New base energy news issue 916 dated 28 august 2016

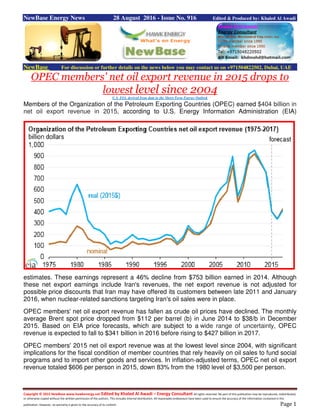

- 1. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 1 NewBase Energy News 28 August 2016 - Issue No. 916 Edited & Produced by: Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE OPEC members' net oil export revenue in 2015 drops to lowest level since 2004 U.S. EIA, derived from data in the Short-Term Energy Outlook Members of the Organization of the Petroleum Exporting Countries (OPEC) earned $404 billion in net oil export revenue in 2015, according to U.S. Energy Information Administration (EIA) estimates. These earnings represent a 46% decline from $753 billion earned in 2014. Although these net export earnings include Iran's revenues, the net export revenue is not adjusted for possible price discounts that Iran may have offered its customers between late 2011 and January 2016, when nuclear-related sanctions targeting Iran's oil sales were in place. OPEC members' net oil export revenue has fallen as crude oil prices have declined. The monthly average Brent spot price dropped from $112 per barrel (b) in June 2014 to $38/b in December 2015. Based on EIA price forecasts, which are subject to a wide range of uncertainty, OPEC revenue is expected to fall to $341 billion in 2016 before rising to $427 billion in 2017. OPEC members' 2015 net oil export revenue was at the lowest level since 2004, with significant implications for the fiscal condition of member countries that rely heavily on oil sales to fund social programs and to import other goods and services. In inflation-adjusted terms, OPEC net oil export revenue totaled $606 per person in 2015, down 83% from the 1980 level of $3,500 per person.

- 2. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 2 Source: U.S. Energy Information Administration, derived from data in the Short-Term Energy Outlook Note: Data before 1994 do not include Angola or Ecuador. Figure does not include Gabon, which rejoined OPEC on July 1, 2016. The effects of recent declines in net oil export revenue on the economies of each OPEC member state depend on the importance of oil export revenues and the existence of other financial assets. Petroleum exports by OPEC members accounted for between 5% (Indonesia) to 99% (Iraq) of total export revenues in 2015. Generally, countries with sizeable financial assets, such as the Persian Gulf States (Saudi Arabia, Kuwait, Qatar, and the United Arab Emirates), are affected to a lesser degree than other oil- producing countries, such as Iraq, Nigeria, and Venezuela, that do not have large financial reserves. Although declining crude oil prices have been the main driver behind lower OPEC revenue since mid-2014, unplanned production outages among some OPEC members have also contributed to lower export earnings. A number of OPEC countries have experienced relatively high levels of unplanned outages. Some of these outages are the result of political factors, such as the sanctions-related production shut-ins in Iran between 2011 and early 2016, when roughly 0.8 million barrels per day (b/d) remained off the market. In Venezuela, crude oil production has declined sharply since the end of 2015, as oil service companies have largely stopped work in response to a lack of payment by state-owned Petroleos de Venezuela S.A., and oil production may continue to decline in the near term. Other unplanned outages have been related to armed conflict and militant activity in countries such as Libya and Nigeria. Libya has struggled to maintain crude oil production and exports since the fall of the Qaddafi regime in 2011, and more recently, opposing factions have clashed for control of the country's oil export terminals. The resulting lack of available oil export outlets has necessitated that most of the country's production capacity remain shut in. In Nigeria, continuing militant attacks since the start of 2016 have targeted oil and natural gas infrastructure, resulting in more shut-in production. More information about OPEC revenue and unplanned outages in OPEC member countries is available in This Week in Petroleum.

- 3. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 3 OPEC's Barkindo: Oil Producers Show Realisation Action Needed On Output… by Reuters OPEC Secretary-General Mohammed Barkindo sees a growing understanding inside and outside the oil producers' group that action is needed to manage crude production in order to support prices, he said in remarks published in London-based newspaper Al-Hayat. He told the newspaper: "There is growing realisation within OPEC and outside that producers inside and outside must take more proactive stands in relation to production management in order to complement traditional market forces." "We have seen where the approach of non-intervention in prices since 2014 has led," he said in remarks published in Arabic. Members of the Organization of the Petroleum Exporting Countries will meet on the sidelines of the International Energy Forum (IEF), which groups producers and consumers, in Algeria on Sept. 26-28. Asked about the possibility of an agreement on freezing production levels, he said: "Nothing is impossible in the current situation, and I know that no country in OPEC is immune to low prices."

