New base energy news 03 january 2019 issue no 1221 by khaled al awadi

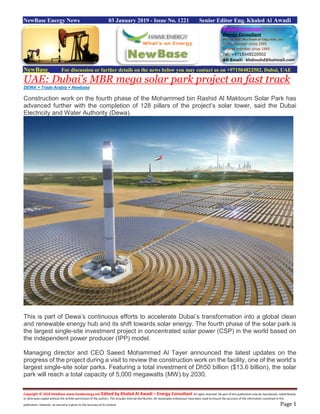

- 1. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 1 NewBase Energy News 03 January 2019 - Issue No. 1221 Senior Editor Eng. Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE UAE: Dubai’s MBR mega solar park project on fast track DEWA + Trade Arabia + Newbase Construction work on the fourth phase of the Mohammed bin Rashid Al Maktoum Solar Park has advanced further with the completion of 128 pillars of the project’s solar tower, said the Dubai Electricity and Water Authority (Dewa). This is part of Dewa’s continuous efforts to accelerate Dubai’s transformation into a global clean and renewable energy hub and its shift towards solar energy. The fourth phase of the solar park is the largest single-site investment project in concentrated solar power (CSP) in the world based on the independent power producer (IPP) model. Managing director and CEO Saeed Mohammed Al Tayer announced the latest updates on the progress of the project during a visit to review the construction work on the facility, one of the world’s largest single-site solar parks. Featuring a total investment of Dh50 billion ($13.6 billion), the solar park will reach a total capacity of 5,000 megawatts (MW) by 2030.

- 2. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 2 Al Tayer was accompanied during his visit by Waleed Salman, executive vice president of Business Development and Excellence at Dewa; Jamal Shaheen Al Hammadi, vice president of Clean Energy & Diversification at Dewa; and a number of Dewa officials. Al Tayer was briefed on the progress of construction work by Abdul Hamid Al Muhaidib, executive managing director of Noor Energy 1, a venture formed through a partnership between Dewa, Saudi Arabia’s Acwa Power and China’s Silk Road Fund to build the fourth phase of the Park. The fourth phase of the solar park will use three technologies to produce 950 MW of clean energy, 600 MW from a parabolic basin complex, 100 MW from a solar tower, and 250 MW will be generated from photovoltaic panels. Al Tayer stressed the importance of ensuring the highest standards of health, safety, and quality in the project. This project has already achieved many world records. It will have the world’s tallest solar tower, at 260 m, and the largest thermal energy storage capacity in the world of 15 hours, which allows for energy generation round the clock. It also achieved the lowest levelised cost of electricity (LCOE) of 2.4 US cents per kilowatt hour (kW/h) for the 250 MW photovoltaic solar panels technology and 7.3 US cents per kW/h for the 700MW CSP technology (600 MW from a parabolic basin complex, 100 MW from a solar tower), the lowest worldwide. The total capacity of the fourth phase of the solar park rose from 700 MW to 950 MW with investments for this ambitious project reaching Dh16 billion ($4.35 billion). The Mohammed bin Rashid Al Maktoum Solar Park is the largest single-site solar park in the world, based on the IPP model. It will generate 5,000 MW by 2030. The 13-MW photovoltaic first phase became operational in 2013. The 200-MW photovoltaic second phase of the solar park was launched in March 2017. The 200-MW first stage of the 800-MW photovoltaic third phase became operational in May 2018. The third phase will be completed in 2020.

- 3. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 3 China surpassed the U.S as the world’s largest crude oil importer in 2017…U.S. EIA Petroleum Supply Monthly and Weekly Petroleum Status Report, China surpassed the United States in annual gross crude oil imports in 2017, importing 8.4 million barrels per day (b/d) compared with 7.9 million b/d for the United States. China had become the world’s largest net importer (imports minus exports) of total petroleum and other liquid fuels in 2013. New refinery capacity and strategic inventory stockpiling combined with declining domestic oil production were the major factors contributing to the recent increase in China’s crude oil imports.

