New base energy news issue 877 dated 21 june 2016

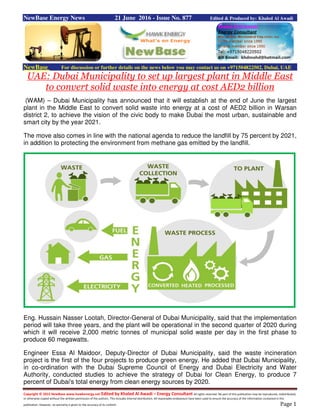

- 1. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 1 NewBase Energy News 21 June 2016 - Issue No. 877 Edited & Produced by: Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE UAE: Dubai Municipality to set up largest plant in Middle East to convert solid waste into energy at cost AED2 billion (WAM) – Dubai Municipality has announced that it will establish at the end of June the largest plant in the Middle East to convert solid waste into energy at a cost of AED2 billion in Warsan district 2, to achieve the vision of the civic body to make Dubai the most urban, sustainable and smart city by the year 2021. The move also comes in line with the national agenda to reduce the landfill by 75 percent by 2021, in addition to protecting the environment from methane gas emitted by the landfill. Eng. Hussain Nasser Lootah, Director-General of Dubai Municipality, said that the implementation period will take three years, and the plant will be operational in the second quarter of 2020 during which it will receive 2,000 metric tonnes of municipal solid waste per day in the first phase to produce 60 megawatts. Engineer Essa Al Maidoor, Deputy-Director of Dubai Municipality, said the waste incineration project is the first of the four projects to produce green energy. He added that Dubai Municipality, in co-ordination with the Dubai Supreme Council of Energy and Dubai Electricity and Water Authority, conducted studies to achieve the strategy of Dubai for Clean Energy, to produce 7 percent of Dubai's total energy from clean energy sources by 2020.

- 2. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 2 Saudi Arabia's crude oil exports fall in April despite high output Reuters + NewBase Saudi Arabia's crude oil exports in April fell despite high production levels, while more crude was used domestically for power generation and to feed rising demand from local refineries. Crude exports in April fell to 7.444 million barrels per day from 7.541 million bpd in March, official data showed on Monday. The world's largest oil exporter and OPEC heavyweight produced 10.262 million bpd in April, compared with 10.224 million bpd a month earlier, the data showed. Saudi Arabia's domestic crude inventories fell to 290.858 million barrels in April from 296.659 million barrels a month earlier, according to the data provided by the Joint Organisations Data Initiative (JODI). Oil inventories reached a record high in October last year at 329.430 million barrels, but have declined since then. Monthly export figures are provided by Riyadh and other members of the Organization of the Petroleum Exporting Countries to JODI, which publishes them on its website. Domestic refineries processed 2.510 million bpd of crude, compared with 2.574 million bpd in March, while exports of refined oil products rose to 1.524 million bpd in April from 1.341 million bpd the month before. In April crude oil burnt to generate power rose 501,000 bpd from 397,000 bpd in March, the JODI data showed.

- 3. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 3 Egypt: OneSubsea awarded subsea production systems contract for the Zohr development, offshore …..Schlumberger OneSubsea, a Schlumberger company, has been awarded an engineering, procurement and construction contract totaling more than $170 million from Belayim Petroleum Company (Petrobel). OneSubsea will supply the subsea production systems for the first stage of the Zohr gas field, located in the Shorouk Concession, offshore Egypt. 'Zohr is one of the largest gas fields discovered in the Mediterranean Sea to date, and is also the world’s second longest step-out, a distance greater than 150 km. This step- out will be enabled by OneSubsea controls systems with fiber-optic communications technology,' said Mike Garding, president, OneSubsea. 'Our supplier-led approach to the field development, coupled with our FasTrac program capability, and our integrated offering that includes flow assurance, subsea production system and landing string capabilities, will help Petrobel meet their first gas commitment.' The award follows an accelerated FEED study by OneSubsea in which a multidisciplinary team collaborated with Eni and Petrobel to develop the subsea equipment architecture and control system to validate handling of high gas volumes, considering reservoir characteristics and subsea equipment specifications. The scope of contract includes six horizontal SpoolTree* subsea trees, intervention and workover control systems, landing string, tie-in, high-integrity pressure protection system, topside and subsea controls and distribution, water detection and salinity monitoring provided by the AquaWatcher* water analysis sensor, and installation and commissioning services. The FasTrac program comprises a strategic inventory capability with the flexibility to configure the system to the customer needs and deliver on a fast turnaround.