- 4. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 4 Morocco: Sound Energy spuds second well at Tendrara, onshore Source: Sound Energy Sound Energy has confirmed the commencement of drilling of the second well at Tendrara, onshore Morocco. Following the recent success of the first Tendrara well (TE-6), a sub-horizontal appraisal well (the Company's second well on the licence; TE-7) was spud on 25 August 2016. The well objectives of TE-7 include proving sufficient gas volumes and well deliverability to enable finalization of the field development plan and a concession application and demonstrating the benefits of sub-horizontal drilling, which is expected to be implemented as the production well concept for Tendrara. The TE-7 site is approx. 830 metres to the Northeast of TE-5 and hence some 1.6 kms from the TE-6 site. Drilling is planned to reach a total measured depth of 3440 meters with specific tools being used to geo steer the well at close to an 88 degree angle inside the TAGI reservoir to ensure a horizontal drain of between 600 and 900 metres. The sub-horizontal section will run to the North, parallel to the minimum horizontal stress observed in TE-6. The TE-7 drilling programme is anticipated to follow key three phases: • Drilling and logging (approx. 54 days) • Completion and stimulation (approx. 30 days) • Clean-up and initial well testing (up to 10 days) The Company looks forward to updating shareholders on achievement of each of the three casing points and achievement of total depth. The final results of the well will be announced after the initial well test. An extended well test will follow for approx. 70 days thereafter to confirm production sustainability and to aid comprehensive field development planning.

- 5. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 5 UK: Scottish deficit grows to nearly £15bn as oil revenues collapse Deficit is now equivalent to 9.5% of its GDP, with latest figures showing bigger gap between tax income and spending than UK….The Gordian The gap between Scotland’s public spending and tax revenues has widened, with the crash in global oil prices leading to a deficit of nearly £15bn. The latest official data shows that Scotland’s structural deficit was more than twice that of the UK last year, after its share of North Sea oil tax revenues collapsed, falling from £1.8bn in the previous year to £60m. The government expenditure and revenue Scotland (Gers) figures show that in 2015-16, Scottish tax receipts were £400 less than the UK average, at £10,000, after several decades during which oil had pushed them above the UK level. The Scottish and UK governments spent £1,200 a head more on public services in Scotland, and on Scotland’s share of UK and overseas spending, while overall tax receipts fell by £400 a head. Compared with spending at UK level, that led to a gulf of £1,600 a head between what was raised in taxes and spent in Scotland. Overall government spending as a share of the economy increased again to reach nearly 44% of Scotland’s GDP, compared with 40% at UK level. Nicola Sturgeon, the Scottish first minister, said the figures were very difficult and the plunge in oil prices meant that Scotland had “suffered an economic shock, which has impact on our fiscal position”. The Gers data presented a challenging picture for Scotland, she said, adding: “It is a challenge we have had for some time now – how to grow and diversify our onshore economy.”

- 6. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 6 Senior economists warned that a budget deficit of this scale made Scottish independence effectively unaffordable, unless Sturgeon made very tough choices on spending cuts or tax rises. The Fraser of Allander Institute, an economics think tank at Strathclyde University, directly challenged Sturgeon’s statement on Wednesday that “the route to closing the deficit is fundamentally on the revenue growth side”. Closing a 21% structural deficit would need rates of economic growth for Scotland not seen in current lifetimes, the FAI said. As Sturgeon had pointed out on Tuesday, the Brexit vote was likely to make those efforts even more difficult. “It is simply not possible to operate under independence with a deficit at this scale – full stop,” the FAI said. “The Scottish government needs to set out the tough choices that it would make alongside a detailed and comprehensive plan for how it would manage the public finances under independence. This won’t be easy, but is essential.” The data put Scotland’s net fiscal deficit last year at £14.8bn, including North Sea receipts, £522m higher than the previous year. That was equivalent to 9.5% of Scotland’s GDP. The UK’s estimated deficit for the same period was 4% of GDP. Asked how an independent Scotland could meet the EU’s requirements for anannual spending deficit to be lower than 3%, Sturgeon said independence would change Scotland’s overall financial position. “I accept Scotland faces, whatever our constitutional arrangements, a very challenging fiscal position, [but] the fundamentals of our economy are strong,” she said. Scotland’s tax revenues were estimated at £53.7bn, but the Scottish and UK governments spent £68.6bn on public services in Scotland, and on Scotland’s share of UK and overseas spending. Kezia Dugdale, the Scottish Labour leader, said the figures “should act as a reality check for those calling for another independence referendum”.