- 4. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 4 In 2017, 56% of China’s crude oil imports came from countries within the Organization of the Petroleum Exporting Countries (OPEC), a decline from the peak of 67% in 2012. More so than other countries, Russia and Brazil increased their market shares of Chinese imports between those years from 9% to 14% and from 2% to 5%, respectively. Russia surpassed Saudi Arabia as China’s largest source of foreign crude oil in 2016, exporting 1.2 million b/d to China in 2017 compared with Saudi Arabia’s 1.0 million b/d. OPEC countries and some non-OPEC countries, including Russia, agreed to reduce crude oil production through the end of 2018, which may have allowed other countries to increase their market shares in China in 2017. Source: China General Administration of Customs, based on Bloomberg, L.P Several factors are driving the increase in China’s crude oil imports. China had the largest decline in domestic petroleum and other liquids production among non-OPEC countries in 2016, and EIA estimates it will have had the second-largest decline in 2017. Total liquids production in China averaged 4.8 million b/d in 2017, a year-over-year decline of 0.1 million b/d (2%) from 2016, and further declines in both 2018 and 2019 are forecasted in EIA’s January 2018 Short-Term Energy Outlook (STEO). In contrast to declining domestic production, EIA estimates that growth in China's consumption of petroleum and other liquid fuels in 2017 was the world’s largest for the ninth consecutive year, growing 0.4 million b/d (3%) to 13.2 million b/d. As China has built up inventories of strategic petroleum reserves, China’s crude oil imports have increased faster than their domestic consumption.

- 5. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 5 In addition, China has reformed its refining sector by reducing restrictions on both imports and exports. Since mid-2015, China granted crude oil import licenses to independent refineries in northeast China, which have since increased refinery utilization and crude oil imports. China’s crude oil imports have also increased because of higher refinery runs and expanding refinery capacity. China’s refinery runs increased by an estimated 0.5 million b/d in 2017 to 11.4 million b/d, driven in part by two refinery expansions in the second half of the year. A 260,000 b/d refinery in Anning in Yunnan province started operating in the third quarter of 2017. The China National Offshore Oil Corporation’s (CNOOC) Huizhou refinery increased capacity by 200,000 b/d and increased its imports from various sources in the third and fourth quarters of 2017. Ongoing infrastructure expansions will likely contribute to further increases in China’s crude oil imports. In January 2018, China and Russia began operating an expansion of the East Siberia- Pacific Ocean (ESPO) pipeline, doubling its delivery capacity to approximately 0.6 million b/d. According to trade press reports, as much as 1.4 million b/d of new refinery capacity is planned to open in China by the end of 2019. Given China’s expected decline in domestic crude oil production, imports will likely continue to increase over at least the next two years. Source: U.S. Energy Information Administration

- 6. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 6 Nigeria: Total starts production at deepwater Egina oilfield Reuters Total SA said on Wednesday it had started production from the Egina oilfield off Nigeria’s coast, part of a shift by the French energy firm toward deepwater oil and gas projects to its drive cashflow. Output from Egina, which is located in waters about 1,600 meters (5,250 ft) deep, is expected to plateau at 200,000 barrels per day of oil, Total said. That rate is equivalent to about 10 percent of Nigeria’s current production. “Egina will significantly boost the group’s production and cashflow from 2019 onwards, and benefit from our strong cost reduction efforts in Nigeria where we have reduced our operating costs by 40 percent over the last four years,” Total’s head of exploration and production, Arnaud Breuillac, said. Total is betting on profitable deepwater oil and gas fields in Sub-Saharan Africa, Brazil and the U.S. Gulf area. In Africa, the company is ramping up deepwater projects in the Republic of Congo and Angola. Total forecasts output from deepwater projects will reach 500,000 barrels of oil equivalent per day by 2020 and account for more than 35 percent of cashflow in coming years, compared with about 15 percent now. Total also said it would take a decision this year on whether to invest in developing the Preowei field, located in the same block as the Egina field. Total has for almost a decade been extracting oil from a third field in the block, Akpo. It holds a 24 percent stake in the block’s lease and is the operator. Its partners are state-owned Nigerian National Petroleum Corp, China’s CNOOC, Brazil’s Petrobras and private Nigerian firm Sapetro. The French company is one of the strongest players in African oil, holding the largest proven reserves on the continent among the world’s top oil companies.

