New base special 16 july 2014

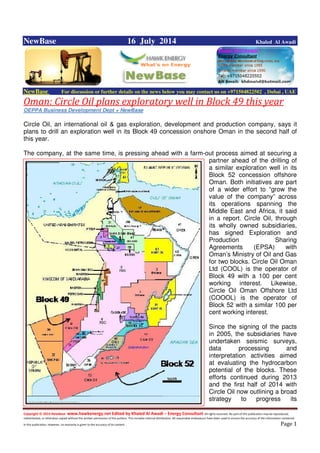

- 1. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 1 NewBase 16 July 2014 Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE Oman: Circle Oil plans exploratory well in Block 49 this year OEPPA Business Development Dept + NewBase Circle Oil, an international oil & gas exploration, development and production company, says it plans to drill an exploration well in its Block 49 concession onshore Oman in the second half of this year. The company, at the same time, is pressing ahead with a farm-out process aimed at securing a partner ahead of the drilling of a similar exploration well in its Block 52 concession offshore Oman. Both initiatives are part of a wider effort to “grow the value of the company” across its operations spanning the Middle East and Africa, it said in a report. Circle Oil, through its wholly owned subsidiaries, has signed Exploration and Production Sharing Agreements (EPSA) with Oman’s Ministry of Oil and Gas for two blocks. Circle Oil Oman Ltd (COOL) is the operator of Block 49 with a 100 per cent working interest. Likewise, Circle Oil Oman Offshore Ltd (COOOL) is the operator of Block 52 with a similar 100 per cent working interest. Since the signing of the pacts in 2005, the subsidiaries have undertaken seismic surveys, data processing and interpretation activities aimed at evaluating the hydrocarbon potential of the blocks. These efforts continued during 2013 and the first half of 2014 with Circle Oil now outlining a broad strategy to progress its

- 2. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 2 exploration campaign targeting its Oman licenses. “On Block 49 we will be drilling an exploration well to be completed in H2 of 2014. We are also awaiting the outcome of our bid to gain a new exploration block in the 2013 Oman Bid Round,” said Stephen Jenkins, Chairman, Circle Oil plc.“We have acquired additional 2D seismic over the inshore portion of Sawqirah Bay in Block 52 and we are continuing our efforts to obtain a partner to join in the drilling of a well on this permit in 2015,” he added in a review of the company’s performance across its portfolio. Block 49, located in the Rub Al Khali Basin, covers an area of 15,439 sq km. Studies have identified three main plays, comprising the Sahmah play which is productive to the in Saudi Arabia, the Natih and Shuaiba plays in northern Oman, and the Lower Haima play in southern Oman. In addition, there is evidence of a salt basin analogous to the prodigious South Oman Salt Basin. This new salt basin, called the Ghudun Salt Basin in the western part of the block, has been the subject of exploration studies designed to delineate likely targets for drilling, says Circle Oil. Block 52, which originally occupied an area of 90,760 sq km but has been reduced by around a third following a part relinquishment in 2008, covers water depths ranging from 200-3,500m. Three potential shallow water targets identified along with a significant undrilled basin in 800-plus metres of water. A farm out package has been compiled to accompany invitations to farm-in to the block prior to exploration drilling, the company said.Circle Oil is one of around 17 international and local companies that are currently engaged in the exploration and production of oil and gas in the Sultanate. Circle Oil’s expanding portfolio now includes assets in Morocco, Tunisia and Egypt, besides Oman. Block 49 Located in the Rub Al Khali Basin the block covers an area of 15,439 sq kms. Historically there are three main plays in the area: the Sahmah play productive to the north in Saudi Arabia, the Natih and Shuaiba plays in northern Oman and the Lower Haima play in southern Oman. In addition several billion barrels of oil have been discovered in Proterozoic/ Cambrian reservoirs associated with the Ara Salt in the South Oman Basin to the southeast of the block. There is evidence of the presence of a similar salt basin beneath the south western part of Block 49, this new salt basin has been named the Ghudun Salt Basin.