- 7. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 7 “During the independence referendum, Nicola Sturgeon personally promised a second oil boom. Her own government’s figures show she misled people and that is unforgivable,” she said. “The SNP’s own figures confirm independence would mean severe cuts over and above those already being imposed by the Tories, at exactly the time when our public services need more investment.” David Mundell, the Scottish secretary, said: “Scotland weathered a dramatic slump in oil revenues last year because we are part of a United Kingdom that has at its heart a system for pooling and sharing resources across the country as a whole. “The fact public spending was £1,200 per head higher in Scotland than the UK as a whole also demonstrates that the United Kingdom, not the European Union, is the vital union for Scotland’s prosperity.” Sturgeon denied that this meant the country was being subsidised by the rest of the UK, saying Scotland had paid in a higher rate of tax revenues than the UK on average in recent decades. That position ignores the far higher levels of public spending in Scotland, which needed in effect an injection of £15bn last year from the UK treasury. Sturgeon denied that closing the gap would require spending cuts or tax rises. “What I say is growing revenue is the priority. Public spending in Scotland is higher than the rest of the UK for some very good and in many respects unavoidable reasons, such as its rurality. It costs more to deliver health services to island communities,” she said. Sturgeon insisted that the data offered cause for some optimism. It showed that taxes from the onshore economy, excluding North Sea revenues, had grown by £1.9bn. At 36.5% of Scotland’s GDP, this was the best figure since the financial crisis and more than offset the £1.7bn lost from the decline in oil and gas taxes. But she said the overall figures underlined her anxieties about the damage that leaving the EU could do to the Scottish economy. “Leaving the EU will leave the task of growing the onshore economy so much harder than it might be,” Sturgeon said. Prof John McLaren, an independent economist at Scottish Trends, said future oil revenues were never likely to recover enough to significantly cut the deficit. A doubling of current oil prices to $100 a barrel would still only raise oil receipts to £2.8bn. McLaren said Scotland’s worse position compared with the UK was likely to continue for the next five years, the direct reverse of claims made in Alex Salmond’s white paper on independence in 2013 that Scotland’s tax revenues and finances would remain stronger than the UK’s. “Scotland’s fiscal position relative to the UK can be forecast with greater certainty and is likely to remain at around the current level – about 5.5% of GDP worse off than the UK’s,” McLaren predicted.

- 8. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 8 Russia-India oil deal at risk due to US sanctions - media Reuters US sanctions are threatening to derail Russian energy major Rosneft’s acquisition of a 49 percent stake in India's Essar Oil, reports The Times of India. The deal was curtailed by the US Treasury's Office of Foreign Assets Control, according to the daily. In July 2014, the Department of the Treasury included Rosneft on the list of sanctioned Russian companies after Washington accused Moscow of involvement in the military conflict in Eastern Ukraine and of annexing Crimea. Indian banks, which invested over $5 billion into Essar Oil and currently hold 17 percent, expressed concerns over the deal due to fears of the potential consequences. “We may have to review our exposure to Essar Oil if Rosneft comes on board,” said a top banker with a state-run lender, as quoted by The Times of India. However, Essar Oil will reportedly try to push the deal with Rosneft through, allowing the Russian company to enter the Indian energy market. Searching to expand cooperation with Russia beyond the traditional defense buyer-supplier relationship, New Delhi has invested over $5 billion in the Russian energy sector. The Essar-Rosneft deal aims to open up India's retail energy business to the world's largest oil producer. The deal was planned to be sealed by June. The Indian company had to reduce the share intended for sale by 25 percent, but the measure failed to change the situation. Moreover, the sale of a 25 percent stake to the Dutch multinational trader Trafigura Group risks collapse due to the close ties with Rosneft. Trafigura handles much of the crude exported by Russia.

- 9. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 9 NewBase 28 August 2016 Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE Oil steady in volatile session, down 2 percent for the week By Devika Krishna Kumar + NewbASE Oil prices were largely unchanged on Friday in a volatile session, as traders reacted to comments from Fed Chair Janet Yellen and reports of missile activity in Saudi Arabia. The market was taking its cues from the movement in the dollar, which has been choppy following Yellen's remarks. At one point, crude benchmarks were up as much as 2 percent before drifting lower. Brent crude futures settled at $49.92, up 25 cents or 0.5 percent. U.S. crude ended the session 31 cents higher at $47.64. Prices gathered support briefly from Baker Hughes data showing that U.S. oil drillers kept rig count steady after eight weeks of additions. The market was primed to react to Yellen's speech in Jackson Hole, Wyoming, as her remarks initially caused a big rally in the dollar, which caused oil to slip. Later, the dollar pared those gains, with the dollar index at one point down as much as 0.5 percent. It was later up 0.8 percent. Oil price special coverage

