More Related Content Similar to New base energy news 17 febuary 2019 issue no 1231 by khaled al awadi (20) More from Khaled Al Awadi (20) 1. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 1

NewBase Energy News 17 February 2019 - Issue No. 1231 Senior Editor Eng. Khaled Al Awadi

NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE

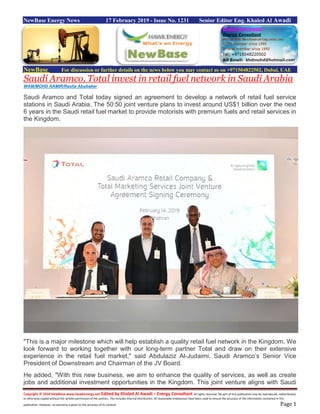

Saudi Aramco, Total invest in retail fuel network in Saudi Arabia

WAM/MOHD AAMIR/Rasha Abubaker

Saudi Aramco and Total today signed an agreement to develop a network of retail fuel service

stations in Saudi Arabia. The 50:50 joint venture plans to invest around US$1 billion over the next

6 years in the Saudi retail fuel market to provide motorists with premium fuels and retail services in

the Kingdom.

"This is a major milestone which will help establish a quality retail fuel network in the Kingdom. We

look forward to working together with our long-term partner Total and draw on their extensive

experience in the retail fuel market," said Abdulaziz Al-Judaimi, Saudi Aramco’s Senior Vice

President of Downstream and Chairman of the JV Board.

He added, "With this new business, we aim to enhance the quality of services, as well as create

jobs and additional investment opportunities in the Kingdom. This joint venture aligns with Saudi

2. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 2

Vision 2030 and supports the goals of the Infrastructure and Transportation Initiative under the

Quality of Life programme, and the project is designed to also help optimise the total value of our

hydrocarbon resources."

Momar Nguer, President of Marketing and Services and Executive Committee Member at Total,

said, "Total is proud to be the first international major oil company to invest in Saudi Arabia’s fuel

retail network. This joint agreement is in line with our strategy to expand in fast-growing markets

worldwide. This new agreement is also reaffirming our long-term partnership with Saudi Aramco.

Following our joint investments in SATORP refining and petrochemical complex, we are pleased to

bring to the Saudi market our expertise and customer-minded approach in retail and contribute to

local employment development."

According to a joint press release sent to WAM, the two companies have also signed an agreement

with the owners of Tas’helat Marketing Company, TMC, and Sahel Transport Company, STC, to

acquire TMC and STC, thereby jointly acquiring their existing network of 270 service stations and

their fuel tanker fleet. Saudi Aramco and Total plan to modernise this network and build high-quality

service stations at selected locations. This transaction is subject to approval of regulatory

authorities.

The venture will take a phased approach to expanding its network of domestic fuel retail stations,

with a plan to reach the goal of owning and operating hundreds of stations by 2021.

3. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 3

Egypt plugs hub status as Shell, Eni, Exxon win energy concessions

Reuters + NewBase

Royal Dutch Shell, Eni, BP and Exxon Mobil were among the winners in one of Egypt’s largest ever

oil and gas exploration tenders on Tuesday, as the country looks to sustain an investment upswing

spurred by major discoveries.

The awards marked Exxon Mobil’s entry into gas exploration in Egypt, while Shell was handed the

most concessions, three for oil and two for gas, at an annual petroleum show that Egypt has used

to promote itself as a hub for gas production and trading in the Eastern Mediterranean.

Egypt expects investments of at least $750 million to $800 million in the first stage of exploration in

the total of 12 concessions announced, Petroleum Minister Tarek El Molla said.

The Egyptian Natural Gas Holding Corporation’s bid round, which was the largest in its history,

included border areas in the Mediterranean Sea as well as land areas in the Nile Delta.

Five gas exploration concessions were

awarded - in which 20 wells will be drilled

- to Shell, Exxon, Petronas, BP, DEA

and Eni, the head of Egypt’s state gas

board said.

Egyptian General Petroleum

Corporation’s (EGPC) tender meanwhile

included areas in the Western Desert,

the Nile Valley, the Gulf of Suez and the

Eastern Desert.

