New base 534 special 05 february 2015

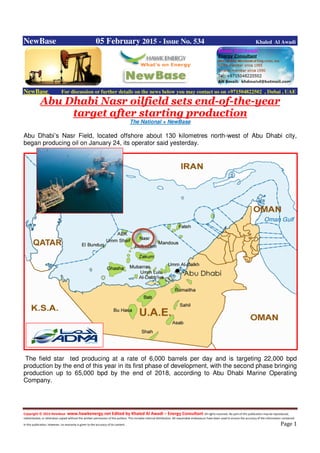

- 1. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 1 NewBase 05 February 2015 - Issue No. 534 Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE Abu Dhabi Nasr oilfield sets end-of-the-year target after starting production The National + NewBase Abu Dhabi’s Nasr Field, located offshore about 130 kilometres north-west of Abu Dhabi city, began producing oil on January 24, its operator said yesterday. The field star ted producing at a rate of 6,000 barrels per day and is targeting 22,000 bpd production by the end of this year in its first phase of development, with the second phase bringing production up to 65,000 bpd by the end of 2018, according to Abu Dhabi Marine Operating Company.

- 2. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 2 The Nasr field is part of Adma-Opco’s programme to add an extra 300,000 bpd capacity to Abu Dhabi’s overall production levels, which itself is part of the emirate’s broader strategy to raise production capacity from a current level of about 3 million bpd to 3.5 million bpd by 2017-18. Last October, Adma-Opco said the first oil began flowing from Umm Lulu, another of the major offshore field developments. It began flowing at a rate of 5,000 bpd and is expected to reach 22,000 bpd by the end of this year and its full field development rate of 105,000 bpd by 2018. In November, Adma-Opco signed three major contracts worth US$3 billion for the second phase of Nasr’s development, with Abu Dhabi’s National Petroleum Construction Company, Hyundai Heavy Industries of South Korea and France’s Technip of France. The Adma concession covers four shallow water offshore oilfields: Lower Zakum, Umm Shaif, Umm Lulu and Nasr. Adma-Opco is 60 per cent owned by Abu Dhabi National Oil Company, with BP holding 14.67 per cent, Total 13.33 per cent and Japan Oil Development Company 12 per cent.

- 3. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 3 Gasco awards Spain’s Tecnicas $700m gas contract The National + NewBase Abu Dhabi Gas Industries, known as Gasco, said yesterday that it had awarded a US$700 million contract to Spain’s Tecnicas Reunidas for a major natural gas expansion project aimed at alleviating the emirate’s gas shortage. The contract is for “package 3” of the huge Integrated Gas Development (IGD) expansion project, which aims to yield 400 million cubic feet of gas from Abu Dhabi National Oil Company’s offshore oilfields by 2017. The extra supply is badly needed to meet domestic demand, which has been growing at a rate of 15 per cent a year and has required the country to import gas in recent years. Gasco said the new contract is the fourth to be awarded to the Spanish firm in Abu Dhabi. “TR has successfully completed a project for the petrochemical complex of Borouge, the Sahil and Shah Field Development project, and it is just starting up the Shah Gas Gathering Centre,” Gasco said in a statement. The project consists of several gas processing units, gas pipelines, condensate pipelines and all required interconnections. It is part of the broader IGD project, led by the Abu Dhabi national energy companies Gasco, Adgas, and Adnoc. Gasco completed the initial US$11 billion IGD project in 2013, facilitating the transfer of 1 billion cubic feet a day (cfd) of high-pressure gas from the offshore Umm Shaif field via Das Island to onshore processing facilities at Habshan and Ruwais. Shell, Total, and Partex also are partners in the IGD. The $10bn Shah project, another of the emirate’s projects to add new gas, began producing gas at the end of last year. Adnoc and partner Occidental Petroleum are bringing Shah’s difficult-to- process “sour” (heavy in hydrogen sulphide) gas to market. Adnoc and Shell are also developing the Bab field’s sour gas.

