New base 09 septemner 2017 energy news issue 1069 by khaled al awadi

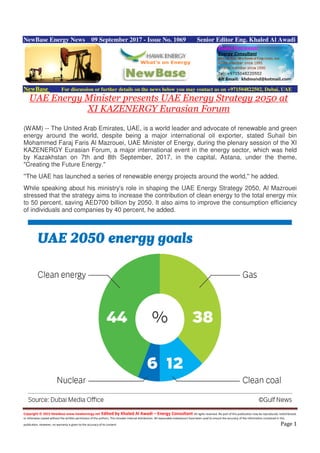

- 1. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 1 NewBase Energy News 09 September 2017 - Issue No. 1069 Senior Editor Eng. Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE UAE Energy Minister presents UAE Energy Strategy 2050 at XI KAZENERGY Eurasian Forum (WAM) -- The United Arab Emirates, UAE, is a world leader and advocate of renewable and green energy around the world, despite being a major international oil exporter, stated Suhail bin Mohammed Faraj Faris Al Mazrouei, UAE Minister of Energy, during the plenary session of the XI KAZENERGY Eurasian Forum, a major international event in the energy sector, which was held by Kazakhstan on 7th and 8th September, 2017, in the capital, Astana, under the theme, "Creating the Future Energy." ''The UAE has launched a series of renewable energy projects around the world,'' he added. While speaking about his ministry's role in shaping the UAE Energy Strategy 2050, Al Mazrouei stressed that the strategy aims to increase the contribution of clean energy to the total energy mix to 50 percent, saving AED700 billion by 2050. It also aims to improve the consumption efficiency of individuals and companies by 40 percent, he added.

- 2. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 2 The plan is a joint effort by all energy-related authorities and executive councils in the UAE, the minister explained. The strategy also aims to change the energy consumption culture, by reducing residential energy consumption by 40 percent. ''New projects will seek greater efficiency and introduce the latest technology in production, transportation and distribution,'' he further added. The Forum, organized by the KAZENERGY Association with the support of Ministry of Energy of the Republic of Kazakhstan, was a key event on the sidelines of the Expo 2017 Astana, which was held from 10th June to 10th September, 2017, under the slogan, "Future Energy." The XI KAZENERGY Eurasian Forum discussed many issues related to the effective management of sustainable energy sources; control over energy production, the storage and use of energy sources; providing access to energy sources; climate change and the reduction of carbon dioxide emissions; the increased use of alternative energy sources; the introduction of energy efficiency programmes, or "smart" energy, and the innovative development of uranium and the nuclear industry by global energy companies. The main speakers and attendees of the forum included Bakhytzhan Sagintayev, Prime Minister of Kazakhstan, and Kanat Bozumbayev, Minister of Energy of Kazakhstan, as well as representatives from major international energy companies, organisations and agencies.

- 3. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 3 Saudi ACWA Power aims to double assets by 2020 with Saudi renewables ArabianBusiness Riyadh-based power and water company ACWA Power expects to double its $35 billion asset base within the next three years, mainly by taking over soon-to-be privatised Saudi utilities, its CEO has said. In an interview with Arabian Business, Paddy Padmanathan said the kingdom's plans to generate 9,500 megawatts (MW) of renewable energy under it's Vision 2030 economic plan presented a multibillion-dollar opportunity for ACWA and other power companies in the region. Saudi Electricity Company (SEC) is being split up and sold on the open market, with bids for the first of four state-run power generation companies expected to go out by the fourth quarter of this year. Padmanathan said ACWA would be bidding and expects to win at least two of the four 'bundles', which together have a 70,000MW capacity and are worth an estimated $7.5 billion, he said. He claimed a further $7.5 billion of investment would be required to repower and re-operate the generators to new standards including renewable sources such as solar and wind -- creating a possible $12 billion-$15 billion worth of investment opportunity in the sector. ACWA has grown to accumulate $35 billion of power assets under management in the 12 years since it was formed, but the huge investment opportunities on offer in Saudi Arabia is likely to significantly escalate the company's growth by 2020. "I would like to bid for them all," said Padmanathan. "But even if we take a minimum of two bundles which we are expecting to do [looking at currently low levels of competition in he kingdom], we do have a real prospect of doubling our size in the next three years." Padmanathan was speaking in Riyadh at the Saudi-US CEO Forum, on the day US President Donald Trump arrived in the kingdom for his first official overseas trip.