- 10. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 10 Oil prices touched the day's highs after reports of Yemeni missiles hitting Saudi Arabia's facilities, traders said. Saudi state TV reported that a projectile fired from Yemen hit a power relay facility in Najran, in the southern part of Saudi Arabia. Sal Umek, senior analyst at the Energy Management Institute in New York, said he did not see much effect on the market from the Saudi Arabia reports. "At the end of the day, what is driving the market right now is short covering, being that it's Friday and the dollar," he said. A weaker dollar can be seen as supportive for oil prices as it makes dollar-traded oil cheaper for countries using other currencies, potentially spurring demand. Oil and natural gas traders have also been watching for the impact of tropical storms, saying some could possibly become a major hurricane in the Gulf of Mexico, taking out further supply. BP said it began securing offshore facilities and evacuating non- essential personnel from our platforms and drilling rigs in the U.S. Gulf. Oil prices were down over 2 percent for the week as the Saudi energy minister watered down expectations that the world's largest producers might agree next month to limit their output. "We don't believe any significant intervention in the market is necessary other than to allow the forces of supply and demand to do the work for us," Saudi Energy Minister Khalid Al-Falih told Reuters late on Thursday. Members of the Organization of the Petroleum Exporting Countries will meet on the sidelines of the International Energy Forum, which groups producers and consumers, in Algeria from Sept. 26-28. . . .

- 11. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 11 Oil up on reports of Yemen missiles hitting Saudi oil facilities Reuters Oil prices rose about 2 percent on Friday after reports of Yemeni missiles hitting Saudi Arabia's oil facilities. Yemeni forces have fired ballistic missiles at the facilities belonging to the Saudi state oil giant Aramco in the kingdom's southwest, according to traders citing reports by Iran Press TV and Yemen TV. Prices were also supported dollar tumbled against a basket of currencies after U.S. Federal Reserve Chair Janet Yellen's comments at an international gathering of central bankers in Jackson Hole. The dollar index fell 0.5 percent following Yellen's comments, giving a boost to greenback-denominated oil. Brent crude futures rose 66 cents to $50.33 a barrel by 10:36 am ET. West Texas Intermediate (WTI) crude rose 72 cents to $48.05 per barrel, a 1.5 percent gain. Prices were pressured early in the session after Saudi energy minister watered down expectations that the world's largest producers might agree next month to limit their output. "We don't believe any significant intervention in the market is necessary other than to allow the forces of supply and demand to do the work for us," Saudi Arabian Energy Minister Khalid Al-Falih told Reuters late on Thursday. Members of the Organization of the Petroleum Exporting Countries will meet on the sidelines of the International Energy Forum, which groups producers and consumers, in Algeria from Sept. 26- 28. Iran said on Friday that it would cooperate with other producers to stabilise oil markets, but added that it expected others to respect its individual rights. Many observers interpreted that as Tehran saying it would continue to try to regain market share by raising output after the lifting of sanctions against it last January. "I do not expect the OPEC meeting in September to agree any freeze or affect the oil market in any significant way. This is because it appears key OPEC members remain more concerned about market share," said Oystein Berentsen, managing director for crude at oil trading firm Strong Petroleum in Singapore. Analysts at Commerzbank also expressed doubt that any agreement might materialise next month. "Capping production at this level would hardly reduce supply in any case, especially since other leading OPEC producers such as Iraq are producing at or near record levels," the bank's commodity team said in a note. "And countries like Libya and Nigeria, which are producing significantly below their potential due to unscheduled outages, are hardly likely to sign up to any voluntary restriction of production."

- 12. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 12 NewBase Special Coverage News Agencies News Release 07 August 2016 Demand for LNG grows in Mena region The national - Anthony McAuley The slump in prices and surging power demand is spurring demand for liquefied natural gas in the Middle East and North Africa. Even the UAE, which earlier this year decided to put on hold indefinitely plans to build a huge onshore LNG plant at the Indian Ocean port of Fujairah, instead recently chartered a floating storage and regasification unit (FSRU) from Texas-based Excelerate to meet domestic gas demand. Throughout the region there are a growing number of such facilities under way or on the drawing board to meet rising demand. The slump in world seaborne gas prices is a major factor, driven largely by the waves of supply that have hit the market as huge long-term projects came onstream in Australia, Papua New Guinea, the US and elsewhere. Last year, worldwide gas trade was surpassed only by oil as the most actively traded commodity, and the surplus of supply over demand reached its highest in a decade, according to data from BP. There have even experimental shipments of LNG from as far afield as the US Gulf coast to buyers in the Arabian Gulf, including delivery to the Jebel Ali LNG facility in Dubai. "The external conditions are driving Mena LNG demand growth," said Emma Richards, an analyst at BMI Research, part of Fitch Ratings. "The fact of the collapse in LNG prices and so much readily available supply has put companies in a position to negotiate favourable long-term supply deals," she said. At the same time, buyers have been favouring the more flexible FSRU option, which can be chartered for a five or 10-year period, rather than a multibillion-dollar investment over 20 or 30 years in an onshore facility.