- 4. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 4 Saudia: Yasref Refinery To Load First Gasoline Cargoes By Reuters + NewBase The Yasref refinery in Saudi Arabia, a joint venture between Saudi Aramco and China’s Sinopec, will load its first gasoline cargoes later this week, according to traders and shipping fixtures. On Feb. 6, the 400,000 barrels per day (bpd) refinery, which has already shipped its first diesel cargoes, will load a 60,000 tonne cargo of gasoline on the Serengeti, a panamax tanker booked by Total’s shipping arm.The cargo will go to Fujairah, rather than Asia, as some traders originally expected. Total has also nominated the panamax Constantinos for another 60,000 tonne gasoline cargo to load at Yanbu on Feb. 10. This is also likely to stay within the Middle East, according to the fixture’s destination. “I think they want to keep some of the barrels within Saudi so will move it from Yanbu to other ports such as Ras Tanura. It’s a long way to go and it’s easier than trucking it,” one trader said. European-based traders and refiners are anxiously monitoring exports from the Yasref refinery as the new capacity will erode their market share. Mediterranean refiners in particular are thought likely to be vulnerable to a ramp up in exports from the Middle East. “It would eventually put pressure on the Med as we export from Europe to the Red Sea,” a trader said. The refinery is expected to reach full capacity in mid-February.

- 5. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 5 Mauritania: Chevron buys stake off Mauritania Chevron Chevron’s subsidiary Chevron Mauritania Exploration Limited has reached an agreement to acquire a 30 percent non-operated working interest in Blocks C8, C12 and C13 offshore Mauritania from Kosmos Energy. According to Chevron, the transaction is subject to the approval of Mauritania’s government. Blocks C8, C12 and C13 cover a contiguous area of approximately 6.6 million gross acres in water depths ranging between 5,249 feet (1,600 meters) and 9,842 feet (3,000 meters). Under the agreement, Kosmos Energy retains a 60 percent interest and remains the operator. Société Mauritanienne des Hydrocarbures et de Patrimoine Minier (SMHPM), Mauritania’s national oil company, will continue to have a 10 percent interest. Following any commercial discovery after the exploration phase, Chevron will become the operator maintaining a 30 percent working interest. Andrew G. Inglis, Kosmos Energy chairman and chief executive officer, said: “This agreement with Chevron validates the quality and scale of our Mauritania licenses, which enabled us to successfully farm out the acreage despite the current environment. The terms are consistent with our business strategy of retaining operatorship through exploration and collaborating with industry leading partners who bring significant technical expertise and strong financial capabilities.”

- 6. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 6 Kenya:Taipan Resources,update on Badada-1 well in Block 2B Source: Taipan Resources Taipan Resources, through its Kenya-based subsidiary Lion Petroleum,has provided an update on drilling operations for the Badada-1 well, Block-2B, onshore Kenya. The Badada-1 well commenced drilling operations at 14:00 GMT on 7 January 2015 and has been drilled to a total depth of 1,647 metres MDBRT (Measured Depth Below the Rotary Table). A 13 3/8- inch casing has been successfully run to 1,644 metres MDBRT and cemented in the 17 1/2-inch hole and the well is currently preparing to drill ahead with the 12 1/4 -inch hole section to the next casing point which is expected to be at TD. The well is planned to be drilled to a total depth of between 3,000 and 4,000 metres in order to test primary targets in Tertiary age reservoirs. The well is expected to take up to 70 days from spud to completion. The Company will provide further operational updates as the Badada-1 well progresses. A comprehensive update will also be provided once operations on the Badada-1 well have been fully completed and analysed. Taipan estimates gross mean un-risked recoverable resources of 251 mmboe (Source: Sproule International Limited (1), February 2014) for Badada. (1) Sproule completed an updated independent assessment of the company's prospective resources on block 2B with an effective date of Dec. 31, 2013. The independent assessment was carried out in accordance with the standards established by the Canadian Securities Administrators in National Instrument 51-101 -- Standards of Disclosure for Oil and Gas Activities. Taipan operates and holds a 30% working interest in Block 2B (1.35 million acres / 5,464 km2) and a 20% working interest in Block 1 (5.497 million acres / 22,246 km2) which is operated by East Africa Exploration (Kenya) Ltd, a subsidiary of Afren plc.