- 4. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 4 Oman’s petroleum and other liquids production reached record levels in 2016..Source: U.S. Energy Information Administration, International Energy Statistics Oman set a new record with annual total oil production in 2016 exceeding 1 million barrels per day (b/d). Oman’s petroleum and other liquids production ranks seventh among the Middle Eastern countries. Oman is the largest oil producer in the Middle East that is not a member of the Organization of the Petroleum Exporting Countries (OPEC). Like many countries in the Middle East, Oman is highly reliant on its hydrocarbons sector. The Oman Ministry of Finance stated that finances have been severely affected by the decline in oil prices since mid-2014. In 2016, Oman's oil and natural gas revenues were 67% lower than in 2014, despite achieving record production. Oil revenue accounted for 27% of Oman’s gross domestic product (GDP) in 2016, a decrease from 34% of GDP in 2015 and 46% in 2014. Before setting the country's oil production record in 2016, Oman’s annual petroleum and other liquids production had peaked at 972,000 b/d in 2000 and dropped to 715,000 b/d in 2007. Since then, Oman’s total oil production has risen because of increased adoption of enhanced oil recovery (EOR) techniques and recent discoveries of oil. Oman was on track to maintain this production level in 2017, but as part of an agreement with OPEC member countries, Oman reduced production to approximately 970,000 b/d in early 2017. Almost all of Oman’s oil production is exported, mainly to Asian markets. In 2016, Oman exported 912,500 b/d of crude oil and condensate, its highest level since 1999. Virtually all of the country’s crude oil exports in 2016 went to countries in Asia, with 78% going to China.

- 5. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 5 Iraq: DNO joins ExxonMobil on Baeshiqa licence in Kurdistan - assumes operatorship Source: DNO DNO, the Norwegian oil and gas operator, has announced an agreement with ExxonMobil to join the Baeshiqa licence in the Kurdistan region of Iraq. DNO will assume operatorship of the licence with a 40 percent paying (32 percent net) interest, acquiring one-half of ExxonMobil's position. ExxonMobil retains a 40 percent paying (32 percent net) interest, the Turkish Energy Company (TEC) its 20 percent paying (16 percent net) interest and the Kurdistan Regional Government its 20 percent carried interest. Pending Government approval, DNO will drill an exploration well in the first half of 2018 with a second exploration well to follow on a separate structure. The 324 sq km licence is situated 60 kms west of Erbil and 20 kms east of Mosul. ExxonMobil had previously conducted extensive geological and geophysical studies and constructed a drilling pad before work was interrupted due to security conditions in the region. The Baeshiqa license contains two large, undrilled structures which are expected to have multiple independent stacked target reservoir systems, including in the Cretaceous, Jurassic and Triassic. DNO currently operates two other licenses in Kurdistan: one contains the Tawke and Peshkabir fields which together produce over 110,000 barrels of oil per day and the other the Benenan and Bastora heavy oil fields which are undergoing further appraisal and development. With three rigs currently deployed, the Company is the most active driller among the international operators in Kurdistan. 'We are pleased to partner with ExxonMobil, TEC and the Government on this exciting exploration opportunity,' said Bijan Mossavar-Rahmani, DNO's Executive Chairman. 'We bring to the project a 10-year record of successful and fast-track operations in Kurdistan, culminating in more than 200 million barrels produced to date,' he added. 'Following regularization of export payments and a landmark agreement with the Government to close out our historical receivables, our foot is back firmly on the accelerator.'