Neptune Energy, Merlon, Shell, Eni and state-controlled EGPC were awarded seven oil exploration

concessions in total in which 39 wells will be drilled, Egypt’s petroleum ministry said.

4. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 4

BOOSTING INVESTMENT

Eni’s discovery of the giant Zohr field in 2015, the largest in the Mediterranean and estimated to

hold about 30 trillion cubic feet of gas, has raised interest in exploration in Egypt. The country has

reached maritime demarcation agreements with several countries in the region in its push over

recent years toward increased oil and gas exploration.

Executives at the forum, which

was attended by the CEOs of

companies including BP and

Shell, said Egypt’s advantages

as a hub include well-developed

infrastructure, established

industry expertise, strong local

demand, and the country’s

strategic location between

Europe and Asia, allowing it to

send gas west or east

depending on markets.

They are also encouraged by

Europe’s desire to diversify gas

supplies and find alternative

suppliers to Russia, and to

reduce carbon emissions. Egypt

hopes to tap long underutilized

liquefaction plants, where gas is

turned into LNG, to export

supplies across the

Mediterranean along with that of

its neighbors, including Israel,

which said it would pipe gas to

Egypt later this year.

“I think we’re starting to see much more robustness for this concept,” said Gasser Hanter, Shell’s

country chairman, in reference to the concept of Egypt as an emerging hub.

“You’re seeing the intergovernmental agreements being sorted out, you’re seeing the deregulation

of the gas market, a lot of confidence in the economy, in Egypt, that is boosting the investment in

the upstream.”

However, executives also said longer-term challenges include geopolitical tensions in the Eastern

Mediterranean, the need to further develop infrastructure, and competition from other suppliers

including Russia and the United States.

5. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 5

Egypt: Egas awards exploration in Nile Delta to Germany DEA

Egas + DEA + NewBase

The Egyptian Natural Gas Holding Company (Egas) has awarded one new exploration licence in

onshore Nile Delta to Germany’s DEA, an international oil and gas company, in its 2018 Bid Round.

The East Damanhour exploration block (originally offered as Block 10) is covering 1,418 sq km and

is located west of the Disouq development leases, where DEA is the operator with a licence share

of 100 per cent.

“We are pleased with the award of this licence, which is in line with our ambition to strengthen our

business in Egypt,” says Sameh Sabry, DEA’s general manager in Egypt. “The block is located in

DEA’s core region in the Onshore Nile Delta, where we

successfully explore the Messinian and Pliocene plays as

operator since 2004.

The extensive knowledge and experience we gained over

the years, the right set of skilled experts and our nearby

infrastructure will offer us very good conditions to continue

this exploration efficiently.”

“The proximity of DEA’s Disouq central processing plant

and infrastructure provides us with an operational edge,

which would enable accelerated development of any

discovered volumes as well as considerable synergies

and cost optimizations. In addition, the block offers

significant potential in pre-Messinian structures, which is

in line with our ambition to further grow in Egypt,” said

Sameh Sabry.

DEA is planning to drill 5 to 7 exploration wells in Block 10 during the first exploration phase of three

years.

6. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 6

DEA has already been operating in Egypt since as early as 1974. Within

these more than 40 years to date, DEA and its partner companies have invested

more than three billion dollars in the region. The crude oil fields of Ras Budran,

Ras Fanar and Zeit Bay in the Gulf of Suez were successfully developed, with

more than 650 million barrels of crude already being produced in over 30 years.

Exploring the Nile Delta

In 2013, DEA started production from the Disouq gas development project in the

onshore Nile Delta.

DEA is partner in the West Nile Deltaproject, in which production from two out of a

total of five fields commenced in March 2017, Taurus and Libra. West Nile Delta is

one of the largest projects of the DEA company history and of significant importance

for the country Egypt, in terms of secured supply of natural gas.

7. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 7

Morocco: capping fuel price despite regulator's disapproval

REUTERS/Marco Bello - By Ahmed Eljechtimi, Reuters News

Morocco's planned fuel price cap would still take place despite criticism from the competition

regulator, governance minister Lahcen Daoudi said on Friday. The head of the competition council

said earlier that controlling fuel prices would not be in the best interests of consumers or the

economy and that boosting local storage capacity and competition in the sector were better options

to put downward pressure on prices.