- 3. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 3 Qatar’s sustainable energy drive shift to high gears Gulf Times Qatar’s programme to develop and monitor its use of sustainable energy is in the view of Michael Tamvakis, professor of Commodity Economics and Finance, Cass Business School, “a commendable initiative — because the first thing in managing any sustainability issue is to actually start measuring it.” Tamvakis noted that there are many ways to reduce emissions and achieve sustainable development. These include improving the architecture of buildings and the technology of power plants. Reducing reliance on massive ‘gas guzzling’ cars, popular throughout the Gulf, would also have a positive impact in his view. One possible way to move drivers away from the big CO2 emitting vehicles, he suggested, could be the introduction of higher taxes on these types of cars. He expected that the development of Doha Metro and the extensive passenger and freight rail transport systems would also lead to a reduction in carbon emissions. He sees the potential for solar as promising. “Qatar has four megawatts capacity of load for solar electricity and they are planning to increase this to eight megawatts. This is out of a total electricity generation capacity of 6,000 megawatts,” he said. He added: “Currently the use of solar is less than 1% of the electricity consumption. If they bring it up to 5% or even 10% then that would be great. Anything above 5% is credible.” One of the disadvantages of solar energy, he said, is that it is a very ‘land-hungry’ technology compared with gas-fired power stations. “Solar takes up a lot of space. You get a lot less electricity from solar per square metre of area used and land is at a premium in Qatar,” he noted. Another fact is that solar panels typically have about a 25% efficiency rate. However, the sustainability plans are clearly aimed at maximising the potential for solar through a wide range of applications. “If you tell your various companies ‘you have to install some sort of capacity in your plant — on your building, in your factory’ that’s a different story because you don’t take up additional space,” said Tamvakis. Commercial buildings with solar panels on the roof and developments designed to optimise insulation and flow of light to cut down energy requirements are, he observed, measures that will have a positive effect on sustainability targets.

- 4. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 4 This integrated approach to the use of renewable energy within commercial, industrial and residential buildings, as well as initiatives to educate people to be more responsible in their energy consumption, are the way forward, he said. With many countries around the world aiming to decarbonise by moving away from coal to gas, Tamvakis said Qatar, as the largest LNG exporter in the world, was well placed to meet global demand over the coming decades. It also made economic sense, he commented, to keep the great natural gas resource for export and develop renewable forms of energy to meet domestic consumption requirements. Simon Currie, Global Head of Energy, Norton Rose Fulbright, gave his perspective on Qatar Solar Energy’s 300 MW PV module production plant. He said: “Solar manufacturing through Qatar Solar Energy is a very positive and forward-thinking move. But in order to get the most out of that you will want a Qatari programme to be quite big; you would want the manufacturing hub to be competitive for projects in the region and internationally. Looking forward, you would want to compete with Iraq, Iran, Jordan and Egypt; in all of these places solar is going to be competitive.” Decision on $3bn ONGC stake sale next month

- 5. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 5 Indian: Decision on $3bn ONGC stake sale next month Reuters/New Delhi Indian Prime Minister Narendra Modi’s government will decide next month on the sale of a $3bn stake in state oil firm Oil and Natural Gas Corp, in a major test of whether he can follow through on reforms outlined in his first budget. The nationalist leader won May’s parliamentary election by a landslide with a pledge to create jobs and revive Asia’s No 3 economy, which is suffering from weak growth and high inflation. Yet Finance Minister Arun Jaitley’s maiden budget last week drew criticism that his fiscal arithmetic did not add up. Capitalising on a record-breaking stock market run to complete asset sales could help him balance the books. The government will decide in August whether to sell a 5% stake in ONGC, a senior oil ministry official said, in a deal that would be worth $2.9bn at current market prices. “The department of divestment has floated a note seeking our comments for a 5% stake sale in ONGC,” the official, who has direct knowledge of the matter, told Reuters yesterday. An official at the finance ministry, home to the divestment department, said the government was interested in selling stakes in ONGC and other state companies given their high market valuations. He did not elaborate. If completed, the sale would raise more than a quarter of the $10.5bn target for asset sales announced by Jaitley for the fiscal year to March 2015. He will need to hit or exceed that figure to cap the budget deficit at 4.1% of gross domestic product, a goal set by his predecessor that he has vowed to uphold. The proposal to sell a 5% stake follows reports that the government may sell a stake of as much as 10% in ONGC, which produces the equivalent of 1.2mn barrels per day, or two-thirds of India’s oil and gas. The state directly owns 69% of ONGC, while further stakes are owned by the state-run Life Insurance Corp of India (LIC) (7.8%), Indian Oil Corp (7.7%) and Gas Authority of India (2.4%). ONGC, with a market value of $57bn, has struggled for years with stagnant production and a lack of commercially viable discoveries. It is burdened by a subsidy regime that forces it to sell oil and gas cheaply. Still, even without wholesale restructuring, some analysts back the stock on expectations that the government will replace the existing, ad hoc, regime for sharing the burden of energy subsidies with a more predictable model.