- 6. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 6 South Africa: Statoil farms into two exploration blocks offshore Source: Statoil Statoil has acquired participating interests in two additional offshore frontier blocks, including one operatorship. Statoil has completed a transaction with ExxonMobil, acquiring a 35% interest in Exploration Right 12/3/252 Transkei-Algoa. Operator ExxonMobil retains 40% interest, while Impact Africa holds 25%.The license covers approx. 45,000 sq kms in water depths up to 3,000 metres. Statoil has also completed a transactionwith OK Energy, acquiring 90% interest and operatorship in the Exploration Right 12/3/257 East Algoa. The remaining 10% interest is held by OK Energy. The licence covers approx. 9,300 sq kms. 'These transactions strengthen Statoil’s position in South Africa and our long-term exploration portfolio. This is in line with our global exploration strategy of early access in basins with high potential,' says Nick Maden, senior vice president for exploration in the southern hemisphere. Statoil entered its first license in South Africa in 2015, acquiring a 35% interest in the ExxonMobil- operated Tugela South Exploration Right.

- 7. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 7 India: Reliance & BP, Close In on India Gas Field Near Bloomberg - Rakteem Katakey Billionaire Mukesh Ambani’s Reliance Industries Ltd. and its partner BP Plc are reviving investment plans for a gas block close to a military missile launching facility in the Bay of Bengal. Reliance and its British partner are preparing a new development plan for the gas-rich NEC-OSN- 97/2 block, also called NEC-25, in the Mahanadi basin offshore eastern India, according to Atanu Chakraborty, head of India’s oil regulator Directorate General of Hydrocarbons. Work in the block was hindered partly by objections from the defense ministry for its proximity to the Chandipur missile test base. “They are already in discussion with us on the technical aspects of their field development plan,” Chakraborty said in an interview in London. “Reservoirs are being assessed, so that they make the final decision.” The new proposal follows an earlier integrated field development plan submitted in March 2013. Prime Minister Narendra Modi’s government has announced a slew of reforms, including the freedom to price and market natural gas, to push production from stalled projects as it aims to increase the fuel’s share in India’s energy mix to 15 percent by 2020 from 6.5 percent. Oil Minister Dharmendra Pradhan expects investments of $20 billion by as early as 2021 to raise India’s gas output. Reliance and BP recently resuscitated their partnership by announcing fresh investments of $6 billion in gas projects in the Krishna-Godavari Basin, which lies south of NEC-25. Indian’s biggest explorer Oil & Natural Gas Corp. also plans to spend $10 billion in deepwater projects off eastern India. Reliance shares rose as much as 0.7 percent to 823.60 rupees before paring gains to trade at 819 rupees as of 2:52 p.m. in Mumbai on Friday. BP shares were trading 0.3 percent lower at 448.55 pence in London. These investments are expected to boost India’s gas production by more than two thirds over the next five years, according to Chakraborty. “We will add 50-55 million cubic meters per day of gas production on a very conservative basis,” he said. The country’s current output is about 80 million cubic meters a day. Reliance and its Canadian partner Niko Resources Ltd. were awarded the NEC-25 block in 2000 and made eight gas discoveries before BP picked up a 30 percent stake in the block through

- 8. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 8 a $7.2-billion deal with Reliance in 2011. That transaction included similar interests in 22 other blocks. Niko decided to exit in 2015. Reliance didn’t respond to an email seeking comment, while a BP India spokeswoman said the company intends to progress with the field development plan within the stipulated time frame. “When you make a first move into a basin, it normally takes time,” Chakraborty said. “The issues related to closeness to Chandipur missile area had to be adjusted and now the Mahanadi basin fields are maturing slowly towards development. We will see investments coming there sooner than later.”