- 13. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 13 Excelerate confirmed that its namesake FSRU, which moored at Ruwais in Abu Dhabi’s Al Gharbia region earlier this month, was chartered by Gasco – a joint venture between Adnoc, Shell and Total. The ship has been commissioned initially to take LNG from the Das Island LNG export facility and feed into the UAE grid about 14 million cubic metres a day, or about 7 per cent of last year’s average daily gas demand.

- 14. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 14 The UAE’s demand for gas grew by nearly two-thirds over a decade to last year’s consumption of 69 billion cubic metres, and although it has slowed it is still forecast to rise at a rate of 5 to 6 per cent a year through 2020. Domestic supply has been limited as the national oil company, Adnoc, prioritises the use of gas for reinjection into oilfields to enhance production. Other GCC countries have similar rates of gas demand growth and outside the troubled hotspots like Yemen, Syria and Iraq, even faster rates of growth are expected. "Egypt has low power consumption per capita and tremendous demand potential," said Ms Richards. "The country is building out its gas power sector, which will be supported by domestic gas projects, but will nonetheless remain dependent on LNG imports for many years. A third FSRU could be installed, allowing for increased LNG imports." Bahrain is expected to install an FSRU at the port of Hidd by 2018 and start importing an increasing amount of LNG over the subsequent decade. Morocco, Tunisia and Lebanon are also expected to become new LNG markets, BMI Research said. In Morocco, there is already a proposal for an LNG import facility at Mohammedia, about 30 kilometres east of Casablanca, while Lebanon needs to overcome some political squabbling to greenlight its FSRU plans. UAE , FSRU - LNG As Dubai grows, so the demand for energy grows. DUSUP supports the growth of Dubai by ensuring that it buys sufficient energy at competitive price to secure the future of the Emirate. Whilst today DUSUP buys the majority of its pipeline gas from Abu Dhabi and Qatar, for the future DUSUP continues to seek out new sources of energy from around the world; to diversify its supply and to manage the growth in energy demand especially during the peak summer period. The development of the DUSUP LNG terminal has been a key element of that diversification goal. In 2010 DUSUP completed the construction of a Liquefied Natural Gas (LNG) Import Terminal in Jebel Ali port which allows the import of LNG via a Floating Storage Regasification Unit (FSRU). The FSRU is an LNG tanker specially converted into an FSRU for this purpose and it is permanently moored at the Terminal. LNG tankers berth alongside the FSRU and discharge LNG into the FSRU. The FSRU warms the liquefied gas back to its gaseous state using seawater through a heat exchanger, and then flows the gas into the onshore pipeline network. DUSUP buys LNG both on the basis of a long term agreement for supply and by purchasing LNG spot cargoes to support changes in demand. The combination of DUSUP's FSRU terminal and Margham gas storage facility makes it possible for DUSUP's LNG trading team to respond to spot market opportunities at short notice. DUSUP has received a wide range of LNG specifications and

- 15. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 15 has sourced the gas from all the major LNG exporting countries taking delivery from as far away as Trinidad and Australia. In 2015 began a programme of upgrading the capacity of the FSRU terminal to meet Dubai's increasing energy needs. A newer and higher capacity FSRU designed to meet the future operational requirements of the terminal replaced the original FSRU. This means that the Import Terminal will be able to receive twice the number of cargoes than the original design. DUSUP conducts regular programme Ship terminal compatability reviews and has a wide range of LNG carriers approved for the terminal including a good safe track record of deliveries of different carrier sizes up to and including the Q-Max class. State-owned Abu Dhabi National Oil Company (ADNOC) is reportedly planning to start a liquefied natural gas FSRU in the second half of 2016. According to a report by Reuters, the floating LNG import terminal is being supplied by U.S. company Excelerate Energy. The LNG import terminal’s import capacity will be about 1 million tonnes per year, the reported added. The UAE already imports LNG via a floating terminal supplied by Excelerate Energy off the coast of Dubai. In 2010, Dubai Supply Authority (DUSUP) completed the construction of the LNG terminal in Jebel Ali port which allows the import of LNG via a floating storage and regasification unit (FSRU).