- 4. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 4 Egypt: BP sanctions fast-track development of Atoll discovery in Source: BP BP has announced that together with the Egyptian Natural Gas Holding Company (EGAS), it has sanctioned development of the Atoll Phase One projectwhich is an early production scheme that will bring up to 300 million cubic feet a day (mmscfd) gross of gas to the Egyptian domestic gas market starting in the first half of 2018. BP has a 100% interest in the concession. Hesham Mekawi, Regional President, BP North Africa commented: 'BP is proud to progress the acceleration of the Atoll project which will bring critical gas to the Egyptian market and establish a new material hub offshore East Nile Delta. Our confidence in the prospectivity of the area along with our ongoing commitment to Egypt and our successful history of partnership with the Ministry of Petroleum, EGPC and EGAS is allowing us to fast track Atoll from discovery to production in less than three years which is a significant achievement.' BP recently completed multiple transportation and processing agreements accelerating the development of the Atoll field which contains an estimated 1.5 trillion cubic feet (tcf) of gas and 31 million barrels (mmbbl) of condensates. Onshore processing will be handled by the existing West Harbour gas processing facilities. BP announced the Atoll discovery in March 2015. The Atoll-1 deepwater exploration discovery well in the North Damietta Offshore concession in East Nile Delta was drilled using the 6th generation semi-submersible rig Maersk Discoverer. The exploration well reached a depth of 6400 metres and penetrated approx. 50 metres of gas pay in high quality sandstones. The Atoll Heads of Agreement was signed by His Excellency Tarek El Molla, Egyptian Minister of Petroleum and Mineral Resources and Bob Dudley, BP Group Chief Executive in November 2015, just eight months after the discovery. Atoll Phase One is an early production scheme (EPS) involving the recompletion of the existing exploration well as a producing well, the drilling of two additional wells and the installation of the necessary tie-ins and facilities required to produce from the field. The Atoll wells will be drilled by the DS-6 rig which arrived in Egypt last month and is expected to start drilling in August for roughly the next 24 months. Success of the Atoll Phase One EPS could lead to further investment in the Atoll Phase Two full field development.

- 5. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 5 Morocco: Sound Energy provides update on the Tendrara and Meridja wells, onshore … Sound Energy Sound Energy, the European / Mediterranean focused upstream gas company, has provided an update on the Tendrara and Meridja wells, onshore Morocco. Tendrara The processing of the logs while drilling and wire line logs at the first Tendrara well has now been completed. The preliminary petrophysical analysis confirms the presence of a number of gas bearing levels and a total net pay of 28 metres in the TAGI reservoir. This is ahead of initial expectations. A further announcement will be made following the completion of operations and when the results of the well test are confirmed. In anticipation of drilling of the second well at Tendrara, the Company has now applied for the first complementary period under the licence terms. This period triggers a commitment to a second well. Meridja The Company has announced that it has now exercised its option to acquire, subject to regulatory and other approvals, a 55% participating interest in the Meridja exploration permit, onshore Morocco, from Oil & Gas Investment Fund S.A.S. The consideration payable and the other terms of the Option were announced by the Company on 8 February 2016. The Meridja licence area is adjacent to the Tendrara licence and is a highly prospective 9,000 Km2 area with the same fundamental geology as Tendrara. The Company continues to pursue its counter-cyclical growth strategy and to evaluate selective opportunities to complement its existing portfolio.

- 6. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 6 Norway: Statoil and partners study Troll post-2020 output expansion Source: Reuters Norwegian oil firm Statoil and its partners are studying the possibilities of expanding gas production at Norway's biggest field, Troll, after 2020, the company said on Monday. The Troll field in the North Sea contains about 40 percent of Norway's gas resources and produced 34.6 billion cubic metres of gas in 2015. 'We are conducting a feasibility study on developing gas resources from the Troll West area... That would mean higher (gas) production post-2020,' a company spokesman said, adding that the study was at a preliminary stage. Troll field (Source: PSA Norway) The spokesman said the most likely scenario was to tie in the Troll West area to the Troll A platform via a pipeline, with potential investment estimated at a preliminary 10 billion Norwegian crowns ($1.21 billion). He could not say by how much gas production at Troll could be increased. State-owned Petoro has a 56-percent stake in the field, with majority-state owned Statoil holding 30.6 percent. The other partners are oil majors Shell with 8.1 percent, Total with 3.7 percent and ConocoPhillips with 1.6 percent.