- 9. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 9 Asia market for liquefied natural gas derivatives catches alight The Financial Times Limited The derivatives market in Asian liquefied natural gas is finally taking off, as the world’s largest importers look to diversify the pricing structures of their purchases by increasing short-term agreements. LNG is one of the few remaining commodities where buyers and sellers are locked into multiyear contracts, and the long-awaited development comes as new supply projects have come online and the LNG price has fallen. Tobias Davis, head of LNG broking at Tullett Prebon, says: “[The Asian derivatives market] is becoming more liquid, enough to become a fair price indicator.” Historically, a large portion of LNG sold to north-east Asia, the world’s largest buyer of the commodity, have been traded under long-term, fixed destination contracts linked to oil. However, an increasing number of Japanese and Korean buyers are signing full or partial short-term contracts linked to LNG price indices. The shifts in the prized Asian market come amid wider changes in the LNG industry. Long the preserve of the largest energy groups such as Shell and Exxon, independent energy traders including Vitol, Gunvor and Trafigura are entering the sector, agreeing on relatively short-term deals with new pricing mechanisms.

- 10. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 10 Trading volumes of LNG derivatives linked to the Asian benchmark have soared as more LNG dealers and companies look to hedge their short-term agreements. Spot and short-term trade in 2016 rose 9 per cent to 74.6m tonnes from the previous year, accounting for 28 per cent of all LNG trades, according to the International Group of Liquefied Natural Gas Importers. Volumes in August cleared through ICE linked to the east Asian spot LNG index Japan-Korea Marker, assessed by S&P Global Platts, reached over 21 cargoes — a new monthly high. After more than quadrupling in 2016, volumes in 2017 overtook that of the previous year in the first five months of the year. The short-term trades have risen as LNG supply has grown with the launch of new LNG plants, which chill and condense gas so it can be shipped on tankers overseas. New projects in Papua New Guinea and Australia have come online over the past few years, increasing the amount of LNG on the world market. The LNG price has been in decline since 2014, when the JKM hit a record high of $20.20 per million British thermal units. It is currently trading just above $6 per mBtu. On the demand side, energy saving practices and the restart of nuclear plants in Japan led to a fall in LNG consumption over recent years in the world’s largest importer. Moreover, Japan has contracted far more LNG than it needs, and the country’s utilities have had to turn themselves into traders in order to resell some long-term supplies. This has increased the short-term contracts, which in turn need to be hedged on the derivatives market.

- 11. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 11 “Some of the Japanese power supplies don’t need all the LNG they’ve signed up for,” says Kerry Anne Shanks, head of Asia Pacific gas and LNG research at energy consultancy Wood Mackenzie. The rise in short-term contracts has led to a significant increase in the number of participants in the LNG derivatives market, with the market now comprising between 20 to 30 counter parties, according to S&P Global Platts. More traders are also taking proprietary positions, adding depth to the market. “They are helping to pull [in] liquidity,” says Mr Davis. Additional changes in Japan could boost liquidity further. In June, the Japanese Fair Trade Commission said it was banning clauses limiting resale of LNG and called on companies to change their business practices for existing contracts. This is likely to lead to some contracts bring renegotiated. In addition, a bulk of the Japanese utilities’ long-term contracts are expiring in 2019 to 2020, and are likely to be replaced with more diverse maturities and flexibility on destination. “After 2019 many existing long- term contracts will expire. They want to allocate a certain portion of that to short-term contracts,” says Tomoko Hosoe, at consultants FG Energy. But despite the rise in trading liquidity, the LNG derivatives market is still a small portion of the whole physical market. “The futures market in oil is multiples of the physical market. JKM [derivatives] is only 1-2 per cent of the LNG physical market if you assume spot trade to be around 40 per cent of production,” says Mr Davis. Some industry executives warn that the liquidity in the derivatives market could dry up as the market tightens beyond 2020. Industry experts see the growth in new demand and the slowing of new production capacity growth leading to a supply dearth in 2022-2023. “The LNG market is going to tighten driven by [demand] growth in Asia,” says Eric Bensaude, in charge of LNG Commercial Operations and Asset Optimisation at Cheniere Energy. He warns: “Yes, the spot market is in favour but I’m not sure that the market liquidity is here to stay. ”