Calls to limit the profit margins of fuel distribution companies were triggered during a consumer

boycott campaign last year, which took aim at big business including Morocco’s largest fuel

company owned by agriculture minister Aziz Akhannouch.

"The council focused on the disadvantages of capping but omitted the merits," Daoudi said in a video on

EcoActu news website, having waited for the council's opinion before setting the price caps. "Setting the

price of fuel will be inappropriate and inefficient to preserve the interests of the Moroccan consumer and the

economy," the head of the competition council, Driss Guerraoui told reporters earlier.

Capping would only have a limited impact and would not take into consideration wider factors affecting prices,

including volatility in international markets, he said. Backtracking on the liberalisation of fuel prices, in force

since 2015, "risks sending a bad signal to the market and investors," he went on to say.

Morocco imports 93 percent of its refined oil needs after the shutdown in 2015 of its sole refinery Samir over

unpaid taxes, a factor that has contributed to an increase in its energy import bill to 82.3 billion dirhams in

2018 from 69.5 billion in 2017.

Guerraoui criticised the government for launching a "badly prepared liberalisation" of fuel prices and

lambasted fuel companies for lacking transparency. Only two companies listed on the stock market reveal

their profits while the rest are not obliged to do so, making it hard to ascertain profit margins.

Twenty fuel distribution companies operate in Morocco of which 7 control 70 percent of the market with only

3 companies controlling 53 percent, Guerraoui said. "It is not the competition council's job to give lessons to

the government," the minister said.

8. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 8

UK: Orsted's huge offshore wind farm produces first power

CNBC - Anmar Frangoul

When completed, the Hornsea One offshore wind farm will be almost double the size of Walney

Extension, which is currently the world's biggest. The Hornsea One site will be made up of 174, 7-

megawatt turbines from Siemens Gamesa.

The first turbine at Hornsea One, an offshore wind farm situated 120 kilometers off the coast of

Yorkshire, has started to generate power.

In an announcement Friday, Danish renewable energy firm Orsted said that, when fully operational,

the Hornsea One offshore wind farm would be almost double the size of Walney Extension, which

is currently the world's biggest.

The Hornsea One site will be made up of 174, 7-megawatt turbines from Siemens Gamesa. It is a

joint venture between Orsted and Global Infrastructure Partners.

Turbine installation for Hornsea One is set to continue until "late summer 2019", according to Orsted.

The wind farm will have a capacity of 1.2 gigawatts and will be able to power more than one million

homes in the U.K.

"Hornsea One is the first of a new generation

of offshore power plants that now rival the

capacity of traditional fossil fuel power

stations," Matthew Wright, Orsted's U.K.

Managing Director, said in a statement. "The

ability to generate clean electricity offshore at

this scale is a globally significant milestone,

at a time when urgent action needs to be

taken to tackle climate change."

In other wind energy news Friday, Norway's

Equinor announced that it had signed a

memorandum of understanding with Korea National Oil Corporation to jointly explore opportunities

to "develop commercial floating offshore wind in South Korea."

Equinor operates Hywind Scotland, the world's "first full-scale commercial floating offshore wind

farm." Located off the coast of Scotland, the facility has a capacity of 30-megawatts and can produce

enough power for around 20,000 homes.

9. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 9

NewBase 17 February 2019 Khaled Al Awadi

NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE

Oil rises over 2 percent to 2019 highs on tightening supplies

Reuters + Bloomberg + NewBase

Oil prices rose more than 2 percent to their highest this year on Friday after an outage at Saudi

Arabia’s offshore oilfield boosted expectations for tightening supply, while progressing U.S.-Sino

trade talks strengthened demand sentiment.

The international Brent crude benchmark rose $1.68, or 2.6 percent, to settle at $66.25 a barrel, its

highest since November. U.S. West Texas Intermediate crude futures settled up $1.18, or 2.2

percent, at $55.59 a barrel, and hit their highest this year in post-settlement trade at $55.80.