- 7. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 7 Myanmar Expected to Export 515 bcf of Gas in 2016-17 Myanmar’s Yadana, Yetagon, Zawtika and Shwe gas projects are expected to collectively produce 515 billion cubic feet (bcf) of natural gas for export and 160.6 bcf for local use in the 2016-2017 fiscal year (Apr-Mar), according to the second five-year National Development Plan (from 2016- 2017 to 2020-2021). Yadana project will produce 206.2 bcf while Yetagon is likely to produce 73.4 bcf, Eleven Myanmarreported on Monday. Zawtika project is expected to produce 89.4 bcf and Shwe 146 bcf. According to the Myanmar Oil and Gas Enterprise (MOGE), the total gas production during this fiscal year will reach 689.8 bcf, including 14.2 bcf from onshore blocks and 675.6 bcf from offshore blocks. Under the second five-year National Development Plan, oil and gas laws and bylaws will be amended and drafted in order to satisfy energy demands for the country’s economic development, Eleven Myanmar added. Gas from the Yadana, Zawtika and Yetagon projects is exported to Thailand, while the Shwe project supplies gas to China.

- 8. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 8 U.S. Gas Hits 9-Month High as Power Use Jumps on Summer Heat Bloomberg - Naureen Malik naurtorious U.S. natural gas futures climbed to the highest level since September as unusually hot weather on the first day of summer drove up demand from power plants. The Southwest will see record heat early this week while above-normal readings sweep most of the lower 48 states through June 29, according to MDA Weather Services. Gas deliveries to electricity producers Monday will be 34.3 billion cubic feet, the most for 2016 and for the time of year, PointLogic Energy data show. Government projections forecast power-plant demand for gas will be at an all-time high later this summer. Gas futures have rebounded 71 percent from a 17-year intraday low in March, as a production frenzy started to slow and demand from generators jumped. Combined with unusually hot weather, this has steadily reduced a supply glut over the past two months, government data show. The high temperature in Los Angeles on Monday will be 105 degrees Fahrenheit (41 Celsius), 26 above normal, according to AccuWeather Inc. “It’s summer, it’s hot and it’s trending,” said Jason Schenker, president of Prestige Economics LLC in Austin, Texas. “Hot summer weather is pushing the relative strength index to the levels not seen since the polar vortex in 2014. The market has worked itself up in a technical tizzy.” Natural gas for July delivery gained 12.4 cents, or 4.7 percent, to $2.747 per million British thermal units on the New York Mercantile Exchange, the highest settlement since Sept. 14. The price surge has been so great that it drove the relative price index, a momentum indicator, to the highest levels since January 2014. The 14-day RSI rose to 76.65 as of 2:31 p.m.. A reading above 70 is a signal that gas is overbought, which some traders may take as a sell signal.

- 9. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 9 The advance in gas prices, along with a rebound in oil futures, pushed up energy shares companies. Southwestern Energy Co. gained as much as 7.5 percent, while Chesapeake Energy Corp. gained 4 percent. “We are going to see stronger demand and lower production levels; that’s why we continue to push higher,” said Gene McGillian, senior analyst at Tradition Energy in Stamford, Connecticut. “We still have an excess of supply on hand, but the dynamics are changing and that fear has been receding slowly that we have too much gas.” Range-Breaking The California Independent System Operator Inc. issued an alert asking customers in the southern part of the state to conserve on Monday to avoid power outages. The grid operator warned that gas supplies to generators in the area may be tight because of limited operations at the Aliso Canyon storage field, according to a notice Sunday. Warmer East The most intense heat in the Southwest will be in the early part of this week. Weather forecasts predict warmer temperatures for the East next week compared with earlier models, meaning a delayed return to seasonal readings, said MDA Weather Services. Gas stockpiles probably rose by 54 billion cubic feet last week, based on the median of four analyst estimates compiled by Bloomberg. The five-year average gain for the period is 88 billion. Inventories totaled 3.041 trillion cubic feet on June 10, 30.1 percent above the five-year average, according to the U.S. Energy Information Administration, which is scheduled to release its next supply report on June 23. The supply glut narrowed from 52.1 percent three months ago as storage injections came in below average in recent weeks. “We should be worried if we get a long period of sustained heat in the next two months; there is a good chance we could push above $3,” McGillian said. The risk is that power generators may switch to coal if gas prices hold above $2.75 or producers decide to take advantage of the gains to connect drilled but uncompleted wells, he said. “If this is the case, production can ramp up and that would cut the rally short .