- 12. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 12 NewBase 09 September 2017 Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE Oil slides as Irma heads for Florida, threatening demand Reuters + NewBase Oil prices slid on Friday, with U.S. crude down more than 3 percent on worries that commerce and energy demand in Florida and the Southeast would be hit hard as Hurricane Irma, one of the most powerful storms in a century, drove toward the region. Irma, the second major hurricane to approach the United States in two weeks, has already killed 14 and destroyed islands in the Caribbean. Its predecessor, Harvey, shut a quarter of U.S. refineries and 8 percent of U.S. oil production, with crude prices slumping as widespread refinery outages sharply reduced demand for crude. It will take weeks for the U.S. petroleum industry to return to full capacity, analysts said. In the case of Irma, analysts are more worried that devastation wrought by the storm could sharply reduce demand for energy. U.S. light crude oil CLc1 was down $1.53 or 3.12 percent at $47.56 a barrel by 1:47 p.m. EDT (1747 GMT). Brent crude LCOc1 was down 67 cents or 1.2 percent to $53.82 a barrel after reaching its highest level since April at $54.80. U.S. oil output fell almost 8 percent because of Harvey, from 9.5 million barrels per day (bpd) to 8.8 million bpd, according to the Energy Information Administration (EIA). C-OUT-T-EIA But Irma is headed away from the heart of U.S. oil production. “Irma looks like it will miss the key Gulf areas, and we’re more worried about shale,” said Mark Watkins, regional investment manager at U.S. Bank. Port and refinery closures along the Gulf coast and harsh sea conditions in the Caribbean have hit shipping. Oil price special coverage

- 13. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 13 “Imports (of oil) to the U.S. Gulf Coast fell to levels not seen since the 1990s,” ANZ bank said. Hurricane Irma hit the Dominican Republic and Haiti on Friday, heading for Cuba and the Bahamas. It was predicted to reach Florida by Sunday. The U.S. National Hurricane Center (NHC) said Irma was a Category 5 hurricane, with wind speeds of 160-185 miles per hours. Hurricane Jose is heading for the Caribbean Leeward islands, which have just been devastated by Irma. U.S. energy firms cut oil rigs for a third time in the past four weeks as a 14-month drilling recovery stalled, with energy firms reducing spending plans in response to falling crude prices. Drillers cut three oil rigs in the week to Sept. 8, bringing the total count down to 756 energy services firm Baker Hughes energy services firm said in its Friday report. Oil declined the most since July as Hurricane Irma threatened to slash energy demand that had only just begun to recover from the wrath of Harvey. Futures slid 3.3 percent in New York. While Valero Energy Corp. and other refiners resumed fuel production after Harvey roared ashore two weeks ago, demand for gasoline and other transportation fuels may falter across much of the southeastern U.S. if Florida and neighboring states take a direct hit from Irma. Florida burns more gasoline than any other state except California and Texas. Uncertainty has traders “pulling in their horns ahead of the storm,” Phil Flynn, senior market analyst at Price Futures Group Inc. in Chicago, said by telephone. “They are worried about demand destruction.” The most recent data from the Energy Information Administration showed last week’s rise in U.S. crude stockpiles was the largest since March. Meanwhile, deliveries of foreign crude to the Gulf Coast fell to the lowestin records going back to 1990 as Harvey’s wind and rain shut every major port in the region.

