New base 810 special 17 march 2016

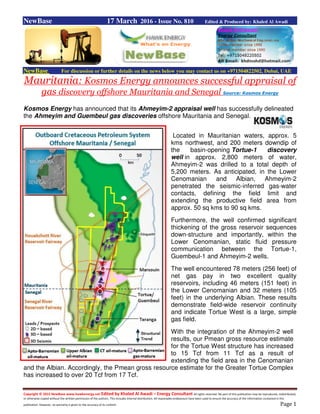

- 1. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 1 NewBase 17 March 2016 - Issue No. 810 Edited & Produced by: Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE Mauritania: Kosmos Energy announces successful appraisal of gas discovery offshore Mauritania and Senegal Source: Kosmos Energy Kosmos Energy has announced that its Ahmeyim-2 appraisal well has successfully delineated the Ahmeyim and Guembeul gas discoveries offshore Mauritania and Senegal. Located in Mauritanian waters, approx. 5 kms northwest, and 200 meters downdip of the basin-opening Tortue-1 discovery well in approx. 2,800 meters of water, Ahmeyim-2 was drilled to a total depth of 5,200 meters. As anticipated, in the Lower Cenomanian and Albian, Ahmeyim-2 penetrated the seismic-inferred gas-water contacts, defining the field limit and extending the productive field area from approx. 50 sq kms to 90 sq kms. Furthermore, the well confirmed significant thickening of the gross reservoir sequences down-structure and importantly, within the Lower Cenomanian, static fluid pressure communication between the Tortue-1, Guembeul-1 and Ahmeyim-2 wells. The well encountered 78 meters (256 feet) of net gas pay in two excellent quality reservoirs, including 46 meters (151 feet) in the Lower Cenomanian and 32 meters (105 feet) in the underlying Albian. These results demonstrate field-wide reservoir continuity and indicate Tortue West is a large, simple gas field. With the integration of the Ahmeyim-2 well results, our Pmean gross resource estimate for the Tortue West structure has increased to 15 Tcf from 11 Tcf as a result of extending the field area in the Cenomanian and the Albian. Accordingly, the Pmean gross resource estimate for the Greater Tortue Complex has increased to over 20 Tcf from 17 Tcf.

- 2. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 2 'Ahmeyim-2 is our fourth successful exploration and appraisal well and continues our 100 percent success rate in the outboard Cretaceous petroleum system offshore Mauritania and Senegal, further demonstrating that Kosmos has opened a world-class hydrocarbon province. With this well, we believe we have proven sufficient gas resource to underpin a world-scale LNG project in the Tortue West structure alone. The combination of the resource size and quality continue to support our view that Tortue is a competitive source of LNG and we are working towards commercialization,' said Andrew G. Inglis, chairman and chief executive officer. 'Our well-to-seismic calibration has again been proven, highlighting the reliability of this tool and increasing our confidence in its use for fully unlocking the basin, which we believe has significant potential for both oil and gas. We now plan to drill the first of three independent oil tests in our blocks offshore Mauritania and Senegal, starting with the Teranga-1 well, located in the Cayar Offshore Profond Block, offshore Senegal.' Ahmeyim-2, Tortue-1 and Guembeul-1 wells (Source: Kosmos) Since 2012, Kosmos has held rights to conduct exploration in the C-8, C-12, and C-13contract areas under production sharing contracts with the Government of Mauritania’s Société Mauritanienne Des Hydrocarbures et de Patrimoine Minier (SMHPM). Kosmos operates the Ahmeyim-2 well with 90 percent equity and is joined by its partner SMHPM at 10 percent. The blocks are contiguous, range in water depth between 1,000 and 3,000 meters, and have combined acreage of approx. 27,000 sq kms.