- 16. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 16 LNG tankers berth alongside the Explorer FSRU, which regasifies the LNG using seawater through a heat exchanger, and then flows the gas into the onshore pipeline network. Oil Industry Shifts From Survival to Growth Bloomberg - Rakteem Katakey Multibillion-dollar oil and gas deals are back on the table. More than $11 billion of transactions were announced globally in July as crude’s recovery fueled hopes of a steadier market, Wood Mackenzie Ltd. said. That’s the highest monthly total this year and brings the amount since May to $32 billion, triple that of the previous three months. Dealmaking will continue to accelerate as oil prices stabilize, according to the consulting firm. Exxon Mobil Corp. and Statoil ASA were among the buyers after crude’s rebound from a 12-year low earlier this year bolstered confidence. Acquisitions will allow the companies to ensure future growth as the industry has slashed $1 trillion in spending to protect their balance sheets during the downturn. “The extreme oil price volatility in the first quarter caused a lot of uncertainty,” said Greig Aitken, principal analyst for mergers and acquisitions at Wood Mackenzie. “Activity picked up as confidence returned and companies started looking towards future growth instead of focusing entirely on survival.” Exxon, the world’s largest oil producer by market value, agreed last month to acquire natural-gas explorer InterOil Corp. for as much as $3.6 billion to add discoveries in Papua New Guinea. The company also is in advanced negotiations with Eni SpA to buy a stake in gas finds off Mozambique, people with knowledge of the talks said in July. Statoil, Norway’s biggest oil producer, agreed last month to purchase an oil block off Brazil from Petroleo Brasileiro SA for $2.5 billion, its biggest acquisition since 2011. The deals follow a period of relative quiet as buyers and sellers failed to agree on valuations amid oil’s decline. North America, home to many higher-cost shale drillers, saw the fewest transactions last year since 2004, according to data compiled by Bloomberg. Benchmark Brent crude averaged $35.21 a barrel in the

- 17. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 17 first quarter of 2016, the lowest in more than a decade. The grade traded at $49.42 at 2:38 p.m. Singapore time. “Buyers and sellers were so far apart in terms of price expectations,” said Bijan Mossavar-Rahmani, executive chairman of oil producer DNO ASA, which made a $300 million bid for Gulf Keystone Petroleum Ltd. in July. “A lot of the sellers still were hopeful that $100 oil or at least $80 oil was around the corner, and it hasn’t happened.” Shell-BG Those companies that did make acquisitions had little cash to draw on. Royal Dutch Shell Plc’s debt ballooned when it bought BG Group Plc, a rare mega-deal of the past two years, valued at more than $70 billion in April 2015. The transaction was announced just weeks before crude prices resumed their slide, prompting some analysts and shareholders to suggest Shell was paying too much. Such anxiety may ease with Brent crude now trading around $50 a barrel, and acquisitions could pick up as buyers and sellers have more similar price expectations, according to Bloomberg Intelligence. While crude has recovered, “there seems to be an increasing consensus that oil will not go back to over $100 any time soon,” said Philipp Chladek, a senior industry analyst for BI in London. “So the differing perceptions about the asset values that, next to the volatility, was the main deal-breaker in the past, are gradually converging.” There’ll be plenty of assets up for grabs. Shell intends to raise $30 billion through divestitures in the three years to 2018, while BP Plc plans as much as $5 billion of disposals this year. Total SA and Eni also are putting assets on the block. The market for oilfield acquisitions has “stabilized in the last three months and the consensus around commodity prices and where prices are going has narrowed,” said Jon Clark, a transaction adviser at Ernst

- 18. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 18 & Young LLP. “There seems to now be a shift back into M&A-type activity and we’re starting to see potential divestments coming out of the majors.” Special Report on - The Slow Death of Diesel The Slow Death of Diesel Chris Bryant Chris Bryant is a Bloomberg Gadfly columnist covering industrial companies. He previously worked for the Financial Times. Oil industry investors are all too familiar with the concept of "stranded assets": the risk that climate policies make hydrocarbon resources financially unviable. It's not just oil. In Europe, coal and gas- fired power stations have been left stranded by solar and wind's ascendance, resulting inbillions of euros of impairments. Carmakers outsource a lot to suppliers, but still insist on building their own combustion engines. They form the bedrock of brand identity and the added value in manufacturing. The effort still consumes billions of euros in capital, but the assets risk being stranded by the rise of electric vehicles. The danger's acute in Europe because carbon dioxide emissions rules are stricter than in the U.S. The big bet on diesel by the continent's carmakers (the chart below shows their percentage of diesel sales in Europe) just makes things worse. Thanks in part to Volkswagen, it's not a technology winning many friends. ICCT For smaller cars in particular, the technical effort of making diesel engines compliant is becoming uneconomical. While more than half the cars sold in the continent are diesel-powered,