- 14. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 14 “People are thinking we’ve had the worst of the refinery outages and that’s behind us,” Michael Lynch, president of Strategic Energy & Economic Research Inc. in Winchester, Massachusetts, said by telephone. “The refineries will be starting up and absorbing more crude.” West Texas Intermediate for October delivery declined $1.61 to settle to $47.48 a barrel on the New York Mercantile Exchange. Total volume traded was about 26 percent above the 100-day average. Prices were up 0.4 percent for the week. Brent for November settlement fell 71 cents to end the session at $53.78 a barrel on the London- based ICE Futures Europe exchange. The global benchmark traded at a premium of $5.72 to November WTI, the largest since 2015. The market also “seems to be a little technically heavy,” Flynn said. “When you don’t know how exactly the fundamentals are going to play out, the computers are just going to play the charts.” Crude Oil Price Forecast September 11, 2017, Technical Analysis WTI Crude Oil The WTI Crude Oil market fell apart on Friday, as it looks to be reaching towards the $47.50 level. There should be a significant amount of support in that area, but part of this is probably due to weekend profit taking and of course the fact that hurricane Irma won’t be doing as much destruction in the Gulf of Mexico. I believe that this market has been overdone for some time, and I had previously suggested that $50 would be “a bridge too far”, and it appears that has come true. Expect a lot of volatility in the markets as weather concerns play a major factor, which of course can change any moment. The US dollar strengthening during the day certainly does not help the price of WTI Crude Oil, and all things being equal I think that we will continue to see choppiness but I also believe that longer-term fundamentals are starting to come back into play.

- 15. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 15 Brent The Brent market went sideways initially on Friday, but then collapsed and reached down towards the $54 level during US trading. There are a couple of different factors involved, as many traders had bet that hurricane Irma would cause disruptions. While it should a point, it looks as if the major infrastructure of the crude oil supply chain should be spared most of the damage. Also, I suspect that there are a lot of people taking profits before they go home for the weekend as betting on the weather is very risky to say the least. After that, there is a report coming out of China that they are closing privately owned oil refineries, which could cause a demand problem. Nonetheless, if we can break down below the $53.50 level, I don’t see the reason that the market doesn’t fall to the $52.50 level. Oil Rig Count Continued to Decline Baker Hughes the Oil Service giant reported that U.S. oil and gas producers added one drilling rig last week, bring total count to 944. Oil rig count decreased by three weeks over week to 756, while the natural gas rig count grew by four to 187. Meanwhile, the U.S. offshore rig count is flat week over week and down two year over year. Baker Hughes rig count is now up 436 rigs since this time in 2016, with oil rigs up 342, natural gas rigs up 95 and miscellaneous rigs down one.

- 16. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 16 NewBase Special Coverage News Agencies News Release 09 Sep. 2017 How Renewables Can Save Natural Gas By David Fickling P H O T O G R A P H E R : K I Y O S H I O T A / B L O O M B E R G Over the past decade, natural gas has somehow managed to snatch defeat from the jaws of victory. Methane demand has boomed, with consumption in 2016 running 631 million tons of oil equivalent higher than 10 years earlier -- only a little behind the growth from oil, nuclear, solar and wind put together. At the same time, the industry is in a deep crisis. The market for liquefying and shipping gas will be oversupplied until 2024, according to McKinsey Energy Insights. All but a handful of projects worldwide would be losing money if they were dependent on current Asian benchmark prices of $5.908 per million British thermal units: At first blush, renewables don't seem to help the situation. Methane can team up with wind, solar and hydro to take down their common enemy of coal in regions like the U.S. and Europe where gas is cheap. But in much of Asia it's coal that undercuts LNG on price. As a result, the rapidly falling cost of renewables is putting more pressure on gas than the black stuff. So why is Maarten Wetselaar, Royal Dutch Shell Plc's director of integrated gas and new energies, so sanguine about the growth of wind and solar?