- 3. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 3 Egypt: SDX Energy commences 3D seismic programme on South Disouq Source: SDX Energy SDX Energy has provided an update on its activities at its South Disouq asset located onshore Nile Delta Egypt. Further to the announcement on 10 November 2015, regarding the signing of contract for the seismic acquisition of 300km2 of 3D data on the South Disouq concession (SDX 55% WI), the Company announces that the programme has commenced. The seismic acquisition programme is expected to take approx. three months after which a 3-4 month period of processing and interpretation will be undertaken. The data obtained through this programme will be used to determine the prospectivity on the block followed by the selection of a location for a high impact exploration well forecast to be drilled in Q4 2016. Commenting on this update, Paul Welch, CEO, said: We are pleased to report that this programme is underway and look forward to receiving the high quality data-set that it will generate. This data will be used by our technical team to quantify the block potential and then to identify a location for our high impact exploration well, which we are anticipating will be drilled towards the end of this year. For SDX this concession contains company-making potential with a Mean gross resource estimate currently being 526 BCF. We believe the 3D seismic will significantly de-risk the potential of the block based upon the success our peers have seen within this prolific Abu Madi-Baltim trend where our acreage is located. This year represents a highly active and potentially transformational period for SDX with the two significant catalysts of the Manatee-1 exploration well in Cameroon, where we are expecting results in late March/early April, and the drilling of the South Disouq well in Q4’16. Alongside these events, we continue to focus on growing our low cost production from NW Gemsa and Meseda where we have already reported positive progress in our announcement on 8 February. I look forward to updating our shareholders on the results of this program and our other activities in due course.'

- 4. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 4 Saudi Dow Jubail ships the first batch of RO elements to emerging markets Saudi Gazette The Dow Chemical Company is celebrating the inaugural shipment of its DOW FILMTEC Reverse Osmosis elements from its new Saudi Arabia Dow Water & Process Solutions’ (DW&PS) Jubail Operations manufacturing facility. This first shipment is targeted to serve emerging markets. A first of its kind built outside the United States, the new rev erse osmosis (RO) production facility came on-stream in December 2015 to better serve the local Saudi Arabian market and help meet aggressively growing demands for RO in Middle East and Africa regions, as well as Eastern Europe, India, China and Southeast Asia. “Through rapid urban economic growth, annual domestic water demand in the Middle East and North Africa countries is estimated to more than triple over the next 20-30 years,” said Yochai Gafni, business unit director for RO at DW&PS, a business unit of Dow. “To combat regional water scarcity challenges and address this growing resource demand, Jubail Operations will help deliver a robust local supply of cutting-edge technologies for municipal and industrial water applications.” Dow’s wholly owned Jubail Operations is located in Jubail Industrial City II within the fully integrated Sadara Chemical Company complex, the joint venture developed by Dow and Saudi Aramco. The plant manufactures FILMTEC RO elements for seawater and brackish water desalination and for water reuse of potable, non-potable and industrial water. “The Jubail Operations replicates and builds on the state-of-the-art production technology employed in Edina, Minn., USA, and adds a high technology investment to the Kingdom” said Chuck Swartz, President for Dow in the Kingdom of Saudi Arabia. “It is also creating jobs for Saudi talents.” It is anticipated that RO elements manufactured at DW&PS Jubail Operations have the capability to reduce the oil requirement to distill water in the region by approximately 10MM barrels per year – equivalent to reducing the greenhouse gas emissions from 900,000 passenger vehicles driven per year. Dow’s investment in the DW&PS Jubail Operations complements its continued activities at the Dow Middle East Research and Development Center at King Abdullah University of Science and Technology (KAUST), where research on RO solutions in combination with ultrafiltration pretreatment for seawater desalination is taking place.

- 5. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 5 Saudi Aramco, Shell plan to break up Motiva, divide up assets Reuters - Kristen Hays and Erwin Seba + NewBase Royal Dutch Shell and Saudi Aramco announced plans on Wednesday to break up Motiva Enterprises LLC in a deal that ends a partnership of nearly two decades and hands control of the biggest U.S. refinery to the Saudi state oil giant. News that the two energy companies will divide assets in their oil refining and marketing joint venture had been expected by many as they navigated an often-frayed relationship where their respective interests sometimes diverged. An early sign of a pending breakup emerged last summer when Motiva announced plans to set up its own oil products trading operation separate from Shell. The desk started up in January. The divorce also comes as the Saudi government considers selling shares in the world's largest oil firm. Abdulrahman Al-Wuhaib, senior vice president of downstream at Saudi Aramco , said in a statement on Wednesday that the joint venture formed in 1998 served the partners' downstream business objectives "very well for many years." "It is now time for the partners to pursue their independent downstream goals," he said. A U.S. spokesman for The Hague-based Royal Dutch Shell said the breakup and split of Motiva's assets were consistent with Shell's plans to simplify its global portfolio. PROPOSED BREAKUP TERMS Motiva's three refineries in the U.S. Gulf Coast region have a combined capacity of over 1.1 million barrels per day, located within a 120-mile (195-km) radius of one another. The marketing operations support a network of about 8,300 Shell-branded gasoline stations in the Eastern and Southern United States. The partners said that under the terms of a non-binding letter of intent, Aramco would take over the Port Arthur, Texas, refinery and retain 26 distribution terminals as well as the Motiva name. Motiva's three refineries operate with a combined refining capacity of over 1 million barrels of crude