For the week, Brent ended more than 6 percent higher and WTI gained more than 5 percent, partly

on tightening supplies since the Organization of the Petroleum Exporting Countries and its allies led

by Russia started voluntary production cuts last month.

Oil price special

coverage

10. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 10

The partial closure of Saudi Arabia’s Safaniya, the world’s largest offshore oilfield, occurred about

two weeks ago, a source said on Friday. Safaniya has production capacity of more than 1 million

barrels per day. It was not immediately clear when the field would return to full capacity.

“It’s another factor that is raising concerns about the availability of crude,” said Phil Flynn, analyst

at Price Futures Group in Chicago. “All of a sudden you don’t have to worry just about OPEC cuts.

Now you have a problem with Saudi Arabia’s ability to actually produce as much oil.”

Leading OPEC producer Saudi Arabia said on Tuesday it would cut an additional half a million bpd

in March more than it previously pledged.

Supply has also been curbed by U.S. sanctions on Venezuelan and Iranian crude and reduced

Libyan output because of civil unrest. Security threats could threaten Nigerian production after

general elections this weekend.

Growing confidence that the United States and China will resolve their ongoing trade dispute also

supported prices. Those talks will restart next week in Washington, with both sides saying this

week’s negotiations in Beijing showed progress.

“Optimism surrounding a potential trade deal has really been the big issue here in the United States

the last couple days,” said Bob Yawger, director of energy futures at Mizuho.

However, prices pared gains after a report showed U.S. energy firms this week increased the

number of oil rigs operating for a second week in a row due to concerns that crude supplies will

swamp global demand as U.S. output keeps growing from record levels.

U.S. oil drillers added three oil rigs this week, General Electric Co’s Baker Hughes energy services

firm said..

U.S. drillers add oil rigs for second week in a row: Baker Hughes

U.S. energy firms this week increased the number of oil rigs operating for a second week in a row

amid concerns that crude supplies will swamp global demand as U.S. output keeps growing from

record levels.

Companies added three oil rigs in the

week to Feb. 15, bringing the total

count to 857, General Electric Co’s

Baker Hughes energy services firm

said in its closely followed report on

Friday.

The U.S. rig count, an early indicator

of future output, is still higher than a

year ago when 798 rigs were active

after energy companies boosted

spending in 2018 to capture higher prices that year.

Thanks to a shale boom, the United States became the world’s top crude producer last year and

record output is expected to rise 1.5 million barrels per day (bpd) to 12.4 million bpd this year, the

U.S. Energy Information Administration said in a monthly forecast on Tuesday.

The International Energy Agency warned in its monthly report this week that the global oil market

will struggle this year to absorb fast-growing crude supply from outside the Organization of the

Petroleum Exporting Countries, highlighting U.S. output growth.

11. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 11

However, U.S. drillers have removed on average of 28 rigs this year so far as a lack of pipeline

capacity in the Permian basin, the largest U.S. oil shale field, landlocked some output and as

investors pushed producers to reduce spending and boost shareholder returns.

The price of crude in the Permian of West Texas and New Mexico fell sharply last year, selling as

much as $18 below U.S. benchmark prices. More than half the total U.S. oil rigs are in the Permian

where active units fell by five this week to 473, the lowest since June.

Pioneer Natural Resources Co, one of the Permian’s largest producers, said this week it plans to

reduce 2019 capital expenditures by 11 percent, or about $350 million, slowing its production

growth. U.S. crude futures were trading around $55 a barrel on Friday, up about 5 percent for the

week as OPEC-led production cuts encouraged investors.

Looking ahead, crude futures were trading around $57 a barrel for the balance of 2019 and calendar

2020. The EIA projected West Texas Intermediate spot crude would average $54.79 in 2019 and

$58.00 in 2020, down from an average of $65.06 in 2018.

U.S. financial services firm Cowen & Co said this week that early indications from the exploration

and production (E&P) companies it tracks point to a 3 percent decline in capital expenditures for

drilling and completions in 2019. In total, Cowen said those E&P companies spent about $93.1

billion in 2018. There were 1,051 oil and natural gas rigs active in the United States this week,

according to Baker Hughes. Most rigs produce both oil and gas.

