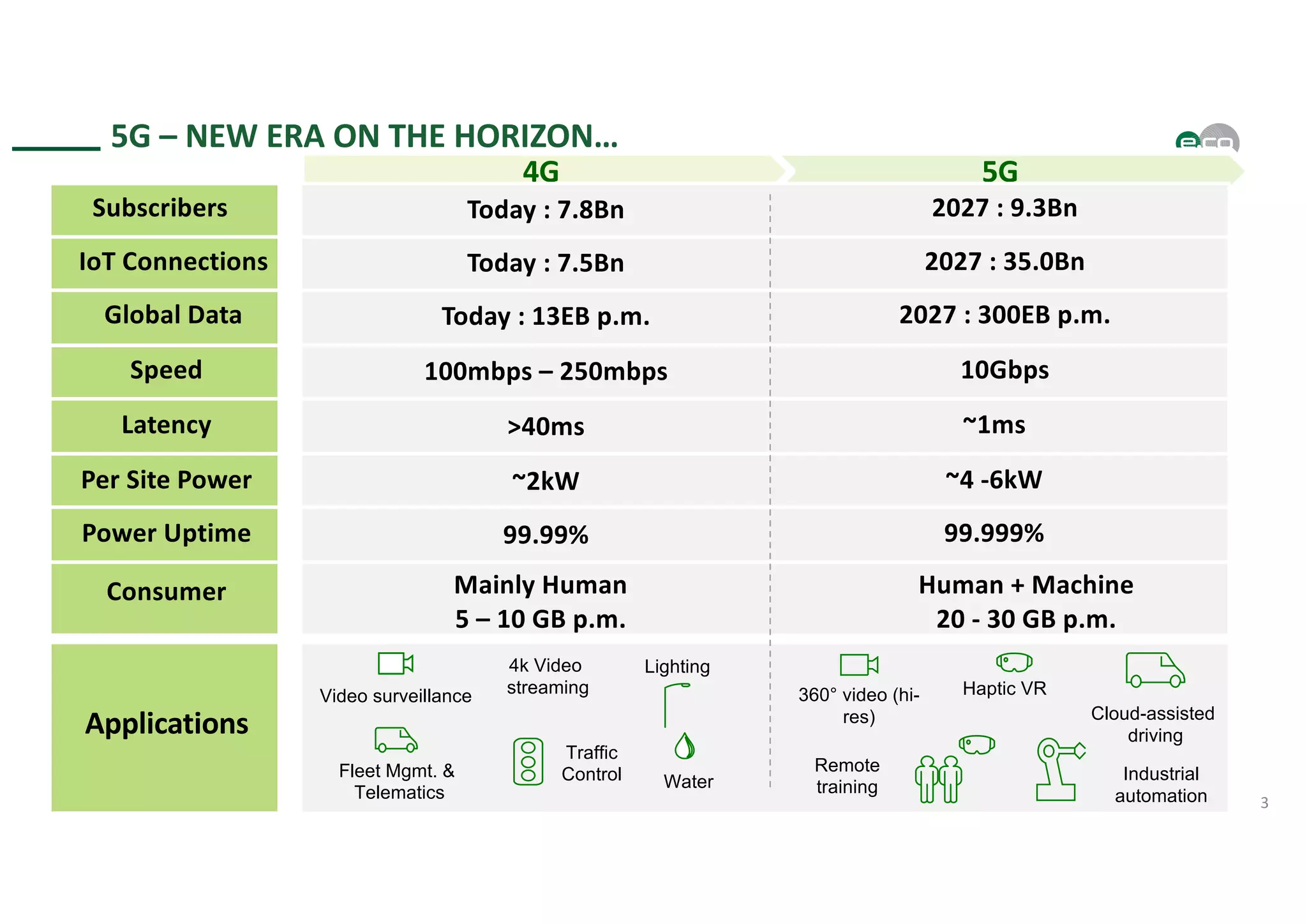

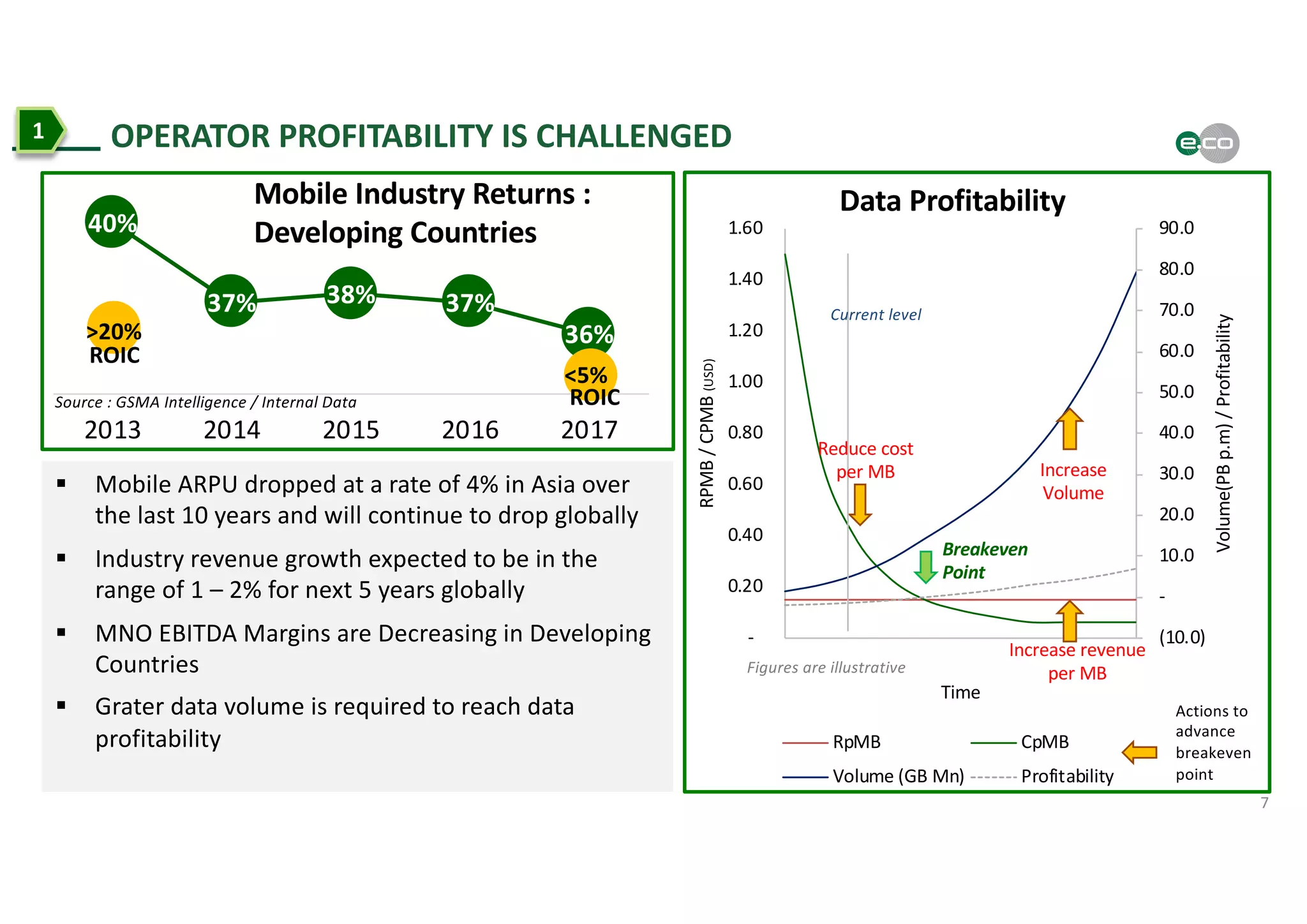

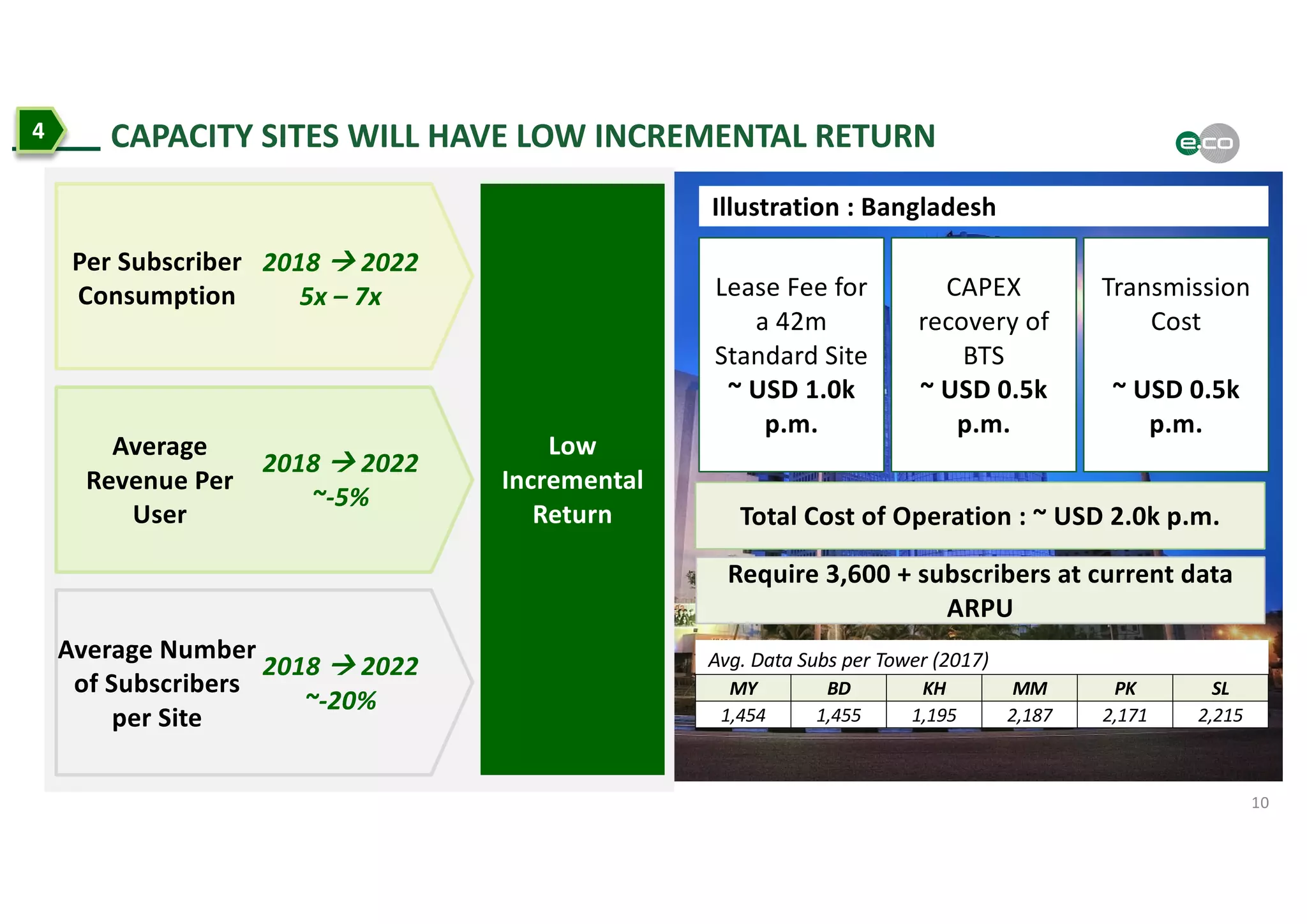

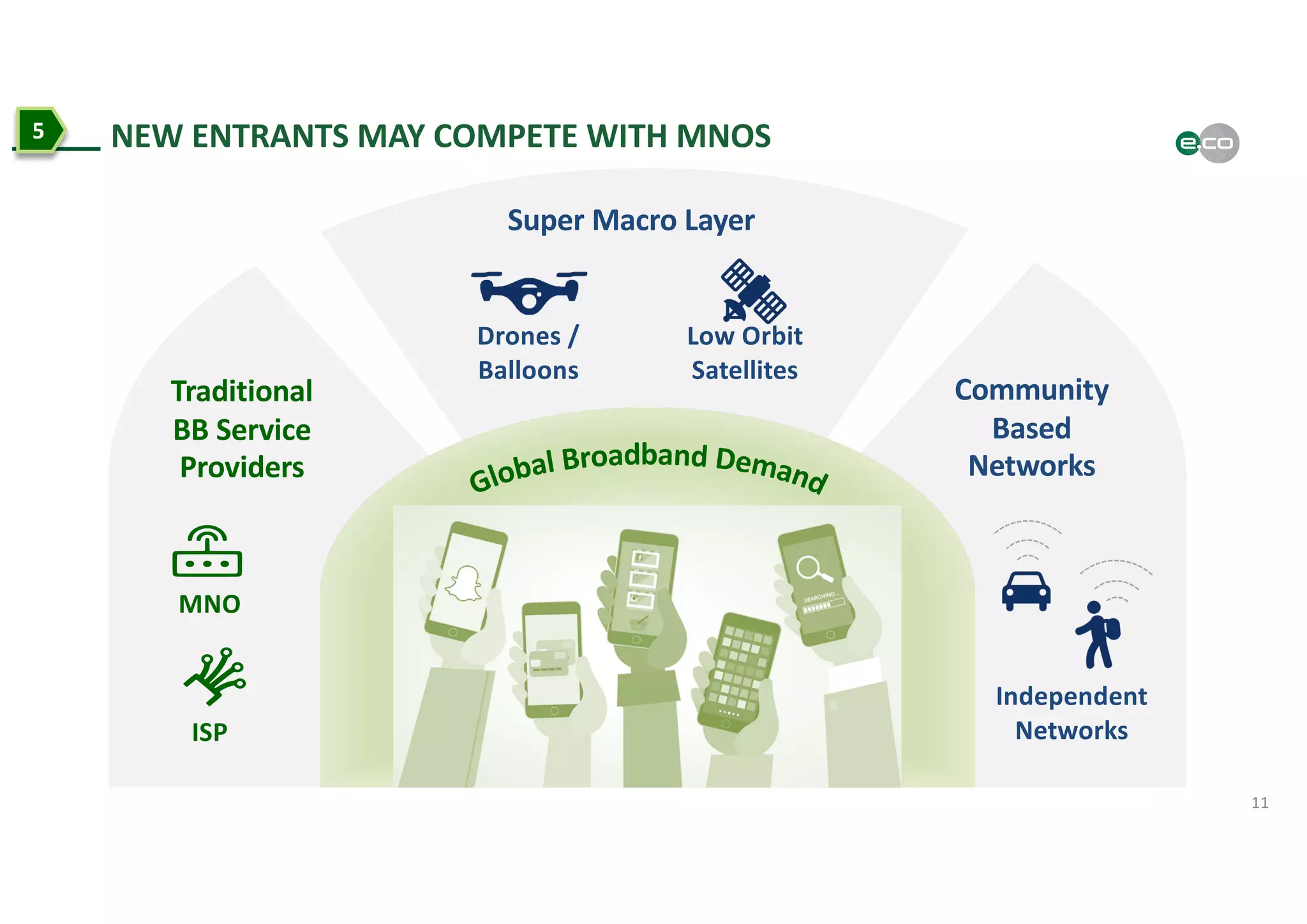