- 6. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 6 It will also have an exclusive license to use the Shell brand for gasoline and diesel sales in Texas, the majority of the Mississippi Valley, the Southeast and Mid-Atlantic markets, it said. Shell will solely own the Louisiana refineries in Convent and Norco, where it also operates a chemicals plant, as well as Shell-branded gasoline stations in Florida, Louisiana and the Northeastern region. A Shell spokesman said the company would move forward with Motiva's plan to integrate the Louisiana refineries to operate as a single 500,000-bpd plant. LONGTIME TENSION While sources close to the situation say the relationship between Shell and Aramco has been troubled, that tension grew after an ambitious $10 billion expansion of Motiva's flagship Port Arthur refinery. The project doubled its size to 603,000 barrels a day and surpassed Exxon Mobil Corp's Baytown, Texas, plant as the country's largest. A disastrous leak of caustic fluid in a new unit crippled the plant shortly after top executives from Shell and Aramco unveiled the expansion in May 2012, upping the cost that already had ballooned from $5 billion. "That was a continuation of the bad blood," said a person familiar with the relationship. In February 2014, Motiva hired Dan Romasko, who had been the top operations executive at refiner Tesoro Corp , to replace former top Shell trading executive Bob Pease as chief executive. Romasko told Reuters in an interview a year ago that Motiva was "coming into its own" after the company announced plans to integrate the two Louisiana refineries. Sources familiar with the relationship also said Aramco was said to be angry at Shell when refinery workers at the three Motiva plants went on strike in early 2015. Shell led negotiations with the United Steelworkers union representing the workers, and the strike ended three weeks after the Motiva walkout.

- 7. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 7 Oman:Rex International Holding Ups Stake in Oman's Masirah by Rex International Holding Ltd. -Press Release Singapore-listed Rex International Holding Limited (the Company or Rex, and together with its subsidiaries, the Group) revealed that Rex Oman Ltd. (Rex Oman), an indirect wholly-owned subsidiary of the Company, had on March 16, been informed by Masirah Oil Ltd. (MOL) of the completion of the allocation made on March 7, of Rex Oman’s subscription of 3,908 new MOL shares at $1,426 per share, for a total amount of $5,572,808, as capital injection into MOL (Capital Injection). Prior to the Capital Injection, Rex has an effective interest of 61.76 percent in MOL through direct interests of 57.06 percent and 6.4 percent in MOL held respectively by Rex Oman and Lime Petroleum Plc (Lime), the Company’s 65 percent indirectly held jointly-controlled entity. MOL issued 4,000 new shares at $1,426 per share to raise an aggregate amount of $5,704,000. The remaining new MOL shares were subscribed by Petroci, an existing shareholder of MOL. The MOL subscription was open to all shareholders of MOL of which only Petroci and Rex Oman decided to participate. The Capital Injection was necessary to allow MOL to pursue its drilling activities and continue its operations in Oman, as well as for general working capital requirements; and was fully satisfied in cash by Rex Oman and fully funded by proceeds raised from the Company’s share placement which was completed in September 2014 (the 2014 Placement). Details on the use of proceeds from the 2014 Placement are contained in a separate announcement made today. The issue price of $1,426 per MOL share was arrived at on a willing seller willing buyer basis, taking into consideration MOL’s unaudited net assets value/net tangible asset value of $88.7 million as at Dec. 31, 2015 and its growth potential, given that it is the operator and 100 percent owner of the Block 50 Oman concession, which is further elaborated in the ensuing paragraph. MOL has in February 2016, started a drilling campaign in the Block 50 Oman concession. The Board considers the Capital Injection to be in the interest of and beneficial to the Group as MOL is the operator and holds 100 percent ownership in the close to 6,564 square miles (17,000 square kilometers) Block 50 Oman concession, which has been identified as one of the Group’s main focus going forward. The Board is of the view that MOL has high potential for growth, as the discovery made in the concession in early 2014 was the first offshore discovery east of Oman, after 30 years of exploration activity in the area. During a 48-hour test, hydrocarbons were flowed to the surface and the well achieved light oil flow rate of up to 3,000 stock tank barrels per day (stb/d) with no water production. Pursuant to the completion of the Capital Injection, Rex Oman now holds 9,668 MOL shares, representing approximately 69.06 percent direct interest in the enlarged issued and paid-up share capital of MOL. Lime and Petroci hold the remaining 4.57 percent and 26.37 percent interest in the enlarged issued and paid-up share capital of MOL, respectively. Accordingly, the Group’s effective interest in MOL has increased from approximately 61.76 percent to 72.03 percent.