- 10. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 10 US:In the Birthplace of U.S. Oil, Methane Gas Is Leaking Everywhere Bloomberg - Jennifer OldhamShare on FacebookShare on Twitter A mail box sits on an abandoned well pipe near blooming peonies, logs snag on metal casings rising out of a creek, children swing next to rusted pump jacks. In Pennsylvania, birthplace of the U.S. oil industry, century-old abandoned oil wells have long been part of the landscape. Nobody gave much thought to it when many were left unplugged or filled haphazardly with dirt, lumber and cannon balls that slipped or rotted away. A home in Pennsylvania with an old pumpjack and tank in front yard. But the holes -- hundreds of thousands of them pockmark the state -- are the focus of growing alarm, especially those in close proximity to new wells fracked in the Marcellus shale formation, the nation’s largest natural-gas field. They leak methane, which contaminates water, adds to global warming and occasionally explodes; four people have been killed in the past dozen years. “We had so much methane in our water, the inspector told us not to smoke a cigar or light a candle in the bath,” said Joe Thomas, a machinist who lives with his wife, Cheryl, on a 40-acre farm with at least 60 abandoned wells. Patches of emerald-hued oil leech to the surface, transforming the ground into a soupy mess. Reviewing Rules Now the state’s attorney general is reviewing rules requiring drillers to document wells within 1,000 feet of a new fracking site. This puts Pennsylvania among states such as California, Texas, Ohio, Wyoming and Colorado confronting the environmentally catastrophic legacy of booms as fracking and home development expand over former drilling sites. Oil and other pollutants from an abandoned oil well on the property of Joe and Cheryl Thomas. As the number of fracked wells increases, so does the chance they might interact with lost wells. Pennsylvania regulators have

- 11. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 11 documented several instances of fracking too close to an abandoned hole, causing methane to leak into homes, the air or water. At least 3.5 million wells have been drilled in America since operators plumbed the first hole in the small Pennsylvania town of Titusville back in 1859. It was oil pumped from this rugged landscape, near the state’s western border with Ohio, that John D. Rockefeller started refining a few years later in a venture that would evolve into the Standard Oil Trust. Years of Work Today, about a quarter of the 3.5 million wells across America are active, leaving an inventory of 2.6 million that are no longer in use. The locations of some inactive wells are documented, but little is known of the whereabouts of wells drilled before permitting regulations were enacted 60 years ago. Only 10 percent of abandoned wells are recorded in state databases -- meaning there are years of work ahead to locate and plug them. Seth Pelepko of Pennsylvania’s Department of Environmental Protection says the agency has plugged only 3,000 such sites in 30 years. Barr points out an abandoned oil well in the Allegheny National Forest. Regulators are ramping up detection efforts, including testing the use of drones equipped with magnetometers. For the moment, however, they rely on a low-tech solution of “citizen scientists” who hunt for leaking wells near watersheds and recreation areas in the Allegheny National Forest. On a recent search, Barr overcame her fear of rattlesnakes sunning in dense grass, bears lurking in hemlock groves and bees -- she’s allergic -- nesting in moss-covered logs. Wearing an orange pocketed vest stuffed with a GPS, mace, a water tester and a methane sniffer, Barr forded a stream and hiked downhill deep into the trees. She urged companions to “remember that rock” to find the way back. The stones, however, all looked the same. Oil Sheen An hour later, she came upon a decades-old rusty pipe and overturned well equipment sticking out of a ravine. Fluid poured out of the abandoned well, which Barr reported to regulators in 2014. The noonday sun reflected a rainbow-colored sheen of oil off a pool surrounding the site. Officials have yet to investigate. “If you were in Pittsburgh and knew this was happening thousands of times in your watershed, you wouldn’t be so happy,” said Barr, who co-founded Save Our Streams Pennsylvania in 2011 to