- 7. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 7 Venezuela Oil Exports Slump to a 28-Year Low Bloomberg - Lucia Kassai Venezuela, once Latin America’s largest oil exporter, ended 2018 with a whimper as overseas sales dropped to the lowest in nearly three decades. Home to the world’s biggest crude reserves, the country exported 1.245 million barrels a day last year, the lowest since 1990, as production tumbles amid an economic and humanitarian crisis. Financial sanctions imposed by the U.S. have further tightened the screws on Venezuela’s ailing economy, while creditors have sought seize its assets including oil cargoes and its prized Citgo refineries in the U.S. Downward Spiral Venezuelan crude oil exports fall to lowest since 1990 Source: Pode, PDVSA reports, OPEC secondary sources, ship-tracking data; 2018 production data is Jan.-Nov. Falling exports compound the pain, as oil is the country’s main source of revenue and bankrolls the regime of president Nicolas Maduro. The OPEC member’s crude production fell by more than half in the past five years to a daily average of 1.346 million barrels this year, according to OPEC secondary source data. The country is also bracing for more sanctions, as the Trump administration is said to mull new actions against Venezuela by Jan. 10, when Maduro’s current term expires. Maduro faced criticism back in May, when he was re-elected in a vote derided as a sham.

- 8. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 8 Canada:oil crisis is in the works amid supply glut chocked by itself Reuters + NewBase A decade ago, Canada's oil sector was growing so fast it was predicted to become a global energy superpower, but a series of political missteps and formidable environmental activism has created a dysfunctional system requiring Opec-style government intervention to move its oil to market. Canada produces 4.9 million barrels per day, more than any country other than the United States, Saudi Arabia and Russia, but the world's fourth largest producer has had to nationalise a pipeline and the province of Alberta is exploring buying trains to handle a glut of oil sitting in storage. Canada's crisis coincides with big producers taking market share away from Opec members, mostly clustered in the Middle East. Global oil demand is expected to surpass 100 million bpd in 2019. The United States has driven exports to record highs on growing demand from China, India and other developing countries. But Ottawa has failed under two governments to effectively counter the strategy of environmental activists to attack the oil sector's heart by choking its arteries - pipelines. Roughly 35 million barrels, twice the normal amount, of Western Canadian crude used to produce diesel, gasoline and jet fuel is stuck in storage. The energy sector accounts for nearly 11 per cent of Canada's gross domestic product. However, Canadian oil trades at a fraction of global prices, costing the economy C$80 million (Dh216m) per day, the Alberta provincial government said. Alberta took the unusual step this month of temporarily curtailing 325,000 bpd starting in January - in the aftermath of a retreat from the oil sands by global companies including ConocoPhillips and Statoil. The world's fourth largest crude producer is intervening in the markets to trim the amount of oil in storage

- 9. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 9 "It's become dire now because the writing is clearly on the wall. The issue is market access," said Jihad Traya, manager of energy advisory service HSB Solomon. Prime Minister Justin Trudeau's government, facing an election next year, offered the oil patch this week C$1.6 billion in aid. In May, Ottawa agreed to buy the Trans Mountain pipeline in hopes of pushing through an expansion to nearly triple capacity as other proposed lines languished. In 2006, then-Prime Minister Stephen Harper boasted Canada would soon become an "energy superpower." Canada was producing 2.6 million bpd, which moved smoothly to US refineries through pipelines. Since then, production has nearly doubled, but pipeline growth has stalled. Both Conservative Harper and Liberal Trudeau squelched opportunities to complete pipelines just as opposition to more lines multiplied. Two projects were killed, and legal setbacks have stymied the development of TransCanada Corp's Keystone XL and the government-owned Trans Mountain expansion. A year after taking office in 2015 Mr Trudeau proposed a bargain aimed at satisfying both environmentalists and the oil industry - a national carbon-pricing plan to reduce Canada's emissions while approving pipeline expansions. The strategy has inflamed both sides.