- 6. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 6 “The objective is not to privatise; just to contain the fiscal deficit,” said Dayanand Mittal, an oil analyst at Ambit Capital in Mumbai who has a ‘buy’ rating on ONGC stock with a price target of Rs500. “Don’t expect restructuring – what you can expect are measures to improve efficiency and reduce India’s oil import dependence,” added Mittal. He forecasts that ONGC will receive $58 per barrel of oil it sells in 2014/15, a 40% gain. ONGC shares were up 2.4% yesterday afternoon, against a 0.9% rise in the benchmark Sensex index. The shares have rallied by 43% in the current year to date, joining other state-controlled enterprises in outperforming a 19.1% gain in the Sensex. “They have to bring in more clarity on gas pricing and subsidies before selling a stake to institutional investors,” said Phani Sekhar, a fund manager at Angel Broking in Mumbai. “Budget estimates would be achieved easily if it goes through. Even if there is lack of demand there is always LIC to support,” said Sekhar. The state insurer’s backing was critical to the success of the sale by the previous government of a 5% stake in ONGC in 2012 that raised Rs127bn rupees ($2.1bn). Over the last two years, the previous government also reduced its stake in Indian Oil, the country’s top oil refiner, Engineers India Ltd and Oil India Ltd. The Modi government’s sell-off drive is set to kick off with the offering of a 5% stake in Steel Authority of India, worth $290mn based on market prices, say sources familiar with the transaction. Other deals are expected to follow a similar pattern of incremental, revenue-raising sales that do not jeopardise state control. On the slate are Coal India, the world’s top producer, and firms involved in power, aerospace and metallurgy, a senior government source said recently.

- 7. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 7 IHS to study Gulf of Guinea Methanol project in Nigeria The local Junior company Gulf of Guinea Oil Exploration Limited (GGOEX) is investigating all opportunities to monetize natural gas in Nigeria through its purposely established subsidiary Gulf of Guinea Methanol Limited (GGML) to develop a world-scale methanol plant in the Niger Delta. At the end of 2012, Nigeria ranked in the first position in Africa and the ninth position globally by the amount of proven reserves of natural gas estimated to 182 trillion cubic feet (tcf). Even if Nigeria is topping Africa by the volume of production recorded at 1.2 tcf in 2012, it only appears in 25th position among the world natural gas producing countries. A significant part of this gas is associated gas to the development of the crude oil and condensate gas fields yielding higher value. This associated gas used to be flared, but since it is no longer allowed, all crude oil operating companies are looking for monetizing this associated gas. The regulation to capture the flared gas in Nigeria came up in the same time as US started to develop their shale gas to depress the gas market prices, rising even more the challenges to monetize the gathered associated gas. In this context, Nigeria encourages all initiatives to monetize this gas through fertilizer or petrochemical products such as this GGOEX Gulf Methanol project. Haldor to provide GGOEX Gulf Methanol technology Established in Lagos in 2011 by local funds, GGOEX created GGML in that perspective, using cheap natural gas glutting in the Gulf of Guinea to develop a local petrochemical industry for the most populated country in Africa. Since methanol manages to maintain attractive and sustainable prices on the global market, the gas conversion into methanol offers the opportunity to supply the domestic market if the demand is large enough or to export in good commercial conditions. Therefore GGOEX is planning to build the first methanol plant of that scale in Africa with a capacity of 5,000 tonnes per day (t/d) out of local natural gas. The goal is to produce Federal Grade AA Methanol in order to propose a first quality feedstock to the local petrochemical industry. The expectation is to use this supply of methanol to produce solvents from acetic acid, gasoline additive like methyl tertiary butyl ether (MTBE) or formaldehyde-based resins. With top management coming from the local Nigeria National Petroleum Company (NNPC), GGOEX is planning to invest $1.1 billion capital expenditure in the project. The Danish methanol specialist Haldor Topsoe will provide GGOEX with the technology while the UK-based IHS consulting company is working on the Gulf Methanol project feasibility study to be located on the Ugborodo Community territory in the Niger Delta.