- 17. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 17 "We are deeply convinced that the end-point energy mix that provides cheap, or at least affordable, reliable and clean energy to everybody will consist of renewable power, biofuels, and natural gas," he told an event in Bloomberg's Sydney offices Wednesday. Sinking Sun In two-and-a-half years, the cost of solar generation in India has dropped 41 percent To understand why, it's worth thinking about how transformatively cheap renewable power is becoming. Unlike petroleum, coal and nuclear, it runs on a fuel that's essentially free. Furthermore, its basic unit isn't a giant one-time construction project like a thermal power plant, but a manufactured object like a turbine or a solar module that gets cheaper as volumes rise and production costs are squeezed. Think of what's happened to PC prices since the 1980s. That helps explain why solar and wind are now the cheapest forms of new generation in Australia, and why the cost of solar has fallen more than 40 percent in India in two-and-a-half years, to the point where project bids now routinely come in below the price of coal equivalents :

- 18. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 18 It's a dramatic shift in the cost structure of energy, but critics are right about one drawback of renewables: their vulnerability to sudden drops in output when the wind dies or clouds block the sun. That's where gas comes in. There are two paths to dealing with the world being created by renewables. One, favored by many coal advocates, is to falsely equate reliability with baseload, always-on generation like coal and nuclear. Reliability is the attribute that variable wind and solar lack. Insisting that baseload is the only way to provide reliability is a way for incumbent players to protect themselves from disruptive rivals. A better approach would be to recognize that other generation technologies are more nimble providers of reliability, and when partnered with renewables can provide a lower-cost solution. Gas is unusually well suited for such a future. In the first seconds after wind and solar output falls on a change in the weather, rechargeable batteries might be best placed to provide instant electrons. After that, though, pumped-storage dams and then peaking gas turbines will be able to provide less costly generation for hours until variable renewable generation recovers. Coal plants tend to be too slow to gear up and down to be suitable for such unpredictable events. Peak Gas Open-cycle gas peaking plants make up all but a fraction of the planned non-renewable generation capacity in Australia While regulators wrangle over which path to take, the industry is voting with its feet. Shell is looking at building renewable generation plants in Australia equipped with back-up gas supply, Wetselaar said, adding to plans for similar facilities in Oman and Brunei. In Australia, open-cycle gas turbines -- the sort mostly used to cover peak demand -- make up the largest share of the industry's planned capacity additions after wind and solar. Gas is still a fossil fuel, so its future isn't eternal. The Intergovernmental Panel on Climate Change expects it to rise as a share of generation before peaking and starting to decline by 2050. In the meantime, though, those fearing an unending glut should be wary of treating renewables as the enemy. Wind and solar may just be their saviors. This column does not necessarily reflect the opinion of Bloomberg LP and its owners.

- 19. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 19 NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE Your partner in Energy Services NewBase energy news is produced daily (Sunday to Thursday) and sponsored by Hawk Energy Service – Dubai, UAE. For additional free subscription emails please contact Hawk Energy Khaled Malallah Al Awadi, Energy Consultant MS & BS Mechanical Engineering (HON), USA Emarat member since 1990 ASME member since 1995 Hawk Energy member 2010 Mobile: +97150-4822502 khdmohd@hawkenergy.net khdmohd@hotmail.com Khaled Al Awadi is a UAE National with a total of 25 years of experience in the Oil & Gas sector. Currently working as Technical Affairs Specialist for Emirates General Petroleum Corp. “Emarat“ with external voluntary Energy consultation for the GCC area via Hawk Energy Service as a UAE operations base , Most of the experience were spent as the Gas Operations Manager in Emarat , responsible for Emarat Gas Pipeline Network Facility & gas compressor stations . Through the years, he has developed great experiences in the designing & constructing of gas pipelines, gas metering & regulating stations and in the engineering of supply routes. Many years were spent drafting, & compiling gas transportation, operation & maintenance agreements along with many MOUs for the local authorities. He has become a reference for many of the Oil & Gas Conferences held in the UAE and Energy program broadcasted internationally, via GCC leading satellite Channels. NewBase : For discussion or further details on the news above you may contact us on +971504822502 , Dubai , UAE