- 10. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 10 When a court overturned Ottawa's approval of the expansion of Trans Mountain in August, the deal was off and Alberta Premier Rachel Notley yanked support for Mr Trudeau's carbon plan just hours later. Indigenous and environmental opposition to pipelines has forced MR Trudeau to push for tighter regulations on future pipelines. The changes are necessary to "depoliticise" the system, Natural Resources Minister Amarjeet Sohi said. "We need to fix the broken system that we have now so we are able to build the pipeline capacity that is so necessary." But Mr Trudeau has already shelved Enbridge's Northern Gateway proposal, which would have run through northern Alberta to the Pacific coast, and the National Energy Board in 2017 toughened its review of TransCanada's Energy East pipeline while it was underway. Both projects are now dead. Alberta is seeking to buy rail cars to reduce the glut, and earlier this month, the province ordered producers to cut output after its oil fell to a discount of $52 per barrel from US oil in October. Ms Notley told reporters earlier this month that people in Alberta can make profits from oil and gas, "but they need Ottawa to take the handcuffs off. We need rail. We need long-term support for getting that pipeline built." Alberta's oil sands, a mixture of sand, water, clay and thick, heavy oil, became a compelling target for environmentalists as production expanded dramatically in the early 2000s. The mining process scrapes away trees and vegetation across huge tracts of land, leaving a path of destruction captured in aerial images, while a different production method using steam consumes huge amounts of natural gas. Clayton Thomas-Muller, an indigenous activist, said environmentalists grew frustrated trying to stop the industry's expansion through the Alberta Energy Regulator, but found a new strategy of opposing the pipelines. They built wider coalitions, tapping into anger of Nebraska ranchers and drawing the attention of Hollywood celebrities such as director James Cameron. Opponents of TransCanada's Keystone XL began protests at the White House in 2011, seeking arrest and attention. Then-US President Barack Obama finally rejected the project in 2015. "Full credit to climate-change advocates, they kicked the snot out of Corporate Canada," said Tim Powers, a Conservative political strategist. He said Canadian resource companies have been too focused on the regulatory process, while climate-change advocates "laid out a better, more compelling narrative" to win public opinion. US President Donald Trump resurrected Keystone XL in 2017. But both KXL and Trans Mountain remain in regulatory limbo after courts ruled in recent months that the US and Canadian governments failed to properly do their jobs. The cases that overturned approvals for Northern Gateway and Trans Mountain led companies to question investment in Canada. The end result is a Canadian oil patch in retreat. "My main fear is that other nations will continue to produce at market price and Canada will be left behind," said Duncan Au, chief executive of CWC Energy Services. The well drilling company has cut about 70 employees, or nearly 10 per cent, since the beginning of 2018. "This is a made-in-Canada crisis," Mr Au said.

- 11. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 11 NewBase 03 January 2019 Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE Oil prices slide on supply surge, global market turmoil scares off investors Reuters + Bloomberg + NewBase Oil prices fell on Thursday amid volatile currency and stock markets, and as analysts warned of an economic slowdown for 2019 just as crude supply is rising globally. U.S. West Texas Intermediate (WTI) crude oil futures dropped by around 2 percent from their last settlement, or 93 cents, to $45.61 by 0404 GMT. International Brent crude futures were down 1.1 percent, or 60 cents, at $54.31 a barrel. In physical oil markets, top exporter Saudi Arabia is expected to cut February prices for heavier crude grades sold to Asia by up to 50 cents a barrel due to weaker fuel oil margins, respondents to a Reuters survey said on Thursday. Markets were roiled by a more than 3 percent slump of the U.S. dollar against the Japanese yen overnight, and after tech giant Apple cut its sales forecast. “We did not foresee the magnitude of the economic deceleration, particularly in Greater China,” Apple chief executive Tim Cook said. Oil price special coverage