- 8. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 8 India govt firms ink energy deals with Russia’s Rosneft Reuters + NewBase Indian state companies signed energy deals worth billions of dollars with Russia’s Rosneft yesterday to buy into its most promising assets in Siberia, stepping up a drive to cut New Delhi’s dependence on imports. Prime Minister Narendra Modi, who wants to cut India’s oil imports by 10% in six years, is steering efforts to buy foreign energy assets, taking advantage of low global oil prices and a slowdown in China’s overseas acquisitions. Under the deals signed with Rosneft CEO Igor Sechin, the Indian companies will raise their stake in the Vankor oilfield to almost 50% and buy about 30% of the Taas-Yuriakh field. The deals will help Rosneft, the world’s biggest listed oil producer by output, to pay off debts incurred in its $55bn acquisition of TNK- BP in 2013. Russia is keen to develop and deepen its Soviet-era economic ties with India and sell oil to one of the world’s fastest-growing economies at a time when its own economy is stagnant, hit by Western sanctions and a plunge in global oil prices. Modi had pitched to Russian President Vladimir Putin for the granting of stakes to Indian oil firms during his visit to Moscow in December. The deals will help India to secure Russian oil output, while Rosneft will gain access to the Indian market, Sechin told reporters in New Delhi. Sechin met Essar Oil officials during his visit and said that Rosneft hopes to conclude a deal to buy a 49% stake in the 400,000 barrel-per-day Vadinar refinery in western India by the end of June. The proposed deal would give Rosneft an additional outlet for its oil as it grapples with a global crude supply glut. “We are establishing a reliable energy bridge between our countries, which will be developing the interests of both Russia and India,” Sechin said. A consortium of Oil India, Indian Oil Corp and Bharat PetroResources (BPRL), a unit of Bharat Petroleum Corp, has bought 29.9% stake in Rosneft’s Taas-Yuriakh field. The companies will

- 9. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 9 together pay $1.121bn for their share in the operation and $180mn each for future capital expenditure, a source with knowledge of the deal said. Meanwhile, India’s Oil and Natural Gas Corp signed an initial deal to raise its stake in the Vankor project to 26% from 15%, while the other three companies could together pick up 23.9%. A final deal for Vankor will be signed in June, sources told Reuters last week. If the deals go through, Rosneft will retain 50.1% of Vankor, which produced 22mn tonnes of oil in 2014, representing about a tenth of the company’s total output. Vankor’s oil is shipped to Asia, mostly to China. Indian companies could pay close to $3bn for boosting their Vankor stake, based on the price ONGC paid for its 15% stake in the project, an ONGC source told Reuters. IOC-Oil India-BPRL also signed a preliminary deal to buy a stake in Rosneft’s Vankor cluster – a separate group of small oil fields.

- 10. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 10 Rosneft Sells Stake in Taas-Yuryakh Neftegasodobycha Field to Indian Investors Rosneft on Wednesday signed an agreement to sell 29.9 percent stake in Taas-Yuryakh Neftegasodobycha oil and gas field to a consortium of Indian firms. Oil India, Indian Oil and Bharat Petroresources signed a legally binding share sale agreement with Rosneft during Rosneft Chairman of the Management Board Igor Sechin’s visit to India. The document provides for the entry of the Indian companies' consortium into the joint venture (JV) established by Rosneft and BP on the basis of Taas-Yuryakh Neftegasodobycha. Price parameters of the transaction with Indian companies are similar to the terms of the agreement with BP signed at the St-Petersburg Economic Forum in June 2015. Rosneft will retain a majority stake in the JV. The transaction will be closed after set of condition precedents are accomplished and Rosneft’s Board of Directors approval is obtained, Rosneft said in a statement. "The joint venture with our Indian and British partners allows to make the most of the technological, resource and commercial potential of all of the JV’s participants. Joined efforts of Rosneft, BP, Oil India, Indian Oil and Bharat Petroresources allow a significant acceleration of the upstream projects’ implementation by virtue of increasing JV financial potential as well as open new prospects for marketing the East Siberian hydrocarbons," Sechin said. Vankor deal Rosneft and the three Indian firms also signed a heads of agreement on acquisition of a 23.9 percent share in Vankorneft project. The document envisages the possible execution of legally binding documents with regard to the sale and purchase transaction. It also envisions joint analysis of a potential partnership with the scope of the development of the Suzunskoye, Tagulskoye and Lodochnoye fields. Rosneft also signed with ONGC Videsh Limited a memorandum of understanding for cooperation in respect of the Vankor project, envisaging the prospective increase to 26 percent of the share of the Indian company in Vankroneft. The Russian firm stated that the deal which is worth almost $1.3 billion is expected to be closed in the short term. Recoverable resources of the Vankor field as of January 1, 2016 stood at 361 mn tons of oil and condensate and 138 bcm of gas. In 2015 Vankor produced 22 mn tons of oil and 8.71 bcm of gas.