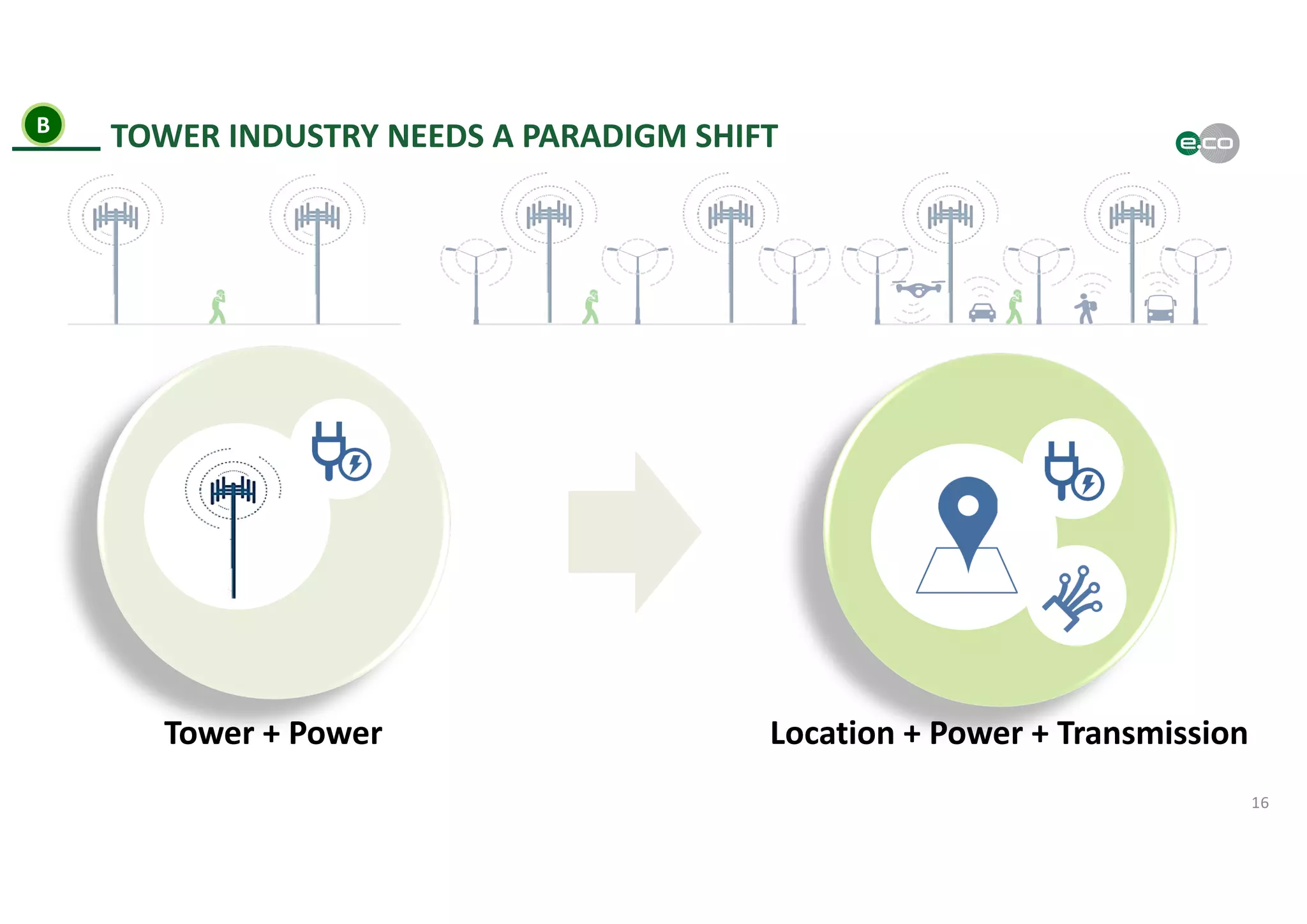

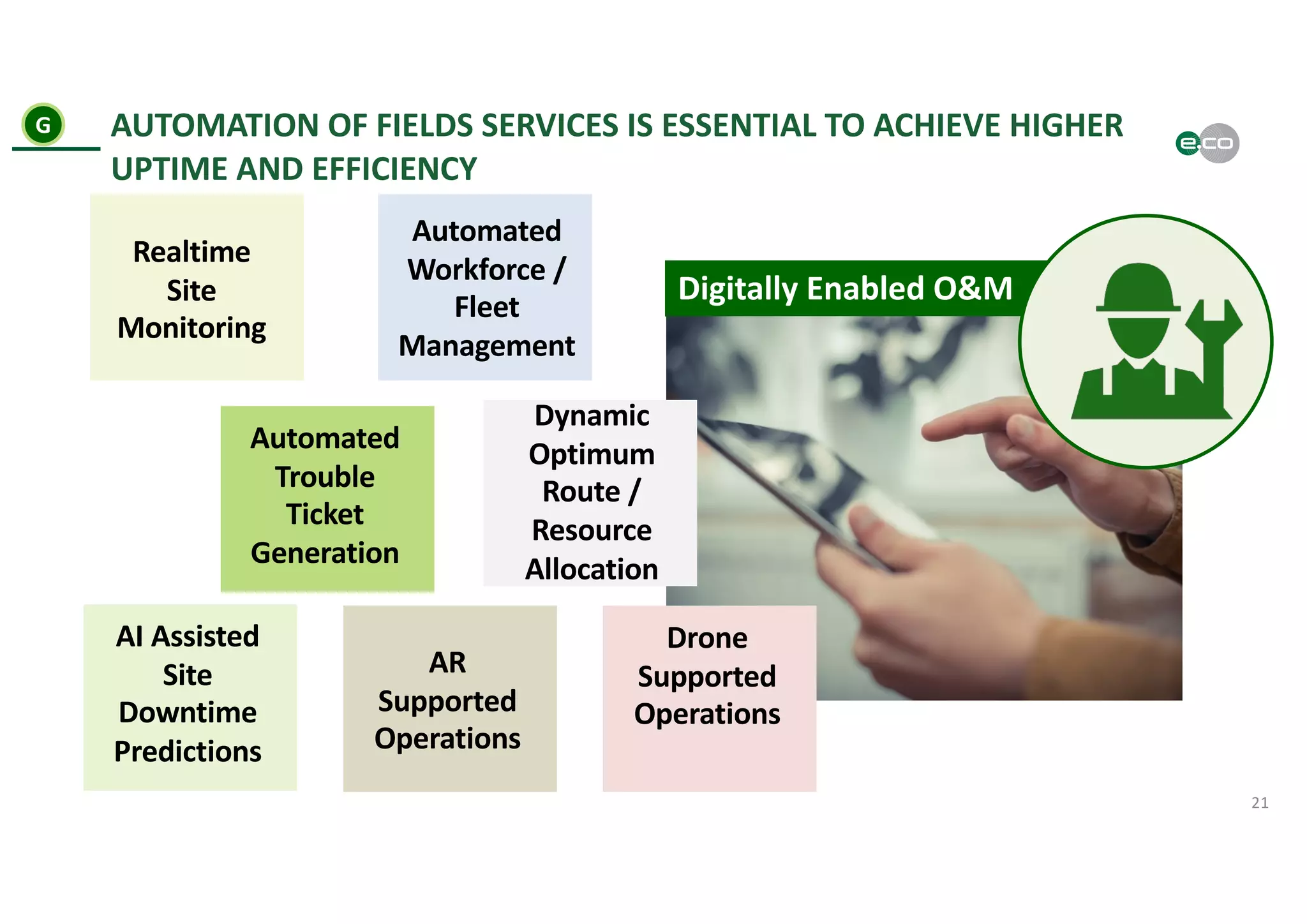

This document discusses the impact of 5G networks on edotco, a leading wireless infrastructure provider in Asia. It notes that 5G will require significantly more network densification through additional sites to handle the higher speeds, lower latency and increased IoT connections compared to 4G. This densification will be a major challenge for mobile operators given issues like declining profits, the need for new investments before previous cycles are monetized, and lower returns from capacity sites. The document argues that the telecom infrastructure industry, including tower companies like edotco, will need to shift from a tower-focused to an infrastructure-focused model and leverage techniques like urban densification solutions, predictive analytics, fiberization, and digitalized operations to help