- 12. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 12 The slowdown in China and turmoil in stock and currency markets is making investors nervous, including in oil markets. Investment bank Jefferies said in a 2019 opening note to clients and employees that the start of the year “doesn’t feel as firm, the future doesn’t feel as certain and optimistic, and the path forward does not seem as clear.” The U.S. bank added that “markets are extremely volatile and virtually impossible to anticipate or navigate.” Shipping brokerage Eastport said the turmoil in markets is scaring off investors. “Falling share prices tend to damage consumer sentiment, which often results in increased caution and reduced spending...Business managers also tend to limit capex, thus weighing on investment as well.” SUPPLY SURGE U.S. crude production stood at a record 11.7 million barrels per day (bpd) in late 2018, making the United States the world’s biggest oil producer. Others are not sitting idle, with Russian output reaching a record of more than 11 million bpd in 2018. Supply from Iraq, the number two producer in the Organization of the Petroleum Exporting Countries (OPEC) behind Saudi Arabia, is also up, with December exports at 3.73 million bpd, up from 3.37 million bpd in November. With production rising and demand growth expected to slow, many analysts expect a global oil supply overhang to build in the first months of 2019. OPEC+ Caps Prove No Barrier to Record Russian Oil Output in 2018 Russia’s oil production reached a post-Soviet high last year even as it coordinated supply with the Organization of Petroleum Exporting Countries. Output averaged 11.16 million barrels a day, up 1.6 percent from 2017, according to preliminary data from the Energy Ministry’s CDU-TEK unit. That compares with an all-time high of 11.416 million barrels a day in 1987, BP Plc figures show.

- 13. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 13 During the first half of last year, Russian volumes were capped as part of an agreement with OPEC to support prices. But after the market rebounded, the producers rolled back their cuts, with Russia rapidly raising output to reach 11.45 million barrels a day in December. “Russia was the clear winner” from that deal, said Dmitry Marinchenko, oil and gas director at Fitch Ratings. It got “billions of rubles in extra oil revenues -- and the country didn’t even sacrifice much of its crude production in return.” Now that fresh cuts by the so-called OPEC+ coalition are planned for the first half of 2019 -- with Russia agreeing to remove 228,000 barrels a day -- the government aims to repeat that success, according to Marinchenko. The country expects its total oil output to hold steady over the full year as producers recoup first-half losses in the latter part of the year, Energy Minister Alexander Novak said last week. Unlike his counterparts in OPEC, Novak currently sees no need to extend or deepen the agreed cuts, saying the effects of the deal on market balance will be visible as soon as January or February. Even so, fears of a resurgent global glut -- fueled by America’s surprise waivers for buyers of Iranian oil and by booming U.S. production -- could make the cooperation less favorable for Russia this time around. “OPEC and its allies will probably need to extend their output-cut deal beyond the first half,” Marinchenko said. “If they need to sacrifice some of their barrels for the sake of stability, they will do it.”

- 14. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 14 Oil Slumps to First Annual Loss Since 2015 to End Turbulent Year Oil capped its worst annual showing since 2015 as fears of scarcity turned into panic about a glut. Futures in New York eked out a small gain on Monday but finished the year down 25 percent, completing a reversal few anticipated just three months ago, when prices jumped to a four-year high. There’s growing concern the U.S.-China trade dispute and tightening Federal Reserve monetary policy will undercut growth. Five American manufacturing indexes all dropped in December, the first such across-the-board decline in two years. Highlighting the muscle of U.S. crude drillers, stockpiles at a key storage hub in Oklahoma probably rose 1.2 million barrels last week, according to a Bloomberg survey of analysts released Monday. Despite encouraging talk on trade from President Donald Trump, the coming months still look unsettled, said Phil Streible, senior market strategist at RJO Futures in Chicago. “We’ll probably start off 2019 on the same foot, weighed down by record U.S. production as well as the lingering trade war,” Streible said in an interview. “We won’t see a rebalancing of the market until past the first quarter, so I would expect us to get trading right around these lows.” West Texas Intermediate for February delivery rose 8 cents to $45.41 a barrel on the New York Mercantile Exchange. Total volume traded Monday was about 32 percent below the 100-day average. Brent for March settlement gained 59 cents to $53.80 on the London-based ICE Futures Europe exchange. The global benchmark closed the year down 20 percent. It traded Monday at a premium of $8.08 to March WTI. Crude’s moves have been amplified by gyrations in equity markets, which have propelled an oil- price volatility gauge to more than double over the past three months.