- 11. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 11 India targets $40bn of untapped oil and gas CNBC - Victor Mallet India aims to attract $25bn of investment in natural gas and crude oil in the next few years with the help of sweeping reforms to its exploration and production rules announced last week. Dharmendra Pradhan, minister of state for petroleum and natural gas, said the new hydrocarbon exploration and licensing policy (Help) and a liberalized gas price regime would help reduce India's heavy dependence on imported energy over the next 10-15 years. Basing his calculations on a crude oil price of $45 a barrel, he said the principal aim was to increase domestic gas production at a time of rising demand and falling output. "Forty billion dollars of hydrocarbons will be unlocked for production through this policy reform," he said in an interview. "To realise this amount we are expecting investment of more than $25bn in the next two to three years." The government had previously said it expected to monetize unexploited gas reserves of around 6.75tn cubic feet, worth more than $28bn, from existing and future discoveries. Businesses and industry analysts welcomed the changes, although some were skeptical given the recent collapse of the oil price and a reluctance to expend capital on high-cost projects. "In the current context it's not going to excite people," said Arvind Mahajan, head of energy and infrastructure at KPMG in India, arguing that such a move a couple of years ago would have had more impact. "The market environment to invest in oil and gas is not good." Mr Pradhan acknowledged that India had been slow to make exploration attractive in the country, but expressed confidence that the reforms would fulfil Prime Minister Narendra Modi's declared aim of reducing the country's dependence on imported oil by 10 per cent by 2022. India imports almost three-quarters of its oil. "Some of the decisions we are taking today for the interests of India and its citizens should have been taken 10, 20 years back," he said. "When Prime

- 12. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 12 Minister Modi took charge there was a trust deficit in the industry between the government and stakeholders . . . We have to go for international business models." The new policy announced by the cabinet includes a uniform licence for new exploration and production of all hydrocarbons and "marketing and pricing freedom", although there will be a ceiling for the gas price based on the landed price of alternative fuels. Big oil companies have largely shunned India's unfavorable investment climate for the industry. BP, whose $7.2bn investment in a Reliance Industries offshore gas block has been hit by production problems and a pricing dispute, welcomed the latest reforms as a "step change". Indian officials, however, have suggested Reliance will need to end that arbitration over pricing to benefit from the new system, while Mr Pradhan said the policy's aim was to encourage the development of unexploited gas and oil reserves. Standard & Poor's said the new policies were "credit positive" for Reliance and for state-owned Oil and Natural Gas Corp but "meaningful cash flows are a few years away". ICRA, another rating agency, said the reforms could help India's gas production increase materially in the next five to eight years, while the benefits for oil output would be moderate. "India is moving gradually towards a gas-based economy," said Mr Pradhan, noting India was the world's third-largest energy consumer with low per capita usage but one of the highest annual rates of consumption growth. India's domestic gas production fell 17 per cent in the two financial years to the end of March 2015.