- 7. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 7 China's Chongqing Plans to Have Shale Gas Production Capacity of 30 Bcm by 2020 NaturalGasasia + NewBase China's Chongqing municipal government last week announced plans to build shale gas production capacity of 30 billion cubic meters (bcm) by 2020 with an annual output of 20 bcm. According to the plan, the city will implement strategies for vertical integration in the shale gas industry. It intends to invest in exploration and development, equipment manufacturing and cluster development to create shale gas development zone. Chongqing has been at the forefront of China’s shale gas industry. In July last year, Sinopec’s Fuling field in Chongqing was verified by Chinese government as country’s largest shale gas play. China’s Ministry of Land and Resources verified proven reserves of nearly 107 billion cubic metres (bcm) in the Fuling shale gas field. In October, Sinopec said that cumulative output from its Fuling shale gas project crossed 1 bcm. The government expects country’s shale gas output to hit 6.5 bcm this year.

- 8. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 8 Oil Price Drop Special Coverage CEO of Total sees oil price at $60/b this year Reuters + NewBase Oil prices are likely to remain relatively low until the summer, the chief executive of Total was quoted as saying on Wednesday, leading the French oil major to assume an average price of $60 a barrel this year. Talking to the privately Saudi-owned Al-Hayat newspaper on the crude oil price outlook, Patrick Pouyanne said: "I see it as relatively low until summer, but it is hard to predict after that. When we see the history of the crude cycles, we notice that prices fall hard and quick then rise back usually within 18 months. "Because we are cautious we have adopted a price of $60 a barrel for this year and this is more of a prediction," he was quoted saying. Pouyanne said that despite the fall in oil prices the company would still maintain investments in its big projects. Total has said it plans to reduce capital spending by 10 percent this year. "We are looking to adapt with the current prices and we have said that we would reduce our investments program by 10 percent, but despite that we will invest this year between $23 and $24 billion," he told the daily. "The adaptation happened in the US shale gas projects where we mainly drill. We can stop for a year if we wanted and redrill later. But it is not feasible with the current prices for oil and gas." On Total's losses from the fall in oil prices, Al-Hayat quoted him as saying: "We lose $2 billion for every $10 drop." Brent was 17 cents lower at $57.74 a barrel by 0742 GMT, after gaining almost 6 per cent on Tuesday and off a near six-year low of $45.19 reached in mid-January. Oil prices may stay depressed until the summer due to weak seasonal demand, even as the strategy of curbing the output growth of rival producers might have started achieving results, OPEC delegates told Reuters this week. Does oil's rally put rebalancing at risk? Kemp Reuters + NewBase Brent crude prices rose almost 18 percent between Friday and Tuesday, despite the absence of real news, which should convince even the most ardent believers in market efficiency that oil trading is noisy and inefficient at processing new information. The 8 percent surge late on Friday was only the third time in five years prices have jumped by three standard deviations in a single day. The March 2015 Brent futures contract gained substantially more on Monday and Tuesday. ()

- 9. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 9 The oil research team at Morgan Stanley has written that the three-day rally is putting at risk a more sustainable recovery later in the year. "U.S. production needs to slow sharply to balance the (global) market, which requires low prices," they wrote in a thoughtful note published on Tuesday ("Crude oil: putting recovery at risk"). "For a more meaningful recovery, demand needs to exceed supply to work off any inventory overhang that develops," they concluded. Premature price increases simply hamper the rebalancing. REAL NEWS AND NOISE The beginning of the rally coincided with the release of data from Baker Hughes showing an unexpectedly large fall in the number of rigs drilling for oil in the United States last week. The decline, although larger than anticipated, was not really news. The number of active rigs had been falling steadily for the previous seven weeks, so the trend was well understood. The size of the move was wholly unrelated to the significance of the information that triggered it. Instead, the rig news sparked a classic short-covering rally, as hedge funds with significant positions betting on a further price fall found themselves losing money as oil rose, and rushed to reduce their exposure, pushing prices up even more. "Is the falling U.S. oil rig count really driving an oil price turnaround" analysts at Citigroup wondered in a research note of the same title published on Wednesday. Productivity gains and more careful selection of drilling targets will reduce the impact of rig cuts, they predicted. But markets are not precision weighing machines. They are voting machines - subject to whims, crazes and manias in the short and medium term as even the greatest fundamental analysts of all admitted in their landmark work ("Security Analysis", 1934, Benjamin Graham and David Dodd). Fundamentals always reassert themselves eventually, but it can be a long time coming, as generations of fundamentally driven investors have discovered. Crude had become heavily