- 15. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 15 “We are most likely past the peak of this long economic uptrend,” said analysts at JBC Energy GmbH in Vienna. Oil jumped to a four-year high in early October on concern that renewed U.S. sanctions on Iran’s oil exports would tighten supply. But Trump’s surprise decision to grant waivers to many buyers pushed prices into a bear market within weeks. “Trump has reigned as the ultimate controller of oil prices this year because everything from sanctions against Iran, the trade war with China and even tensions with Saudi Arabia, he’s been involved,” said Sungchil Will Yun, a commodities analyst at HI Investment & Futures Corp. “While prices won’t fall further from here, the pace of increase will also be quite gradual next year.” Output Cut OPEC and its partners including Russia responded to the downturn earlier this month with a promise to cut 1.2 million barrels a day of output starting January. Estimates from consultants JBC Energy on Monday showed they’ve already started to make good on that pledge as Saudi Arabia takes the lead in restricting production. But OPEC faces a formidable challenge from American drillers that are pumping at record levels. More than 100 additional oil rigs have been deployed across the U.S. this year, with overall crude production topping 11 million barrels a day. Oil stockpiles at the U.S. storage hub in Cushing have surged to the highest level since January, while nationwide inventories are near a one-year high, according to Energy Information Administration data. Gulf Arab Energy Companies May Lean on Debt in 2019 as Oil Falters Gulf Arab energy companies are expected to borrow more in 2019 to finance expansion plans after rising oil prices triggered a sharp retreat from debt markets in 2018. Higher oil prices eased pressure on government budgets in Gulf Cooperation Council countries in 2018 and allowed the region’s energy companies to self-finance operations, according to Rory Fyfe, chief economist at MENA Advisors. That’s a shift from 2017 when lower oil prompted companies to issue record debt. This dynamic could be repeated in 2019. Average oil prices hit a four-year high in 2018, but ended the year on a dismal quarter that clouded the outlook for 2019. With global benchmark Brent crude down about 35 percent since October, energy companies in the region may have to accelerate their borrowing again. “Companies will look to issue more debt,” said Ashley Kelty, an oil and gas research analyst at Cantor Fitzgerald Europe. Projects need to be funded and crude reserves have to be replenished. “They won’t be going back to the ‘care and maintenance’ of a few years ago. They will use debt because it’s still relatively cheap.” State-run companies in the United Arab Emirates, Oman and Bahrain loaded up on bonds and loans in 2018, with U.A.E. energy firms borrowing over $9 billion of the $19.4 billion regional haul. Saudi Arabian Oil Co. issued just $150 million of debt through one of its subsidiaries, its lowest since 2014.