- 8. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 8 US: Swift Energy and Saka Energi Indonesia close JV to develop Fasken Eagle Ford acreage . Source: Swift Energy Swift Energy has closed its previously announced agreement with Saka Energi Indonesia to fully develop 8,300 acres of Fasken area Eagle Ford shale properties owned by Swift Energy in Webb County, Texas. Swift Energy sold a 36% full participating interest in Swift Energy’s Fasken properties to Saka for $175 million in total cash consideration, with $125 million (subject to adjustments for interim operations) to be paid at closing and $50 million in cash to be paid by Saka over time to carry a portion of Swift Energy’s field development costs incurred after the January 1, 2014 effective date. At closing, Swift Energy received approx. $147 million, composed of the initial $125 million cash consideration plus Saka’s share of capital costs, net of revenue, since the effective date of the transaction, which capital costs include Saka’s carry of a portion of Swift Energy’s field development costs for that same period. After closing, approx.$38 million remains of Saka’s original $50 million drilling carry obligation, which is expected to be fulfilled during calendar year 2016. The net proceeds received by Swift Energy in this transaction will be used initially to reduce the amount of borrowings under the Company’s credit facility and ultimately to use a portion of the proceeds to fund accelerated development of its Eagle Ford shale properties. J.P. Morgan Securities acted as financial advisor to Swift Energy in this transaction. 'Both parties have worked diligently towards the conclusion of this transaction, and we look forward to working alongside Saka to optimize this asset’s value through an advanced technology development program,' Terry Swift, CEO of Swift Energy commented, 'This arrangement marks the beginning of a strategic partnership to grow production in the Eagle Ford dry gas window of South Texas.'

- 9. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 9 South Africa ready to re-evaluate new oil and gas law Source: Reuters + NewBase South Africa may reconsider a new oil and gas law to ensure that investors can be make profits while securing a place for the state in the sector, Mineral Resources Minister Ngoako Ramatlhodi said on Tuesday. Parliament passed the law in March, giving the state a 20 percent free stake in new gas and oil exploration and production ventures and alarming operators such as Total and Exxon Mobil, which are looking to explore in South Africa. 'Having spent time listening to stakeholders ... I am ready for any eventuality,' Ramatlhodi told parliament. 'In the event the current bill is assented to in its form, I commit to rigorous and transparent engagement with stakeholders on draft regulations,' he said. The bill is before President Jacob Zuma who must give it his assent before it becomes law. Ramatlhodi told reporters there was broad agreement on the 20 percent free-carry for the state and 10 percent for 'black empowerment', but the sticking point was on where to cap these. 'Black empowerment' refers to state-mandated targets to lift black ownership in Africa's most advanced economy, part of a government drive to rectify the racial imbalances of white apartheid rule. We want to limit the amount that the state can actually take, even on an agreed price, so that you allow investors to get their investment returns back,' the minister said.

- 10. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 10 US: Shell adds third major discovery to the Norphlet play in the Gulf of Mexico Source: Shell Shell has announced its third major discovery in the Norphlet play in the deep waters of the Gulf of Mexico with the successful Rydberg exploration well. After more than 10 years of exploration activities in the Eastern Gulf of Mexico, Shell continues to lead industry in exploring this Jurassic play. 'The Rydberg discovery builds upon our leadership position in the Eastern Gulf of Mexico and its proximity to our other discoveries in the area make Rydberg particularly exciting.' said Marvin Odum, Shell Upstream Americas Director. 'These successes represent the emergence of another hub for Shell’s deep-water activities that should generate shareholder value.' The Rydberg well is located 75 miles (120 kms) offshore in the Mississippi Canyon Block 525 in 7,479 feet (2,280 metres) of water. It was drilled to a total depth of 26,371 feet (8,038 metres) and encountered more than 400 feet (122 metres) of net oil pay. Shell is completing the full evaluation of the well results but expects the resource base to be approx. 100 million barrels of oil equivalent. Together with the Appomattox and Vicksburg discoveries, this brings the total potential Norphlet discoveries to over 700 million barrels of oil equivalent. This is the first discovery for the partnership of Shell (operator, interest 57.2%), Ecopetrol America Inc. (28.5%) and Nexen (14.3%), a wholly-owned affiliate of CNOOC Limited. The discovery is within 10 miles (16 kms) of the planned Appomattox development and the 2013 Vicksburg discovery (Shell, operator, 75% and Nexen, 25%). Shell and Nexen are following up the Rydberg discovery with an exploratory well at Gettysburg, located in Desoto Canyon Block 398 which is also within 10 miles (16 kms) of the planned Appomattox Development. Background • The Jurassic-period Norphlet play is a geological formation that extends from onshore to the deep waters of the Eastern Gulf of Mexico. • Appomattox (Shell 80%, Nexen 20%) is currently in the define phase of development and is moving forward with engineering design for the floating production system, subsea infrastructure and wells. • The drillship Noble Globetrotter I drilled the Rydberg well and is currently repositioning to drill the Gettysburg exploratory well. • The Gulf of Mexico is a major production area in the USA, accounting for almost 50% of Shell’s oil and gas production in the country and almost 180 thousand boe per day in 2013. •