- 13. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 13 Afghanistan: Mine Removal Process on TAPI Route Begins The Nation The process of removal of mines in Afghanistan from the Turkmenistan-Afghanistan-Pakistan- India (TAPI) gas pipeline route has begun with the help of Afghan security forces, Pakistani newspaper The Nation reported Wednesday citing a senior energy official. Mobeen Saulat, the CEO of Pakistan's Inter-State Gas Systems (ISGS) told The Nation project is near its financial close and will be ready for implementation by the end of 2016. Security of the gas pipeline will be high on Turkmenistan President Gurbanguly Berdimukhamedov’s visit to Pakistan which began Wednesday. Berdimuhamedow will also discuss the progress of the multi-billion dollar pipeline with Pakistan Prime Minister Nawaz Sharif. Last week, Turkmen oil and gas ministry said in a statement that preparation for the construction of the linear part of the Turkmen section of TAPI gas pipeline is being completed. The much delayed TAPI gas pipeline project was formally inaugurated on December 13. Security of the project is a major concern, especially in Afghanistan. Earlier this year, members of Helmand provincial council said that the volatile situation in the province could pose a major threat to the implementation of TAPI. However, Daud Shah Saba, Afghan Minister of Mines and Petroleum, told Upper House in Kabul in December that a 7,000-member security force will be raised to guard the gas pipeline project. TurkmenGaz will be the leader of the consortium and shall take 85%. Along with GAIL India, ISGS and Afghan Gas Enterprise (AGE) will also take 5% each. The TAPI pipeline will have a capacity to carry 90mn m³/day.

- 14. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 14 Kenya: Tullow Oil's Cheptuket-1 Block 12A encounters good oil Tullow Oil + NewBase Tullow Oil has announced that the Cheptuket-1 well in Block 12A, Northern Kenya, has encountered good oil shows, seen in cuttings and rotary sidewall cores, across an interval of over 700 metres. Cheptuket-1 is the first well to test the Kerio Valley Basin and was drilled by the PR Marriott Rig- 46 to a final depth of 3,083 metres. The objective of the well was to establish a working petroleum system and test a structural closure in the south-western part of the basin. The strong oil shows encountered in Cheptuket-1 indicate the presence of an active petroleum system with significant oil generation. Post-well analysis is in progress ahead of defining the future exploration programme in the basin. As previously advised, the PR Marriott Rig-46 will now be demobilised. On the back of the encouraging Cheptuket-1 and successful Etom-2 results further exploration activities are being evaluated. Tullow operates Block 12A with 40% equity and is partnered byDelonex Energy with 40% and Africa Oil Corp with 20%. Angus McCoss, Exploration Director, commented today: 'This is the most significant well result to date in Kenya outside the South Lokichar basin. Encountering strong oil shows across such a large interval is very encouraging indeed. I am delighted by this wildcat well result and the team are already working on our follow-up exploration plans for the Kerio Valley Basin.'

- 15. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 15 NewBase 17 March 2016 Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE Oil extends strong gains after supplier meeting agreed Reuters + NewBase Oil futures extended strong gains on Thursday, continuing to gather support after the world's biggest suppliers firmed up plans to meet to discuss an output freeze. Oil producers including Gulf OPEC members support holding talks next month on a deal to keep production at current levels, even if Iran declines to participate, OPEC sources said on Wednesday. A meeting would increase the likelihood of the first global supply deal in 15 years. U.S. crude was up 65 cents at $39.11 a barrel at 0452 GMT, having earlier risen as high as $39.38. The contract settled up $2.12, or 5.8 percent, at $38.46 a barrel on Wednesday, erasing losses from the previous two trading days. Brent crude rose 38 cents to $40.71, after finishing up $1.59, or 4.1 percent, at $40.33 a barrel on Wednesday. "A smaller than expected gain in inventories in the U.S. also supported prices," ANZ said in a morning note. U.S. crude oil stocks rose last week to record highs for a fifth straight week, data from the Energy Information Administration showed on Wednesday. Crude inventories increased 1.3 million Oil price special coverage

- 16. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 16 barrels in the week to March 11 to 523.2 million, a much smaller build than the 3.4 million-barrel increase expected by analysts. The market is also rallying after a less hawkish U.S. monetary outlook, as the U.S. Federal Reserve held interest rates steady and indicated two rate hikes this year instead of the four expected. Qatari oil minister Mohammed Bin Saleh Al-Sada said producers from within and outside the Organization of the Petroleum Exporting Countries (OPEC) will meet in Doha on April 17 to discuss plans for a freeze in output. The initiative was supported by around 15 OPEC and non-OPEC producers, accounting for about 73 percent of global oil production, the minister said. Since the freeze was first proposed last month, prices have recovered about 50 percent from decade-low levels but have been volatile without a firm date for a meeting. Phillip Futures said it remains skeptical that anything more than a production freeze would be agreed. "A production cut at this stage would likely be detrimental to the longer run," Phillip Futures analyst Daniel Ang said in a note. "The need to cut out the more expensive forms of production is necessary, and thus, a premature support in prices could reset what has been done over the past two years."

