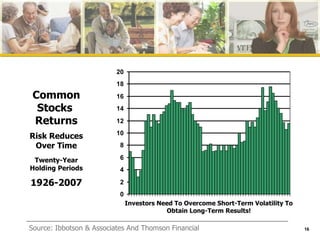

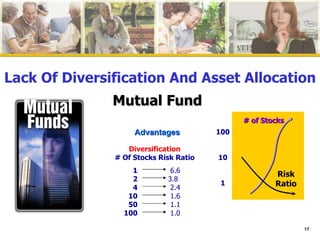

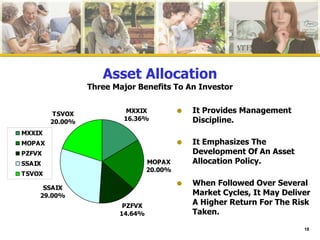

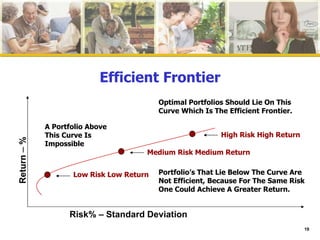

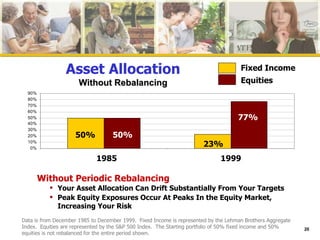

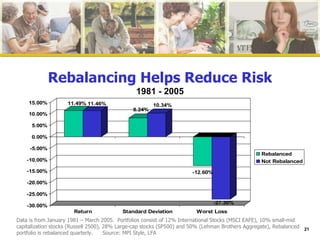

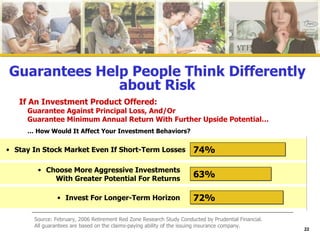

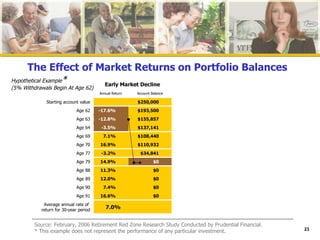

The document discusses key considerations for retirement planning including assessing lifestyle needs and goals, understanding investment risks in retirement, ensuring adequate income and managing assets appropriately. It emphasizes creating a financial plan, diversifying investments, rebalancing portfolios over time and avoiding emotional reactions to market volatility to achieve retirement objectives.