- 10. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 10 oversold in the expectation prices would continue the steady downtrend of the previous 17 weeks. Once that assumption was invalidated, market participants and prices reacted sharply. There is no mystery about why oil fell so far and so fast between June 2014 and late January 2015, or why the decline terminated so abruptly. Price formation in bubbles and crashes has been thoroughly examined by Didier Sornette at the Swiss Federal Institute of Technology ("Why stock markets crash: critical events in complex financial systems", 2003). There is much more disagreement about where prices will settle for the rest of the year. For oil market bears, futures must remain below $50 a barrel and perhaps even $40, to force a much larger and sustained drop in U.S. drilling. RIGS VERSUS PRODUCTION Citigroup notes the largest activity declines so far have been among smaller, older, less sophisticated rigs that drill vertical or slanted wells, rather than the most modern and powerful rigs with horizontal capability. In the Big Three shale formations (Bakken, Eagle Ford and Permian), which account for almost all of the increase in U.S. oil production since 2010, 199 rigs have been idled since early October. About 170 other rigs have been idled in conventional oilfields or more marginal plays that have added relatively little to production growth in recent years. By employing the remaining, larger and more modern rigs on the best and surest drilling prospects, and withdrawing from more marginal and speculative well sites, production could be maintained or even continue to grow, according to Citi. The bears are almost certainly correct. The decline in production from new wells is likely to be much smaller than the drop in the rig count owing to efficiency improvements and more selective drilling.

- 11. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 11 Based on an analysis of drilling productivity in the Big Three shale basins, Citi estimates U.S. production could still grow by another 700,000 to 900,000 barrels per day despite a 40 percent reduction in rigs. Nonetheless, in my view, the decline in the rig count is too large not to have a substantial impact. The number of rigs active in North Dakota, for example, has fallen from more than 190 in September and October 2014 to just 142 on Wednesday, says the Department of Mineral Resources (DMR), which regulates drilling in the state. In a presentation to state budget-setters last month, the DMR estimated a fleet of 140 active rigs would be needed just to sustain output at the current level of 1.2 million barrels per day, given decline rates on old wells. The number of active rigs has now been reduced to this threshold level. If the DMR is correct, output should flatten over the next few months. PRICES RISK ADJUSTMENT But even after the rally, the price U.S. shale oil producers receive at the wellhead remains below breakeven levels in all but the most attractive parts of the Big Three shale plays. For example, wellhead prices in North Dakota are only around $45 per barrel, based on an average of WTI futures prices ($53) and posted prices ($37). With wellhead prices at $45, the DMR projects that state production will decline by around 100,000 barrels per day by the start of July. State oil producers need wellhead prices of around $55 per barrel to sustain output, which implies WTI prices of perhaps $60 or more. The recent rally in Brent and WTI futures is unlikely yet to put the rebalancing at risk. Output is still likely to fall in the second half of the year. Underscoring the depth of the adjustment already under way, National Oilwell Varco , the largest supplier of drilling equipment in the United States, reported that fourth-quarter orders in its rig technology equipment division were down 90 percent compared with a year earlier. "Customers are delaying purchases of both capital and consumables wherever possible, seeking to conserve cash in the face of market uncertainty," the company's chief executive said on a post- earnings call. As long as wellhead prices remain below breakeven levels, drilling will continue to slow, and output will remain on course to peak around the middle of the year and then start to decline.