Soaring U.S. Crude Oil Production Highlights OPEC's Quandary

U.S. crude output is accelerating, highlighting OPEC’s dilemma as the cartel reins in its own

production to revive prices.

Crude supply will average 12.41 million barrels a day this year and 13.2 million in 2020, the U.S.

Energy Information Administration said on Tuesday, up more than 300,000 barrels a day from the

previous month’s estimates. The latest short-term energy outlook “puts the nation on track to set a

new production record for a third consecutive year,” EIA Administrator Linda Capuano said in a

statement.

Soaring output is putting the U.S. on course to become a net exporter of crude oil and petroleum

products next year. It’s also forcing OPEC to scale back estimates of how much crude the group

needs to pump this year as the demand outlook softens.

12. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 12

“Every report of any kind for the U.S. is basically adding barrels to the flow,” said Bob Yawger,

director of futures at Mizuho Securities USA Inc. in New York. “If you accommodate them by leaving

the door open, they’re going to stick a foot in the door and steal your customer.”

OPEC’s Vienna-based research department reduced its estimates for the average amount of crude

the world requires from the group this year by 240,000 barrels a day to 30.59 million. Forecasts for

non-OPEC supply were lifted by an improved outlook for the Gulf of Mexico, while projections for

global demand were lowered as a result of weakness in Europe and the Americas.

The EIA reduced its forecasts for both Brent and West Texas Intermediate oil benchmarks by $3 a

barrel for 2020. “Despite many uncertainties, EIA believes strong growth in global oil production will

put downward pressure on prices,” Capuano said.

Oil Rises as Saudi, Venezuela Supply Cuts Eclipse Boom in U.S

Oil climbed for a second day as dwindling shipments from two of the world’s biggest crude exporters

eclipsed another big jump in U.S. supplies.

Futures in New York closed up 1.5 percent, reaching the highest point in a week. The rally came as

the International Energy Agency warned that turmoil in Venezuela could disrupt global flows of

heavy crude and after Saudi Arabia said it would extend its own cuts. A U.S. Energy Department

report showed higher-than-expected domestic inventories but plummeting imports.

The inventories increase was “kind of shocking," said Phil Streible, senior market strategist at RJO

Futures in Chicago. “But the import data was much lower than expected. so eventually, we are going

to burn off some of that excess."

Oil has advanced around 19 percent this year as the OPEC+ alliance of producers cut output, but

the rally has sputtered in February amid record U.S. shale drilling. In another bullish sign this week,

President Donald Trump struck a conciliatory tone on trade talks with China, suggesting higher

tariffs might be averted.

13. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 13

NewBase Special Coverage

News Agencies News Release 15 February 2019

It’s All Going Wrong Again for OPEC: Oil Strategy

Big oil agencies cut estimates for how much OPEC crude the world will need. Demand growth ebbs

and U.S. producers are going from strength to strength. By - Julian Lee

Even as oil producing states in OPEC and beyond begin implementing the output cuts they agreed

in December, the world’s need for their crude is shrinking further, suggesting that they will need to

extend the deal through the second half of the year.

The latest forecasts from supply-and-demand studies of the oil industry’s most-

watched organizations – the International Energy Agency, the U.S. Energy Information

Administration, and the Organization of Petroleum Exporting Countries itself – show the need for

OPEC crude diminishing as demand forecasts are trimmed and U.S. supply outlooks are increased.

The industry’s three main agencies are unanimous in reducing their assessments of the volume of

oil the world will need from OPEC countries this year compared with what they were forecasting last

month. The average level of the reduction from the January forecast is 300,000 barrels a day, that’s

about the combined production of OPEC’s two smallest members Equatorial Guinea and Gabon.

Shrinking Market

Assessments of the world's need for OPEC crude in 2019 have been cut by around 300,000 barrels

a day from last month's forecasts

Source: Bloomberg, IEA, EIA, OPEC

Note: Month on month change in the world's need for OPEC crude, calculated as global demand

minus non-OPEC supply, minus OPEC NGLs production Note: The big drops in January reflect

Qatar's departure from OPEC

14. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 14

Of greater concern for producers, two of the three agencies see the world needing less OPEC crude

in the second half of the year than the first. Only the IEA currently sees the demand increasing as

the year progresses.