- 17. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 17 NewBase Special Coverage News Agencies News Release 17 March 2016 With or without Iran, oil producers to meet in April on output deal Reuters - Rania El Gamal and Alex Lawler Oil producers including Gulf OPEC members support holding talks next month on a deal to freeze output even if Iran declines to participate, OPEC sources said. That a meeting could go ahead with or without Iran indicates a shift in the stance of Gulf oil exporters including Saudi Arabia, who had previously maintained that all major producers should participate in any agreement. OPEC and non-OPEC producers will meet in Doha on April 17, Qatari Energy Minister Mohammed bin Saleh Al-Sada said, following a February agreement between Saudi Arabia, Qatar, Venezuela and non-OPEC Russia to stabilise output. "To date, around 15 OPEC and non- OPEC producers, accounting for about 73 percent of global oil output, are supporting this initiative," Sada said in a statement. Qatar holds the OPEC presidency in 2016 and has been organising the effort. Oil prices rose on Wednesday, supported by the announcement and on growing signs of a decline in U.S. crude production. Brent crude was trading above $40 a barrel, up from a 12-year low of $27.10 reached in January. The reluctance of Iran to join an accord while it seeks to boost its oil exports to recover market share after the lifting of Western sanctions has been cited by OPEC sources as a potential roadblock to an agreement. Sources familiar with the matter said the issue was among the factors which caused an earlier plan to hold the producer meeting on March 20 to be dropped. But on Monday, Russian Energy Minister Alexander Novak said after talks in Tehran that a deal could be signed in April and exclude Iran. An exemption for Iran is not a deal breaker, OPEC sources said. "It's a setback but it will not necessarily change the positive atmosphere that has already started," said one OPEC source from a major producer, referring to Iran saying it will not join any freeze accord.

- 18. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 18 Novak was due to call Saudi Oil Minister Ali al-Naimi on Wednesday to brief him on his trip to Tehran, two sources said. A freeze in output would at least stop adding to the excess supply that has caused prices to collapse from levels above $100 a barrel seen in June 2014. OPEC delegates have said that further action including a supply cut could follow by the end of the year, depending on Russia's commitment to the freeze and how much oil Iran adds to the market. HARD TO BACKTRACK A second delegate from the Organization of the Petroleum Exporting Countries said a pact that failed to include Iran was not the worst possible outcome. However, "if the others freeze and the Iranians are outside the agreement, it will not help the market unless the demand is very large", this delegate said. "January output is already at high levels." Backtracking on the deal would risk jeopardising the recent rally in oil prices, other OPEC sources said. "You can't ignore all other oil producers. The meeting is likely to go ahead," a third source said, adding that the April meeting was likely to discuss and finalise details of the deal. "We will not just meet for the sake of meeting." It was unclear whether all 13 OPEC members and which outside producers would attend. Kuwait and the United Arab Emirates have said they would commit to the freeze if other major producers also participated. Novak said Qatar was sending invitations to all OPEC members as well as to some producers outside the organisation. "After it receives confirmations it will be possible to talk about the exact number of participants," Novak said. "Iran said it was ready to take part in this meeting," he added. The willingness of Iraq, the biggest source of OPEC supply growth in 2015, to join the deal is also important. Baghdad on Monday said the freeze initiative was acceptable.