- 19. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 19 consultants at Alix Partners expect this to be just 9 percent in 2030. Combustion engine plants will close: The problem for the industry is that the plants, technology and tools needed to make combustion engines, vehicle transmissions and gearboxes, make up a big chunk of company balance sheets. As Philippe Houchois at Jefferies points out, there's a real risk that Europe's autos industry will have to write down investments. It's hard to say by how much because there isn't much detail on those balance sheets. But you get some indication about the industry's exposure from Fiat Chrysler, which estimates that powertrain tooling and R&D is 20 percent of the cost of developing a vehicle.

- 20. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 20 Tesla, the electric bogeyman to Germany's wheezing carmakers, has its own problems, as chronicled by my colleague Liam Denning. But Elon Musk won't have to write down a bunch of legacy diesel plants. It's no wonder carmakers trade on such lowly earnings multiples. The balance sheet hit will depend on how quickly electric vehicles take off. They account for less than 2 percent of Europe's car sales and the industry thought they'd be a minority pursuit for years, giving it time to depreciate investments at a manageable pace. Yet with battery costs plummeting, Bloomberg New Energy Finance expects the cost of owning an electric vehicle to fall below conventional fuel vehicles as soon as 2022. Having dragged its heels, even Volkswagen says as much as one quarter of its sales will be electric cars by 2025. ELECTRIC CARS CHEAPER THAN CONVENTIONAL ONES by 2022 Ideally, carmakers would halt diesel spending. Unfortunately, they'll have to keep investing to hit Europe's tough 2021 emission targets. Electric cars won't have picked up the slack by then. So they're stuck. Daimler announced a 3 billion euro ($3.4 billion) investment in diesel engines this year. It says it still sees a long future for combustion engines -- both for new cars and spares. VW's new boss Matthias Mueller at least seems to recognize the danger. He's said there may be a time when it's no longer worth investing in diesel. BMW's chief Harald Krueger says similar. But that time's getting uncomfortably close. There are things that can be done to smooth the transition. Besides cutting diesel investment to the minimum, carmakers could partner with rivals. Engine joint ventures already exist: Renault has one with Daimler. Trade unions will demand carmakers preserve jobs, so expect some to try converting combustion engine factories to electric technology. VW is among those considering investments in battery production. But making electric motors and transmissions is much less complicated than combustion engines, meaning there's less value added by carmakers. Some may outsource to a supplier. Meanwhile, battery production won't be labour intensive, otherwise costs won't fall enough to make electric vehicles economical.

- 21. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 21 With the demise of diesel looking assured, employees and investors face an electric shock. Tesla Unveils the World’s Fastest Production Car: 0 to 60 in 2.5 SecondsIt’s also the first electric automobile with a range of more than 300 miles. Bloomberg - Tom Randall Tesla’s Model S was already the fastest four-door sedan in the world. In “Ludicrous Mode,” it had the speediest zero-to 60 jump of any car under $200,000. But this, apparently, wasn’t ludicrous enough. On Tuesday, Tesla Chief Executive Officer Elon Musk released a new, 100-kilowatt-hour battery pack for the dual-motor versions of the Model S and Model X. The upgrade makes the Model S the first all-electric sedan with a range of more than 300 miles, and it cuts the zero-to-60 miles per hour interval to just 2.5 seconds. Only a few cars can compete with that, including the LaFerrari and Porsche’s 918 Spyder. Those cars, however, are limited-run supercars that cost $1.4 million and $845,000 respectively. For the first time, Musk said, “the fastest car in the world, of any kind, is electric. In the future, people are really going to look at gasoline cars in the same way we look at steam engines today: They’re quaint, but it’s not really how you get around.” Here are the specs on the new Model S, which is big enough to seat five and is available now, starting at $134,500: What may be even more impressive is the upgrade for the Model X SUV. The Model X seats seven people, has two trunks, and can now get to 60 mph in 2.9 seconds, faster than a Lamborghini. The new P100D Model X starts at $135,500. Squeezing another 10 kilowatt hours out of what was already the world's largest car battery has posed a difficult challenge, Musk said. The new battery packs use the same Panasonic cells as previous Teslas but require new wiring and changes to the seats to ensure safety, given the additional weight. Production will initially be limited to about 200 packs a week and will only be available to the performance models equipped with Ludicrous Mode, at least for the first few months.