The differences aren’t big, the EIA and OPEC see the need for OPEC oil falling by another 50,000-

60,000 barrels a day in the second half compared with the first. The IEA sees a similar sized shift

in the opposite direction. None of the agencies sees the need for the group’s crude rising enough

to allow them to end their current supply management deal.

What has driven the fall in the need for OPEC crude? A mixture of lower demand growth projections

and higher non-OPEC supply, in particular from the U.S.

Demand Growth Trimmed

Oil demand growth forecasts for 2019 have been trimmed by all three agencies

Source: Bloomberg, IEA, EIA, OPEC

Note: Year-on-year change in global oil demand: 2019 vs 2018

The IEA’s Executive Director Fatih Birol said in a Bloomberg television interview Tuesday that

it’s too early to make a definite judgment whether a slower global economy means the agency

should revise its oil demand growth forecasts lower.

Nonetheless, the following morning it trimmed that forecast by 60,000 barrels a day. It now sees

global oil demand rising by 1.37 million barrels a day on average in 2019 compared with 2018. That

is the smallest increase it has forecast since October.

15. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 15

Non-OPEC Supply

All three agencies raised their forecasts of non-OPEC oil output growth in 2019

Source: Bloomberg, IEA, EIA, OPEC

Note: Year-on-year change in non-OPEC production: 2019 vs 2018

OPEC producers can’t expect any help from their non-OPEC counterparts — at least not from those

outside the group of ten countries that have joined them in the attempt to rebalance oil supply and

demand. The EIA raised its forecast of 2019 U.S. oil production by 340,000 barrels a day, with more

than a third of that coming from the Gulf of Mexico and the increase heavily skewed to the second

half of the year.

Sorry OPEC

The EIA raised its forecast of 2019 U.S. oil production by 340,000 barrels a day

Source: Bloomberg, EIA

The IEA and OPEC may have some catching up to do on their U.S. production outlooks. The IEA increased

its forecast of 2019 U.S. oil production by 250,000 barrels a day compared with what it foresaw a month ago.

OPEC also raised its forecast, but by a much smaller 94,000 barrels. If those two agencies follow the leads

of the EIA, it will undermine further the need for OPEC oil in next month’s forecasts.

An OPEC+ output deal that was originally meant to rebalance oil supply and demand in six months is now set to last

five times as long as initially planned. The dwindling demand for OPEC oil seen by the three major forecasting agencies

suggests it may need to be extended yet again. *This story will keep track of the big oil agencies’ supply, demand and

balances figures on an on-going basis.

16. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 16

NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE

The Editor :”Khaled Al Awadi” Your partner in Energy Services

NewBase energy news is produced daily (Sunday to Thursday) and

sponsored by Hawk Energy Service – Dubai, UAE.

For additional free subscription emails please contact Hawk

Energy

Khaled Malallah Al Awadi,

Energy Consultant

MS & BS Mechanical Engineering (HON), USA

Emarat member since 1990

ASME member since 1995

Hawk Energy member 2010

Mobile: +97150-4822502

khdmohd@hawkenergy.net

khdmohd@hotmail.com

Khaled Al Awadi is a UAE National with a total of 28 years of experience in

the Oil & Gas sector. Currently working as Technical Affairs Specialist for

Emirates General Petroleum Corp. “Emarat“ with external voluntary Energy

consultation for the GCC area via Hawk Energy Service as a UAE operations

base , Most of the experience were spent as the Gas Operations Manager in

Emarat , responsible for Emarat Gas Pipeline Network Facility & gas

compressor stations . Through the years, he has developed great experiences

in the designing & constructing of gas pipelines, gas metering & regulating

stations and in the engineering of supply routes. Many years were spent drafting, & compiling gas

transportation, operation & maintenance agreements along with many MOUs for the local

authorities. He has become a reference for many of the Oil & Gas Conferences held in the UAE

and Energy program broadcasted internationally, via GCC leading satellite Channels.

NewBase : For discussion or further details on the news above you may contact us on +971504822502 , Dubai , UAE

NewBase Feb. 2019 K. Al Awadi

17. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 17

18. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 18