- 11. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 11 Significant fuel economy improvement options exist for light-duty Source: U.S. Energy Information Administration, Although light-duty vehicle types such as diesel, full-hybrid, plug-in hybrid, and plug-in electric have garnered significant attention in recent years as ways to reduce petroleum consumption and lower consumer fuel costs, standard gasoline vehicles, including those that use micro and mild hybridization, are projected to retain nearly 80% of new sales in 2025 and 78% in 2040 in EIA's Annual Energy Outlook 2014 Reference case. Several fuel-efficient technologies that can deliver significant reductions in fuel consumption are currently or will soon be available for standard gasoline vehicles. These technologies can enable manufacturers to meet future greenhouse gas emissions and Corporate Average Fuel Economy (CAFE) standards, at a relatively modest cost. These technologies include: • Engine technologies such as variable valve timing and lift, cylinder deactivation, turbocharging, and downsizing • Electrification technologies such as electric power steering, and micro or mild hybridization (turning off the engine when the car is stopped) • Vehicle technologies such as fuel-efficient tires and aerodynamics • Weight-reduction technologies • Transmission technologies such as aggressive shift logic (controlling on automatic transmission to maximize fuel efficiency) or 8-speed transmission

- 12. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 12 The addition of these fuel-efficient technologies to standard gasoline vehicles substantially increases fuel economy. For example, in the midsize passenger car category, the largest share of sales among light-duty vehicles, standard gasoline vehicle compliance fuel economy increases from around 35 miles per gallon (mpg) today to 53 mpg by 2025, an increase of about 50%, while the vehicle price rises from about $25,000 (2012$) today to about $27,000, an increase of less than 10%. Given the long time frame taken in setting greenhouse gas and CAFE standards through model year 2025, EPA and the National Highway Traffic Safety Administration plan to conduct a comprehensive mid-term evaluation by no later than April 2018. The agencies plan to assess fuel efficient vehicle technologies with up-to-date information as part of this mid-term evaluation. Source: U.S. Energy Information Administration, Annual Energy Outlook 2014 Note: Data for the technology assumptions graphed above.

- 13. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 13 Qafac to host first-ever Mideast Methanol Forum in Doha Amid the rapidly growing demand for methanol in the region and across the globe, Qatar Fuel Additives Company (Qafac) will be holding the first-ever Middle East Methanol Forum (MEMF) in Doha on November 26, 2014 . Resource speakers at the forum will include senior executives from some of the region’s and the world’s top producers of methanol, along with strong support from the Methanol Institute. Themed ‘Miracle energy on hand,’ the event is to held under the patronage of HE the Minister of Energy and Industry Dr Mohamed bin Saleh al-Sada. It will be attended by some of the world’s leading experts of Methanol. “Methanol is a basic chemical molecule that touches our daily lives in so many various ways,” said Qafac CEO Nasser Jeham al-Kuwari. Among the key topics to be discussed at the one-day forum are ‘Global methanol markets overview’ and ‘Making a case for oxygenates in the GCC,’ and ‘Analysing current and future opportunities.’ “As the basic component of paints, solvents and plastics, to innovative applications in energy, transportation fuel and fuel cells, methanol is a key commodity and an integral part of our global economy,” al-Kuwari noted. He explained that methanol was one of the most versatile compounds developed and the basis for hundreds of chemicals and thousands of products. It is also the second ranked commodity in the world in terms of amount shipped and transported around the globe every year. Al-Kuwari said the forum aimed to provide scientific experts, producers and end-users a platform to examine and deliberate the emerging trends in the methanol industry: methanol as a marine fuel and the global vision of Qatar and GCC countries with regard to petrochemical industries. “Qafac deemed it imperative to hold this forum to enable every stakeholder to find better ways of efficiently and effectively producing and harnessing its capacity for the benefit of everyone,” he said. Qafac is the leading producer and exporter of methanol and methyl tertiary butyl ether (MTBE) in Qatar.