- 12. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 12 search for such sites. She’s located about 1,000; most hadn’t been recorded in the state’s system. The state is clarifying coordinates before visiting some wells, said the DEP’s Pelepko. Hiking through swamps, Barr pointed out a well spewing orange bacteria into a stream, a hole frequented by deer burping methane and brine, and a long rusted pipe with gas bubbling around it into the Allegheny Reservoir. Greenhouse-Gas Emissions “The assumption was these wells are not emitting much methane and we don’t need to worry about them,” said Mary Kang, a postdoctoral fellow at Stanford University in California who co- authored a widely cited paper on Pennsylvania’s wells. “Yet these old wells are emitting methane into the atmosphere, and they are worth considering in greenhouse-gas emissions inventories.” An abandoned oil well pipe in Western Pennsylvania. Officials also are warning private-property owners of health risks. Generations of Pennsylvanians relied on the oil patch for their livelihood and became desensitized to the industrial footprint left behind. The Thomases, who live near the New York border, have become aware that such wells pose risks. Recently, Barr held her methane sniffer over a muddy, oily hole she dubbed “the fudge pot” at their farm as blackbirds harassed a crow overhead. Beeping wildly, the device soon hit its limit. The well is now in line to be capped.

- 13. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 13 NewBase 21 June 2016 Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE Oil prices fall for first time in three days Reuters – NewBase Oil prices fell in early Asian trade after a strong two-day rally that was fed by easing concerns Britain would leave the European Union after a referendum this week, allowing market participants to focus on supply issues. Saudi Arabia's crude oil exports also dropped despite high production levels, suggesting demand remains in a deficit to supply. U.S. crude's expiring July front-month contract was down 18 cents at $49.19 a barrel at 0046 GMT. The more actively traded August contract, the new front-month from Wednesday, was down 19 cents at $49.77. That contract settled up nearly 3 percent at $49.96 on Monday. Brent crude futures' August front-month contract was down 31 cents at $50.34 a barrel. On Monday it rose $1.48, or 3 percent, to $50.65 a barrel. The contract has risen about 7 percent since Thursday's settlement, after falling 10 percent in six previous sessions. Saudi Arabia's crude exports in April fell to 7.444 million barrels per day from 7.541 million bpd in March, official data showed on Monday. The world's largest oil exporter and OPEC heavyweight produced 10.262 million bpd in April, compared with 10.224 million bpd a month earlier, the data showed. Potentially adding to supply, Iran has increased its crude exports capacity at its main terminal on Kharg Island to allow eight tankers to load simultaneously, the oil ministry's news agency Shana reported on Monday. Following upgrades to infrastructure over the past two years eight tankers can berth at the terminal's eastern harbor, with one more vessel able to load ship-to-ship cargo at the same time. Oil price special coverage

- 14. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 14 Raymond James: Get Ready for $80 Oil Bloomberg|Luke Kawa & Julie Verhage|Monday Rebounding after a two-year collapse, it's only this month that oil prices have pushed up past $50 a barrel, but Raymond James & Associates says this is just the beginning for higher prices. In a note to clients, analysts led by J. Marshall Adkins say West Texas Intermediate will average $80 per barrel by the end of next year — that's higher than all but one of the 31 analysts surveyed by Bloomberg. "Over the past few months, we've gained even more confidence that tightening global oil supply/demand dynamics will support a much higher level of oil prices in 2017," the team says. "We continue to believe that 2017 WTI oil prices will average about $30/barrel higher than current futures strip prices would indicate." The team went on to lay out three reasons for their bullish call, all of which are tied to global supply — the primary factor that precipitated crude's massive decline. Here's how the rebalancing of the global oil market will be expedited from the supply side, according to the analysts: First, the analysts see production outside the U.S. being curbed by more than they had previously anticipated, which constitutes 400,000 fewer barrels of oil per day being produced in 2017 relative to their January estimate. In particular, they cite organic declines in China, Columbia, Angola, and Mexico as prompting this downward revision. "When oil drilling activity collapses, oil supply goes down too!," writes Raymond James. "Amazing, huh?" Adkins and his fellow analysts also note that the unusually large slew of unplanned supply outages will, in some cases, persist throughout 2017, taking a further 300,000 barrels per day out of global supply. Finally, U.S. shale producers won't be able to get their DUCs in a row to respond to higher prices by ramping up output, the team reasons, citing bottlenecks that include a limited available pool of labor and equipment. Combine this supply curtailment with firmer than expected global demand tied to gasoline consumption, and Adkins has a recipe for $80 crude in relatively short order. "These newer oil supply/demand estimates are meaningfully more bullish than at the beginning of the year," he writes. "Our previous price forecast was considerably more bullish than current Street consensus, and our new forecast is even more so." The only analyst with a higher price forecast for 2017, among those surveyed by Bloomberg, is Incrementum AG Partner Ronald Stoeferle. He sees West Texas Intermediate at $82 per barrel next year. The consensus estimate is for this grade of crude to average $54 per barrel in 2017. Over the long haul, however, Raymond James' team sees WTI prices moderating to about $70 per barrel.