- 19. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 19 Saudi Arabia Said to Join Mid-April Oil Producer Meeting in Doha Bloomberg - Wael Mahdi Saudi Arabia will join a meeting of producers from within and outside OPEC in Doha next month, adding weight to the campaign by financially stricken crude exporters to freeze output and overcome the glut that’s weighing on the market. Qatar’s oil minister said that countries would meet in the nation’s capital Doha on April 17, without providing details of who would attend. While the participation of Iran is seen as critical for the deal to be effective, the meeting may go ahead without the Persian Gulf nation, according to two delegates who asked not to be identified because the talks are private. Saudi Arabia will attend, according to a person with direct knowledge of the kingdom’s oil policy. Prices have rallied more than 30 percent since a mid-February proposal by Saudi Arabia, Russia, Venezuela and Qatar to cap oil output and reduce a worldwide surplus that had seen prices slump to 12-year low in January. The summit in April would seek commitments from a wider range of producers both within and outside the Organization of Petroleum Exporting Countries. Kuwait was the first other OPEC member to confirm it would attend, according to an e-mailed statement from its oil minister. Russian Energy Minister Alexander Novak, speaking to reporters in Moscow, said that 15 countries have confirmed they’ll participate and that Iran is willing to join in. Novak and Saudi Oil Minister Ali al-Naimi planned to discuss the meeting on Wednesday by phone, one person said. Delegates from four OPEC members said they hadn’t yet received an invitation. Latest Date April 17 is the latest and firmest date in a series of suggested times for follow-up talks on the freeze. Nigerian Petroleum Minister Emmanuel Kachikwu said on March 3 that those talks would be held in Russia on March 20. The next day, Russian Energy Minister Novak told state television channel Rossiya 24 that a meeting could take place between March 20 and April 1 in Russia, Doha or Vienna. The proposed freeze “put a floor under oil prices,” Qatari Oil Minister Mohammad Al-Sada said in an e-mailed statement on Wednesday. “To date, around 15 OPEC and non-OPEC producers, accounting for about 73 percent of global oil output, are supporting this initiative.” Oil rallied after the Qatari statement, gaining 4.1 percent Wednesday to settle at $40.33 a barrel in London. Iran Increase There are reasons to be doubtful that the planned freeze can radically alter an oil market that’s fallen victim to a global fight for market share, causing stockpiles to rise to a record. Most significantly, Iran is seeking to increase production after the end of economic sanctions and has said it won’t participate in any accord until its output has recovered. Iran boosted output by 187,800 barrels a day to 3.13 million a day in February, the biggest monthly gain since 1997, OPEC said in a report on Monday.

- 20. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 20 Brazil will also add more than 100,000 barrels of supply this year and has shown little interest in taking part. “We will now see if OPEC and Russia are able to freeze the bears in the oil market,” said Olivier Jakob, managing director at consultants Petromatrix GmbH. “The significance of the agreement is that it could remove the perception that OPEC is fighting for market share.” Other forces have driven prices higher in recent weeks. Outages from Iraq and Nigeria have disrupted more than 800,000 barrels a day of supply and tightened the Brent market, according to Citigroup Inc. And falling drilling activity in the U.S. shale industry has seen analysts raise forecasts for declines in North American production. One key question is how fast shale production could come back if OPEC and some non-OPEC producers succeed in driving prices higher. Oil ministers for Argentina, Venezuela and Colombia didn’t immediately respond to questions on whether they would attend. Ecuador’s oil minister said he still plans to gather Latin American producers before the April 17, after a planned meeting earlier this month was postponed. “It’s not surprising they’d be willing to agree to this because the outlook for a further production increase was quite limited,” Jeff Currie, global head of commodities research at Goldman Sachs Group Inc., said in an interview on Bloomberg Television. “You can’t operate a cartel the way you used to.”

- 21. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 21 NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE Your partner in Energy Services NewBase energy news is produced daily (Sunday to Thursday) and sponsored by Hawk Energy Service – Dubai, UAE. For additional free subscription emails please contact Hawk Energy Khaled Malallah Al Awadi, Energy Consultant MS & BS Mechanical Engineering (HON), USA Emarat member since 1990 ASME member since 1995 Hawk Energy member 2010 Mobile: +97150-4822502 khdmohd@hawkenergy.net khdmohd@hotmail.com Khaled Al Awadi is a UAE National with a total of 25 years of experience in the Oil & Gas sector. Currently working as Technical Affairs Specialist for Emirates General Petroleum Corp. “Emarat“ with external voluntary Energy consultation for the GCC area via Hawk Energy Service as a UAE operations base , Most of the experience were spent as the Gas Operations Manager in Emarat , responsible for Emarat Gas Pipeline Network Facility & gas compressor stations . Through the years, he has developed great experiences in the designing & constructing of gas pipelines, gas metering & regulating stations and in the engineering of supply routes. Many years were spent drafting, & compiling gas transportation, operation & maintenance agreements along with many MOUs for the local authorities. He has become a reference for many of the Oil & Gas Conferences held in the UAE and Energy program broadcasted internationally, via GCC leading satellite Channels. NewBase : For discussion or further details on the news above you may contact us on +971504822502 , Dubai , UAE NewBase 17 March 2016 K. Al Awadi

- 22. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 22