- 22. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 22 Musk said the battery packs are reaching performance and capacity limits for the current round of battery cells. The company will be shifting to a new, larger cell with the launch of the Model 3, enabling additional gains for the entire Tesla lineup in the future, he said. Pedestrians pass the New York Stock Exchange (NYSE) in New York, U.S., on Friday, Aug. 26, 2016. U.S. stocks rose as investors focused on Federal Reserve Chair Janet Yellen's bullish comments on the economy and signaled more skepticism that Federal Reserve officials will follow through with interest-rate increases. On Tuesday, Tesla announced new versions of its luxury cars that break major barriers for electric vehicles. But are the upgrades, as Chief Executive Officer Elon Musk claims, enough to hand Tesla the title of fastest car in the world? The P100D Model S with Ludicrous mode will propel the car to 60 miles per hour in just 2.5 seconds. Tesla's Model X sport utility vehicle will get there in 2.9 seconds. The bigger, 100- kilowatt-hour batteries also provide the first official U.S. Environmental Protection Agency range of more than 300 miles on a charge. These speeds are crazy fast, matched only by sold-out supercars with tiny production runs: Ferrari’s $1.4 million LaFerrari, Porsche’s $845,000 918 Spyder, and Bugatti’s $2.3 million Veyron Grand Sport Vitesse. Tesla’s new Model S, at $134,500, is just as quick as any vehicle on the road. Even its seven-seat SUV beats the McLaren 675LT. Speeds like this offer more Gs than Earth, so the rate of acceleration is faster than falling. It can feel difficult to support your head and shoulders if you first don't lean back on the headrest. And perhaps the strangest feeling of punching it on a Tesla is that, with two all- electric motors, the wheels don’t slip and acceleration is practically silent. Here’s a chart that shows how Tesla ranks in speed and price among the world’s elite. The latest Model S is in a category of its own, especially when you consider it’s a spacious four-door sedan with two trunks. The Model X Tesla's Newest Model S: 0 to 60 in 2.5 Seconds

- 23. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 23 is the only SUV to make the list. For the first time, Musk said, “the fastest car in the world, of any kind, is electric. In the future, people are really going to look at gasoline cars in the same way we look at steam engines today: They’re quaint, but it’s not really how you get around.” Squeezing another 10 kilowatt hours out of what was already the world’s largest car battery posed a difficult challenge, Musk said. The improved battery packs use the same Panasonic cells as previous Teslas, but they require new wiring and changes to the seats to ensure safety, given the additional weight. Musk said the packs are reaching performance and capacity limits for the current generation of cells. The company will be shifting to a larger cell with the launch of the Model 3 next year, enabling additional gains for the entire Tesla lineup. Here’s a table of the world’s quickest cars. The acceleration times are provided by the manufacturers, though some cars have been clocked a bit faster on the track. (Previous versions of Teslas have, too.) The new Model S will get an EPA range of 315 miles per charge (that’s 613 kilometers, using the more forgiving European rating model), while the Model X SUV will have a range of 289 miles (542 kilometers on the EU scale). Production of the new cars will initially be limited to about 200 a week, at least for the first few months, Musk said. As the new batteries roll out to cheaper versions of the car that aren't optimized for performance, we could see EPA ranges approach 350 miles per charge, if previous models are any indication

- 24. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 24 NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE Your partner in Energy Services NewBase energy news is produced daily (Sunday to Thursday) and sponsored by Hawk Energy Service – Dubai, UAE. For additional free subscription emails please contact Hawk Energy Khaled Malallah Al Awadi, Energy Consultant MS & BS Mechanical Engineering (HON), USA Emarat member since 1990 ASME member since 1995 Hawk Energy member 2010 Mobile: +97150-4822502 khdmohd@hawkenergy.net khdmohd@hotmail.com Khaled Al Awadi is a UAE National with a total of 26 years of experience in the Oil & Gas sector. Currently working as Technical Affairs Specialist for Emirates General Petroleum Corp. “Emarat“ with external voluntary Energy consultation for the GCC area via Hawk Energy Service as a UAE operations base , Most of the experience were spent as the Gas Operations Manager in Emarat , responsible for Emarat Gas Pipeline Network Facility & gas compressor stations . Through the years, he has developed great experiences in the designing & constructing of gas pipelines, gas metering & regulating stations and in the engineering of supply routes. Many years were spent drafting, & compiling gas transportation, operation & maintenance agreements along with many MOUs for the local authorities. He has become a reference for many of the Oil & Gas Conferences held in the UAE and Energy program broadcasted internationally, via GCC leading satellite Channels. NewBase : For discussion or further details on the news above you may contact us on +971504822502 , Dubai , UAE NewBase 28 August 2016 K. Al Awadi

- 25. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 25