- 15. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 15 NewBase Special Coverage News Agencies News Release 21 June 2016 Shell takes unconventional route with shale refocus Reuters Having turned round its North American shale business, Royal Dutch Shell is putting so-called unconventional energy at the heart of its long-term growth plans, and believes lessons from the revamp can be applied across the company. Greg Guidry, the head of the Anglo-Dutch group’s unconventionals business, said a drive to slash costs and streamline decision-making had put his division largely on a par with leading rivals in terms of productivity and efficiency. “The executive committee charged us to be a catalyst for change within the broader Shell," Mr Guidry said. He also said Shell planned to make small acquisitions near its existing North American shale areas, notably from producers struggling in the current industry downturn, and hoped to launch an early production well this year in Argentina’s Vaca Muerta, considered the world’s second-biggest shale resource after North America. That is quite a change in fortunes. As recently as late last year, the Shell chief executive Ben van Beurden was considering jettisoning the unconventionals business over concerns it would drag down group profitability after the group’s US$54 billion acquisition of BG Group in February. Shell and rivals including Chevron and ExxonMobil were late to the shale revolution at the end of the last decade and struggled to match the success of smaller independent producers that increased US output by around 4 million barrels per day between 2008 and 2015. Oil majors’ often cautious pace in complex, high-risk projects was ill-suited to the nimble needs of shale, which requires drilling hundreds of wells and injecting water at high pressure to break the rock that holds oil and gas. So Shell moved to adapt. In recent years, it has shed half of its North American unconventional assets for about $4bn to focus on four areas in the United States and Canada. It has cut its technical check-list for drilling shale wells from 20,000 requirements to less than 200 and given managers “end-to-end" control of the production process from well exploration through to well abandonment, Guidry said. The division’s efficiency has risen by 50 per cent over the past three years, production has grown by 35 per cent and capital spending is down by 60 per cent to around $2bn to $2.5bn.

- 16. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 16 Today, Shell makes a profit from shale oil production in “sweet spots" in the Permian, where it has a joint venture with Anadarko, or Duvernay in Canada with crude prices of $40 a barrel, Mr Guidry said. After dipping below $30 in January, Brent crude is currently trading at about $48. “In terms of execution, we are completely competitive and have aspirations to be leading," Mr Guidry said, adding the business could now compete with leading shale producers such as Pioneer Natural Resources and EOG Resources, although costs still could be reduced. Advances in technology meant there was scope to increase oil recovery from shale rock from today’s 7 to 9 per cent by another 1 to 3 per cent over the coming years, Mr Guidry added. “That is billions of barrels. We absolutely can reach that," the 55-year-old American said. And unlike multibillion-dollar deepwater projects, shale can be turned on “with the drop of a hat", Mr Guidry said. “We have more resource on our books with half the assets that we did when we got started." At about 300,000 barrels per day, shale today represents around 8 per cent of Shell’s overall production. However, the company holds shale reserves of around 12 billion barrels, about as much as its deepwater resources, Mr Guidry said. The shale business got its reward this month when Mr Van Beurden identified it as a key growth priority for Shell in the next decade along with renewable energy. What is more, Shell engineers are now using the experience in the shale business to improve deepwater projects, which helped knock out $1.5bn in costs for the development of the Stones field in the Gulf of Mexico. As oil producers scrap costly and complex projects such as deepwater fields and sharply reduce budgets in the face of the oil price downturn, they are turning again to onshore shale, which offers quicker returns and lower investments. Some analysts, including at Bernstein, still argue Shell should divest the shale business to focus on core strengths such as deepwater and liquefied natural gas (LNG), which are generating larger profits. “Surely private equity would have offered some healthy cash proceeds for this business today," said the Bernstein analyst Oswald Clint. But analysts at the US investment bank Tudor Pickering, Holt and Co see growing value in Shell’s unconventional portfolio, particularly in the Permian basin, which they value at $13bn if oil hits $75 a barrel. “We believe Shell’s North American unconventional portfolio is less core relative to global deepwater and LNG but we do see additional value that should command a premium multiple when compared to its European supermajor peers," they said. C R E D