- 12. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 12 LNG Supply Seen Falling After 2020 as Oil Plunge Delays Projects (Bloomberg) Global output of liquefied natural gas may shrink after 2020 as falling oil prices prompt producers to withdraw plans for new plants and delay investments. Projects that sell LNG linked to the price of oil will be under pressure with crude between $50 and $60 a barrel, and more than $60 billion in cash flow may be affected this year, Wood Mackenzie Ltd. said in an e-mail on Feb. 4. Projects with more than $100 billion of investment are at risk of delays or cancellation, according to the Edinburgh-based consultant. Companies have moved to cut costs after benchmark crude slumped almost 50 percent last year as the U.S. pumped oil at the fastest rate in more than three decades, exacerbating a global glut. Royal Dutch Shell Plc, BG Group Plc, Petroliam Nasional Bhd and Chevron Corp. have cut or delayed spending on LNG projects from Australia to Canada. “We’ll see a marginal tightening in the market,” said Leigh Bolton, managing director of Holmwood Consulting, a Surrey, England-based energy consultant. “Some of the projects will disappear entirely while some of them will be deferred for three to five years.” Brent crude added 74 cents to $54.90 a barrel on the London-based ICE Futures Europe exchange at 9:53 a.m. Singapore time. Oil may fall below a six-month forecast of $39 a barrel and rallies could be thwarted by the speed at which lost shale output can recover, Goldman Sachs Group Inc. said last month. Long-term LNG contracts can be priced off by up to 15 percent of oil prices, according to a Jan. 5 report by Bloomberg New Energy Finance. Spot LNG prices fell to their lowest since June 2010 at $7 per million British thermal units on Feb. 4, according to data from New York-based Energy Intelligence’s World Gas Intelligence publication. Sunk Costs “From 2018 to 2022, the market is very well supplied as there are new U.S. and Australian projects ramping up,” Nicholas Browne, Wood Mackenzie’s senior manager for primary fuel research said in a phone interview last month. “Producers will be affected because costs are sunk into projects whereas the returns they get are significantly less as the lower oil price works its way into contracts,” said Browne. Costs in Asia, the region that buys the most supercooled fuel, will this year average below $10 for the first time in four years as new projects in Australia and the U.S. boost supply through 2016, Bloomberg New Energy Finance said. “Low oil price is good for the LNG business because it drives out the unsuccessful projects,” said Bolton.

- 13. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 13

- 14. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 14

- 15. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 15

- 16. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 16 NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE Your partner in Energy Services NewBase energy news is produced daily (Sunday to Thursday) and sponsored by Hawk Energy Service – Dubai, UAE. For additional free subscription emails please contact Hawk Energy Khaled Malallah Al Awadi, Energy Consultant MS & BS Mechanical Engineering (HON), USA Emarat member since 1990 ASME member since 1995 Hawk Energy member 2010 Mobile : +97150-4822502 khdmohd@hawkenergy.net khdmohd@hotmail.com Khaled Al Awadi is a UAE National with a total of 25 years of experience in the Oil & Gas sector. Currently working as Technical Affairs Specialist for Emirates General Petroleum Corp. “Emarat“ with external voluntary Energy consultation for the GCC area via Hawk Energy Service as a UAE operations base , Most of the experience were spent as the Gas Operations Manager in Emarat , responsible for Emarat Gas Pipeline Network Facility & gas compressor stations . Through the years , he has developed great experiences in the designing & constructing of gas pipelines, gas metering & regulating stations and in the engineering of supply routes. Many years were spent drafting, & compiling gas transportation , operation & maintenance agreements along with many MOUs for the local authorities. He has become a reference for many of the Oil & Gas Conferences held in the UAE and Energy program broadcasted internationally , via GCC leading satellite Channels. NewBase : For discussion or further details on the news above you may contact us on +971504822502 , Dubai , UAE NewBase 01 February 2015 K. Al Awadi

- 17. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 17