- 16. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 16 Although Saudi Arabia, the world’s biggest crude exporter, didn’t factor in the 2018 tally, its state- owned oil company may issue bonds and loans next year to finance a deal that would forever alter regional debt charts. Saudi Aramco is considering a range of options to come up with as much as $80 billion it needs to buy a majority stake in petrochemicals maker Saudi Basic Industries Corp. Expansion remains a focus of Gulf Cooperation Council energy companies, even as OPEC’s leading members Saudi Arabia, the U.A.E. and Kuwait curb output to prop up oil prices. Oil and gas producers in those countries plan to spend more than $600 billion on energy projects over the next decade, according to official announcements. Abu Dhabi National Oil Co., which was responsible for more than half the debt issued in the U.A.E. in 2018, plans to boost its crude production capacity to 4 million barrels a day by 2021 from the current ceiling of 3.5 million barrels. It will spend $132 billion on projects over the next five years, raising the potential for more energy borrowings. Top Borrowers U.A.E. accounted for almost half of Gulf energy company borrowing in 2018 Oman’s energy companies issued record debt in 2018. The largest Arab oil producer that isn’t a member of OPEC took out a $4.6 billion project loan to finance a refinery at Duqm and its gas company borrowed $1.1 billion to finance its spending.

- 17. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 17 NewBase Special Coverage News Agencies News Release 03 January 2019 Here’s What to Expect From Oil in 2019 Bloomberg - Christopher Sell Oil had a tumultuous 2018, with prices rising to a four-year high in October before plunging more than $30 in the following months. Oversupply and demand worries are high on the concern list for the industry, making volatility a buzzword this year as well. There are other power dynamics at play. OPEC’s Viennese waltz in early December was a perfect example of a shift, with Russia brokering a deal to curb output and sharing the reins with traditional leader Saudi Arabia. President Donald Trump’s tweets demanding lower oil prices and U.S. shale producers pumping out unprecedented volumes of crude, threaten to undo all of OPEC and Russia’s years-long work. There are “major uncertainties” and forecasting trends in 2019 is “even more hazardous than usual,” said Neil Atkinson, head of oil markets at the International Energy Agency. Geopolitical uncertainty is a serious risk to the industry, according to Ryan Lance, chief executive officer of ConocoPhillips. Still, there is likely to be a lack of “shock and awe” in OPEC policy, which could temper volatility, said Greg Sharenow, a portfolio manager at Pacific Investment Management Co. So, what will be the state of oil in 2019? Executives, money managers and analysts weigh in. Ryan Lance, CEO of ConoccoPhillips “We expect oil markets to remain volatile, in part driven by flexible North American shale production that can ramp up and down quickly in response to changes in investment levels. In order to thrive in this environment, given the short-cycle nature of shale, we believe it’s necessary to run an exploration and production business for sustained through-cycle financial returns, which is necessary for attracting investors back to the sector. Ours must offer investors both resilience to lower prices and participation in higher prices, and we’re doing that via an approach that rations capital across a low-cost- of-supply portfolio, competes on per-share versus absolute growth, and pays out a significant portion of cash from the business to shareholders. From the resource and production standpoints, North American shale continues to be a bright spot in the global energy industry. Shale has transformed the industry and will enable the U.S. to stay positioned as the world’s No. 1 producer of both liquids and natural gas. We believe shale can drive the industry’s growth for many years. Among the most serious near-term risks we see to the energy industry are geopolitical uncertainty and factors that could reduce global economic growth and energy demand.”