- 17. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 17 A Quick Trip to the Oil Patch Shows Energy-Related Losses Rising Bloomberg - Tracy Alloway tracyalloway "Like an oil lease, you’re easily disposable," the villainous J.R. Ewing quipped to his beauty queen wife in the 1970s television series Dallas. Readers of the latest edition of the Federal Reserve Bank of Dallas's quarterly southwest economy publication might want to keep that quote in mind. News from the oil patch — the 11th Fed district that encompasses the shale heartland — is not encouraging, as it reveals a sharper rise in souring energy-related loans. "The persistence of relatively low oil prices has begun taking a toll on district bank customers," the Dallas Fed said in its report. "Oil-price hedges become less effective the longer prices stay low, and the cushion built by energy firms during the good times gets thinner. Cash flow becomes stretched and collateral loses its value, further pressuring borrowers." That forces them closer to default unless banks are able to keep their lending spigots open. Many of these loans fall under the umbrella of commercial and industrial (C&I) lending — a category which has been surging in conjunction with commercial real estate (CRE) lending in recent years. While regulators have kept a somewhat lazy eye on rising CRE loans since even before the 2008 financial crisis (and certainly after it), the boom in C&I lending has been met with far less scrutiny — resulting in charts which look like this:

- 18. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 18 The ability of C&I lending to grow unconstrained looks set to change, however, as energy-related strains help elevate the amount of loans that are in or close to default. C&I lending in the Dallas Fed district has grown to become the biggest single component of past-due loans at the region's banks — outstripping both noncurrent (also known as non-performing) residential real estate and commerical real estate loans for the first time since 2005. "While noncurrent C&I loans have increased since the beginning of 2014, the pace quickened in the second half of 2015," the Dallas Fed said in its report, noting that the category now accounts for almost a third of district banks' total noncurrent loans — up from just 19 percent as recently as 2014. That more energy borrowers are falling behind on their payments has prompted the Office of the Comptroller of Currency to issue new guidance in March governing how banks should lend to oil and gas companies. Of particular note, given the above, is the new mandate for banks to judge secured energy loans based on a borrower's total financing profile and ability to repay their debt, as opposed to the value of the underlying collateral. "Eliminating the value of the collateral backing the loans tightens the loan grading methodology, making it more likely that a loan will be downgraded and a bank will be forced to provision against future losses," the Dallas Fed said. It may also go some way towards explaining the quicker rate at which energy loans are becoming overdue, and the higher loan loss provisions in the Dallas Fed region given the historic tendency of oil and gas companies to tap markets for significant sums of financing based on the inferred value of their collateral. Here, another J.R. Ewing one-liner springs to mind: "They got us over a barrel ... And I mean a barrel of oil." I T : R E Z A / C O N T R I B U T O R

- 19. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 19 NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE Your partner in Energy Services NewBase energy news is produced daily (Sunday to Thursday) and sponsored by Hawk Energy Service – Dubai, UAE. For additional free subscription emails please contact Hawk Energy Khaled Malallah Al Awadi, Energy Consultant MS & BS Mechanical Engineering (HON), USA Emarat member since 1990 ASME member since 1995 Hawk Energy member 2010 Mobile: +97150-4822502 khdmohd@hawkenergy.net khdmohd@hotmail.com Khaled Al Awadi is a UAE National with a total of 25 years of experience in the Oil & Gas sector. Currently working as Technical Affairs Specialist for Emirates General Petroleum Corp. “Emarat“ with external voluntary Energy consultation for the GCC area via Hawk Energy Service as a UAE operations base , Most of the experience were spent as the Gas Operations Manager in Emarat , responsible for Emarat Gas Pipeline Network Facility & gas compressor stations . Through the years, he has developed great experiences in the designing & constructing of gas pipelines, gas metering & regulating stations and in the engineering of supply routes. Many years were spent drafting, & compiling gas transportation, operation & maintenance agreements along with many MOUs for the local authorities. He has become a reference for many of the Oil & Gas Conferences held in the UAE and Energy program broadcasted internationally, via GCC leading satellite Channels. NewBase : For discussion or further details on the news above you may contact us on +971504822502 , Dubai , UAE NewBase 21 June 2016 K. Al Awadi

- 20. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 20