- 14. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 14 NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE Your partner in Energy Services Khaled Malallah Al Awadi, MSc. & BSc. Mechanical Engineering (HON), USA ASME member since 1995 Emarat member since 1990 Energy Services & Consultants Mobile : +97150-4822502 khalid_malallah@emarat.ae khdmohd@hotmail.com Khaled Al Awadi is a UAE NatKhaled Al Awadi is a UAE NatKhaled Al Awadi is a UAE NatKhaled Al Awadi is a UAE National with a total of 24 yearsional with a total of 24 yearsional with a total of 24 yearsional with a total of 24 years of experience in theof experience in theof experience in theof experience in the Oil & Gas sector. CurrentlyOil & Gas sector. CurrentlyOil & Gas sector. CurrentlyOil & Gas sector. Currently working as Technical Affairs Specialist for Emirates General Petroleum Corp. “Emarat“ with external voluntaryworking as Technical Affairs Specialist for Emirates General Petroleum Corp. “Emarat“ with external voluntaryworking as Technical Affairs Specialist for Emirates General Petroleum Corp. “Emarat“ with external voluntaryworking as Technical Affairs Specialist for Emirates General Petroleum Corp. “Emarat“ with external voluntary Energy consultation for the GCC area via Hawk Energy ServiceEnergy consultation for the GCC area via Hawk Energy ServiceEnergy consultation for the GCC area via Hawk Energy ServiceEnergy consultation for the GCC area via Hawk Energy Service as a UAE operations base , Most of the experience were spentas a UAE operations base , Most of the experience were spentas a UAE operations base , Most of the experience were spentas a UAE operations base , Most of the experience were spent as the Gas Operations Manager in Emarat , responsible for Emarat Gas Pipeline Network Facility & gas compressor stations .as the Gas Operations Manager in Emarat , responsible for Emarat Gas Pipeline Network Facility & gas compressor stations .as the Gas Operations Manager in Emarat , responsible for Emarat Gas Pipeline Network Facility & gas compressor stations .as the Gas Operations Manager in Emarat , responsible for Emarat Gas Pipeline Network Facility & gas compressor stations . Through the years , he has developed great experiences in the desiThrough the years , he has developed great experiences in the desiThrough the years , he has developed great experiences in the desiThrough the years , he has developed great experiences in the designing & constructinggning & constructinggning & constructinggning & constructing of gas pipelines, gas metering &of gas pipelines, gas metering &of gas pipelines, gas metering &of gas pipelines, gas metering & regulating stations and in the engineering of supply routes. Many years were spent drafting, & compiling gas transportation ,regulating stations and in the engineering of supply routes. Many years were spent drafting, & compiling gas transportation ,regulating stations and in the engineering of supply routes. Many years were spent drafting, & compiling gas transportation ,regulating stations and in the engineering of supply routes. Many years were spent drafting, & compiling gas transportation , operation & maintenance agreements along with many MOUs for the local authoperation & maintenance agreements along with many MOUs for the local authoperation & maintenance agreements along with many MOUs for the local authoperation & maintenance agreements along with many MOUs for the local authorities. He has become a reference for many oforities. He has become a reference for many oforities. He has become a reference for many oforities. He has become a reference for many of the Oil & Gas Conferences held in the UAE andthe Oil & Gas Conferences held in the UAE andthe Oil & Gas Conferences held in the UAE andthe Oil & Gas Conferences held in the UAE and Energy program broadcasted internationally , via GCC leading satelliteEnergy program broadcasted internationally , via GCC leading satelliteEnergy program broadcasted internationally , via GCC leading satelliteEnergy program broadcasted internationally , via GCC leading satellite ChannelsChannelsChannelsChannels .... NewBase : For discussion or further details on the news above you may contact us on +971504822502 , Dubai , UAE NewBase 16 July 2014 K. Al Awadi Brent crude oil fell more than $1 a barrel to a three-month low below $106 on Tuesday, extending losses to almost 9 per cent since mid-June, as weak demand and rising Libyan supplies overshadow renewed violence in the country. Brent futures dropped $1.20 to $105.78 a barrel by 1125 GMT, hitting a three-month low of $105.68. The front-month August contract expires on Wednesday, further pressuring prices as investors liquidate positions, analysts and traders US crude fell 82 cents to $100.09 a barrel and was approaching the 200-day moving average at $99.92, a key technical indicator closely watched by traders. Brent prices briefly spiked to a nine-month high of $115.71 in June.