- 18. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 18 Greg Sharenow, portfolio manager, Pimco “There will be a stark change from the past four years for commodity investors, as one big driver of balance and prices will be notably diminished. Specifically, OPEC has moved from competing for market share in 2014 and contributing to materially lower prices to then reversing course two years later, dropping output sharply and contributing to rising prices. But 2019, in many respects, might be notable for the lack of shock-and- awe OPEC policy as it shifts to an approach of limiting any surplus or deficit. This has some meaningful implications for markets and expected realized volatility. OPEC’s decision should lead to a gradual stabilization of Brent prices and, dare one say, a return to a lower-volatility environment. That said, there are known unknowns that could upend the best-laid plans, such as Whether the U.S. is able to continue to exceed production expectations; Whether the slowdown in the global economy devolves into something worse, or if policy makers can help change the trajectory; And how effective additional U.S. pressure on buyers of Iran crude will be, with the current set of waivers set to expire late in the second quarter of 2019 (conveniently just after the next OPEC meeting). In addition, at the end of 2019, the International Maritime Organization is set to restrict sulfur content in marine fuels, offering additional potential support to lighter, lower-sulfur crude oils such as Brent. Currently, we see these risks as roughly balanced around our baseline and quite manageable for OPEC.” David Lebovitz, VP and global market strategist, JPMorgan “Will we see more responsible behavior from producers in shale as we go into 2019. It does seem like they are becoming more disciplined in how they pump, how they invest and so the chances of a supply glut like we saw a few years back are not our base case. Obviously what happens to OPEC, and the decision by Qatar to remove itself from OPEC and focus more on natural gas, is an interesting smoke signal that perhaps not all is alive and well, and you could perhaps see more fragmentation. It just feels like there is a bit of divergence in interests among that group. And my guess, given the state of politics globally, this is a situation or backdrop that could deteriorate going forward. So in a world where hopefully the U.S. has some pumping discipline and OPEC isn’t as effective in curbing production as they have been, all eyes will be back on the U.S. as we make the transition. It will require a psychological adjustment on the part of both consumers and policy makers. Because as we’ve seen, when the oil patch comes under pressure, employment comes under pressure and investment spending comes under pressure. So while we are still a consumption-driven economy with 70 percent of GDP coming from the consumer, we need to be sensitive that an increasing number of consumers have a more direct tie to the oil industry than previously.”

- 19. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 19 Neil Atkinson, IEA’s head of oil markets “Forecasting trends in the oil market for the new year looks to be even more hazardous than usual. There is a long list of uncertainties on the demand and supply side of the balance. As the new year progresses, the implementation in 2020 of new marine fuel regulations by the International Maritime Organization will draw closer. We will learn whether the shipping and refining industries are prepared for this major regulatory change without serious disruption to the fuel market. For supply, there are many complicating factors: the recent agreement by OPEC countries and 10 non-OPEC producers to cut oil production will, if it is successful, help to re-balance an oil market that was becoming over-supplied. We will see what the U.S. decides with respect to the second round of waivers for Iran’s oil customers. Will we see a significant further decline in production from Venezuela? Will Libya manage to maintain production or will it fall victim to more regular interruptions? These are major uncertainties. What the IEA hopes is that the market is able to operate in 2019 without the very high volatility we saw in 2018. It was not good for consumers to see oil prices above $85 a barrel as we did in early October. But nor is it good for producers for prices to fall to $55 a barrel as this will inhibit investment in much-needed new production capacity.

- 20. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 20 NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE The Editor :”Khaled Al Awadi” Your partner in Energy Services NewBase energy news is produced daily (Sunday to Thursday) and sponsored by Hawk Energy Service – Dubai, UAE. For additional free subscription emails please contact Hawk Energy Khaled Malallah Al Awadi, Energy Consultant MS & BS Mechanical Engineering (HON), USA Emarat member since 1990 ASME member since 1995 Hawk Energy member 2010 Mobile: +97150-4822502 khdmohd@hawkenergy.net khdmohd@hotmail.com Khaled Al Awadi is a UAE National with a total of 28 years of experience in the Oil & Gas sector. Currently working as Technical Affairs Specialist for Emirates General Petroleum Corp. “Emarat“ with external voluntary Energy consultation for the GCC area via Hawk Energy Service as a UAE operations base , Most of the experience were spent as the Gas Operations Manager in Emarat , responsible for Emarat Gas Pipeline Network Facility & gas compressor stations . Through the years, he has developed great experiences in the designing & constructing of gas pipelines, gas metering & regulating stations and in the engineering of supply routes. Many years were spent drafting, & compiling gas transportation, operation & maintenance agreements along with many MOUs for the local authorities. He has become a reference for many of the Oil & Gas Conferences held in the UAE and Energy program broadcasted internationally, via GCC leading satellite Channels. NewBase : For discussion or further details on the news above you may contact us on +971504822502 , Dubai , UAE NewBase January 2019 K. Al Awadi

- 21. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 21

- 22. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 22